Comparing Auto Insurance Rates

In the realm of personal finance, understanding how to navigate the world of auto insurance is crucial. It's not just about finding coverage; it's about getting the best value for your money. This comprehensive guide aims to shed light on the factors that influence auto insurance rates, providing you with the knowledge to make informed decisions and potentially save a significant amount on your insurance premiums.

The Complexities of Auto Insurance Rates

Auto insurance rates are a intricate blend of various elements, each playing a role in determining the cost of your policy. From your personal driving history to the type of car you drive, every detail matters. Let’s delve into these factors and explore how they influence the rates you pay.

1. Driving Record: The Foundation of Insurance Rates

Your driving record is the primary determinant of your insurance rates. Insurance companies meticulously examine your driving history to assess your risk profile. A clean record, free from accidents and traffic violations, is ideal. However, even a single moving violation or at-fault accident can significantly impact your rates. For instance, a recent at-fault accident could increase your insurance premium by up to 47%, depending on your state and insurance provider.

| Violation | Average Rate Increase |

|---|---|

| Speeding Ticket | 15% |

| DUI/DWI | 30% |

| At-Fault Accident | 47% |

It's important to note that the impact of these violations on your rates can vary widely based on the insurance company and your state's regulations. Some providers offer accident forgiveness programs, which can mitigate the rate increase after an accident. Additionally, the duration of these rate increases can differ, with some violations impacting your rates for up to three years or more.

2. The Car You Drive: A Major Cost Factor

The type of car you drive is another critical factor in determining your insurance rates. Insurance companies consider a vehicle’s make, model, and year when calculating premiums. Factors such as the car’s safety features, repair costs, and likelihood of theft all come into play. For instance, a luxury sports car may attract higher rates due to its expensive repair costs and higher risk of theft.

| Vehicle Type | Average Insurance Rate |

|---|---|

| Economy Car | $800 - $1,200 annually |

| Mid-Size Sedan | $1,000 - $1,500 annually |

| Luxury SUV | $1,500 - $2,500 annually |

Additionally, the usage of your vehicle matters. If you use your car primarily for commuting, your rates will likely be lower compared to someone who uses their car for business or pleasure, as the former typically incurs fewer miles driven and lower risks.

3. Location, Location, Location: Geographical Impact on Rates

Your location is a significant determinant of your insurance rates. Factors such as population density, traffic congestion, and even weather conditions can influence the cost of your insurance. For instance, living in an urban area with high traffic and a higher risk of accidents and theft will typically result in higher insurance rates.

Moreover, the crime rate and number of claims in your area can also affect your rates. If your neighborhood has a high incidence of car theft or insurance claims, your rates may be impacted. For example, in a high-risk area, you might see insurance rates as high as $2,000 annually, compared to $1,200 in a lower-risk area.

4. Credit Score: The Surprising Influence on Insurance Rates

Surprisingly, your credit score can have a substantial impact on your insurance rates. Many insurance companies use credit-based insurance scores to assess your risk level. A higher credit score often indicates better financial responsibility, which can lead to lower insurance rates. Conversely, a lower credit score may result in higher premiums.

Research shows that individuals with excellent credit scores can save up to 29% on their insurance premiums compared to those with poor credit scores. This practice, known as insurance scoring, is legal in most states and is a significant factor in determining insurance rates.

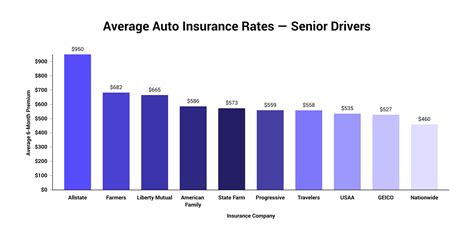

5. Age and Gender: Statistical Factors in Rate Determination

Your age and gender are also considered in the calculation of your insurance rates. Statistically, younger drivers, especially males, are often seen as higher risk and thus pay higher premiums. This is because young drivers tend to have less driving experience and are involved in more accidents.

| Age Group | Average Insurance Rate |

|---|---|

| 16-20 years | $3,000 - $5,000 annually |

| 21-25 years | $2,000 - $3,500 annually |

| 26-60 years | $1,200 - $2,000 annually |

| 61+ years | $1,000 - $1,800 annually |

However, it's important to note that age discrimination in insurance rates is a contentious issue, and some states have implemented regulations to limit the impact of age on insurance rates. Nonetheless, the statistical correlation between age, gender, and insurance rates remains a significant factor in rate determination.

6. Marital Status and Education: The Less Obvious Factors

Your marital status and level of education can also influence your insurance rates, albeit to a lesser extent. Married individuals are often seen as more stable and responsible, which can lead to lower insurance rates. Similarly, a higher level of education can indicate a more mature and responsible individual, potentially resulting in lower rates.

Research suggests that married individuals can save up to 8% on their insurance premiums compared to their single counterparts. Additionally, those with a college degree may see insurance rates that are 5-10% lower than those without a degree.

7. Coverage and Deductibles: Balancing Cost and Protection

The coverage you choose and your deductible amount are crucial decisions that impact your insurance rates. Opting for higher levels of coverage, such as comprehensive and collision coverage, can increase your rates. Conversely, choosing a higher deductible can lower your premiums but may require you to pay more out-of-pocket in the event of a claim.

It's important to strike a balance between the cost of your insurance and the level of protection you need. Consider your financial situation and risk tolerance when making these decisions. A higher deductible may save you money on premiums, but it's crucial to ensure you can afford the deductible in the event of an accident.

8. Shopping Around and Bundling: Maximizing Savings

Shopping around for insurance quotes is a powerful way to save on your premiums. Comparing quotes from multiple providers can help you identify the best rates for your specific situation. Additionally, bundling your auto insurance with other policies, such as home or renters insurance, can often lead to significant discounts.

Many insurance companies offer multi-policy discounts of up to 20% when you bundle your auto insurance with another policy. This can be a substantial savings, especially if you're already in the market for other types of insurance.

9. Usage-Based Insurance: A New Approach to Rates

In recent years, usage-based insurance (UBI) has emerged as a new way to determine insurance rates. With UBI, your insurance premium is based on your actual driving behavior, rather than just your demographics and driving history. This approach can benefit safe drivers who may see lower rates, while risky drivers may pay more.

UBI programs typically use telematics devices or smartphone apps to track your driving habits, such as miles driven, speeding, hard braking, and time of day. Based on this data, your insurance rates are adjusted accordingly. While this approach may not be for everyone, it can be a great option for safe drivers looking to save on their insurance premiums.

10. The Future of Auto Insurance Rates: AI and Telematics

As technology advances, the future of auto insurance rates is likely to be shaped by artificial intelligence (AI) and telematics. These technologies can provide more precise data on driving behavior, allowing insurance companies to offer more personalized rates. AI can analyze vast amounts of data to identify patterns and predict risks more accurately.

Additionally, the integration of autonomous vehicles into our roads may significantly impact insurance rates in the future. As self-driving cars become more prevalent, the risk of accidents may decrease, potentially leading to lower insurance rates. However, this also raises new questions and challenges for the insurance industry, such as determining liability in autonomous vehicle accidents.

How often should I review my insurance policy and rates?

+It's recommended to review your insurance policy and rates annually or anytime your circumstances change significantly. This includes changes in your driving record, vehicle, location, or personal life. Regular reviews can help ensure you're getting the best rates and coverage for your needs.

Can I negotiate my insurance rates with providers?

+While insurance rates are largely determined by factors outside your control, you can negotiate with providers to some extent. Highlight your safe driving record, any safety features in your vehicle, and your loyalty to the company. Additionally, bundle your policies and ask about discounts to potentially save on your premiums.

What are some ways to improve my insurance score and lower rates?

+Improving your insurance score primarily involves improving your credit score. Pay your bills on time, reduce your credit card balances, and consider a credit monitoring service to help improve your score. Additionally, maintaining a clean driving record and shopping around for the best rates can also help lower your insurance costs.

In conclusion, understanding the factors that influence auto insurance rates is crucial for making informed decisions about your coverage. By considering your driving record, the car you drive, your location, credit score, and other personal factors, you can navigate the insurance landscape with confidence. Remember, shopping around, bundling policies, and considering new approaches like usage-based insurance can all help you save on your premiums.