Liberty Mutual Auto Insurance Quote

When it comes to choosing an auto insurance provider, getting an accurate and competitive quote is crucial. Liberty Mutual, a well-known name in the insurance industry, offers a range of coverage options to meet the diverse needs of drivers. In this comprehensive guide, we will delve into the world of Liberty Mutual auto insurance quotes, exploring the factors that influence pricing, the steps to obtain a quote, and the benefits it offers to policyholders. By the end of this article, you'll have a clear understanding of the process and the value Liberty Mutual brings to the table.

Understanding Liberty Mutual Auto Insurance Quotes

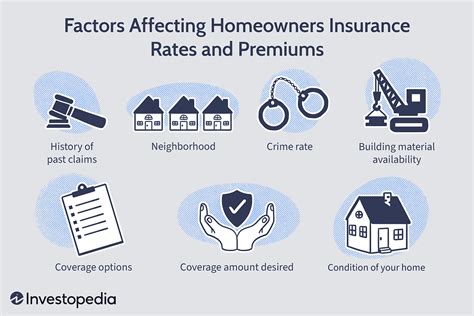

Liberty Mutual’s auto insurance quotes are tailored to individual drivers, taking into account various factors that contribute to the overall risk assessment. These factors include but are not limited to:

- Age and Driving Experience: Younger drivers with less experience on the road often face higher premiums, as they are statistically more likely to be involved in accidents. Conversely, experienced drivers with a clean record may enjoy more competitive rates.

- Vehicle Type and Usage: The make, model, and age of your vehicle play a role in determining the quote. Additionally, factors such as the primary purpose of the vehicle (e.g., personal use, commuting, or business) can impact the premium.

- Location and Driving Conditions: Where you live and drive can significantly influence your quote. Areas with high traffic density, severe weather conditions, or a higher incidence of accidents may result in increased premiums.

- Driving Record: A clean driving record with no recent accidents or violations is favored by insurance providers. Liberty Mutual takes into account your history to assess the level of risk you present.

- Credit Score: In many states, insurance companies consider an individual’s credit score when calculating premiums. A higher credit score can lead to more favorable rates.

- Coverage Options and Limits: The level of coverage you choose, including liability, collision, comprehensive, and additional endorsements, will impact your overall quote. Higher coverage limits typically result in higher premiums.

The Quote Process with Liberty Mutual

Obtaining an auto insurance quote from Liberty Mutual is a straightforward process. Here’s a step-by-step guide to help you navigate it:

- Online Quote Tool: Visit the Liberty Mutual website and locate the “Get a Quote” section. This tool allows you to input basic information about yourself, your vehicle, and your driving history.

- Provide Personal Details: You’ll be asked to provide your name, date of birth, and contact information. Ensure the details are accurate to receive an accurate quote.

- Vehicle Information: Enter the make, model, and year of your vehicle. Additionally, provide details about the primary driver and any additional drivers who may be covered under the policy.

- Coverage Selection: Choose the level of coverage you desire. Liberty Mutual offers a range of options, including liability, collision, comprehensive, personal injury protection, and more. Consider your needs and budget when making your selection.

- Review and Customize: After entering your information, the quote tool will generate a preliminary quote. Review the coverage limits, deductibles, and premiums carefully. You can customize your policy by adjusting the coverage options and limits to find the right balance for your needs.

- Submit Additional Details (if required): In some cases, Liberty Mutual may request additional information to refine the quote. This could include your driving record, vehicle identification number (VIN), or other relevant details.

- Receive Your Quote: Once you’ve provided all the necessary information, Liberty Mutual will generate a personalized auto insurance quote. The quote will outline the coverage, premiums, and any applicable discounts.

Benefits of Choosing Liberty Mutual Auto Insurance

Liberty Mutual offers a range of benefits to its policyholders, ensuring a comprehensive and satisfying insurance experience. Here are some key advantages:

- Competitive Pricing: Liberty Mutual is known for its competitive pricing, offering quotes that are often comparable to or better than those of other major insurance providers. This is especially beneficial for budget-conscious drivers seeking quality coverage.

- Comprehensive Coverage Options: Liberty Mutual provides a wide array of coverage options to cater to different needs. Whether you require basic liability coverage or comprehensive protection, they have you covered. Their policies can be tailored to your specific requirements.

- Discounts and Savings: Liberty Mutual offers a variety of discounts to help policyholders save on their premiums. These discounts may include multi-policy discounts (for bundling auto and home insurance), good student discounts, safe driver discounts, and more. Every discount can make a significant difference in your overall costs.

- Excellent Customer Service: Liberty Mutual prides itself on its commitment to providing exceptional customer service. Their team of knowledgeable and friendly representatives is readily available to assist with any inquiries or concerns you may have. Whether you need assistance with your quote, policy changes, or claims, they aim to deliver a seamless and positive experience.

- Digital Convenience: Liberty Mutual embraces digital technology to enhance the insurance experience. Their online quote tool is user-friendly and efficient, allowing you to obtain a quote quickly and conveniently. Additionally, policyholders can manage their accounts, make payments, and file claims online or through the Liberty Mutual mobile app.

- Claim Handling: In the event of an accident or incident, Liberty Mutual’s claim handling process is designed to be efficient and stress-free. They offer 24⁄7 claims support, ensuring prompt assistance when you need it most. Their claims adjusters are experienced and dedicated to resolving claims fairly and promptly.

Performance Analysis and Customer Satisfaction

Liberty Mutual has consistently demonstrated strong performance in the auto insurance market, earning recognition for its financial stability and customer satisfaction. Here are some key insights:

| Metric | Performance |

|---|---|

| Financial Strength Rating | A+ (Superior) by AM Best, indicating excellent financial stability and ability to meet obligations. |

| J.D. Power Customer Satisfaction | Ranked highly in the J.D. Power U.S. Auto Insurance Study, with scores above the industry average for overall customer satisfaction. |

| Claim Satisfaction | Liberty Mutual receives positive feedback for its efficient and fair claim handling process, with customers reporting timely payments and helpful support during the claims process. |

| Digital Innovation | The company’s digital initiatives, including the mobile app and online services, have been well-received, providing policyholders with convenient access to their insurance information and services. |

Frequently Asked Questions

How long does it take to get an auto insurance quote from Liberty Mutual?

+The time it takes to receive an auto insurance quote from Liberty Mutual can vary depending on several factors. Typically, you can expect to receive a quote within a few minutes to an hour after providing the necessary information. The online quote tool is designed to be efficient, allowing you to input your details and receive a preliminary quote quickly. However, if additional information is required or there are complexities in your driving history or vehicle details, the process may take slightly longer.

Can I customize my auto insurance policy with Liberty Mutual after receiving the quote?

+Absolutely! Liberty Mutual understands that every driver has unique needs and preferences. After receiving your initial quote, you have the flexibility to customize your policy to align with your specific requirements. You can adjust coverage limits, add or remove optional coverages, and explore different deductible options to find the right balance between cost and protection. Their online quote tool and customer service representatives are available to guide you through the customization process.

What factors influence the cost of my auto insurance quote with Liberty Mutual?

+Several factors influence the cost of your auto insurance quote with Liberty Mutual. These include your age, driving record, the type of vehicle you drive, the coverage options you select, and your location. Additionally, factors such as your credit score (in applicable states) and the number of miles you drive annually can impact your premium. Liberty Mutual takes these factors into account to provide a personalized quote that reflects your individual risk profile.

Does Liberty Mutual offer any discounts on auto insurance policies?

+Yes, Liberty Mutual offers a range of discounts to help policyholders save on their auto insurance premiums. These discounts may include multi-policy discounts (for bundling auto and home insurance), good student discounts for eligible students, safe driver discounts for maintaining a clean driving record, and loyalty discounts for long-term policyholders. Additionally, they may offer discounts for certain safety features in your vehicle or for completing defensive driving courses. Be sure to inquire about available discounts when obtaining your quote.

How can I compare Liberty Mutual’s auto insurance quotes with other providers?

+To compare Liberty Mutual’s auto insurance quotes with other providers, it’s essential to obtain quotes from multiple companies. You can use online quote comparison tools or reach out directly to different insurance providers. Ensure that you’re comparing quotes with similar coverage levels and deductibles to make an accurate assessment. Additionally, consider factors such as customer service, claim handling reputation, and available discounts when evaluating your options.

By exploring the world of Liberty Mutual auto insurance quotes, you can make an informed decision about your coverage needs. Remember to tailor your policy to your specific requirements, leverage available discounts, and benefit from Liberty Mutual’s commitment to customer satisfaction. Stay safe on the roads, and let Liberty Mutual protect your driving experience.