Direct Insurance Customer Service

Welcome to an in-depth exploration of the world of Direct Insurance and its customer service, a crucial aspect of the insurance industry. In today's digital age, the way insurance companies interact with their customers has evolved significantly, with a growing emphasis on direct, personalized, and efficient service. This article aims to delve into the specifics of Direct Insurance's customer service, its unique approach, and its impact on the industry.

The Evolution of Insurance Customer Service

Insurance customer service has come a long way since its traditional, paper-based roots. The industry has transformed from a time when policies were solely sold through agents to a more dynamic and customer-centric model. The emergence of Direct Insurance companies has revolutionized this space, offering customers a new level of accessibility and control.

With the advent of the internet and advancements in technology, customers now have the power to compare, purchase, and manage their insurance policies directly online. This shift has not only empowered consumers but has also challenged traditional insurance providers to enhance their service models.

Direct Insurance: A Disruptive Force

Direct Insurance has disrupted the insurance industry by providing a more transparent and streamlined service. These companies operate without the intermediary layer of agents, allowing them to offer policies directly to consumers at potentially lower costs. This direct-to-consumer approach has gained traction, particularly among millennials and Gen Z, who value convenience, digital accessibility, and personalized experiences.

Direct Insurance companies have also been at the forefront of leveraging technology to enhance their customer service. They utilize AI, machine learning, and data analytics to offer personalized recommendations, streamline claims processes, and provide efficient customer support. This has resulted in a more efficient and satisfying customer experience.

Key Features of Direct Insurance Customer Service

- Online Accessibility: Direct Insurance companies provide a comprehensive online platform where customers can purchase policies, manage their accounts, and access support resources 24⁄7. This accessibility ensures that customers can handle their insurance needs at their convenience.

- Personalized Recommendations: Through the use of advanced algorithms, Direct Insurance companies can offer tailored policy suggestions based on individual customer profiles and needs. This level of personalization enhances the customer experience and ensures a better fit for their specific circumstances.

- Efficient Claims Process: These companies have streamlined their claims processes, often leveraging digital tools and automation to expedite the handling of claims. This results in quicker resolutions, reducing the stress and hassle typically associated with insurance claims.

- Proactive Customer Support: Direct Insurance customer service teams are trained to be proactive, reaching out to customers to provide updates, offer additional services, and ensure a positive experience. This approach not only resolves issues but also builds stronger customer relationships.

Case Study: Direct Insurance’s Impact

To understand the real-world impact of Direct Insurance customer service, let’s consider a case study. Imagine a scenario where a customer, Mr. Smith, has a car accident and needs to file a claim. With Direct Insurance, the process is seamless:

- Initial Contact: Mr. Smith can immediately report the accident through the Direct Insurance app or website. The platform guides him through the process, providing clear instructions and real-time updates.

- Claims Assessment: Using advanced technology, Direct Insurance can quickly assess the damage, often requiring minimal documentation from the customer. This efficiency ensures a swift start to the claims process.

- Repair Process: Direct Insurance works directly with trusted repair shops, ensuring high-quality repairs. Mr. Smith receives regular updates on the progress, and the company ensures a timely resolution.

- Customer Satisfaction: Throughout the process, Mr. Smith receives personalized support, ensuring he understands each step. The company's proactive approach results in a satisfied customer, who feels well-supported and valued.

The Future of Insurance Customer Service

The future of insurance customer service looks promising, with Direct Insurance leading the way in innovation. As technology continues to advance, we can expect even more sophisticated tools and processes to enhance the customer experience.

Emerging Trends

- AI-Powered Chatbots: AI chatbots are becoming increasingly sophisticated, providing 24⁄7 customer support and resolving simple queries without human intervention. This not only reduces response times but also frees up customer service representatives for more complex issues.

- Blockchain Technology: Blockchain has the potential to revolutionize insurance by providing secure, transparent, and tamper-proof records. This can enhance the accuracy and efficiency of insurance processes, particularly in areas like fraud detection and claims handling.

- Virtual Reality (VR) and Augmented Reality (AR): VR and AR technologies can offer immersive experiences, allowing customers to better understand their policies and make more informed decisions. These technologies can also be used for virtual inspections and assessments, reducing the need for physical visits.

Conclusion: The Direct Insurance Advantage

Direct Insurance customer service has proven to be a game-changer in the insurance industry. By embracing technology and focusing on direct, personalized interactions, these companies have elevated the customer experience. As the industry continues to evolve, Direct Insurance will likely set the standard for innovative, customer-centric service.

Key Takeaways

- Direct Insurance offers a streamlined, tech-driven approach to customer service, enhancing accessibility and efficiency.

- The use of advanced technology, such as AI and blockchain, is revolutionizing the industry, providing faster, more accurate services.

- Direct Insurance’s focus on personalization and proactive support has led to increased customer satisfaction and loyalty.

Frequently Asked Questions

How does Direct Insurance compare to traditional insurance in terms of cost?

+

Direct Insurance often offers more competitive pricing due to the absence of agent commissions. However, the cost can vary based on factors like coverage, deductibles, and individual risk profiles.

What types of insurance policies does Direct Insurance offer?

+

Direct Insurance companies typically offer a range of policies, including auto, home, health, and life insurance. The specific offerings can vary between companies.

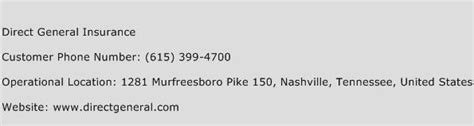

How can customers reach Direct Insurance customer support?

+

Direct Insurance provides multiple support channels, including online chat, email, phone, and sometimes even social media platforms. Customers can choose the most convenient option for them.