Blue Cross Blue Shield Insurance Plan

In the ever-evolving landscape of healthcare, insurance plans play a pivotal role in ensuring individuals and families have access to quality medical services. Among the myriad of options, Blue Cross Blue Shield (BCBS) has established itself as a cornerstone in the US healthcare system. This comprehensive guide delves into the intricacies of BCBS, offering an in-depth analysis of its coverage, benefits, and impact on millions of Americans.

Understanding Blue Cross Blue Shield: A Healthcare Giant

Blue Cross Blue Shield, often referred to as BCBS, is not just an insurance provider; it’s an intricate network of independent companies united under a shared brand. With a rich history spanning over a century, BCBS has grown to become one of the largest health insurance organizations in the United States.

The BCBS story began in the early 20th century with the emergence of two distinct organizations: Blue Cross, focusing on hospital care, and Blue Shield, dedicated to surgical and physician services. Over time, these entities merged, forming a powerful alliance that has since become synonymous with comprehensive healthcare coverage.

Today, BCBS operates through 35 independent, community-based and locally operated companies, spread across the United States. This unique structure allows each company to tailor its offerings to the specific healthcare needs of its region, while still maintaining the unified strength and recognition of the Blue Cross Blue Shield brand.

The BCBS network offers a vast array of insurance plans, catering to diverse demographics and healthcare requirements. From individual and family plans to group coverage for employers, BCBS strives to provide accessible and affordable healthcare solutions to all.

Key Features and Benefits of BCBS Plans

Comprehensive Coverage Options

BCBS plans are renowned for their extensive coverage, ensuring policyholders have access to a wide range of medical services. Here’s a glimpse into some of the key coverage areas:

- Hospitalization: BCBS plans typically cover a range of hospital services, including inpatient stays, emergency room visits, and critical care treatments.

- Medical Services: From primary care to specialist visits, BCBS ensures policyholders can access the medical expertise they need. This includes coverage for physician services, diagnostic tests, and treatments.

- Prescription Drugs: Many BCBS plans offer prescription drug coverage, providing financial relief for individuals requiring ongoing medication.

- Preventive Care: BCBS recognizes the importance of preventive healthcare. As such, many plans include coverage for annual check-ups, screenings, and immunizations, helping to catch potential health issues early on.

- Maternity and Newborn Care: Expectant mothers and newborns are well-catered for under BCBS plans, with coverage for prenatal care, delivery, and postnatal support.

It's important to note that the specific coverage details can vary between BCBS companies and plan types. Policyholders should carefully review their plan documents to understand the full scope of their coverage.

Flexible Plan Designs

BCBS understands that one-size-fits-all solutions don’t work in healthcare. That’s why they offer a variety of plan designs, allowing individuals and families to choose the option that best suits their healthcare needs and budget.

- Health Maintenance Organization (HMO): HMO plans typically require policyholders to select a primary care physician (PCP) and obtain referrals for specialist care. They often have lower premiums and deductibles but may have more limited provider networks.

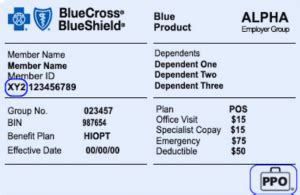

- Preferred Provider Organization (PPO): PPO plans offer more flexibility, allowing policyholders to visit any healthcare provider, in or out of network. While premiums and deductibles may be higher, the ability to choose any provider can be advantageous for those with specific healthcare needs.

- Exclusive Provider Organization (EPO): EPO plans are similar to PPO plans in that they offer a broader network of providers. However, unlike PPOs, EPOs do not cover out-of-network care, except in emergencies.

- Point-of-Service (POS) Plans: POS plans combine elements of HMO and PPO plans. Policyholders typically choose a primary care physician but have the flexibility to visit out-of-network providers at a higher cost.

The choice of plan design depends on individual preferences and healthcare requirements. It's essential to carefully consider these options and select the plan that aligns best with one's needs.

Additional Benefits and Services

Beyond traditional healthcare coverage, BCBS plans often include a range of additional benefits and services to enhance the overall healthcare experience.

- Wellness Programs: Many BCBS plans offer wellness incentives and programs to encourage healthy lifestyles. These can include discounts on gym memberships, access to health coaching, and rewards for achieving specific health goals.

- Telehealth Services: With the rise of digital healthcare, BCBS has embraced telehealth services, allowing policyholders to access medical advice and consultations remotely, often at a lower cost than in-person visits.

- Member Discounts: BCBS often partners with various healthcare providers and businesses to offer exclusive discounts to its members, providing additional savings on healthcare-related expenses.

- 24/7 Customer Support: BCBS understands the importance of timely support. As such, they provide 24/7 customer service, ensuring policyholders can always reach out for assistance with their insurance needs.

Impact and Accessibility of BCBS Plans

Wide Reach and Accessibility

With its network of independent companies, BCBS has an extensive reach across the United States. This geographic spread ensures that millions of Americans, regardless of their location, have access to BCBS insurance plans.

BCBS companies actively work to make their plans accessible to diverse populations. This includes offering a range of plan options with varying premiums and deductibles, ensuring that individuals and families with different financial capabilities can find a suitable plan.

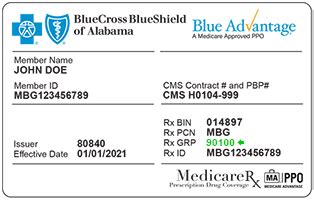

Furthermore, BCBS has initiatives in place to support specific demographic groups, such as seniors and individuals with pre-existing conditions. These initiatives aim to provide affordable coverage options and ensure that healthcare is accessible to all.

Impact on Healthcare Outcomes

The impact of BCBS plans extends beyond mere coverage. Numerous studies have highlighted the positive influence of BCBS on healthcare outcomes.

BCBS's emphasis on preventive care and wellness initiatives has been linked to improved health outcomes. By encouraging regular check-ups and early detection of health issues, BCBS plans contribute to better overall health and reduced healthcare costs in the long term.

Additionally, the comprehensive nature of BCBS plans ensures that individuals have access to a wide range of medical services, from routine check-ups to specialized treatments. This accessibility to quality healthcare can significantly impact an individual's health and well-being.

Conclusion: Empowering Healthcare Choices

Blue Cross Blue Shield insurance plans offer a comprehensive and flexible approach to healthcare coverage. With their wide range of plan options, extensive coverage, and additional benefits, BCBS strives to empower individuals and families to make informed healthcare choices.

As one of the largest and most recognized healthcare providers in the United States, BCBS continues to play a pivotal role in ensuring access to quality healthcare for millions of Americans. Their commitment to innovation, accessibility, and member support makes them a trusted choice for those seeking reliable and comprehensive healthcare coverage.

FAQs

What is the difference between Blue Cross and Blue Shield plans?

+Blue Cross and Blue Shield plans are part of the same network, but they offer different coverage options. Blue Cross plans typically focus on hospital care, while Blue Shield plans cover surgical and physician services. Many BCBS companies now offer combined plans that provide comprehensive coverage for both hospital and medical services.

Are BCBS plans available in all states?

+Yes, BCBS plans are available in all 50 states, Washington, D.C., and Puerto Rico. Each state has its own independent BCBS company, ensuring that residents have access to local, community-based healthcare coverage.

How can I find the right BCBS plan for my needs?

+Choosing the right BCBS plan depends on your specific healthcare needs and budget. It’s recommended to carefully review the plan’s coverage, including the network of providers, prescription drug coverage, and any additional benefits. You can also consult with a BCBS representative or use their online tools to compare plans and find the best fit for you.

Can I keep my BCBS plan if I move to a different state?

+It depends on the specific BCBS plan and the state you’re moving to. Some BCBS plans may be portable, allowing you to keep your coverage even if you move. However, it’s important to check with your BCBS company to understand the terms and conditions of your plan. In some cases, you may need to transition to a new plan offered by the BCBS company in your new state.

What support services does BCBS offer its members?

+BCBS offers a range of support services to its members, including 24⁄7 customer support, online tools for managing your plan and finding providers, and educational resources on various health topics. Many BCBS companies also provide access to wellness programs, telehealth services, and member discounts, ensuring a holistic approach to healthcare.