Can You Cash Out A Term Life Insurance Policy

Term life insurance is a popular choice for many individuals and families as it offers a cost-effective way to secure financial protection for a specified period. However, it is a common misconception that term life insurance policies are non-cashable. In this article, we will explore the possibilities and limitations of cashing out a term life insurance policy, providing a comprehensive guide to help you understand your options and make informed decisions.

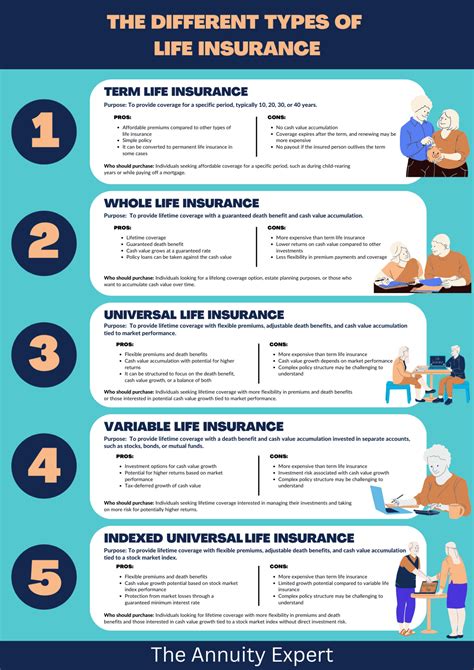

Understanding Term Life Insurance

Term life insurance policies are designed to provide coverage for a defined term or period, typically ranging from 10 to 30 years. During this term, the policyholder pays regular premiums, and in the event of their death within the policy term, the beneficiaries receive a tax-free death benefit. The primary purpose of term life insurance is to offer financial security and peace of mind during critical periods of life, such as when individuals have young families or significant financial obligations.

Cashing Out: The Options

Contrary to popular belief, there are indeed ways to cash out or surrender a term life insurance policy, albeit with certain limitations and potential consequences. Here are the primary methods to consider:

Policy Surrender

One straightforward way to cash out a term life insurance policy is by surrendering it to the insurance company. This involves terminating the policy and receiving a cash payout, which is typically a portion of the premiums paid, minus any administrative fees and charges. The surrender value of a term life policy is usually low, especially in the early years, as most of the premiums are allocated towards the cost of coverage.

It is important to note that surrendering a policy may have tax implications, as the cash received may be considered taxable income. Additionally, the surrender value may not cover the full amount of premiums paid, resulting in a financial loss. Therefore, it is crucial to carefully evaluate the long-term financial implications before opting for a policy surrender.

Converting to Permanent Life Insurance

Many term life insurance policies offer a conversion option, allowing policyholders to convert their term policy into a permanent life insurance plan, such as whole life or universal life insurance. This conversion can be a strategic move, especially if the policyholder’s financial situation or needs have changed. By converting, individuals can retain their life insurance coverage for life, often with increased flexibility and additional benefits.

The conversion process typically involves filling out an application and providing updated health information. The insurance company will then evaluate the risk and determine the premium for the new permanent policy. It is worth noting that the conversion option may have time limits, so it is advisable to review the policy details and act promptly if interested in this route.

Policy Loans and Withdrawals

Some term life insurance policies may offer the option to take out a policy loan or make withdrawals from the cash value of the policy. While this may provide a temporary solution for immediate financial needs, it is essential to understand the implications. Policy loans accrue interest and, if not repaid, may reduce the death benefit payable to the beneficiaries. Withdrawals, on the other hand, reduce the cash value and death benefit proportionally, impacting the overall coverage.

It is crucial to carefully consider the long-term impact of policy loans and withdrawals on the financial security provided by the term life insurance policy. These options should be utilized judiciously and only when necessary, as they can significantly impact the policy’s overall value and purpose.

Factors to Consider Before Cashing Out

Before deciding to cash out a term life insurance policy, it is essential to evaluate several critical factors. These considerations will help ensure that you make an informed decision that aligns with your financial goals and circumstances.

Financial Implications

The financial implications of cashing out a term life insurance policy can be significant. As mentioned earlier, surrendering a policy may result in a loss of premiums paid, and the cash received may be taxable. Additionally, the policy’s death benefit, which is the primary purpose of the coverage, will no longer be in effect, leaving your beneficiaries without the financial protection they were entitled to.

It is crucial to assess your financial situation and determine if the potential cash payout is worth sacrificing the long-term security provided by the policy. Consulting with a financial advisor or insurance professional can provide valuable insights and help you make an informed decision.

Alternative Options

Instead of cashing out, there may be alternative options to consider that can provide financial relief without sacrificing your life insurance coverage. For instance, if you are facing temporary financial hardship, you may explore the possibility of reducing your coverage or adjusting your premium payments to a more manageable level.

Some insurance companies offer premium relief options or policy rider benefits that can provide temporary relief during challenging times. These options can help you maintain your coverage while navigating financial difficulties. It is always advisable to discuss these possibilities with your insurance provider to understand the available options and their implications.

Health and Age Considerations

The health and age of the policyholder can significantly impact the decision to cash out a term life insurance policy. As individuals age, their health status may change, and acquiring a new life insurance policy may become more challenging or even impossible. In such cases, surrendering a term policy may leave you without adequate coverage, especially if your health conditions have deteriorated.

It is essential to carefully assess your current and future health needs and consider the potential impact of cashing out on your long-term financial and health security. If you anticipate future health concerns, retaining your term life insurance policy may be a prudent decision to ensure you have adequate coverage when you need it most.

The Future of Term Life Insurance

The term life insurance market is evolving, with insurers continually introducing innovative products and features to meet the changing needs of policyholders. While the core concept of term life insurance remains the same, providing temporary coverage for a specified period, insurers are offering more flexible and customizable options.

Renewable and Convertible Policies

Many modern term life insurance policies offer renewal options, allowing policyholders to extend their coverage beyond the initial term. This provides flexibility and peace of mind, as individuals can continue their coverage without the need for a medical exam or significant premium increases. Renewable policies often have specific conditions and limits, so it is essential to review the policy details carefully.

Additionally, the conversion option mentioned earlier is becoming increasingly common, providing a seamless transition from term to permanent life insurance. This feature ensures that policyholders can adapt their coverage to their changing needs and circumstances without the hassle of acquiring a new policy.

Riders and Additional Benefits

Insurers are now offering a wide range of riders and additional benefits that can enhance the value of term life insurance policies. These riders may include options such as waiver of premium, which waives the premium payments if the policyholder becomes disabled, or accelerated death benefit, which allows for an early payout in the event of a terminal illness diagnosis.

These additional benefits can provide valuable financial support during challenging times and add significant value to term life insurance policies. Policyholders should carefully review the available riders and consider their potential impact on their overall financial and health security.

Conclusion

Term life insurance policies offer valuable financial protection during critical periods of life. While cashing out a term life insurance policy is an option, it is essential to carefully evaluate the potential consequences and explore alternative solutions. Surrendering a policy may result in financial loss and sacrifice the long-term security it provides.

By understanding the options available, such as policy surrender, conversion, and riders, policyholders can make informed decisions that align with their financial goals and circumstances. The evolving nature of the term life insurance market, with its flexible and customizable options, further emphasizes the importance of staying informed and adapting coverage to meet changing needs.

Remember, life insurance is a crucial component of financial planning, and making informed decisions can ensure the long-term security and well-being of yourself and your loved ones.

Can I get my money back if I cancel my term life insurance policy?

+Yes, you can potentially get some money back if you cancel your term life insurance policy. However, the amount you receive will depend on the policy terms and conditions. Typically, you may receive a portion of the premiums paid, minus any administrative fees and charges. It is important to review your policy details and understand the surrender value before making a decision.

What happens if I let my term life insurance policy lapse without cashing it out?

+If you let your term life insurance policy lapse without taking any action, it will result in the termination of your coverage. This means you will no longer have the financial protection provided by the policy, and your beneficiaries will not receive any death benefit in the event of your passing. It is crucial to consider the implications of lapsing a policy and explore alternative options if you wish to maintain your coverage.

Are there any tax implications when cashing out a term life insurance policy?

+Yes, there may be tax implications when cashing out a term life insurance policy. The cash received from surrendering the policy may be considered taxable income, depending on the circumstances and the amount received. It is advisable to consult with a tax professional or financial advisor to understand the potential tax consequences and ensure compliance with tax regulations.