Compare Auto Insurance Rate

In the complex world of insurance, understanding how auto insurance rates are determined is crucial for drivers seeking the best coverage at an affordable price. The factors influencing these rates are multifaceted and often interconnected, making it a challenging task to navigate. This in-depth analysis will delve into the intricacies of auto insurance rates, offering a comprehensive understanding of the key determinants and providing valuable insights for drivers aiming to secure the most cost-effective coverage.

The Landscape of Auto Insurance Rates

Auto insurance rates are a dynamic entity, shaped by a multitude of factors that can vary significantly from one individual to another. These rates are not merely a reflection of the cost of doing business for insurance companies; they are intricate calculations that take into account an array of personal, geographical, and statistical factors. By understanding these determinants, drivers can make more informed decisions when selecting an insurance policy, ensuring they receive the coverage they need without paying for unnecessary add-ons.

Personal Factors: A Significant Influence

Personal attributes and driving history play a pivotal role in determining auto insurance rates. Insurance companies meticulously evaluate a driver’s record, considering factors such as age, gender, marital status, and even occupation. Younger drivers, particularly those under the age of 25, often face higher premiums due to their perceived higher risk profile. Similarly, gender and marital status can also impact rates, with some companies offering discounts to married couples or females, citing statistical evidence of lower risk profiles.

Driving history is another critical factor. A clean driving record, free of accidents and traffic violations, can lead to significant savings on insurance premiums. Conversely, a history of accidents or moving violations can substantially increase rates, with some companies even refusing to provide coverage for high-risk drivers.

| Personal Factor | Impact on Rates |

|---|---|

| Age | Younger drivers often pay more due to higher risk |

| Gender | Some companies offer gender-based discounts |

| Marital Status | Married individuals may receive reduced rates |

| Driving History | Clean records lead to lower premiums; accidents and violations increase costs |

Geographical Considerations

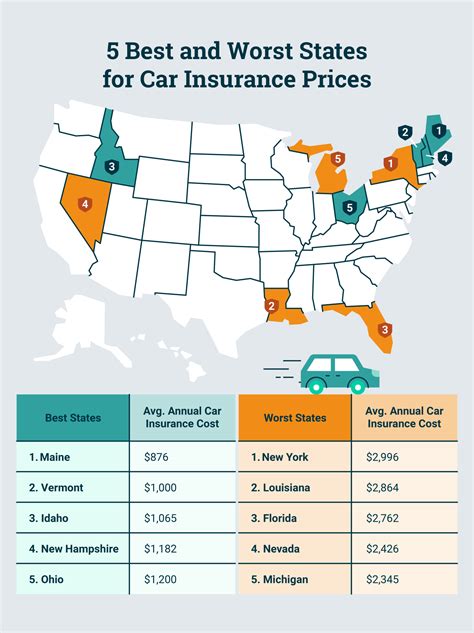

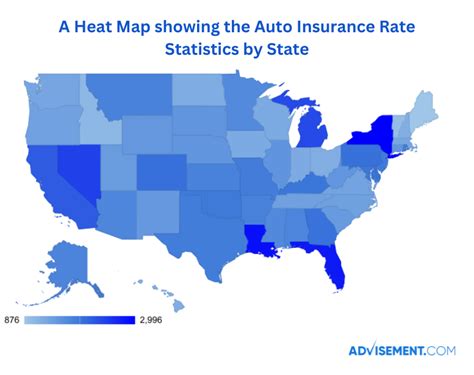

The geographical location of a driver is another significant factor in insurance rate determination. Insurance companies consider the prevalence of accidents, thefts, and natural disasters in a given area when setting rates. Urban areas, for instance, often have higher rates due to increased traffic congestion, higher risk of accidents, and a greater prevalence of thefts. Conversely, rural areas may have lower rates due to reduced traffic and fewer incidents.

State-specific laws and regulations also play a role. Some states mandate certain types of coverage or have unique no-fault systems, which can influence the cost of insurance. Additionally, the cost of living and labor in a particular state can affect repair costs, thereby impacting insurance rates.

Vehicle-Specific Factors

The type of vehicle being insured is another critical determinant of insurance rates. Insurance companies consider the make, model, and year of the vehicle, along with its safety ratings and the likelihood of theft. Vehicles with advanced safety features or those that are less prone to theft may qualify for lower rates.

The usage of the vehicle is also a consideration. Drivers who use their vehicles for business purposes or those who drive long distances for leisure may face higher premiums due to the increased risk associated with these activities. Conversely, low-mileage drivers or those who primarily use their vehicles for short commutes may be eligible for discounts.

| Vehicle Factor | Impact on Rates |

|---|---|

| Make, Model, and Year | Older or high-risk models may cost more to insure |

| Safety Features | Vehicles with advanced safety features may qualify for discounts |

| Theft Risk | Vehicles with a high theft risk may increase insurance costs |

| Vehicle Usage | Business or high-mileage usage can lead to higher premiums |

Insurance Coverage and Add-ons

The level of insurance coverage and any additional add-ons chosen by the driver also significantly impact the insurance rate. Comprehensive coverage, which includes protection against theft, fire, and natural disasters, can increase the premium. Similarly, collision coverage, which protects against accidents, can also add to the cost. However, these additional coverages can provide valuable peace of mind and financial protection in the event of an incident.

Optional add-ons, such as rental car coverage or roadside assistance, can further increase the insurance premium. While these add-ons may provide convenience, they are not always necessary, and drivers should carefully consider their needs before opting for these additional services.

Discounts and Special Programs

Insurance companies often offer a variety of discounts and special programs to attract customers and reward safe driving behavior. These can include multi-policy discounts for customers who bundle their auto insurance with other types of insurance, such as homeowners or renters insurance. Multi-car discounts are also common, offering reduced rates for customers who insure multiple vehicles with the same company.

Other discounts may be available for safe driving habits, such as maintaining a clean driving record or completing a defensive driving course. Some companies also offer discounts for vehicle safety features, such as anti-lock brakes or advanced driver assistance systems.

| Discount Type | Description |

|---|---|

| Multi-Policy Discount | Discount for customers who bundle multiple insurance policies with the same company |

| Multi-Car Discount | Reduced rates for insuring multiple vehicles with the same company |

| Safe Driver Discount | Reward for maintaining a clean driving record or completing a defensive driving course |

| Vehicle Safety Discount | Discounts for vehicles with advanced safety features or systems |

The Role of Technology

Advancements in technology have brought about new ways for insurance companies to assess risk and set rates. Telematics, for instance, allows drivers to install a device in their vehicle that tracks their driving behavior. This data is then used to offer personalized insurance rates based on actual driving habits, potentially rewarding safe drivers with lower premiums.

Furthermore, the rise of online insurance marketplaces and comparison tools has made it easier for drivers to shop around and compare rates from multiple insurers. This increased transparency and competition can drive down insurance costs, benefiting consumers who are proactive in their search for the best deals.

Conclusion: Navigating the Complexities of Auto Insurance Rates

Understanding the factors that influence auto insurance rates is a critical step towards securing the best coverage at the most competitive price. While personal, geographical, and vehicle-specific factors are beyond a driver’s control, there are still several avenues to explore for potential savings. By maintaining a clean driving record, choosing a safe vehicle, and taking advantage of available discounts and special programs, drivers can significantly reduce their insurance premiums.

Additionally, embracing technological advancements, such as telematics and online insurance marketplaces, can further empower drivers to make informed decisions and take control of their insurance costs. As the insurance landscape continues to evolve, staying informed and proactive will be key to navigating the complexities of auto insurance rates.

How do insurance companies determine risk for auto insurance rates?

+Insurance companies use a combination of personal, geographical, and statistical factors to assess risk. This includes evaluating the driver’s age, gender, marital status, and driving history, as well as considering the geographical location and the type of vehicle being insured. The risk assessment also takes into account the coverage and add-ons chosen by the driver.

Can I negotiate my auto insurance rates?

+While insurance rates are primarily determined by a complex algorithm that takes into account various risk factors, there are still opportunities to negotiate or adjust your rates. You can review your policy annually and discuss with your insurer about any changes in your personal circumstances or driving habits that may qualify you for discounts. Additionally, shopping around and comparing quotes from multiple insurers can help you find the best rates available.

What are some common misconceptions about auto insurance rates?

+One common misconception is that auto insurance rates are solely based on driving history. While driving history is a significant factor, insurance rates are influenced by a multitude of factors, including personal attributes, geographical location, vehicle type, and coverage choices. Another misconception is that insurance rates are set in stone and cannot be negotiated or influenced. As mentioned earlier, there are ways to potentially lower your rates by taking advantage of discounts and special programs offered by insurance companies.