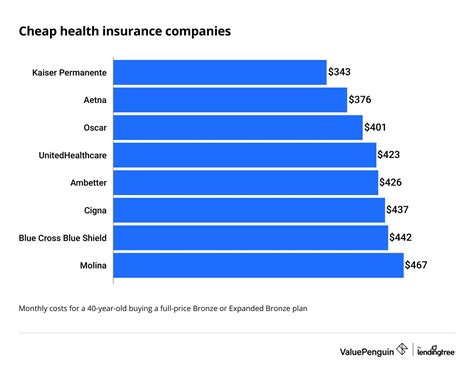

Cheapest Health Care Insurance

When it comes to health care insurance, finding the cheapest option is often a top priority for many individuals and families. With rising healthcare costs, having affordable coverage is essential to ensure access to necessary medical services without breaking the bank. In this comprehensive guide, we will explore the world of health care insurance, delve into the factors that influence its cost, and uncover strategies to identify and secure the cheapest plans available in the market.

Understanding Health Care Insurance Costs

The cost of health care insurance is influenced by a multitude of factors, each playing a significant role in determining the overall premium. Let’s break down these factors to gain a clearer understanding:

Individual vs. Family Plans

One of the primary considerations is whether you require an individual plan or a family plan. Individual plans cater to a single person, offering coverage tailored to their specific needs. On the other hand, family plans provide coverage for multiple individuals, typically including spouses and dependent children. Naturally, family plans tend to be more expensive due to the broader coverage they offer.

Age and Gender

Age and gender are fundamental factors in health care insurance pricing. Generally, younger individuals are offered lower premiums as they are perceived to have fewer health risks. Conversely, older individuals, especially those above the age of 50, may face higher premiums due to an increased likelihood of health issues. Gender-based pricing is also a consideration, with some insurers charging different rates for male and female policyholders.

Geographical Location

Your geographical location plays a vital role in determining the cost of health care insurance. Insurance rates can vary significantly from one state to another, influenced by factors such as the cost of living, healthcare infrastructure, and the overall demand for medical services in the area. Urban areas, for instance, often have higher insurance costs compared to rural regions.

Coverage Options and Deductibles

The extent of coverage you choose also impacts the cost of your health care insurance. Plans with comprehensive benefits and lower deductibles typically come with higher premiums. On the other hand, plans with limited coverage and higher deductibles may offer more affordable options. It’s crucial to strike a balance between the cost and the level of coverage that aligns with your healthcare needs.

Network and Provider Preferences

The network of healthcare providers and facilities covered by your insurance plan can affect its cost. Plans with a narrower network, often referred to as managed care plans, may offer more affordable premiums as they have negotiated lower rates with a select group of providers. Conversely, plans with a broader network, known as fee-for-service or indemnity plans, provide more flexibility in choosing healthcare providers but may come with higher costs.

Strategies to Find the Cheapest Health Care Insurance

Now that we have a grasp of the factors influencing health care insurance costs, let’s explore some effective strategies to identify and secure the cheapest plans available:

Research and Compare Plans

Conduct thorough research and compare various health care insurance plans offered by different providers. Utilize online comparison tools and resources to evaluate the features, coverage, and costs of multiple plans. This process allows you to identify the most affordable options that align with your specific needs.

Utilize Government Programs

Government-sponsored programs, such as Medicaid and the Children’s Health Insurance Program (CHIP), provide low-cost or no-cost health care insurance to eligible individuals and families. These programs are designed to assist those with low incomes or specific medical conditions. Check your eligibility and explore these options to access affordable healthcare coverage.

Employer-Sponsored Plans

Many employers offer health care insurance as part of their employee benefits package. These plans are often subsidized by the employer, making them more affordable than individual plans. Explore the options provided by your employer and compare them with other available plans to find the best value for your money.

Consider High-Deductible Health Plans (HDHPs)

High-deductible health plans offer a cost-effective alternative to traditional health insurance. These plans have lower premiums but come with higher deductibles, meaning you pay more out of pocket before the insurance coverage kicks in. HDHPs are often paired with Health Savings Accounts (HSAs), allowing you to save pre-tax dollars for qualified medical expenses.

Explore Short-Term Health Insurance

If you are between jobs or need temporary coverage, short-term health insurance plans can be a more affordable option. These plans typically have lower premiums and provide coverage for a limited period, usually ranging from a few months to a year. However, it’s important to note that short-term plans often have limited benefits and may not cover pre-existing conditions.

Negotiate and Bundle Services

Don’t hesitate to negotiate with insurance providers to secure a better rate. Sometimes, insurers are willing to offer discounts or negotiate terms to retain customers. Additionally, consider bundling multiple insurance services, such as health, life, and auto insurance, with the same provider. This can result in significant cost savings and streamlined management of your insurance needs.

The Impact of Subsidies and Tax Credits

For individuals and families with limited incomes, the availability of subsidies and tax credits can significantly reduce the cost of health care insurance. The Affordable Care Act (ACA) introduced various provisions to make healthcare more accessible and affordable for low- and middle-income households. Here’s how these subsidies and tax credits work:

Premium Tax Credits

Premium tax credits are available to individuals and families who purchase health insurance through the Health Insurance Marketplace. These credits are designed to reduce the monthly premium costs, making insurance more affordable. The amount of the tax credit is based on your income, family size, and the cost of insurance in your area. It can be claimed in advance and applied directly to your monthly premiums, or you can claim it when you file your taxes.

Cost-Sharing Reductions

Cost-sharing reductions (CSRs) are another form of financial assistance offered by the ACA. CSRs help lower the out-of-pocket costs, such as deductibles, copayments, and coinsurance, for individuals and families with lower incomes. These reductions are available to those who enroll in silver plans through the Health Insurance Marketplace. CSRs can significantly reduce the overall cost of healthcare, making it more manageable for those with limited financial resources.

Medicaid and CHIP

Medicaid and the Children’s Health Insurance Program (CHIP) are government-sponsored programs that provide low-cost or no-cost health care insurance to eligible individuals and families. Medicaid is available to those with limited incomes, while CHIP caters specifically to children and pregnant women. These programs offer comprehensive coverage, including medical, dental, and vision services, at little to no cost.

Choosing the Right Plan: A Personalized Approach

Finding the cheapest health care insurance plan is not solely about identifying the lowest premium. It’s essential to consider your unique healthcare needs, preferences, and budget. Here are some factors to keep in mind when selecting a plan:

Healthcare Needs and Preferences

Assess your current and potential future healthcare needs. Consider any ongoing medical conditions, prescription medications, or specialized treatments you or your family members may require. Choose a plan that provides adequate coverage for these needs without unnecessary frills. Additionally, evaluate your preferences for healthcare providers and facilities to ensure the plan’s network aligns with your choices.

Budget and Financial Considerations

Your budget plays a crucial role in determining the right health care insurance plan. Evaluate your financial situation and determine how much you can comfortably afford to spend on premiums, deductibles, and out-of-pocket expenses. Remember that while lower premiums may be tempting, they often come with higher deductibles and out-of-pocket costs. Strike a balance between affordability and the coverage that meets your healthcare needs.

Understanding the Fine Print

Before committing to a health care insurance plan, carefully review the policy’s fine print. Pay attention to the coverage limits, exclusions, and any hidden fees or restrictions. Ensure that the plan covers the essential health benefits required by law, such as ambulatory patient services, hospitalization, prescription drugs, and mental health services. Understanding the details of the plan will help you make an informed decision and avoid unexpected costs or coverage gaps.

The Future of Affordable Health Care Insurance

The landscape of health care insurance is continually evolving, driven by technological advancements, policy changes, and shifting consumer preferences. Here’s a glimpse into the future of affordable health care insurance:

Telemedicine and Digital Health Solutions

Telemedicine and digital health solutions are gaining traction, offering convenient and cost-effective alternatives to traditional in-person healthcare. These technologies enable remote consultations, virtual diagnostics, and online prescription refills, reducing the need for costly hospital visits. As these services become more prevalent, insurers may incorporate them into their plans, providing affordable and accessible healthcare options.

Value-Based Care Models

Value-based care models are gaining momentum, focusing on delivering high-quality healthcare outcomes while controlling costs. These models reward healthcare providers for delivering efficient and effective care, rather than simply billing for services rendered. As value-based care becomes more widespread, insurers may adopt these models, resulting in more affordable and outcome-oriented healthcare plans.

Consumer-Driven Health Plans

Consumer-driven health plans, such as Health Reimbursement Arrangements (HRAs) and Health Savings Accounts (HSAs), are becoming increasingly popular. These plans empower individuals to take control of their healthcare decisions and expenses. By combining high-deductible health plans with tax-advantaged accounts, consumers can save for qualified medical expenses and make more informed choices about their healthcare. This shift towards consumer-driven plans may lead to increased affordability and personalized healthcare experiences.

Conclusion

Finding the cheapest health care insurance is a multifaceted process that requires careful consideration of various factors. By understanding the cost influencers, researching and comparing plans, exploring government programs and employer-sponsored options, and negotiating with providers, you can secure affordable coverage that meets your healthcare needs. Additionally, stay informed about the evolving landscape of health care insurance, embracing innovative solutions and consumer-driven models that may offer more cost-effective options in the future.

Can I qualify for subsidies or tax credits if I have a moderate income?

+Yes, individuals and families with moderate incomes may still be eligible for subsidies and tax credits to reduce the cost of health care insurance. The eligibility criteria and the amount of assistance vary based on factors such as income level, family size, and the cost of insurance in your area. It’s recommended to explore the Health Insurance Marketplace to determine your eligibility and the potential savings you can receive.

Are there any drawbacks to short-term health insurance plans?

+Short-term health insurance plans offer a more affordable alternative for temporary coverage, but they come with certain limitations. These plans typically have shorter coverage periods, often ranging from a few months to a year. Additionally, they may have limited benefits, excluding coverage for pre-existing conditions or certain essential health services. It’s crucial to carefully review the terms and conditions of short-term plans to ensure they align with your healthcare needs.

How can I save money on prescription medications?

+There are several strategies to save money on prescription medications. Firstly, explore generic alternatives to brand-name drugs, as they are often significantly more affordable. Compare prices at different pharmacies, both online and offline, to find the best deals. Consider using prescription discount cards or joining pharmacy reward programs that offer savings on medications. Additionally, some insurance plans offer prescription drug coverage, so it’s worth checking if your plan includes this benefit.