Liability Insurance For Vehicle

Liability insurance for vehicles is an essential aspect of responsible driving and vehicle ownership. It plays a crucial role in protecting individuals and businesses from financial risks and legal liabilities that may arise from accidents or incidents involving their vehicles. This comprehensive guide will delve into the intricacies of liability insurance for vehicles, exploring its significance, coverage options, and real-world implications.

Understanding Liability Insurance

Liability insurance, in the context of vehicles, is a form of coverage that provides financial protection to policyholders in the event of accidents or incidents where they are found to be at fault. It covers the costs associated with damages to other vehicles, property, or individuals involved in the accident. By having liability insurance, vehicle owners can mitigate the potential financial burdens and legal consequences that may arise from such incidents.

Key Components of Liability Insurance

Liability insurance typically consists of two main components: bodily injury liability and property damage liability.

- Bodily Injury Liability: This coverage pays for the medical expenses, pain and suffering, and lost wages of individuals injured in an accident caused by the policyholder. It ensures that the financial burden of treating injuries and compensating victims is covered, up to the policy limits.

- Property Damage Liability: This aspect of liability insurance covers the costs associated with repairing or replacing damaged property, including other vehicles, buildings, fences, and even personal belongings. It ensures that the policyholder is not left financially responsible for costly repairs or replacements.

Importance of Liability Insurance

The significance of liability insurance for vehicles cannot be overstated. Here are some key reasons why it is essential:

- Financial Protection: Liability insurance provides a vital financial safety net, ensuring that policyholders do not face catastrophic financial losses in the event of an accident. It covers the costs that may arise from injuries, property damage, and legal fees, which can be substantial.

- Legal Compliance: In most jurisdictions, liability insurance is a legal requirement for vehicle owners. Operating a vehicle without adequate liability coverage can result in severe penalties, including fines, license suspension, and even criminal charges.

- Peace of Mind: Having liability insurance offers peace of mind to vehicle owners. It allows them to drive with confidence, knowing that they are protected against potential financial liabilities and legal ramifications of accidents.

- Community Safety: Adequate liability insurance contributes to the overall safety of the community. It ensures that victims of accidents have a means of recovering their losses, promoting fairness and accountability on the roads.

Coverage Options and Considerations

When selecting liability insurance for your vehicle, several factors and coverage options come into play. Here’s a detailed look at some crucial considerations:

Liability Limits

Liability limits refer to the maximum amount that the insurance company will pay for covered damages. These limits are typically set for both bodily injury and property damage. It is essential to choose liability limits that provide adequate coverage for potential risks. Higher limits offer more protection but may also result in higher premiums.

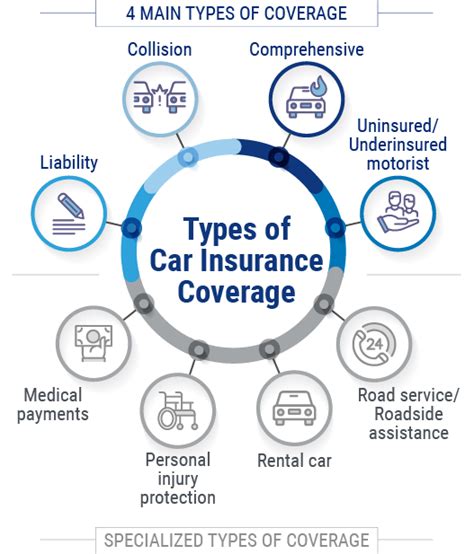

Collision and Comprehensive Coverage

While liability insurance covers damages to others, it does not necessarily cover damages to your own vehicle. Collision and comprehensive coverage are additional types of insurance that provide protection for your vehicle in various scenarios. Collision coverage pays for repairs or replacements when your vehicle is involved in an accident, regardless of fault. Comprehensive coverage, on the other hand, covers damages caused by non-collision incidents such as theft, vandalism, natural disasters, or collisions with animals.

Uninsured and Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage is an essential aspect of liability insurance. It provides protection in cases where the at-fault driver does not have sufficient insurance coverage to compensate for the damages caused. This coverage ensures that you are not left bearing the financial burden when involved in an accident with an uninsured or underinsured driver.

Personal Injury Protection (PIP)

Personal Injury Protection, often referred to as PIP, is a type of insurance coverage that provides medical and related benefits to the insured and their passengers, regardless of fault. PIP coverage ensures that medical expenses and other related costs are covered, even if the insured is at fault in an accident. It is a crucial component of liability insurance, as it focuses on providing immediate medical care and financial support during the recovery process.

| Coverage Type | Description |

|---|---|

| Liability Insurance | Covers damages to others caused by the insured |

| Collision Coverage | Pays for repairs or replacements when the insured vehicle is involved in an accident |

| Comprehensive Coverage | Covers damages caused by non-collision incidents |

| Uninsured/Underinsured Motorist Coverage | Protects the insured in cases where the at-fault driver lacks sufficient insurance |

| Personal Injury Protection (PIP) | Provides medical and related benefits to the insured and their passengers, regardless of fault |

Real-World Implications

Liability insurance for vehicles has tangible real-world implications that affect both individuals and businesses.

Individual Drivers

For individual drivers, liability insurance is a critical component of their financial planning and risk management. It provides a safety net, ensuring that an accident does not lead to financial ruin. Additionally, liability insurance plays a vital role in maintaining one’s driving record and reputation. By having adequate coverage, drivers can avoid legal complications and the potential long-term consequences of being uninsured.

Businesses and Fleets

Businesses that operate fleets of vehicles face unique challenges when it comes to liability insurance. They must consider not only the insurance needs of their vehicles but also the potential liabilities associated with their operations. Comprehensive liability insurance coverage is essential for businesses to protect themselves against lawsuits, property damage claims, and other financial risks that could arise from their fleet operations.

Legal and Regulatory Considerations

Liability insurance for vehicles is subject to various legal and regulatory requirements. Insurance laws and regulations vary across jurisdictions, and it is crucial for vehicle owners and businesses to understand and comply with these rules. Failure to adhere to insurance mandates can result in severe penalties and legal repercussions.

Future Implications and Innovations

The landscape of liability insurance for vehicles is continually evolving, driven by technological advancements and changing industry dynamics. Here are some future implications and innovations to consider:

Autonomous Vehicles

The emergence of autonomous vehicles presents unique challenges and opportunities for liability insurance. As self-driving cars become more prevalent, insurance companies will need to adapt their policies to address the specific risks and responsibilities associated with this new technology. This may involve developing specialized coverage options and redefining liability in the context of autonomous driving.

Telematics and Usage-Based Insurance

Telematics technology, which collects and analyzes data from vehicles, is gaining traction in the insurance industry. Usage-based insurance (UBI) programs utilize telematics to assess driving behavior and offer customized insurance rates based on actual driving habits. This innovation has the potential to revolutionize liability insurance, providing more accurate risk assessments and tailored coverage options for policyholders.

Data-Driven Risk Assessment

With advancements in data analytics and artificial intelligence, insurance companies are increasingly leveraging data-driven risk assessment models. These models analyze vast amounts of data, including driving behavior, vehicle usage patterns, and environmental factors, to predict and manage risks more effectively. By incorporating data-driven insights, insurance providers can offer more precise and personalized liability insurance coverage.

Insurance-as-a-Service

The concept of Insurance-as-a-Service (IaaS) is gaining momentum, particularly in the vehicle insurance space. IaaS models offer flexible and on-demand insurance coverage, allowing policyholders to tailor their coverage based on their immediate needs. This innovative approach provides greater convenience and cost-effectiveness, especially for short-term vehicle usage or specialized driving situations.

What is the minimum liability insurance coverage required by law?

+The minimum liability insurance coverage required by law varies across jurisdictions. It is crucial to research and understand the specific requirements in your area. In some cases, states or provinces may mandate a minimum amount of bodily injury liability and property damage liability coverage. It is recommended to consult with an insurance professional to ensure compliance with local regulations.

How can I choose the right liability limits for my insurance policy?

+Choosing the right liability limits involves considering your financial situation, the value of your assets, and the potential risks associated with your driving habits and location. It is advisable to consult with an insurance agent who can assess your specific needs and recommend appropriate liability limits. Higher limits offer greater protection but may result in higher premiums.

Are there any discounts available for liability insurance?

+Yes, many insurance companies offer discounts for liability insurance. These discounts may be based on factors such as safe driving records, multiple policy bundles, or the installation of safety features in your vehicle. It is worth exploring these options with your insurance provider to potentially reduce your premiums.

Liability insurance for vehicles is a complex yet essential aspect of responsible vehicle ownership. By understanding the various coverage options, legal requirements, and future innovations, vehicle owners and businesses can make informed decisions to protect themselves and their assets. This comprehensive guide aims to provide valuable insights and knowledge to navigate the world of liability insurance effectively.