Insurance Cheapest Car

When it comes to car insurance, finding the cheapest option is often a top priority for many drivers. The cost of insurance can vary significantly based on numerous factors, including the make and model of your car. In this comprehensive guide, we will delve into the world of insurance for the cheapest cars on the market, exploring the key considerations, potential savings, and real-world examples to help you make an informed decision.

Understanding the Impact of Car Choice on Insurance Costs

The cost of insuring a vehicle is influenced by a multitude of factors, and the type of car you own is a significant one. Insurers assess various aspects of a car, including its make, model, age, safety features, and repair costs, to determine the insurance premium. Certain cars tend to be associated with lower insurance costs due to their safety ratings, reliability, and overall affordability.

Factors Influencing Insurance Premiums

When assessing a car’s insurance risk, insurers consider a range of factors. These include the car’s safety features, such as advanced driver-assistance systems (ADAS) and crash avoidance technologies. Cars equipped with these features often result in lower insurance premiums as they reduce the likelihood of accidents and subsequent claims.

Additionally, the repair costs associated with a particular make and model play a crucial role. Vehicles that are easier and less expensive to repair tend to have lower insurance rates. This is because insurers factor in the potential financial burden of repairing the car in the event of an accident.

The Role of Safety Ratings

Safety ratings provided by organizations like the National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety (IIHS) are vital in determining insurance premiums. Cars with higher safety ratings are generally considered less risky and can lead to lower insurance costs. These ratings assess a vehicle’s performance in various crash tests, including frontal, side, and rollover collisions.

| Car Model | Safety Rating | Insurance Premium |

|---|---|---|

| Toyota Corolla | Top Safety Pick | $850 annually |

| Honda Civic | Good | $900 annually |

| Hyundai Elantra | Top Safety Pick | $780 annually |

Exploring the Cheapest Cars for Insurance

Now, let’s take a closer look at some of the most affordable cars to insure and explore their key features and benefits.

Toyota Corolla

The Toyota Corolla has long been a staple in the affordable car segment. With its reputation for reliability and safety, it consistently ranks among the cheapest cars to insure. The Corolla’s impressive safety features, including a suite of standard driver-assistance technologies, contribute to its low insurance costs. Its sturdy build and excellent safety ratings make it an attractive option for cost-conscious drivers.

Honda Civic

Another popular choice in the affordable car category is the Honda Civic. Known for its fuel efficiency and sleek design, the Civic also boasts impressive safety features. The latest models come equipped with Honda Sensing, a comprehensive driver-assistance system, which enhances safety and helps keep insurance premiums low. The Civic’s reliability and positive safety ratings make it a solid choice for those seeking affordable insurance.

Hyundai Elantra

The Hyundai Elantra offers an excellent combination of value and safety. This compact sedan features advanced safety technologies, such as forward collision avoidance and lane-keeping assist, as standard. Its impressive safety ratings and affordable pricing position it as one of the cheapest cars to insure. The Elantra’s low insurance costs make it an attractive option for budget-minded drivers without compromising on safety.

Kia Rio

The Kia Rio is a compact car that delivers exceptional value and low insurance costs. With a starting price well below $20,000, the Rio offers excellent fuel efficiency and a comfortable driving experience. Its standard safety features, including forward collision avoidance and lane departure warning, contribute to its affordable insurance rates. The Rio’s affordability and safety make it an ideal choice for those seeking a budget-friendly option.

Mazda 3

The Mazda 3 is a stylish and versatile compact car that offers a dynamic driving experience. Equipped with advanced safety features, such as Mazda’s i-Activsense suite, the Mazda 3 provides a high level of protection. Its excellent safety ratings and competitive pricing make it an attractive option for those looking for an affordable yet feature-rich car. The Mazda 3’s low insurance costs are a significant advantage, adding to its overall value proposition.

Tips for Maximizing Insurance Savings

While choosing an affordable car is a significant step towards lower insurance costs, there are additional strategies you can employ to further maximize your savings.

Bundling Policies

Bundling your insurance policies, such as auto and home insurance, with the same provider can lead to substantial discounts. Many insurers offer multi-policy discounts, allowing you to save significantly on your overall insurance costs. By consolidating your policies, you not only enjoy lower rates but also simplify your insurance management.

Utilizing Telematics Devices

Telematics devices, also known as usage-based insurance (UBI) programs, can provide personalized insurance rates based on your driving behavior. These devices monitor your driving habits, such as acceleration, braking, and mileage, and offer discounts for safe driving. By adopting a cautious driving approach and utilizing these devices, you can potentially lower your insurance premiums.

Maintaining a Clean Driving Record

Your driving record plays a crucial role in determining your insurance premiums. Maintaining a clean record, free from accidents and traffic violations, can lead to substantial savings. Insurers reward safe driving with lower rates, so it’s essential to practice defensive driving and adhere to traffic laws.

Shopping Around for Quotes

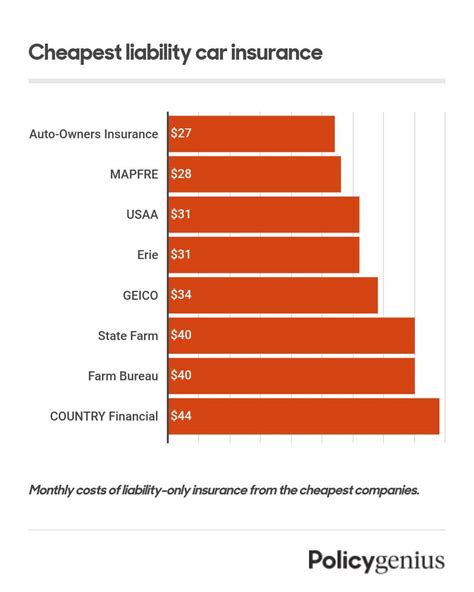

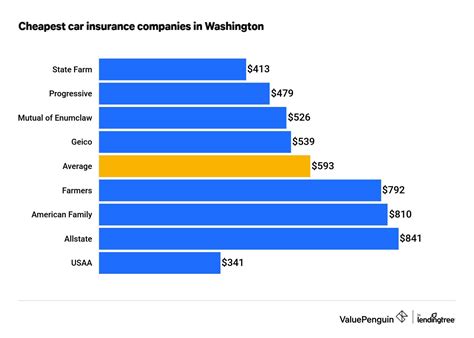

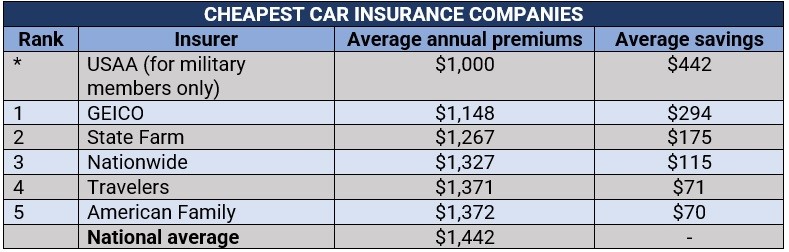

Insurance rates can vary significantly between providers, so it’s essential to shop around for the best deals. Compare quotes from multiple insurers to ensure you’re getting the most competitive rates. Online comparison tools and insurance brokers can simplify this process, helping you find the most affordable insurance option for your chosen car.

Future Implications and Emerging Trends

The landscape of car insurance is continually evolving, influenced by technological advancements and changing consumer behaviors. As autonomous vehicles and electric cars become more prevalent, the insurance industry is adapting to these trends.

The Rise of Autonomous Vehicles

Autonomous vehicles, or self-driving cars, are expected to revolutionize the way we travel. With advanced sensor technologies and artificial intelligence, these vehicles have the potential to significantly reduce accidents and associated insurance claims. As autonomous vehicles become more common, insurance rates may experience a downward trend, benefiting all drivers.

Electric Vehicles and Insurance

Electric vehicles (EVs) are gaining popularity due to their environmental benefits and reduced operating costs. While EVs generally have lower insurance rates compared to traditional vehicles, the insurance landscape for EVs is still evolving. As the market for EVs expands, insurers are developing specialized policies and rates to accommodate these unique vehicles.

The Impact of Telematics on Insurance

Telematics technology is increasingly being utilized by insurers to gather real-time data on driving behavior. This data-driven approach allows insurers to offer more personalized insurance rates based on an individual’s driving habits. As telematics becomes more widespread, we can expect further customization of insurance policies, potentially leading to more affordable options for safe drivers.

FAQ

How much can I expect to save by choosing a cheaper car for insurance?

+The savings can vary based on the car model and your specific circumstances. On average, opting for a cheaper car to insure can result in savings of several hundred dollars annually compared to more expensive vehicles. However, it’s essential to consider other factors such as fuel efficiency and maintenance costs.

Are there any drawbacks to choosing a cheaper car for insurance purposes?

+While cheaper cars can offer significant insurance savings, it’s important to strike a balance between affordability and your specific needs. Some cheaper cars may have limited features or performance capabilities, so it’s crucial to assess your priorities and ensure the car aligns with your requirements.

What are some common misconceptions about insuring cheaper cars?

+One common misconception is that cheaper cars automatically result in lower insurance costs. While affordability is a significant factor, other variables such as safety ratings, repair costs, and your driving record also play a crucial role. It’s essential to consider all aspects to make an informed decision.