Insurance Number Number

Unraveling the Insurance Enigma: Understanding the Significance of Policy Numbers

In the complex world of insurance, policy numbers serve as unique identifiers, much like a personal ID. These numbers play a pivotal role in the entire insurance process, from the initial quote to the final claim settlement. Understanding their importance and functionality is key to navigating the insurance landscape effectively.

This article aims to demystify insurance policy numbers, exploring their structure, purpose, and the crucial role they play in safeguarding policyholders' interests. By the end of this exploration, readers will have a comprehensive understanding of these numerical codes, enabling them to better manage their insurance affairs.

The Anatomy of an Insurance Policy Number

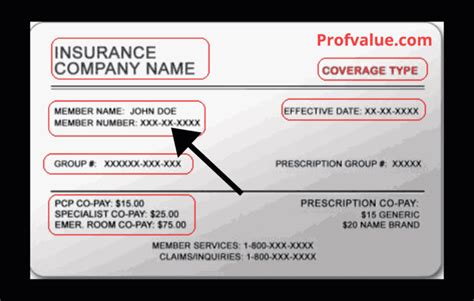

Insurance policy numbers are typically a sequence of digits, sometimes accompanied by letters, which serve to uniquely identify a specific insurance policy. The length and structure of these numbers can vary across insurance companies and the type of coverage offered. For instance, auto insurance policies might have different numbering systems compared to health or life insurance.

While the specific details of a policy number's construction are often proprietary, some general patterns can be observed. Often, the first few digits represent the policyholder's account number, providing a link to their personal information and insurance history. Subsequent digits might indicate the type of insurance coverage, the policy term, or even the policy's unique reference within the insurer's system.

For example, consider the following fictional policy number: ABC1234567. Here, ABC might represent the insurer's code, 123456 could be the policyholder's unique identifier, and 7 might signify the policy term or a specific coverage type.

| Policy Number Segment | Potential Meaning |

|---|---|

| ABC | Insurer Code |

| 123456 | Policyholder Identifier |

| 7 | Policy Term or Coverage Type |

The Role of Policy Numbers in Insurance Operations

Identifying Policyholders and Their Policies

At its core, a policy number's primary function is to uniquely identify a policyholder and their specific insurance policy. This ensures that insurers can accurately manage and administer a vast number of policies, each with its own unique set of terms and conditions.

When a policyholder interacts with their insurer, whether it's to make a claim, update their policy, or simply inquire about their coverage, providing their policy number is often the first step. This number allows the insurer to swiftly access the relevant policy details, ensuring efficient and accurate service.

Streamlining Administrative Processes

Policy numbers are also instrumental in streamlining the insurer's internal processes. They facilitate the easy sorting, filing, and retrieval of policy documents, claims records, and other related paperwork. This efficiency is crucial, especially when dealing with large volumes of policies and claims.

Moreover, policy numbers play a vital role in data analytics and reporting. Insurers can use these numbers to track policy trends, analyze claim patterns, and make informed decisions about pricing, coverage, and risk management strategies.

Enhancing Customer Experience

Despite their administrative focus, policy numbers also contribute significantly to the customer experience. By enabling quick and accurate policy access, insurers can provide faster and more personalized service. This, in turn, fosters customer satisfaction and loyalty, which are essential for any insurance business.

Real-World Applications and Scenarios

Claim Processing

One of the most critical applications of policy numbers is in the claim process. When a policyholder needs to make a claim, they must provide their policy number to initiate the process. This number is then used to verify the policyholder's identity, validate their coverage, and assess the validity of the claim.

For instance, imagine a car accident where the insured driver needs to file a claim for vehicle repairs. By providing their policy number, the insurer can quickly verify the policy's active status, assess the level of coverage for the specific type of accident, and process the claim efficiently.

Policy Updates and Amendments

Policy numbers are also essential when making changes to an existing policy. Whether it's adding a new driver to an auto insurance policy, adjusting coverage limits, or renewing a policy, the policy number is the key to accessing and modifying the correct policy.

For example, if a homeowner wants to increase their coverage limits to account for recent home improvements, they would need to provide their policy number to the insurer. With this number, the insurer can locate the policy, assess the requested changes, and provide a quote for the updated coverage.

Policy Monitoring and Analysis

Policy numbers are invaluable for insurers when monitoring and analyzing policy performance. By tracking policy numbers, insurers can identify trends, assess risk levels, and make informed decisions about policy offerings and pricing.

Consider a health insurance provider analyzing policy numbers to identify regions with higher claim rates. This analysis could reveal areas where specific health conditions are prevalent, allowing the insurer to adjust coverage options or premium rates accordingly.

Future Implications and Innovations

As technology advances, the role and functionality of policy numbers are likely to evolve. The integration of digital platforms and artificial intelligence could lead to more sophisticated and efficient uses of policy numbers.

For instance, with the rise of digital insurance platforms, policy numbers could become embedded within digital wallets or personal profiles, making policy access and management even more seamless. Additionally, advanced analytics could leverage policy numbers to provide personalized insurance recommendations or tailored coverage options based on an individual's specific needs and risk profile.

Moreover, as the insurance industry continues to embrace sustainability and ethical practices, policy numbers could play a role in tracking and incentivizing environmentally friendly behaviors or social responsibility initiatives. Insurers might use policy numbers to offer discounts or rewards for policyholders who adopt sustainable practices or support community initiatives.

Conclusion

In conclusion, insurance policy numbers are far more than just a sequence of digits. They are the backbone of efficient insurance operations, enabling insurers to manage policies, process claims, and provide personalized service. As the insurance landscape continues to evolve, policy numbers will likely play an even more central role, integrating with digital technologies and advancing sustainability initiatives.

Understanding the significance and functionality of policy numbers empowers policyholders to better navigate the insurance world, ensuring their policies are managed effectively and their interests are well-protected.

What happens if I forget or misplace my policy number?

+

If you misplace your policy number, you can typically retrieve it by contacting your insurance provider. They may ask for personal information to verify your identity and then provide you with your policy number. It’s always a good idea to keep a record of your policy number in a safe and easily accessible place.

Can policy numbers be changed, and if so, why and how?

+

Policy numbers are generally unique and permanent for the duration of the policy. However, in rare cases, an insurer might change a policy number, typically due to administrative reasons or system upgrades. In such cases, the insurer will notify the policyholder of the change and provide the new number.

Are policy numbers secure, and how are they protected from fraud or misuse?

+

Policy numbers are considered secure, and insurers take measures to protect them from fraud and misuse. These measures often include encryption, secure storage, and stringent access controls. Additionally, policyholders are encouraged to keep their policy numbers confidential and report any suspicious activity immediately.