General Insurance Liabilities

In the world of insurance, general liabilities play a crucial role in protecting individuals, businesses, and organizations from unforeseen events and potential legal consequences. This comprehensive article delves into the intricacies of general insurance liabilities, exploring its significance, coverage options, and the impact it has on risk management strategies.

Understanding General Insurance Liabilities

General insurance liabilities, often referred to as general liability insurance, is a vital component of the insurance landscape. It serves as a protective shield, safeguarding policyholders from various risks and legal responsibilities that could arise during their day-to-day operations or interactions with others.

At its core, general liability insurance is designed to cover third-party claims against the insured entity. These claims can stem from a wide range of incidents, including bodily injury, property damage, personal injury, or even advertising-related disputes. The purpose of this insurance is to provide financial coverage and legal support in the event of such claims, helping policyholders navigate the complexities of legal proceedings and potential settlements.

Key Coverage Areas

General liability insurance offers a broad spectrum of coverage, ensuring that policyholders are protected from a multitude of potential risks. Here are some of the key areas it typically covers:

- Bodily Injury: This coverage extends to injuries sustained by individuals on the policyholder’s premises or as a result of their products or services. It covers medical expenses, pain and suffering, and even lost wages for the injured party.

- Property Damage: In the event that the policyholder’s actions or products cause damage to someone else’s property, this coverage steps in to repair or replace the damaged items, ensuring financial relief for the affected party.

- Personal Injury: Personal injury claims, such as defamation, libel, or slander, are also covered under general liability insurance. This protection is essential for businesses and individuals who interact with the public, ensuring they are not left vulnerable to such allegations.

- Advertising and Product Claims: General liability insurance often includes coverage for disputes arising from advertising practices or product defects. This can include false advertising claims or situations where a product causes harm to a consumer.

By offering such comprehensive coverage, general liability insurance provides a robust safety net for policyholders, allowing them to focus on their core operations without constant worry about potential liabilities.

The Importance of General Insurance Liabilities

General insurance liabilities are of utmost importance for both individuals and businesses alike. They serve as a critical component of risk management strategies, offering several key benefits that contribute to overall financial stability and peace of mind.

Financial Protection

One of the primary reasons for obtaining general liability insurance is the financial protection it provides. In today’s litigious society, the potential for lawsuits and claims is ever-present. Whether it’s a slip and fall accident on your business premises or a product defect that causes harm, the costs associated with such incidents can be astronomical. General liability insurance steps in to cover these expenses, including legal fees, settlements, and judgments, ensuring that policyholders are not left financially devastated.

Legal Defense and Settlement Assistance

When faced with a liability claim, having general liability insurance means having a team of legal experts on your side. Insurance providers often offer legal defense coverage, which includes the cost of hiring attorneys to represent the policyholder in court. This support is invaluable, as it ensures that the insured party has the best possible legal representation to navigate the complexities of the legal system.

Additionally, general liability insurance often includes settlement assistance. This means that the insurance company will work with the policyholder to negotiate and reach a settlement with the claimant, aiming to resolve the issue swiftly and fairly. This process can significantly reduce the stress and uncertainty associated with legal disputes.

Business Continuity

General insurance liabilities are essential for maintaining business continuity. In the event of a liability claim, businesses can face significant disruptions to their operations. Legal battles, financial strains, and damage to reputation can all contribute to a business’s downfall. However, with general liability insurance in place, businesses can weather these storms more effectively.

By providing financial coverage and legal support, general liability insurance allows businesses to focus on their core operations and long-term goals. It ensures that they can continue serving their customers, honor their commitments, and maintain their reputation in the market. Without this crucial insurance, a single liability claim could potentially lead to the demise of a thriving business.

Customizing Coverage: Tailoring General Insurance Liabilities

General liability insurance is not a one-size-fits-all solution. Insurance providers understand that different industries, businesses, and individuals face unique risks. As such, they offer a range of customization options to ensure that policyholders can tailor their coverage to their specific needs.

Industry-Specific Considerations

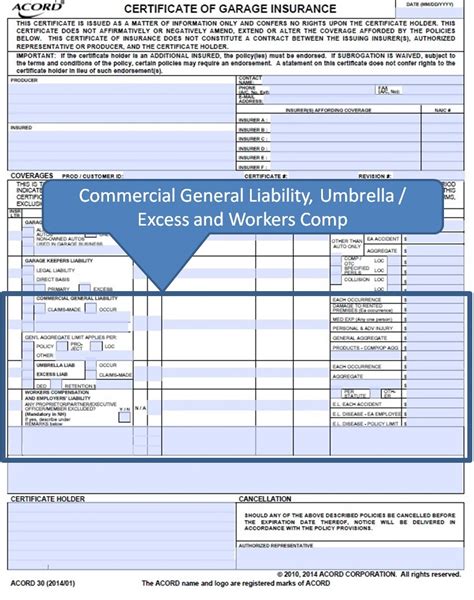

Different industries come with their own set of risks and liabilities. For instance, a construction company faces distinct challenges compared to a retail store or a professional services firm. Insurance providers recognize these differences and offer industry-specific endorsements and riders to enhance coverage. These additions can provide protection for unique scenarios, such as construction defects or professional errors and omissions.

Policy Limits and Deductibles

Policyholders have the flexibility to choose their desired policy limits and deductibles when purchasing general liability insurance. Policy limits refer to the maximum amount the insurance company will pay out for a covered claim, while deductibles are the portion of the claim that the policyholder must pay out of pocket. By adjusting these factors, individuals and businesses can strike a balance between premium costs and the level of coverage they require.

Additional Coverage Options

Beyond the standard general liability coverage, insurance providers often offer a range of additional coverage options to further enhance protection. These may include:

- Cyber Liability Insurance: With the increasing prevalence of cyber threats, this coverage protects against data breaches, hacking, and other online risks.

- Business Interruption Insurance: In the event of a covered loss, this insurance covers the business’s lost income and expenses during the interruption of operations.

- Umbrella Insurance: This policy provides an extra layer of liability protection, extending coverage beyond the limits of the primary general liability policy.

By carefully reviewing their options and consulting with insurance professionals, policyholders can create a comprehensive insurance portfolio that addresses their unique risks and needs.

Real-World Applications and Case Studies

To illustrate the practical impact of general insurance liabilities, let’s explore a few real-world scenarios and case studies.

Scenario 1: Bodily Injury Claim

Imagine a small cafe owner who has recently purchased general liability insurance. One afternoon, a customer slips and falls on a wet floor, sustaining a serious injury. The customer files a claim against the cafe, seeking compensation for medical expenses and pain and suffering. With general liability insurance in place, the cafe owner is protected. The insurance company steps in to cover the medical bills, lost wages, and any other associated costs, providing the necessary financial relief to the injured party and ensuring the cafe owner is not personally liable.

Scenario 2: Property Damage Dispute

A construction company specializing in residential projects has been hired to build a new home. During the construction process, an adjacent property sustains water damage due to a leak in the newly installed plumbing system. The homeowner files a claim against the construction company, demanding compensation for the repairs. General liability insurance steps in to cover the cost of repairing the damaged property, ensuring that the construction company is not held financially responsible for the mistake.

Case Study: Product Liability Claim

A well-known electronics manufacturer faces a class-action lawsuit due to a defect in one of its products. The defect has caused harm to multiple consumers, resulting in personal injuries. With general liability insurance in place, the manufacturer is protected. The insurance company provides legal defense, negotiates settlements with the affected consumers, and covers the associated costs, allowing the manufacturer to continue its operations without significant financial strain.

The Future of General Insurance Liabilities

As the world continues to evolve, so too does the landscape of general insurance liabilities. With advancements in technology, changing consumer behaviors, and evolving legal landscapes, the insurance industry must adapt to stay relevant and effective.

Emerging Risks and Challenges

The rise of technology has introduced new risks that were previously unheard of. Cyber attacks, data breaches, and online defamation are just a few examples of emerging liabilities. Insurance providers are continually developing new coverage options and endorsements to address these evolving risks, ensuring that policyholders remain protected in an increasingly digital world.

The Role of Technology in Insurance

Technology is not only presenting new challenges but also offering innovative solutions. Insurtech, or insurance technology, is revolutionizing the industry. From digital platforms that streamline the insurance purchasing process to advanced analytics that predict and mitigate risks, technology is enhancing the efficiency and effectiveness of general liability insurance.

Furthermore, the use of data analytics and machine learning allows insurance providers to make more informed decisions about risk assessment and pricing. This data-driven approach ensures that policyholders receive fair and accurate coverage, tailored to their unique circumstances.

Regulatory and Legal Considerations

The insurance industry operates within a complex web of regulations and legal frameworks. As these rules evolve, insurance providers must adapt their offerings to remain compliant. This includes staying abreast of changes in liability laws, consumer protection regulations, and industry-specific standards. By actively engaging with regulatory bodies and legal experts, insurance companies can ensure that their policies continue to provide the necessary protection and meet the evolving needs of their policyholders.

Conclusion

General insurance liabilities are an indispensable aspect of modern risk management. They provide a vital safety net for individuals and businesses, offering financial protection, legal defense, and peace of mind. As we’ve explored, general liability insurance covers a wide range of risks, from bodily injury and property damage to personal injury and advertising claims. By tailoring coverage to specific needs and staying abreast of emerging risks and regulatory changes, policyholders can ensure they are adequately protected in an ever-changing world.

In an increasingly complex and interconnected world, general insurance liabilities serve as a crucial foundation for stability and resilience. With the right coverage in place, individuals and businesses can focus on their goals and aspirations, knowing they are protected from the unexpected.

What is the average cost of general liability insurance?

+The cost of general liability insurance varies depending on several factors, including the industry, business size, and the level of coverage required. On average, small businesses can expect to pay between 300 to 1,000 annually for general liability insurance. However, larger businesses or those with higher risk profiles may pay significantly more.

How long does it take to process a general liability claim?

+The timeline for processing a general liability claim can vary based on the complexity of the claim and the insurance provider’s processes. Simple claims with clear liability and minimal damages may be resolved within a few weeks. More complex claims involving extensive investigations or legal proceedings can take several months or even longer to reach a resolution.

Can general liability insurance cover intentional acts or criminal behavior?

+General liability insurance typically does not cover intentional acts or criminal behavior. This is because insurance policies are designed to protect against accidental or unforeseen events. However, there may be specific endorsements or riders available that can extend coverage to certain intentional acts, depending on the circumstances and the insurance provider.