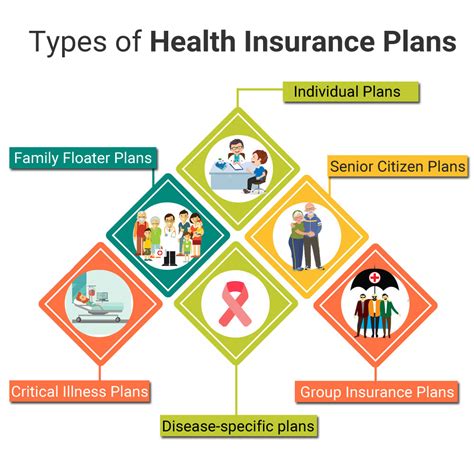

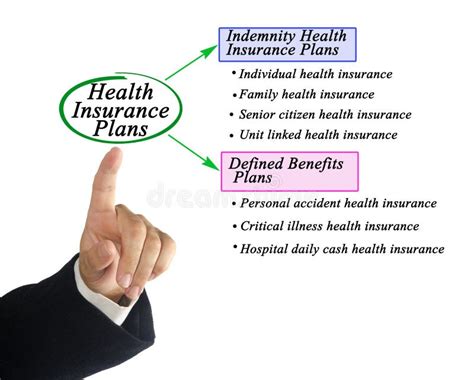

Types Of Medical Insurance Coverage

Medical insurance is a vital aspect of healthcare, providing individuals and families with financial protection and access to essential medical services. With the rising costs of healthcare, understanding the different types of medical insurance coverage is crucial for making informed decisions about your health and well-being. In this comprehensive guide, we will delve into the various types of medical insurance plans, exploring their features, benefits, and considerations to help you navigate the complex world of healthcare coverage.

Health Maintenance Organization (HMO)

Health Maintenance Organizations (HMOs) are one of the most common types of medical insurance plans. HMOs emphasize preventive care and typically offer lower premiums compared to other plans. Here’s an overview of HMO plans:

- Primary Care Physician (PCP): HMOs require members to choose a primary care physician who acts as the gatekeeper for their healthcare. The PCP coordinates all medical services and referrals to specialists.

- Network Providers: HMO plans have a network of healthcare providers with whom they have negotiated discounted rates. Members must use these in-network providers to receive the full benefits of their insurance.

- Low Out-of-Pocket Costs: HMOs often have lower deductibles and co-pays, making them an affordable option for individuals and families. However, the trade-off is a more restrictive network and limited choice of providers.

- Preventive Care Focus: HMOs promote preventive care through regular check-ups, screenings, and immunizations. They encourage members to take a proactive approach to their health, often covering these services at little to no cost.

- Pre-Authorization: Certain medical procedures or tests may require pre-authorization from the insurance company. This ensures that the services are necessary and covered by the plan.

Key Considerations for HMO Plans

HMOs are ideal for individuals who prioritize affordability and preventive care. However, the limited choice of providers and the need for pre-authorization can be restrictive for some. It’s important to review the HMO’s network of providers to ensure your preferred doctors and specialists are included.

| Category | HMO Features |

|---|---|

| Premium | Affordable, lower premiums |

| Provider Network | In-network providers only |

| Choice of Doctors | Limited to in-network PCP and specialists |

| Out-of-Pocket Costs | Lower deductibles and co-pays |

| Preventive Care | Strong focus on preventive services |

Preferred Provider Organization (PPO)

Preferred Provider Organization (PPO) plans offer more flexibility compared to HMOs. PPOs provide members with a wider network of healthcare providers and the freedom to choose their own doctors. Here’s an overview of PPO plans:

- Network Providers: PPOs have a network of preferred providers with whom they have negotiated discounted rates. Members have the option to use in-network providers or seek care from out-of-network providers.

- Freedom of Choice: Unlike HMOs, PPOs do not require members to choose a primary care physician. You can directly access specialists without a referral, giving you more control over your healthcare decisions.

- Higher Out-of-Pocket Costs: PPO plans often have higher premiums and out-of-pocket expenses, such as deductibles and co-insurance, compared to HMOs. However, the trade-off is greater flexibility and a broader network of providers.

- Pre-Authorization: Similar to HMOs, certain medical procedures or tests may require pre-authorization from the insurance company.

Key Considerations for PPO Plans

PPO plans are ideal for individuals who value flexibility and the ability to choose their own healthcare providers. However, the higher out-of-pocket costs and premiums may make them less affordable for some. It’s important to carefully review the PPO’s network and compare it to your preferred providers.

| Category | PPO Features |

|---|---|

| Premium | Moderate to higher premiums |

| Provider Network | Wider network, including in-network and out-of-network providers |

| Choice of Doctors | Freedom to choose any provider, no PCP required |

| Out-of-Pocket Costs | Higher deductibles and co-insurance |

| Pre-Authorization | May be required for certain procedures |

Exclusive Provider Organization (EPO)

Exclusive Provider Organization (EPO) plans are similar to PPOs but with a more restricted network. EPOs offer a balance between the affordability of HMOs and the flexibility of PPOs. Here’s an overview of EPO plans:

- Network Providers: EPOs have a network of exclusive providers with whom they have negotiated discounted rates. Members must use these in-network providers to receive coverage, similar to HMOs.

- Limited Out-of-Network Coverage: Unlike PPOs, EPOs do not provide coverage for out-of-network providers. If you choose to seek care outside the network, you will be responsible for the full cost of services.

- Lower Out-of-Pocket Costs: EPO plans often have lower premiums and out-of-pocket expenses compared to PPOs, making them a more affordable option. However, the restricted network may limit your choice of providers.

- Pre-Authorization: Similar to other plans, certain medical procedures or tests may require pre-authorization.

Key Considerations for EPO Plans

EPO plans strike a balance between affordability and flexibility. They are suitable for individuals who want a larger network than an HMO but don’t require the extensive out-of-network coverage offered by PPOs. It’s essential to review the EPO’s network to ensure your preferred providers are included.

| Category | EPO Features |

|---|---|

| Premium | Moderate premiums, lower than PPOs |

| Provider Network | In-network providers only, limited out-of-network coverage |

| Choice of Doctors | Limited to in-network providers |

| Out-of-Pocket Costs | Lower deductibles and co-pays |

| Pre-Authorization | May be required for certain procedures |

Point-of-Service (POS) Plans

Point-of-Service (POS) plans combine elements of both HMOs and PPOs, offering a hybrid approach to medical insurance coverage. POS plans provide members with a primary care physician and a network of preferred providers, but also allow for some out-of-network coverage. Here’s an overview of POS plans:

- Primary Care Physician (PCP): POS plans require members to choose a primary care physician who coordinates their healthcare. The PCP acts as a gatekeeper for specialty care and referrals.

- Network Providers: POS plans have a network of preferred providers with whom they have negotiated discounted rates. Members can choose to use these in-network providers for full coverage benefits.

- Out-of-Network Coverage: Unlike HMOs, POS plans provide some coverage for out-of-network providers. However, the out-of-network coverage is typically more limited and may come with higher out-of-pocket costs.

- Lower Out-of-Pocket Costs: POS plans often have lower premiums and out-of-pocket expenses compared to PPOs, making them a more affordable option. The trade-off is a more restrictive network and the need for a primary care physician.

- Pre-Authorization: Certain medical procedures or tests may require pre-authorization from the insurance company.

Key Considerations for POS Plans

POS plans are a good option for individuals who want the security of a primary care physician and a network of providers but also value some flexibility in choosing out-of-network healthcare services. However, the limited out-of-network coverage and the need for a PCP may be restrictive for some.

| Category | POS Features |

|---|---|

| Premium | Moderate premiums, lower than PPOs |

| Provider Network | In-network providers, limited out-of-network coverage |

| Choice of Doctors | Primary care physician required, specialists with referral |

| Out-of-Pocket Costs | Lower deductibles and co-pays |

| Pre-Authorization | May be required for certain procedures |

High-Deductible Health Plans (HDHP)

High-Deductible Health Plans (HDHPs) are a unique type of medical insurance plan designed to be paired with a Health Savings Account (HSA). HDHPs have higher deductibles, but they offer tax advantages and the ability to save for future healthcare expenses. Here’s an overview of HDHP plans:

- High Deductible: HDHPs have significantly higher deductibles compared to other plans, which means you must pay a larger portion of your medical expenses out of pocket before the insurance coverage kicks in.

- Health Savings Account (HSA): HDHPs are often paired with HSAs, which are tax-advantaged savings accounts. You can contribute pre-tax dollars to your HSA and use the funds to pay for qualified medical expenses. Any unused funds roll over year to year, allowing you to build a healthcare savings nest egg.

- Lower Premiums: HDHPs typically have lower premiums compared to traditional health plans. This makes them an attractive option for individuals who are healthy and don’t anticipate frequent medical expenses.

- Limited Out-of-Pocket Maximum: While HDHPs have high deductibles, they also have a limited out-of-pocket maximum. Once you reach this maximum, the insurance plan covers 100% of your medical expenses for the rest of the year.

- Preventive Care Coverage: HDHPs often cover preventive care services, such as annual check-ups and immunizations, at little to no cost.

Key Considerations for HDHP Plans

HDHP plans are ideal for individuals who are healthy, have minimal healthcare needs, and want to take advantage of tax-efficient savings options. The high deductibles can be a disadvantage for those who require frequent medical care or have significant healthcare expenses.

| Category | HDHP Features |

|---|---|

| Premium | Lower premiums compared to traditional plans |

| Deductible | High deductible, must be met before coverage kicks in |

| Out-of-Pocket Maximum | Limited maximum out-of-pocket expenses |

| Health Savings Account (HSA) | Pairing with an HSA offers tax advantages and savings opportunities |

| Preventive Care | Often covers preventive services at little to no cost |

Short-Term Health Insurance Plans

Short-term health insurance plans are temporary medical insurance options designed to bridge gaps in coverage. These plans offer limited benefits and are not suitable for individuals with pre-existing conditions or those seeking comprehensive healthcare coverage. Here’s an overview of short-term health insurance plans:

- Temporary Coverage: Short-term plans are intended for individuals who need temporary coverage for a specific period, typically ranging from 30 days to a maximum of 12 months. They are often used as a stopgap measure while waiting for a more permanent insurance plan.

- Limited Benefits: Short-term plans have restricted benefits and coverages compared to traditional health insurance plans. They may exclude pre-existing conditions, mental health services, prescription drugs, and other essential health benefits.

- Lower Premiums: Due to their limited coverage, short-term plans often have lower premiums compared to comprehensive health insurance plans. However, they may not provide adequate financial protection in the event of a serious illness or injury.

- No Guarantee Issue: Short-term plans are not required to cover pre-existing conditions, and insurance companies can deny coverage based on your medical history.

- Renewal and Duration: Short-term plans can be renewed, but the total duration of coverage cannot exceed 364 days. After the initial term, you may need to apply for a new plan or transition to a more permanent insurance option.

Key Considerations for Short-Term Plans

Short-term health insurance plans are best suited for individuals who are healthy, have minimal healthcare needs, and require temporary coverage during a transition period. They are not a long-term solution and may not provide adequate financial protection for individuals with complex medical conditions.

| Category | Short-Term Plan Features |

|---|---|

| Premium | Lower premiums compared to comprehensive plans |

| Coverage Duration | Temporary coverage, typically up to 12 months |

| Benefits | Limited benefits and exclusions |

| Pre-Existing Conditions | May not cover pre-existing conditions |

| Renewal | Can be renewed, but total coverage duration is limited |

Catastrophic Health Insurance Plans

Catastrophic health insurance