Is Medicaid A Marketplace Insurance

Medicaid, a cornerstone of the American healthcare system, is a critical program that provides health coverage to millions of individuals and families across the United States. While it shares some similarities with Marketplace insurance plans, there are distinct differences between the two. This article aims to delve into the intricacies of Medicaid and clarify its relationship with the Marketplace, shedding light on their unique roles in ensuring healthcare accessibility.

Understanding Medicaid

Medicaid, established under Title XIX of the Social Security Act, is a federal and state-funded program designed to provide healthcare coverage to eligible individuals and families with limited income and resources. It is a means-tested program, meaning eligibility is primarily determined by financial need, with specific income and asset limits varying by state.

Key Features of Medicaid

- Comprehensive Coverage: Medicaid offers a wide range of healthcare services, including doctor visits, hospital stays, prescription drugs, mental health services, and more. It often covers services not typically included in private insurance plans, such as long-term care and personal care services.

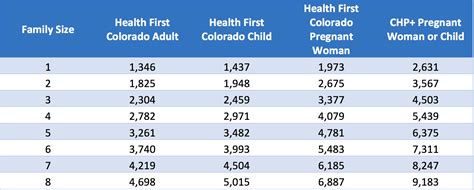

- Income Eligibility: The program is primarily aimed at low-income individuals and families. Income limits can vary significantly based on factors like family size, state residency, and age. For example, in 2023, the income limit for a family of four in most states ranges from 28,500 to 35,500, with some states having higher limits.

- Asset Limits: Besides income, Medicaid may also consider an individual’s assets, such as savings, investments, or property. However, certain assets like a primary residence are often exempt.

- State Administration: Medicaid is administered by individual states, which means eligibility criteria, covered services, and provider networks can vary significantly. This allows states to tailor the program to their specific healthcare needs and demographics.

Enrolling in Medicaid

Enrollment in Medicaid is typically done through state agencies or designated healthcare marketplaces. Applicants will need to provide documentation to prove their eligibility, such as income statements, proof of citizenship or immigration status, and other personal information. The application process can vary by state, but many states now offer online applications for convenience.

Comparing Medicaid to Marketplace Insurance

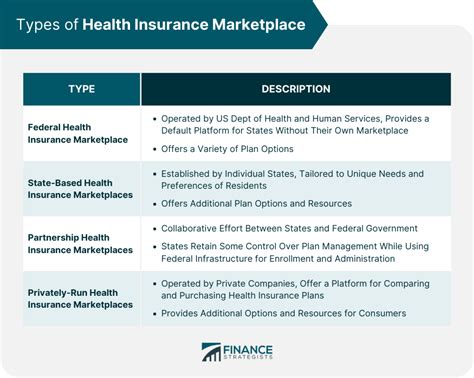

The Marketplace, officially known as the Health Insurance Marketplace, is a platform created by the Affordable Care Act (ACA) to help individuals and small businesses purchase health insurance plans. It offers a range of private insurance options, with coverage and costs varying based on the chosen plan.

Key Differences

- Eligibility Criteria: Unlike Medicaid, which primarily focuses on financial need, Marketplace insurance is available to a broader range of individuals, including those with higher incomes. However, Marketplace plans may have age-based or tobacco-use-based rating factors that can impact premiums.

- Cost and Coverage: Marketplace plans can vary significantly in terms of cost and coverage. Plans are categorized into Metal tiers (Bronze, Silver, Gold, and Platinum) based on the proportion of costs covered. Premium costs and out-of-pocket expenses can vary, and some plans may have limited provider networks.

- Open Enrollment Period: Marketplace insurance has a designated open enrollment period each year when individuals can enroll in or switch plans. Outside of this period, special enrollment periods may be available for qualifying life events, such as marriage, birth of a child, or loss of other coverage.

- Financial Assistance: The Marketplace offers financial assistance in the form of premium tax credits and cost-sharing reductions to make insurance more affordable. These are based on an individual’s expected income for the year and can significantly reduce monthly premiums and out-of-pocket costs.

Medicaid and Marketplace Integration

In some cases, individuals may be eligible for both Medicaid and Marketplace insurance. When this happens, the Marketplace will typically direct the individual to Medicaid enrollment, as Medicaid coverage takes precedence. However, for those who are not eligible for Medicaid but still require financial assistance, the Marketplace can provide valuable options.

Performance Analysis and Future Implications

Medicaid’s impact on healthcare accessibility is significant, with the program covering a substantial portion of the U.S. population. According to the Kaiser Family Foundation, Medicaid and the Children’s Health Insurance Program (CHIP) provided health coverage to over 76 million individuals in 2021, accounting for approximately 23% of the U.S. population. This coverage is especially crucial for vulnerable populations, including children, pregnant women, the elderly, and individuals with disabilities.

| Population Served | Medicaid Coverage Percentage |

|---|---|

| Children | 43% |

| Adults (Ages 19-64) | 21% |

| Elderly (Ages 65+) | 16% |

| Individuals with Disabilities | 30% |

Looking forward, the future of Medicaid and healthcare coverage in the U.S. remains a topic of ongoing debate and policy discussion. While the program has proven its effectiveness in providing coverage to millions, there are ongoing efforts to reform and improve its efficiency and accessibility. These efforts include proposals to streamline enrollment processes, enhance provider networks, and improve the coordination of care for individuals with complex health needs.

Conclusion

Medicaid and the Marketplace play complementary roles in ensuring healthcare accessibility in the United States. Medicaid, with its focus on financial need and comprehensive coverage, serves as a safety net for vulnerable populations, while the Marketplace provides a range of private insurance options for individuals with varying income levels and healthcare needs. Understanding the differences and similarities between these programs is crucial for individuals seeking to navigate the complex landscape of healthcare coverage.

Can I have both Medicaid and Marketplace insurance?

+In most cases, individuals cannot have both Medicaid and Marketplace insurance simultaneously. If you are eligible for both, you will typically be directed to enroll in Medicaid, as it is the primary source of coverage. However, there may be exceptions, so it’s best to check with your state’s Medicaid office or a healthcare navigator for specific guidance.

What if I don’t qualify for Medicaid but still need financial assistance for healthcare?

+If you don’t qualify for Medicaid but still need financial help, you can explore your options through the Health Insurance Marketplace. You may be eligible for premium tax credits and cost-sharing reductions, which can make insurance more affordable. These financial assistance programs are based on your income and family size.

How can I apply for Medicaid?

+To apply for Medicaid, you can visit your state’s Medicaid website or use the Health Insurance Marketplace. You will need to provide personal information, such as income, family size, and citizenship status. The application process may vary by state, so it’s beneficial to review your state’s specific requirements.