Government Insurance

Government insurance is a vital aspect of many nations' social safety nets, offering protection and financial security to individuals and families in times of need. This comprehensive guide will delve into the intricacies of government insurance, exploring its various forms, benefits, and implications for citizens and the economy.

Understanding Government Insurance

Government insurance, also known as social insurance or public insurance, is a system established by a country’s government to provide a safety net for its citizens. It encompasses a range of programs designed to protect individuals from financial risks associated with specific life events or circumstances.

Types of Government Insurance

Government insurance can take several forms, each catering to different needs and covering distinct aspects of life. Here are some common types:

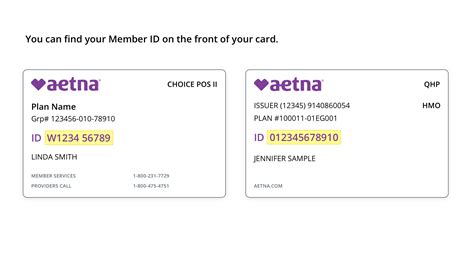

- Health Insurance: This is perhaps the most well-known form of government insurance. It aims to ensure that citizens have access to healthcare services without facing financial hardship. Many countries provide universal healthcare coverage, ensuring that all residents receive necessary medical care.

- Social Security: Social security programs provide financial support to individuals during retirement, disability, or in the event of a spouse’s death. These programs often include pension plans, disability benefits, and survivor benefits.

- Unemployment Insurance: During periods of unemployment, government insurance steps in to provide temporary financial assistance. This support helps individuals and their families maintain a basic standard of living while they seek new employment opportunities.

- Workers’ Compensation: This type of insurance protects employees who suffer work-related injuries or illnesses. It provides compensation for medical expenses and lost wages, ensuring workers are not left without financial support during their recovery.

- Education Grants: Some governments offer financial assistance for education, supporting students from low-income backgrounds or those pursuing specific fields of study. These grants can cover tuition fees, books, and other educational expenses.

The Benefits and Impact

Government insurance programs offer a multitude of benefits to both individuals and society as a whole. They provide:

- Financial Security: By offering insurance coverage, governments ensure that citizens have a safety net during challenging times. This reduces the risk of poverty and provides a sense of stability.

- Access to Essential Services: Programs like universal healthcare ensure that all residents, regardless of income, have access to necessary medical care. This promotes better overall health and reduces health disparities.

- Economic Stability: During economic downturns, unemployment insurance and other government assistance programs help maintain consumer spending, supporting local businesses and preventing a further decline in the economy.

- Equity and Social Justice: Government insurance programs often aim to reduce inequality by providing support to those most in need. This includes individuals facing financial hardships, the elderly, and those with disabilities.

- Long-Term Planning: Social security and pension plans encourage long-term financial planning, ensuring that individuals can retire with dignity and financial independence.

The Process and Eligibility

The process of accessing government insurance benefits varies depending on the program and the country. In most cases, individuals must meet specific eligibility criteria to qualify for coverage. Here’s a general overview:

Application and Registration

To access government insurance benefits, individuals typically need to:

- Understand the eligibility criteria and requirements for the specific program.

- Gather necessary documentation, such as proof of identity, income, and residence.

- Complete an application form, either online or in person at a government office.

- Provide additional information or evidence as requested by the relevant authority.

Eligibility Factors

Eligibility for government insurance programs can depend on various factors, including:

- Income Level: Many programs are means-tested, meaning they are designed to support individuals and families with limited financial resources.

- Residency Status: In some cases, only permanent residents or citizens are eligible for certain benefits.

- Employment Status: Unemployment insurance, for example, is often available to individuals who have lost their jobs through no fault of their own.

- Age and Dependency: Social security and pension plans often have age requirements, while benefits for dependent family members may also be available.

- Medical Conditions: Certain government insurance programs cater to individuals with specific health conditions or disabilities.

Performance and Effectiveness

The effectiveness of government insurance programs can be assessed through various metrics. Here are some key indicators:

| Metric | Description |

|---|---|

| Enrollment Rates | The percentage of eligible individuals who are enrolled in a particular insurance program. |

| Benefit Utilization | Measuring the extent to which enrolled individuals utilize the benefits offered by the program. |

| Financial Stability | Evaluating the financial sustainability of the insurance program, including funding sources and long-term viability. |

| Impact on Society | Assessing the overall social and economic impact, such as reduced poverty rates, improved health outcomes, or increased economic stability. |

Real-World Examples

Let’s explore how government insurance programs have made a difference in the lives of individuals:

- Case Study 1: Health Insurance: In a country with universal healthcare, Ms. Johnson, a single mother, faced a serious medical condition. Thanks to government-provided health insurance, she received the necessary treatment without worrying about the financial burden, allowing her to focus on her recovery.

- Case Study 2: Social Security: Mr. Lee, a retired teacher, relies on social security benefits to support his retirement. These benefits ensure he can maintain a comfortable lifestyle and provide for his basic needs without having to rely on his savings alone.

- Case Study 3: Unemployment Insurance: After losing his job due to a company downsizing, Mr. Chen received unemployment insurance benefits. This support helped him and his family maintain their home and meet their basic expenses while he searched for new employment opportunities.

FAQ

How do government insurance programs affect the economy?

+Government insurance programs can have a positive impact on the economy. During economic downturns, they help maintain consumer spending, preventing a further decline in the economy. Additionally, by providing financial security, these programs encourage individuals to take risks and start businesses, contributing to economic growth.

Are government insurance programs universal across all countries?

+No, the extent and nature of government insurance programs vary widely between countries. While some nations offer comprehensive social safety nets with universal healthcare and generous benefits, others have more limited programs or rely on private insurance markets.

How are government insurance programs funded?

+Funding sources for government insurance programs can include taxes, payroll contributions, and government budgets. In some cases, a combination of these funding streams is used to ensure the financial sustainability of the programs.