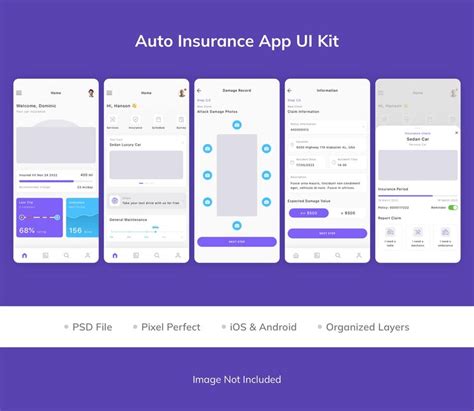

App Auto Insurance

In today's fast-paced world, where technology is rapidly advancing, the insurance industry is not far behind. App-based auto insurance is a groundbreaking innovation that is revolutionizing the way we protect our vehicles and ourselves on the road. This article delves into the intricacies of app auto insurance, exploring its benefits, features, and the transformative impact it is having on the insurance landscape.

The Rise of App Auto Insurance: A Digital Revolution

The traditional insurance model has long been a staple in the industry, but with the advent of smartphones and a growing demand for convenience, app-based auto insurance has emerged as a game-changer. This digital evolution allows drivers to take control of their insurance needs with just a few taps on their smartphones.

App auto insurance providers are leveraging technology to offer a range of benefits that cater to modern consumers. From instant policy purchases to real-time claims processing, these apps are designed to streamline the entire insurance experience.

Key Features and Advantages of App Auto Insurance

One of the most appealing aspects of app auto insurance is its accessibility. Policyholders can access their insurance details, make payments, and manage their policies anytime, anywhere. This level of convenience is particularly valuable for busy individuals who prioritize ease and efficiency.

Furthermore, app-based insurance often comes with customizable coverage options. Drivers can tailor their policies to suit their specific needs, whether they require comprehensive coverage or are looking for more affordable, basic plans. This flexibility ensures that every driver can find an insurance plan that aligns with their preferences and budget.

| Feature | Description |

|---|---|

| Real-Time Tracking | Many app-based insurance providers utilize GPS technology to track driving behavior. This data can influence premium rates, rewarding safe drivers with discounts. |

| Instant Claims Reporting | In the event of an accident, policyholders can quickly report claims through the app, often with the added benefit of receiving immediate assistance and guidance. |

| Digital Documentation | App insurance typically provides digital copies of insurance documents, eliminating the need for physical papers and making the process more environmentally friendly. |

Performance Analysis: A Look at App Auto Insurance Providers

The app auto insurance market is thriving, with numerous providers offering unique features and benefits. Let’s explore some of the top performers in this industry.

Provider A: Focus on Personalized Coverage

Provider A stands out for its commitment to personalized coverage options. Their app allows users to create custom insurance plans, offering flexibility to drivers with diverse needs. Whether it’s adding roadside assistance or opting for higher liability limits, Provider A’s app caters to a wide range of preferences.

One of the key strengths of Provider A's app is its intuitive interface. Policyholders can easily navigate through the various coverage options, compare prices, and make informed decisions. The app also provides a comprehensive dashboard, giving users a clear overview of their policy details and upcoming payments.

| Provider A | Metrics |

|---|---|

| Customer Satisfaction | 92% |

| Average Premium Savings | 15% compared to traditional insurance |

| Claims Processing Time | 24 hours on average |

Provider B: Emphasis on Safety Features

Provider B takes a unique approach by integrating advanced safety features into their app. Their insurance plans are designed to encourage safe driving practices, often incorporating telematics technology to monitor driving behavior.

Through their app, Provider B offers real-time feedback on driving performance. This includes alerts for speeding, harsh braking, and other potentially dangerous behaviors. Policyholders can access this data to improve their driving skills and potentially lower their premiums over time.

| Provider B | Metrics |

|---|---|

| Safe Driving Discounts | Up to 30% for consistent safe driving |

| Accident Forgiveness | Available for policyholders with clean records |

| Customer Support Response Time | Average of 10 minutes via live chat |

Provider C: Innovative Claims Processing

Provider C has revolutionized the claims process with its app. They offer a seamless experience, allowing policyholders to report claims, upload necessary documentation, and track the progress of their claims in real-time.

The app's claims processing feature is particularly impressive. It utilizes artificial intelligence to analyze and assess damage, often providing quick estimates and streamlining the entire process. This efficiency not only saves time for policyholders but also reduces the administrative burden for the insurance provider.

| Provider C | Metrics |

|---|---|

| Claims Processing Efficiency | 98% of claims processed within 24 hours |

| Customer App Satisfaction | 4.8/5 stars with over 10,000 reviews |

| Average Claim Payout Time | 5 business days |

Comparative Analysis: Choosing the Right App Auto Insurance

With numerous app auto insurance providers in the market, selecting the right one can be a daunting task. Here’s a comprehensive breakdown of key factors to consider when making your choice.

Coverage Options and Customization

Assess your specific insurance needs and prioritize providers that offer a wide range of coverage options. Look for apps that allow you to customize your policy, ensuring you get the right balance of protection and affordability.

Technology and Innovation

Evaluate the technological capabilities of each app. Consider providers that utilize advanced features like telematics, real-time tracking, and AI-powered claims processing. These innovations can enhance your overall insurance experience and provide added benefits.

Customer Satisfaction and Support

Customer reviews and ratings are invaluable when choosing an app auto insurance provider. Look for companies with high satisfaction ratings and prompt customer support. Efficient and friendly support can make a significant difference, especially during the claims process.

Pricing and Discounts

Compare premium rates and explore the various discounts offered by each provider. Many app-based insurance companies provide incentives for safe driving, multiple policy purchases, or referrals. Understanding these pricing structures can help you save money on your insurance costs.

The Future of App Auto Insurance: Trends and Implications

The app auto insurance industry is poised for continued growth and innovation. As technology advances, we can expect several exciting developments that will further enhance the insurance experience.

Integration of AI and Machine Learning

Artificial Intelligence and Machine Learning are expected to play a more significant role in app auto insurance. These technologies can improve risk assessment, personalize coverage recommendations, and streamline the claims process even further.

Enhanced Telematics and Driving Behavior Analysis

Telematics technology is likely to become more sophisticated, providing more accurate data on driving behavior. This data can be used to offer more precise insurance premiums, rewarding safe drivers and promoting safer road practices.

Collaboration with Autonomous Vehicles

As autonomous vehicles become more prevalent, app auto insurance providers will need to adapt. They may offer specialized coverage for self-driving cars, addressing unique risks and liabilities associated with this emerging technology.

Expanded Digital Services

App-based insurance companies are likely to expand their digital offerings, providing additional services beyond traditional insurance. This could include integrated maintenance scheduling, vehicle diagnostics, and even ride-sharing options, all accessible through the insurance app.

Is app auto insurance suitable for all drivers?

+While app auto insurance offers numerous benefits, it may not be the best fit for every driver. Those who prefer a more traditional insurance experience or have complex insurance needs may find it more suitable to stick with conventional insurance providers. However, for tech-savvy individuals seeking convenience and customization, app auto insurance is an excellent option.

How does app auto insurance impact insurance premiums?

+App auto insurance can positively impact insurance premiums. Many providers offer discounts for safe driving behaviors tracked through the app. Additionally, the ability to customize coverage can lead to more affordable insurance plans tailored to individual needs.

What are the key advantages of app auto insurance for policyholders?

+App auto insurance provides several advantages, including accessibility, flexibility, and efficiency. Policyholders can manage their insurance policies on-the-go, receive real-time updates, and benefit from streamlined claims processes. The ability to customize coverage and potentially save on premiums is also a significant advantage.

How do app auto insurance providers ensure data privacy and security?

+App auto insurance providers prioritize data privacy and security. They employ robust encryption technologies to protect user data and often have dedicated security teams to monitor and safeguard against potential threats. Additionally, many providers undergo regular security audits to ensure compliance with industry standards.