Pet Insurance Costs

Pet insurance is a valuable tool for pet owners, offering financial protection and peace of mind in the event of unexpected veterinary expenses. With the rising costs of veterinary care, understanding the costs associated with pet insurance is essential for making informed decisions. This comprehensive guide will delve into the factors influencing pet insurance costs, providing you with the insights needed to navigate this critical aspect of pet ownership.

Understanding Pet Insurance Costs

The cost of pet insurance varies significantly depending on a multitude of factors. From the type of pet and its breed to the age of the animal and the level of coverage desired, each aspect plays a crucial role in determining the overall cost.

Breed and Species Considerations

Different breeds and species of pets come with their own unique set of health concerns. For instance, certain dog breeds are more prone to specific genetic disorders, while cats may have breed-specific predispositions to particular illnesses. These breed-related health risks can significantly impact the cost of insurance, as providers factor in the likelihood and potential cost of treating these conditions.

| Pet Type | Average Premium (Annual) |

|---|---|

| Large Breed Dog (e.g., Labrador Retriever) | $750 - $1,200 |

| Small Breed Dog (e.g., Yorkshire Terrier) | $500 - $800 |

| Mixed Breed Cat | $300 - $550 |

| Exotic Bird | $250 - $400 |

Age and Health Status

The age of your pet is another critical factor influencing insurance costs. Generally, younger pets are considered a lower risk by insurance providers, resulting in more affordable premiums. As pets age, their risk of developing health issues increases, leading to higher insurance costs. Pre-existing conditions can also impact the cost of insurance, with some providers offering limited or no coverage for these conditions.

Level of Coverage

The level of coverage you choose will directly affect the cost of your pet insurance. Comprehensive plans that cover a wide range of treatments, including accidents, illnesses, and even routine care, will typically cost more than basic plans that only cover accidents or specific illnesses.

| Coverage Type | Average Premium (Monthly) |

|---|---|

| Comprehensive (Accident, Illness, Routine Care) | $50 - $80 |

| Accident-Only | $30 - $50 |

| Illness-Only | $40 - $60 |

Deductibles and Co-Pays

Similar to human health insurance, pet insurance plans often include deductibles and co-pays. A higher deductible can lower your monthly premium, while a lower deductible will increase the monthly cost. Co-pays, or the amount you pay out-of-pocket for each claim, can also impact the overall cost of insurance. Plans with lower co-pays may seem more expensive upfront, but they can provide significant savings when making multiple claims.

Geographic Location

The cost of living in your area can also influence pet insurance costs. Regions with a higher cost of living or a higher concentration of veterinary specialists may result in increased insurance premiums to cover the potential for more expensive treatments.

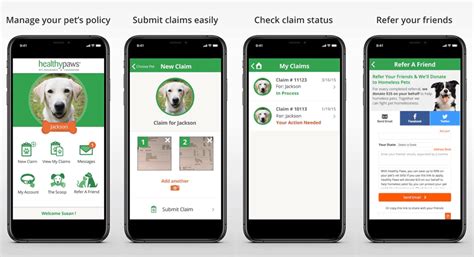

Managing Pet Insurance Costs

While pet insurance costs can be significant, there are strategies to help manage these expenses and ensure your pet receives the care they need.

Choosing the Right Coverage

Selecting the appropriate level of coverage is crucial. Assess your pet's unique needs and consider the likelihood of various health issues based on their breed and age. If your pet is generally healthy and has no known predispositions to serious illnesses, a basic accident-only plan might suffice. On the other hand, for older pets or those with known health risks, a comprehensive plan could provide the necessary coverage.

Bundling and Discounts

Many pet insurance providers offer discounts for bundling multiple pets on the same plan or for long-term customers. Taking advantage of these discounts can help reduce the overall cost of insurance.

Preventative Care and Wellness Plans

Investing in preventative care can help reduce the likelihood of your pet developing serious health issues, potentially saving you money in the long run. Some pet insurance providers offer wellness plans that cover routine care, such as annual check-ups, vaccinations, and flea/tick prevention. These plans can be a cost-effective way to ensure your pet's health is maintained.

Annual Review and Comparison

Regularly reviewing your pet insurance policy and comparing it to other providers' offerings can help ensure you're getting the best value for your money. As your pet ages or their health status changes, you may find that a different plan or provider better suits your needs.

The Future of Pet Insurance Costs

The pet insurance industry is evolving, with new providers entering the market and existing providers offering innovative coverage options. As the industry grows, we can expect to see more specialized plans, better coverage for chronic conditions, and potentially more affordable premiums due to increased competition.

The Rise of Telemedicine

The integration of telemedicine into veterinary care is a significant development that could impact pet insurance costs. With telemedicine, pet owners can access veterinary advice and even receive prescriptions remotely, reducing the need for in-person visits for minor issues. This could lead to lower overall veterinary costs and, subsequently, more affordable insurance premiums.

Advancements in Veterinary Technology

Advancements in veterinary technology, such as improved diagnostic tools and treatments, can lead to more efficient and effective care. This could result in lower treatment costs, which could be passed on to pet owners in the form of reduced insurance premiums.

The Role of Data Analytics

Data analytics is playing an increasingly important role in the pet insurance industry. By analyzing large datasets, providers can better understand the risks associated with different breeds and age groups, leading to more accurate pricing and potentially better coverage options. This could also help identify trends and patterns in pet health, allowing for more proactive care and potentially reducing the need for expensive treatments.

Conclusion

Pet insurance costs are influenced by a multitude of factors, from the breed and age of your pet to the level of coverage you choose. While these costs can be significant, there are strategies to manage them effectively. By choosing the right coverage, taking advantage of discounts, and investing in preventative care, you can ensure your pet receives the care they need while managing your financial obligations.

Frequently Asked Questions

Can I get pet insurance for an older pet?

+

Yes, many pet insurance providers offer coverage for older pets. However, the cost may be higher due to the increased risk of health issues. It’s best to research and compare plans specifically tailored for senior pets.

What is the difference between accident-only and illness-only coverage?

+

Accident-only coverage provides protection for injuries resulting from accidents, such as broken bones or cuts. Illness-only coverage, on the other hand, covers illnesses such as diabetes or kidney disease. Comprehensive plans typically include both accident and illness coverage.

Do all pet insurance plans cover pre-existing conditions?

+

No, most pet insurance plans have a waiting period or exclusion for pre-existing conditions. However, some providers offer limited coverage for certain pre-existing conditions, so it’s important to carefully review the policy details.

How do I choose the right deductible and co-pay for my pet insurance plan?

+

Consider your financial situation and the likelihood of your pet needing veterinary care. A higher deductible can lower your monthly premium, but you’ll pay more out-of-pocket when making a claim. Similarly, a lower co-pay can increase your monthly premium but may be more affordable if you anticipate making multiple claims.