How Much Is Flood Insurance

Flood insurance is a vital aspect of safeguarding one's property and finances, especially in areas prone to flooding. Understanding the cost of flood insurance is essential for homeowners and business owners alike. The price of flood insurance can vary significantly based on numerous factors, and it is important to delve into these details to make informed decisions. This comprehensive guide aims to provide an in-depth analysis of the costs associated with flood insurance, offering a clear picture of what to expect and how to navigate the complexities of this essential coverage.

Factors Influencing Flood Insurance Costs

The cost of flood insurance is influenced by a multitude of factors, each playing a crucial role in determining the final premium. Let’s explore these factors in detail to gain a comprehensive understanding.

1. Location and Flood Risk

The primary determinant of flood insurance costs is the location of the property and its associated flood risk. Areas with a higher historical flood frequency or those situated in known floodplains will typically face higher insurance premiums. The Federal Emergency Management Agency (FEMA) has designated different flood zones based on the likelihood of flooding, and these zones directly impact insurance rates.

| Flood Zone | Risk Level | Typical Premium |

|---|---|---|

| X (Moderate Risk) | Moderate | $500 - $1,000 annually |

| A (High Risk) | High | $1,000 - $3,000 annually |

| V (Coastal High Hazard) | Very High | $2,000 - $5,000 annually |

It's important to note that these are rough estimates, and the actual premium can vary based on other factors and the specific insurance provider.

2. Property Type and Age

The type of property being insured is another significant factor. Residential properties typically have different rates than commercial properties. Additionally, the age of the building can impact insurance costs. Older structures may have different construction standards and may be more susceptible to flood damage, leading to higher premiums.

3. Coverage Amount and Deductible

The coverage amount you choose directly affects your premium. Higher coverage limits will result in a higher premium. Similarly, the deductible you select can influence costs. A higher deductible often means a lower premium, as it reduces the insurance company’s risk.

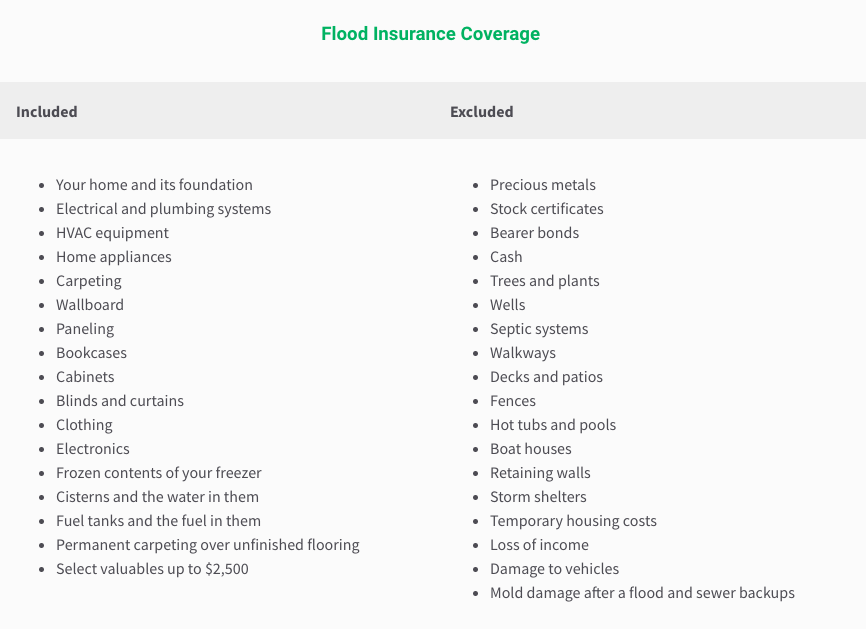

4. Additional Coverage Options

Flood insurance policies often offer additional coverage options, such as coverage for basement improvements or valuable personal belongings. These add-ons can increase the overall cost of your policy.

5. Insurance Provider and Plan

The insurance provider and the specific flood insurance plan you choose can impact costs. Different providers may offer varying rates and plans, so it’s essential to shop around for the best deal.

6. Community Rating System (CRS) Discounts

FEMA’s Community Rating System (CRS) offers discounts on flood insurance premiums for communities that take steps to reduce flood risk. If your community participates in the CRS and has a good rating, you may be eligible for significant discounts on your flood insurance.

Average Flood Insurance Costs

While the exact cost of flood insurance can vary widely, we can look at some average costs to provide a general idea of what to expect. These averages are based on data from various sources and should be used as a rough guide.

Residential Properties

For residential properties, the average cost of flood insurance can range from 500 to 3,000 annually. This wide range is due to the various factors mentioned earlier, such as location, coverage amount, and deductible.

Commercial Properties

Commercial properties typically face higher flood insurance costs. The average annual premium for commercial flood insurance can range from 1,000 to 5,000, depending on the specific business and its location.

Specific Examples

Let’s look at some real-world examples to illustrate the cost variations. In a moderate-risk flood zone (Zone X), a residential property owner might pay around 750 annually</strong> for a basic flood insurance policy with a coverage limit of 250,000 and a 1,000 deductible. On the other hand, a commercial property owner in a high-risk zone (Zone A) could expect to pay <strong>3,500 annually for a policy with similar coverage limits.

Strategies to Lower Flood Insurance Costs

While flood insurance is essential, there are strategies you can employ to potentially lower your costs without compromising protection.

1. Shop Around and Compare

Different insurance providers offer varying rates and plans. By comparing quotes from multiple providers, you can find the best deal for your specific circumstances.

2. Understand Your Coverage Needs

Assess your specific coverage needs and choose a policy that provides adequate protection without unnecessary add-ons. Overinsuring can lead to higher premiums.

3. Increase Your Deductible

Opting for a higher deductible can reduce your premium. However, ensure that you can afford the deductible in the event of a claim.

4. Take Mitigation Measures

Implementing flood mitigation measures on your property can reduce the risk of flood damage and potentially lower your insurance premiums. This could include installing flood barriers, elevating mechanical systems, or using flood-resistant materials.

5. Explore Discounts

Inquire about available discounts with your insurance provider. This could include multi-policy discounts if you bundle your flood insurance with other types of coverage.

The Future of Flood Insurance

As climate change continues to impact global weather patterns, the future of flood insurance is an important consideration. Experts predict that flooding events will likely increase in frequency and severity, which could lead to higher insurance premiums and potentially limited coverage options in high-risk areas.

However, advancements in technology and data analytics are also shaping the future of flood insurance. Improved risk assessment models and the integration of climate data are helping insurance providers more accurately price flood risk, which could lead to more stable and sustainable insurance markets.

Conclusion

Understanding the cost of flood insurance is a crucial step in protecting your property and finances. By considering the various factors that influence insurance costs and employing strategies to lower premiums, you can make informed decisions about your coverage. Remember, flood insurance is an essential safeguard, and being prepared is always better than facing unexpected costs after a flood event.

What is the typical flood insurance coverage limit for residential properties?

+

The standard coverage limit for residential flood insurance is typically 250,000 for the building and 100,000 for personal belongings. However, you can opt for higher coverage limits if needed.

Can I get flood insurance if my property is in a high-risk flood zone?

+

Yes, you can obtain flood insurance regardless of your property’s flood zone. However, properties in high-risk zones may face higher premiums.

Are there any government programs to assist with flood insurance costs?

+

The National Flood Insurance Program (NFIP) is a government-backed program that provides flood insurance to homeowners, renters, and business owners. It offers affordable coverage and is available to all eligible properties, regardless of flood zone.

How often should I review my flood insurance policy?

+

It’s recommended to review your flood insurance policy annually, especially if your circumstances change (e.g., renovations, additions, or changes in coverage needs). Regular reviews ensure your policy aligns with your current situation.

Can I bundle my flood insurance with other types of insurance for a discount?

+

Yes, many insurance providers offer multi-policy discounts when you bundle your flood insurance with other types of coverage, such as homeowners or business insurance.