Nationwide Car Insurance Quote

Unveiling Nationwide Car Insurance Quotes: A Comprehensive Guide

When it comes to safeguarding your vehicle and yourself on the road, understanding car insurance quotes is crucial. Nationwide, a renowned insurance provider, offers a range of comprehensive coverage options to meet the diverse needs of drivers across the United States. In this in-depth guide, we'll delve into the world of Nationwide car insurance quotes, exploring the factors that influence them, the coverage options available, and the steps to obtain an accurate quote tailored to your specific circumstances.

Understanding the Fundamentals of Nationwide Car Insurance Quotes

Nationwide's car insurance quotes are tailored to provide drivers with the coverage they need at a competitive price. The company offers a wide array of coverage options, allowing policyholders to customize their plans to suit their individual requirements. Whether you're seeking liability coverage, collision protection, comprehensive insurance, or additional perks like roadside assistance, Nationwide aims to provide a comprehensive solution.

The quote process with Nationwide is designed to be straightforward and transparent. By providing essential information about yourself, your vehicle, and your driving history, you can receive a personalized quote that takes into account various factors to determine your premium. These factors include your age, gender, location, driving record, the make and model of your car, and the coverage limits you choose.

Factors Influencing Nationwide Car Insurance Quotes

1. Driver Profile

Your personal details play a significant role in determining your car insurance quote. Factors such as age, gender, and driving experience influence the perceived risk associated with insuring you. Younger drivers, for instance, are generally considered higher-risk due to their lack of experience on the road, which can result in higher premiums. Conversely, mature drivers with a clean driving record and extensive experience may benefit from more competitive rates.

Your driving history is another crucial factor. A clean record, free of accidents and violations, can lead to lower insurance costs. Conversely, a history of accidents or traffic violations may result in higher premiums, as insurance companies perceive you as a higher-risk driver.

| Driver Profile Factors | Impact on Quote |

|---|---|

| Age | Younger drivers may pay more; mature drivers often get discounts. |

| Gender | Gender can influence rates, with some insurers charging different premiums. |

| Driving Experience | More experience often leads to lower rates. |

| Driving Record | A clean record can lower premiums; accidents and violations may increase costs. |

2. Vehicle Details

The make, model, and year of your vehicle are important considerations when calculating your car insurance quote. Certain vehicle types are statistically more prone to accidents or theft, which can impact your premium. Additionally, the safety features and anti-theft devices installed in your car may also affect your quote, as they reduce the risk of accidents and theft.

The primary use of your vehicle also comes into play. If you primarily use your car for commuting to work, your insurance needs may differ from someone who primarily uses their vehicle for business purposes. Understanding how you use your car can help Nationwide tailor your coverage and quote accordingly.

3. Coverage Options and Limits

The coverage options and limits you choose significantly impact your car insurance quote. Nationwide offers a range of coverage types, including liability, collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage. Each coverage type has different premium costs associated with it, and the limits you select can further influence your quote.

For example, opting for higher liability limits provides greater financial protection in the event of an accident, but it also comes with a higher premium. Similarly, adding optional coverages like rental car reimbursement or roadside assistance can increase your premium, but they provide additional peace of mind and convenience.

| Coverage Options | Impact on Quote |

|---|---|

| Liability Coverage | Mandatory; higher limits may increase your premium. |

| Collision Coverage | Optional; covers damage to your vehicle in an accident. |

| Comprehensive Coverage | Optional; covers non-accident-related damages (e.g., theft, vandalism, natural disasters) |

| Personal Injury Protection (PIP) | Varies by state; covers medical expenses and lost wages after an accident. |

| Uninsured/Underinsured Motorist Coverage | Optional; protects you if an at-fault driver lacks sufficient insurance. |

Steps to Obtain an Accurate Nationwide Car Insurance Quote

1. Gather Necessary Information

Before requesting a quote from Nationwide, ensure you have the following information readily available:

- Personal details: Name, date of birth, gender, driver's license number, and social security number.

- Vehicle information: Make, model, year, VIN number, and mileage.

- Driving history: Any accidents, violations, or claims in the past 5 years.

- Current insurance coverage: Details of your existing policy, if applicable.

- Desired coverage options and limits: Consider the type and level of coverage you require.

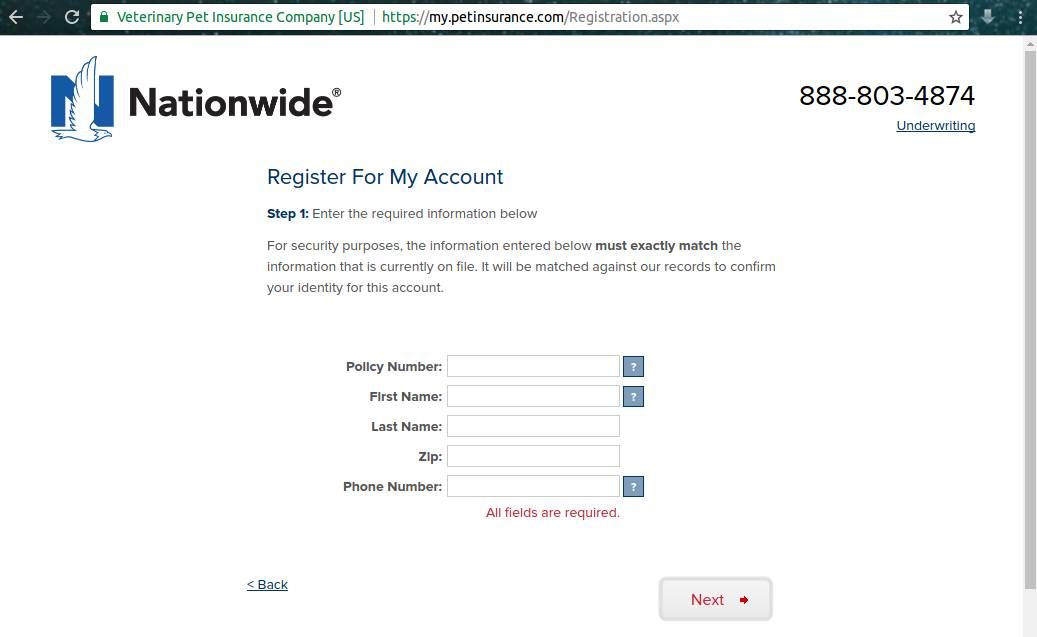

2. Visit Nationwide's Website or Contact an Agent

You have two primary options for obtaining a car insurance quote from Nationwide:

- Online Quote: Visit Nationwide's official website and navigate to the car insurance quote section. Follow the prompts to provide the necessary information and receive an instant quote.

- Agent Assistance: Contact a Nationwide insurance agent in your area. They can guide you through the quote process, answer any questions you may have, and provide personalized recommendations based on your specific needs.

3. Review and Customize Your Quote

Once you've obtained a quote, take the time to review it carefully. Ensure that all the information you provided is accurate and that the coverage options and limits align with your requirements. If needed, you can customize your quote by adjusting coverage limits, adding or removing optional coverages, or choosing different deductible amounts.

Remember, obtaining multiple quotes from different insurance providers is advisable to ensure you're getting the best value for your money. Nationwide's quote is a great starting point, but exploring other options can help you make an informed decision.

Conclusion

Understanding the factors that influence Nationwide car insurance quotes empowers you to make informed decisions about your coverage and premiums. By considering your driver profile, vehicle details, and coverage options, you can tailor your policy to your specific needs while ensuring a competitive rate. Whether you choose to obtain your quote online or work with a Nationwide agent, the process is designed to be efficient and transparent, allowing you to take control of your car insurance coverage.

Can I get a discount on my Nationwide car insurance quote?

+

Absolutely! Nationwide offers various discounts to help lower your premium. These may include discounts for safe driving, bundling multiple policies, having safety features in your vehicle, being a loyal customer, and more. Be sure to inquire about available discounts when obtaining your quote.

What if I have a poor driving record? Will it affect my quote significantly?

+

Yes, a poor driving record, including accidents and violations, can indeed impact your car insurance quote. Insurance companies consider such records as a higher risk, which may result in higher premiums. However, Nationwide offers programs and discounts that can help mitigate the impact of a less-than-perfect driving record. It’s best to be transparent about your driving history when obtaining a quote to ensure an accurate assessment.

How often should I review and update my car insurance coverage and quote?

+

It’s recommended to review your car insurance coverage and quote annually, or whenever your circumstances change significantly. Life events like moving to a new state, purchasing a new vehicle, getting married, or having a child can all impact your insurance needs and quote. Regular reviews ensure you’re always getting the best coverage at the most competitive price.