Is Flight Insurance Worth It

Flight insurance is a type of travel insurance that provides coverage for various situations that may arise before or during a flight. It offers protection against unforeseen circumstances, such as trip cancellations, flight delays, lost luggage, and even medical emergencies while traveling. With an increasing number of travelers opting for flight insurance, the question arises: is it worth the investment, or is it just an unnecessary expense? In this comprehensive analysis, we will delve into the details of flight insurance, exploring its benefits, potential drawbacks, and real-world examples to help you make an informed decision.

Understanding Flight Insurance

Flight insurance policies can vary widely, but they typically cover a range of scenarios related to air travel. Here’s an overview of the key aspects of flight insurance coverage:

Trip Cancellation and Interruption

One of the primary benefits of flight insurance is the protection it offers in case of trip cancellations or interruptions. If you need to cancel your flight due to unforeseen circumstances, such as a medical emergency, a family member’s illness, or even severe weather conditions, flight insurance can reimburse you for the cost of the unused portion of your trip. This coverage is especially valuable for expensive international trips or trips with non-refundable bookings.

Flight Delays and Missed Connections

Flight delays are an inevitable part of air travel, and they can cause significant inconvenience and additional expenses. Flight insurance policies often include coverage for flight delays, providing reimbursement for meals, accommodation, and other expenses incurred while waiting for your delayed flight. Additionally, if you miss a connecting flight due to delays, flight insurance can help cover the costs of alternative transportation and accommodations until you can reach your final destination.

Lost or Delayed Luggage

Losing your luggage during a trip can be a stressful and costly experience. Flight insurance policies commonly offer coverage for lost, stolen, or delayed luggage. This coverage typically includes reimbursement for essential items you may need to purchase while waiting for your luggage to be located or delivered. Some policies also provide compensation for the value of the lost items, up to a certain limit.

Medical Emergencies and Evacuation

In the event of a medical emergency while traveling, flight insurance can be a lifesaver. It provides coverage for emergency medical treatment, hospitalization, and even medical evacuation back to your home country if necessary. This aspect of flight insurance is particularly crucial when traveling to remote or less developed areas, where access to quality healthcare may be limited.

Other Benefits and Add-ons

Flight insurance policies may also include additional benefits and add-ons, such as coverage for travel accidents, rental car damage, or personal liability. These extra coverages can provide further peace of mind and financial protection during your travels. It’s important to carefully review the policy terms and conditions to understand the specific benefits and limitations of each coverage option.

Is Flight Insurance Worth the Cost?

Determining whether flight insurance is worth it depends on various factors, including your travel plans, personal circumstances, and risk tolerance. Here’s a closer look at some considerations to help you decide:

Assessing Your Travel Needs

Consider the nature of your trip and the potential risks involved. Are you traveling to a remote destination with limited medical facilities? Do you have pre-existing medical conditions that could lead to unexpected expenses? Are you planning an adventure-filled vacation with activities that carry a higher risk of injury? Answering these questions can help you gauge the potential benefits of flight insurance.

Analyzing Your Financial Situation

Your financial circumstances play a significant role in deciding whether flight insurance is a wise investment. If you have sufficient savings or an emergency fund to cover unexpected travel expenses, you may feel more confident traveling without insurance. However, if you rely on a tight budget or have limited financial flexibility, flight insurance can provide a safety net against unforeseen financial burdens.

Comparing Policy Options and Costs

Flight insurance policies come in various forms and with different price tags. It’s essential to compare multiple policies and providers to find the best fit for your needs. Look for policies that offer comprehensive coverage for the specific risks you anticipate, while also considering the overall cost. Some travel insurance companies offer customizable policies, allowing you to select only the coverages you require, which can help keep costs down.

Real-Life Scenarios and Case Studies

Examining real-life examples can provide valuable insights into the value of flight insurance. Consider the following scenarios:

| Scenario | Impact |

|---|---|

| Medical Emergency Abroad | A traveler experiences a severe injury while hiking in a remote area. Flight insurance covers the cost of emergency medical treatment, evacuation, and follow-up care, ensuring they receive the necessary care without financial strain. |

| Lost Luggage Nightmare | A business traveler's luggage goes missing during a conference trip. Flight insurance provides compensation for the value of the lost items and covers the cost of purchasing essential clothing and supplies until the luggage is recovered. |

| Trip Cancellation Due to Illness | A family is forced to cancel their dream vacation due to a sudden illness. Flight insurance reimburses them for the cost of the non-refundable flights and accommodations, allowing them to reschedule the trip without incurring significant financial loss. |

These real-world examples illustrate how flight insurance can provide critical support and financial relief during unexpected travel challenges.

Tips for Choosing Flight Insurance

If you decide that flight insurance is a worthwhile investment for your travel plans, here are some tips to help you make an informed choice:

- Research and compare multiple insurance providers to find the best policy for your needs and budget.

- Read the fine print carefully. Understand the exclusions, limitations, and conditions of the policy to ensure it aligns with your expectations.

- Consider bundling flight insurance with other travel insurance coverages, such as trip cancellation, travel medical insurance, and baggage protection, to create a comprehensive travel protection plan.

- Review customer reviews and ratings to gauge the reliability and reputation of the insurance provider.

- If you're a frequent traveler, consider annual travel insurance plans, which often offer better value and convenience than purchasing separate policies for each trip.

Conclusion: Making an Informed Decision

The decision to purchase flight insurance ultimately depends on your personal circumstances, travel plans, and risk tolerance. While flight insurance can provide valuable protection against unexpected travel hurdles, it’s not a one-size-fits-all solution. By carefully assessing your needs, comparing policies, and considering real-life examples, you can make an informed decision about whether flight insurance is worth the investment for your next journey.

What are the common exclusions in flight insurance policies?

+Flight insurance policies often exclude pre-existing medical conditions, acts of war or terrorism, and deliberate self-injury. It’s important to review the policy exclusions carefully to understand the limitations of coverage.

Can I purchase flight insurance after booking my trip?

+In most cases, you can purchase flight insurance up until your departure date. However, it’s recommended to buy insurance as soon as you book your trip to ensure coverage for any unexpected cancellations or delays that may occur close to your departure.

Are there any alternative options to flight insurance?

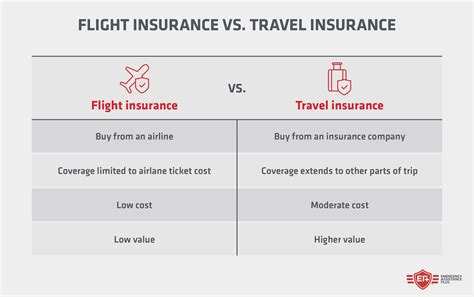

+Yes, some credit card companies offer travel protection benefits, including trip cancellation and interruption coverage. Additionally, some airlines provide their own travel insurance plans. It’s worth exploring these options and comparing them to traditional flight insurance policies.