Cheap Liability Only Insurance

Securing adequate insurance coverage is a crucial aspect of financial planning, especially when it comes to protecting yourself and your assets from potential liabilities. While comprehensive insurance policies often come with a hefty price tag, there are options available for those seeking more affordable alternatives. This article explores the concept of cheap liability-only insurance, providing an in-depth analysis of its benefits, limitations, and suitability for different scenarios.

Understanding Liability-Only Insurance

Liability-only insurance, as the name suggests, focuses solely on providing coverage for liability risks rather than offering extensive protection for property damage or personal injuries. It is a cost-effective solution designed to meet the basic insurance needs of individuals or businesses with limited budgets. By opting for liability-only coverage, policyholders can obtain essential protection against legal claims and financial losses arising from accidents or incidents for which they may be held responsible.

Key Features and Benefits of Liability-Only Insurance

Liability-only insurance policies typically include the following essential components:

- Bodily Injury Liability Coverage: This coverage protects the policyholder if someone is injured on their property or as a result of their actions. It covers medical expenses, pain and suffering, and lost wages of the injured party.

- Property Damage Liability Coverage: In the event that the policyholder’s actions or negligence cause damage to someone else’s property, this coverage steps in to pay for repairs or replacement costs.

- Defense Costs: Liability-only insurance often includes legal defense costs, providing financial support for the policyholder’s legal representation in liability-related lawsuits.

- Financial Protection: By having liability insurance, individuals and businesses can avoid paying substantial amounts out of pocket in the event of a claim, which can be especially crucial for those with limited financial resources.

Ideal Scenarios for Liability-Only Insurance

Liability-only insurance is particularly suitable for individuals and businesses in the following situations:

- Minimal Risk Exposure: If your daily activities or business operations pose a low risk of causing significant harm or property damage, liability-only insurance can provide adequate protection at a reduced cost.

- Budget Constraints: For those on a tight budget, liability-only insurance offers a more affordable alternative to comprehensive coverage, ensuring that you are not left vulnerable to potential liabilities.

- Renters and Tenants: Renters often require liability insurance as part of their lease agreements. Liability-only insurance can fulfill this requirement without the need for additional coverage that may not be necessary.

- Small Businesses: Start-ups and small businesses with limited assets and operations can benefit from liability-only insurance, providing protection against common liability risks without straining their finances.

Limitations and Considerations

While cheap liability-only insurance offers an attractive solution for those on a budget, it is essential to understand its limitations and make informed decisions based on your specific circumstances.

Coverage Limitations

Liability-only insurance policies typically do not include the following types of coverage:

- Property Damage to Your Own Property: In the event of a covered loss, liability-only insurance will not compensate you for damage to your own home, vehicle, or personal belongings.

- Medical Payments Coverage: This coverage, often included in comprehensive policies, provides immediate medical expense reimbursement for injuries sustained by you or your family members, regardless of fault.

- Collision and Comprehensive Coverage: These coverages are essential for vehicle owners, providing protection against accidents, theft, and natural disasters. Liability-only insurance does not offer this type of coverage.

- Personal Property Coverage: In the event of a theft or natural disaster, liability-only insurance will not compensate you for the loss or damage to your personal belongings.

Suitability for High-Risk Activities

Liability-only insurance may not be sufficient for individuals or businesses engaged in high-risk activities or facing significant exposure to liability risks. For example, if you own a hazardous materials transport company or operate heavy machinery, a more comprehensive insurance policy may be necessary to adequately protect your business and assets.

Deductibles and Out-of-Pocket Costs

Cheap liability-only insurance often comes with higher deductibles, meaning you will have to pay a larger portion of the claim out of pocket before the insurance coverage kicks in. This can be a significant consideration for those with limited financial resources.

Choosing the Right Liability-Only Insurance

When selecting a liability-only insurance policy, it is crucial to carefully evaluate your specific needs and circumstances. Consider the following factors:

- Policy Limits: Ensure that the liability limits provided by the policy are sufficient to cover potential claims against you. Higher limits may result in a slightly higher premium but can provide greater peace of mind.

- Reputable Insurer: Choose a well-established insurance company with a strong financial rating to ensure the stability and reliability of your coverage.

- Customizable Options: Some insurers offer the ability to customize your liability-only policy, allowing you to add optional coverages to address specific risks you may face.

- Claims Handling: Research the insurer’s claims process and reputation for timely and fair claim settlements. Efficient and transparent claims handling can be crucial in the event of a liability incident.

Real-World Example: Liability-Only Insurance for a Small Business

Imagine you own a small coffee shop in a bustling city. Your shop is located in a busy area, and while you take every precaution to ensure the safety of your customers, accidents can happen. A liability-only insurance policy can provide essential protection in the following scenarios:

- Slip and Fall Incident: If a customer slips on a freshly mopped floor and sustains an injury, your liability coverage can help cover their medical expenses and any legal costs associated with a potential lawsuit.

- Property Damage: In the event that a customer’s belongings are damaged while they are in your shop, liability insurance can compensate them for the cost of repair or replacement.

- Food Allergy Incident: If a customer has an allergic reaction to a dish they ordered due to a miscommunication, liability insurance can help cover their medical bills and any legal costs if they choose to pursue legal action.

In each of these scenarios, having liability-only insurance can protect your business from potentially devastating financial consequences while ensuring that your customers are fairly compensated for their losses.

Future Implications and Trends

The insurance industry is continuously evolving, and the demand for affordable liability-only insurance is likely to grow as more individuals and businesses seek cost-effective solutions. Here are some potential future implications and trends to consider:

- Increased Competition: As more insurers enter the market with liability-only offerings, competition is likely to drive down prices, making these policies even more affordable for consumers.

- Digital Transformation: The rise of digital insurance platforms and online comparison tools will make it easier for consumers to research and purchase liability-only insurance, potentially leading to increased accessibility and affordability.

- Customized Coverage: Insurers may begin to offer more tailored liability-only policies, allowing individuals and businesses to choose specific coverages based on their unique risks and needs.

- Integration with Technology: With the advancement of technology, liability-only insurance policies may integrate with smart devices and sensors to provide real-time risk assessments and personalized coverage recommendations.

| Insurance Type | Cost | Coverage |

|---|---|---|

| Comprehensive Insurance | High | Extensive protection for property damage, personal injuries, and liabilities |

| Liability-Only Insurance | Affordable | Limited coverage for liabilities only, excluding property damage and personal injuries |

How much does liability-only insurance typically cost?

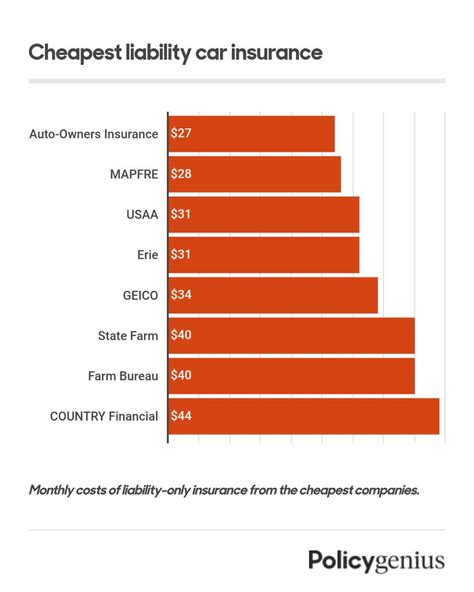

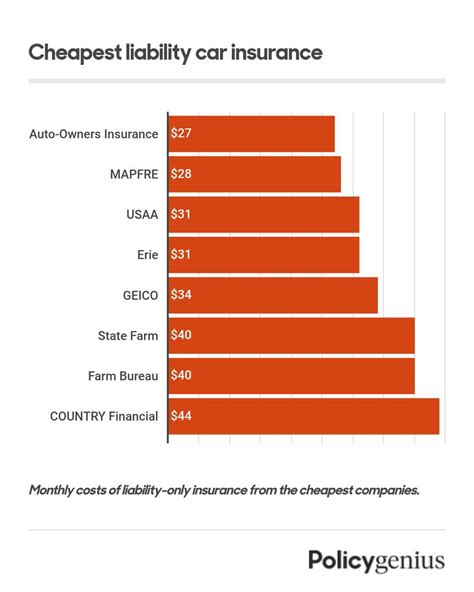

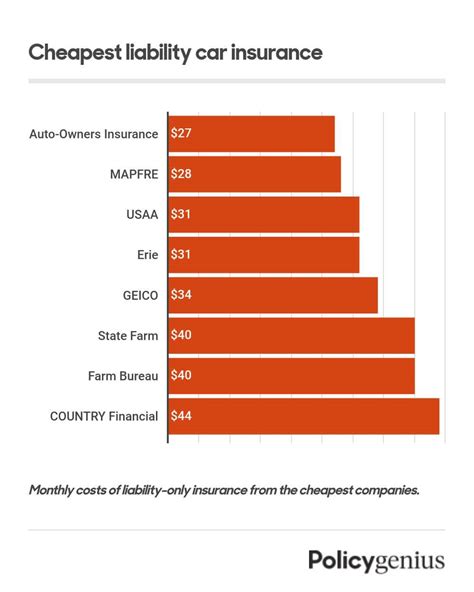

+The cost of liability-only insurance can vary depending on several factors, including the type of policy, the insurer, and your specific circumstances. On average, liability-only policies tend to be more affordable compared to comprehensive coverage, often starting at a few hundred dollars per year. However, it’s important to note that prices can fluctuate based on your location, the nature of your business or activities, and the level of coverage you require.

Can I add additional coverage to my liability-only policy?

+Yes, many insurers offer the option to customize your liability-only policy by adding specific coverages to address your unique needs. For example, you might choose to add medical payments coverage or coverage for specific types of property damage. These optional coverages can provide added protection while still keeping the overall cost of your insurance within your budget.

What happens if I exceed my liability limits in a claim?

+If the damages in a liability claim exceed your policy limits, you may be responsible for paying the excess amount out of pocket. This is why it’s crucial to carefully assess your potential liability risks and choose liability limits that are sufficient to cover these risks. It’s also worth considering umbrella liability policies, which can provide additional coverage above and beyond your primary liability insurance.