New Insurance

Welcome to the world of insurance, a realm that plays a vital role in securing our financial well-being and mitigating risks. In this comprehensive guide, we delve into the intricate process of acquiring a new insurance policy, exploring the steps, considerations, and best practices that empower individuals and businesses to make informed decisions. From understanding the nuances of different insurance types to navigating the complex landscape of coverage options, we aim to provide a definitive resource for anyone embarking on the journey of acquiring new insurance.

The Importance of Insurance: A Protective Shield for Your Future

Insurance is an indispensable tool for managing risks and ensuring financial stability. It acts as a safety net, providing coverage for a wide range of potential losses, from unexpected medical emergencies to property damage and liability claims. Whether you’re an individual, a family, or a business owner, insurance plays a crucial role in safeguarding your assets, protecting your loved ones, and ensuring a secure future.

For individuals, insurance offers peace of mind, knowing that financial burdens can be alleviated in times of crisis. It provides a safety net, allowing you to focus on recovery rather than the financial repercussions of unforeseen events. Similarly, for businesses, insurance is a critical component of risk management, protecting against potential losses and ensuring continuity.

The importance of insurance extends beyond personal or business interests. It plays a significant role in the broader economy, promoting stability and fostering growth. By transferring risks from individuals and businesses to insurance companies, the financial system remains resilient, allowing for continued investment and development.

Understanding Your Insurance Needs: A Personalized Approach

The journey of acquiring new insurance begins with a comprehensive assessment of your unique needs and circumstances. Every individual and business has distinct requirements, and understanding these nuances is essential for tailoring an insurance plan that provides adequate coverage.

For instance, consider a young professional starting their career. Their insurance needs may primarily revolve around health coverage, disability insurance, and perhaps liability protection for their personal assets. In contrast, a small business owner might require a more comprehensive approach, including business interruption insurance, commercial property coverage, and professional liability insurance.

Evaluating your insurance needs involves examining various factors, such as your age, health status, financial obligations, and the nature of your work or business. It's a personalized process, and seeking expert advice can be invaluable in ensuring you make the right choices.

Assessing Risk Factors

When determining your insurance needs, it’s crucial to assess the risks you face. This involves identifying potential hazards, whether it’s the risk of illness or injury, property damage, or liability claims. By understanding these risks, you can make informed decisions about the types and levels of coverage you require.

| Risk Category | Examples |

|---|---|

| Health Risks | Illness, accidents, chronic conditions |

| Property Risks | Fire, theft, natural disasters |

| Liability Risks | Legal claims, professional negligence |

Assessing risk factors also involves evaluating your tolerance for risk. Some individuals or businesses may be more comfortable with a higher level of risk, while others prefer a more conservative approach. This subjective assessment influences the level of coverage you opt for and the insurance provider you choose.

Exploring Insurance Types: A Comprehensive Overview

The insurance industry offers a vast array of coverage options, each designed to address specific needs. Understanding the different types of insurance is essential for making informed decisions and ensuring you have the right protection in place.

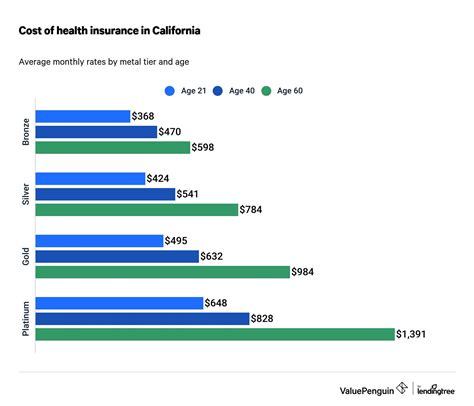

Health Insurance: Securing Your Well-being

Health insurance is perhaps the most critical form of coverage, providing financial protection against the costs of medical care. It covers a range of expenses, from routine check-ups and prescription drugs to more significant medical procedures and hospital stays.

There are various types of health insurance plans, including:

- Indemnity Plans: These traditional plans allow you to choose your healthcare providers and offer flexibility but may have higher out-of-pocket costs.

- Managed Care Plans: HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization) plans offer cost-effective coverage but may have provider networks and referral requirements.

- Catastrophic Plans: Designed for younger, healthier individuals, these plans provide basic coverage for emergencies with lower premiums.

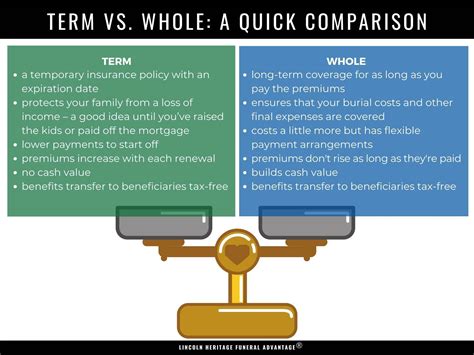

Life Insurance: Protecting Your Legacy

Life insurance is a crucial component of financial planning, ensuring that your loved ones are provided for in the event of your untimely demise. It offers a lump-sum payment to your beneficiaries, helping them cover expenses such as funeral costs, outstanding debts, and ongoing living expenses.

Key types of life insurance include:

- Term Life Insurance: This provides coverage for a specific term, offering high coverage at a relatively low cost. It's ideal for those seeking temporary protection.

- Whole Life Insurance: Offering permanent coverage, whole life insurance builds cash value over time, providing both protection and potential savings.

- Universal Life Insurance: A flexible option, universal life insurance allows you to adjust coverage and premiums, making it adaptable to changing needs.

Property Insurance: Safeguarding Your Assets

Property insurance is essential for protecting your tangible assets, such as your home, vehicles, and valuable possessions. It provides coverage against a range of perils, including fire, theft, and natural disasters.

Common types of property insurance include:

- Homeowner's Insurance: Covering your residence and personal belongings, homeowner's insurance is a must-have for homeowners.

- Renter's Insurance: Providing protection for renters, this insurance covers personal belongings and liability risks.

- Auto Insurance: Mandatory in most states, auto insurance covers your vehicle and protects against liability claims.

Business Insurance: Mitigating Risks for Commercial Enterprises

For businesses, insurance is a critical component of risk management. It protects against a wide range of potential losses, from property damage to liability claims and business interruption.

Key business insurance types include:

- Commercial Property Insurance: Covering physical assets such as buildings, equipment, and inventory, this insurance is essential for protecting business premises.

- Business Liability Insurance: Protecting against claims arising from bodily injury or property damage, this insurance is crucial for businesses interacting with the public.

- Professional Liability Insurance: Also known as Errors and Omissions (E&O) insurance, this covers legal costs and damages arising from professional negligence.

The Insurance Application Process: A Step-by-Step Guide

Once you've assessed your insurance needs and selected the appropriate coverage, the next step is to navigate the application process. This process can vary depending on the type of insurance and the provider, but understanding the general steps can help streamline the procedure.

Gathering Necessary Information

Before initiating the application, gather all relevant information. This may include personal details, such as your name, address, and date of birth, as well as specific information related to the insurance type you’re applying for.

For instance, if applying for health insurance, you'll need to provide details about your health status, including any pre-existing conditions. Similarly, for property insurance, you'll need information about the assets you wish to insure, such as the value of your home or vehicle.

Choosing the Right Insurance Provider

Selecting an insurance provider is a critical decision. Consider factors such as the provider’s reputation, financial stability, and the range of coverage options they offer. Research customer reviews and ratings to ensure you’re choosing a reliable and trusted insurer.

It's also essential to compare quotes from multiple providers. While cost is an important consideration, it shouldn't be the sole factor. Ensure you're getting the best value for your money by comparing coverage levels, deductibles, and any additional benefits or perks offered by each provider.

Completing the Application

The application process typically involves filling out an extensive form, providing detailed information about yourself and your insurance needs. Ensure you read the application carefully and provide accurate and truthful information.

For some types of insurance, such as health or life insurance, the application may involve a medical exam or health questionnaire. These assessments help the insurer evaluate your risk level and determine your premium.

Reviewing and Finalizing the Policy

Once you’ve submitted your application, the insurer will review your information and assess your risk. If approved, you’ll receive a policy document outlining the coverage, terms, and conditions of your insurance.

It's crucial to review the policy carefully, ensuring it aligns with your expectations and needs. Pay attention to the coverage limits, deductibles, and any exclusions or limitations. If you have any questions or concerns, don't hesitate to reach out to the insurer for clarification.

Once you're satisfied with the policy, you can finalize the agreement by paying the initial premium and signing any necessary documentation.

Maintaining and Managing Your Insurance Policy: A Long-Term Commitment

Acquiring a new insurance policy is just the beginning. Effective insurance management involves ongoing maintenance and periodic reviews to ensure your coverage remains adequate and aligned with your changing needs.

Regular Policy Reviews

Life is dynamic, and your insurance needs may evolve over time. Regular policy reviews are essential to ensure your coverage remains relevant and comprehensive. Consider reviewing your insurance policies annually or whenever significant life changes occur, such as marriage, the birth of a child, or a change in career or business status.

During policy reviews, assess whether your current coverage is sufficient or if any adjustments are necessary. For instance, if you've recently purchased a new home or acquired valuable assets, you may need to increase your property insurance coverage.

Understanding Policy Changes and Adjustments

Insurance policies can change over time, and it’s essential to stay informed about any modifications. Insurers may adjust premiums, coverage limits, or terms and conditions periodically. Stay updated on these changes to ensure you’re aware of any potential impacts on your coverage.

If you have concerns about policy changes, reach out to your insurer for clarification. They can provide insights into the reasons behind the adjustments and guide you in making informed decisions about your coverage.

Making Claims: Navigating the Process

In the event of a covered loss, you’ll need to navigate the claims process. This process can vary depending on the type of insurance and the nature of the claim, but understanding the general steps can help ensure a smooth and efficient experience.

When making a claim, provide the insurer with all relevant information and documentation. This may include a detailed description of the incident, any supporting evidence, and contact details for involved parties.

Keep in mind that the claims process can take time, especially for complex or large-scale claims. Be patient and cooperate with the insurer's investigation to ensure a prompt and fair resolution.

Conclusion: Empowering Your Financial Security with Insurance

Acquiring new insurance is a critical step towards securing your financial well-being and protecting against unforeseen risks. By understanding your unique needs, exploring the various insurance types, and navigating the application process, you can make informed decisions that provide adequate coverage and peace of mind.

Remember, insurance is a long-term commitment, and effective management involves ongoing reviews and adjustments. Stay proactive in maintaining your policies, and don't hesitate to seek expert advice when needed. With the right insurance coverage in place, you can face the future with confidence, knowing that you're protected against life's uncertainties.

What are the key factors to consider when choosing an insurance provider?

+When selecting an insurance provider, consider factors such as their reputation, financial stability, and the range of coverage options they offer. Research customer reviews and ratings to ensure they are reliable and trusted. Additionally, compare quotes from multiple providers to find the best value for your money.

How often should I review my insurance policies?

+It’s recommended to review your insurance policies annually or whenever significant life changes occur, such as marriage, the birth of a child, or a change in career or business status. Regular reviews ensure your coverage remains relevant and aligned with your evolving needs.

What should I do if my insurance needs change over time?

+If your insurance needs change, it’s important to adjust your coverage accordingly. Contact your insurer to discuss your options and make any necessary modifications to your policy. Staying proactive in managing your insurance ensures you maintain adequate protection.

How can I make the insurance application process more efficient?

+To streamline the insurance application process, gather all necessary information beforehand and choose a reputable insurance provider that aligns with your needs. Compare quotes and review the application carefully to ensure accuracy. Additionally, be prepared for any required medical exams or health questionnaires.