Automobile Insurances

Automobile insurance, often referred to as car insurance, is a crucial aspect of vehicle ownership. It provides financial protection and coverage for various situations that may arise while operating a motor vehicle. With millions of vehicles on the roads worldwide, understanding the intricacies of automobile insurance is essential for every driver and car owner.

The Importance of Automobile Insurance

Automobile insurance serves as a safety net, offering peace of mind to drivers and mitigating potential financial risks. In the event of an accident, whether it’s a minor fender bender or a more significant collision, insurance coverage can make a significant difference. It ensures that the costs associated with repairs, medical expenses, and legal liabilities are covered, preventing individuals from facing overwhelming financial burdens.

Additionally, automobile insurance is a legal requirement in many countries and regions. It is designed to protect not only the policyholder but also other road users, pedestrians, and property. By having adequate insurance coverage, drivers can contribute to a safer and more responsible driving environment.

Types of Automobile Insurance

Automobile insurance policies can vary greatly depending on the provider, location, and the specific needs of the policyholder. Here are some common types of automobile insurance coverage:

Liability Coverage

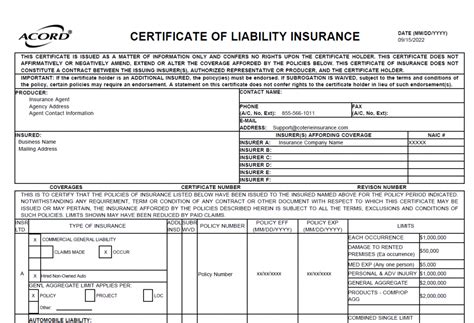

Liability insurance is a fundamental component of automobile insurance. It covers the policyholder’s legal responsibility for bodily injury or property damage caused to others in an accident for which they are at fault. This type of coverage is mandatory in most places and provides protection against potential lawsuits and compensation claims.

Collision Coverage

Collision coverage is an optional add-on to liability insurance. It provides protection for the policyholder’s own vehicle in the event of a collision, regardless of fault. This coverage pays for repairs or the replacement of the vehicle if it’s damaged in an accident. Collision insurance is particularly valuable for newer or more expensive vehicles, as it helps ensure they can be restored to their pre-accident condition.

Comprehensive Coverage

Comprehensive insurance, often referred to as “comp” coverage, offers protection against non-collision-related incidents. It covers damages caused by theft, vandalism, natural disasters, and other unforeseen events. Comprehensive coverage is beneficial for protecting vehicles from a wide range of potential risks and is recommended for those who want comprehensive protection.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is a type of coverage that provides medical benefits to the policyholder and their passengers, regardless of fault. It covers medical expenses, lost wages, and other related costs resulting from an accident. PIP is especially important in states with no-fault insurance laws, where it ensures that victims receive prompt medical attention and financial support.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage protects policyholders in situations where they are involved in an accident with a driver who has no insurance or insufficient insurance coverage. This coverage provides compensation for injuries, property damage, and other losses caused by the uninsured/underinsured driver. UM/UIM coverage is an essential safeguard against the financial risks posed by irresponsible drivers.

Factors Affecting Automobile Insurance Rates

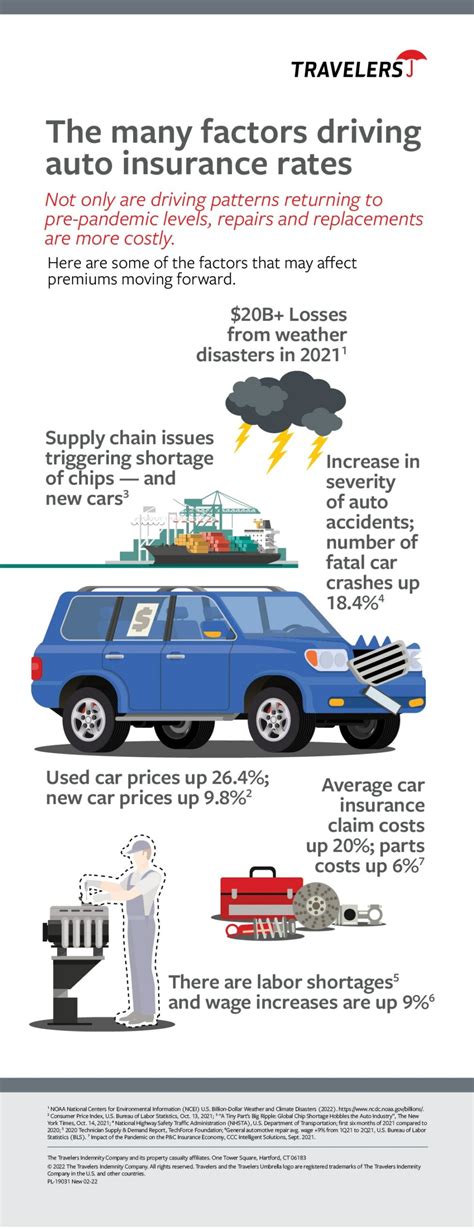

The cost of automobile insurance can vary significantly from one policyholder to another. Several factors influence the premiums that individuals pay for their insurance coverage. Understanding these factors can help drivers make informed decisions when choosing an insurance policy.

Vehicle Type and Usage

The type of vehicle and how it is used play a significant role in determining insurance rates. Generally, newer, more expensive vehicles with powerful engines tend to have higher insurance premiums. Additionally, vehicles that are primarily used for personal transportation may have different rates compared to those used for business purposes or as commercial vehicles.

Driver’s Age and Experience

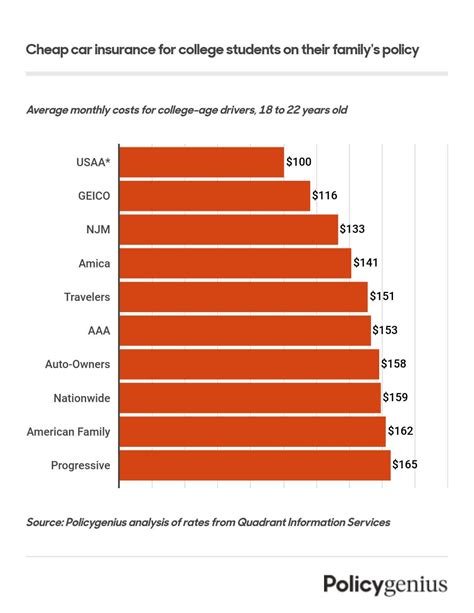

Age and driving experience are key factors in insurance pricing. Younger drivers, particularly those under the age of 25, often face higher insurance premiums due to their relative lack of experience on the road. On the other hand, mature drivers with a long history of safe driving may enjoy more competitive rates.

Driving Record

A driver’s history of accidents, traffic violations, and claims can greatly impact their insurance rates. Insurance companies carefully assess an individual’s driving record to determine their level of risk. A clean driving record with no accidents or violations can lead to lower premiums, while a history of frequent accidents or traffic citations may result in higher insurance costs.

Location and Traffic Conditions

The geographic location where a vehicle is registered and primarily used can affect insurance rates. Areas with higher populations, increased traffic congestion, and a higher incidence of accidents or thefts may result in higher premiums. Additionally, the specific neighborhood or region where a vehicle is garaged can also influence insurance costs.

Coverage and Deductibles

The level of coverage chosen by the policyholder and the deductibles they select also impact insurance rates. Comprehensive and collision coverage with lower deductibles typically result in higher premiums, as the insurance company assumes more financial responsibility. On the other hand, opting for higher deductibles can reduce monthly premiums but may require the policyholder to pay more out of pocket in the event of a claim.

Benefits and Considerations of Automobile Insurance

Automobile insurance offers a multitude of benefits, but it’s important to carefully consider the coverage and choose a policy that aligns with individual needs and circumstances.

Financial Protection

One of the primary advantages of automobile insurance is the financial protection it provides. In the event of an accident, insurance coverage ensures that policyholders and others involved are protected from potentially devastating financial losses. This protection extends to medical expenses, property damage, and legal liabilities, offering peace of mind to drivers and their families.

Legal Compliance

Automobile insurance is often a legal requirement, and having adequate coverage ensures compliance with local laws and regulations. This compliance not only avoids legal penalties but also contributes to a safer and more responsible driving environment for everyone on the roads.

Peace of Mind

Knowing that you have the right automobile insurance coverage can provide a sense of security and peace of mind. It allows drivers to focus on their daily lives and responsibilities without constant worry about the financial consequences of an accident or unforeseen event. With proper insurance, individuals can rest assured that they are protected and prepared for unexpected situations.

Customizable Coverage

Automobile insurance policies offer a high degree of customization. Policyholders can choose the level of coverage, deductibles, and optional add-ons that best fit their needs and budget. This flexibility ensures that drivers can tailor their insurance to their specific circumstances, whether they are looking for comprehensive protection or more affordable coverage.

Choosing the Right Automobile Insurance

Selecting the right automobile insurance policy involves careful consideration of various factors. Here are some key steps to guide you through the process:

Assess Your Needs

Start by evaluating your specific needs and circumstances. Consider factors such as the type of vehicle you own, your driving record, and the level of coverage you desire. Determine whether you require basic liability coverage or if you want to include comprehensive and collision coverage for added protection.

Compare Providers

Research and compare different insurance providers in your area. Look for reputable companies with a strong track record of customer satisfaction and financial stability. Compare their coverage options, policy terms, and premiums to find the best fit for your needs.

Review Policy Details

When considering a specific policy, carefully review the fine print. Understand the coverage limits, deductibles, and any exclusions or limitations. Ensure that the policy aligns with your expectations and provides the level of protection you require. Don’t hesitate to seek clarification on any unclear terms or conditions.

Consider Optional Add-Ons

Evaluate the optional add-ons available with the insurance policy. These can include rental car coverage, roadside assistance, or additional liability coverage. Assess whether these add-ons are necessary for your situation and whether they are worth the additional cost.

Seek Expert Advice

If you’re unsure about which automobile insurance policy to choose, consider consulting with an insurance agent or broker. These professionals can provide expert guidance based on your specific needs and help you navigate the complexities of insurance coverage. Their insights can ensure that you make an informed decision.

The Future of Automobile Insurance

The automobile insurance industry is evolving rapidly, driven by technological advancements and changing consumer expectations. Here are some trends and developments that are shaping the future of automobile insurance:

Telematics and Usage-Based Insurance

Telematics technology, which involves the use of sensors and GPS devices to track driving behavior, is gaining popularity in the insurance industry. Usage-based insurance (UBI) programs offer policyholders the opportunity to pay premiums based on their actual driving habits. These programs reward safe drivers with lower premiums, while those with risky driving behaviors may see higher costs. UBI is expected to become more prevalent as technology advances.

Connected Car Technology

The integration of connected car technology is revolutionizing the way insurance companies assess risk. With vehicles becoming increasingly connected and data-rich, insurers can gather real-time information about driving behavior, vehicle diagnostics, and even driver health. This data-driven approach allows for more accurate risk assessment and personalized insurance offerings.

AI and Machine Learning

Artificial Intelligence (AI) and machine learning algorithms are transforming the insurance industry. These technologies enable insurers to analyze vast amounts of data quickly and accurately, leading to more efficient underwriting processes and improved risk assessment. AI-powered systems can identify patterns, detect fraud, and personalize insurance offerings based on individual driver profiles.

Digital Transformation

The digital transformation of the insurance industry is making it more accessible and convenient for policyholders. Online platforms and mobile apps allow customers to purchase insurance policies, file claims, and manage their accounts with ease. Digital transformation also enables insurers to offer more personalized experiences, provide real-time updates, and streamline the overall insurance process.

Sustainable and Electric Vehicle Insurance

As the world shifts towards more sustainable and environmentally friendly transportation options, the insurance industry is adapting to cover electric vehicles (EVs) and other alternative fuel vehicles. Insurers are developing specialized policies that address the unique needs and risks associated with these vehicles, such as charging station coverage and battery replacement costs.

Conclusion

Automobile insurance is an essential component of responsible vehicle ownership, providing financial protection and peace of mind to drivers worldwide. By understanding the different types of coverage, the factors influencing insurance rates, and the benefits of having adequate insurance, individuals can make informed decisions to protect themselves and others on the road. As the insurance industry continues to evolve with technological advancements, policyholders can expect more personalized and data-driven insurance experiences that meet their unique needs.

What is the average cost of automobile insurance?

+The average cost of automobile insurance can vary widely depending on factors such as location, driving record, and the type of coverage chosen. On average, policyholders can expect to pay between 500 and 1,500 annually for basic liability coverage. However, the cost can increase significantly with comprehensive and collision coverage, especially for high-value vehicles or drivers with a history of accidents or violations.

Can I get automobile insurance if I have a poor driving record?

+Yes, even drivers with a poor driving record can obtain automobile insurance. However, insurance companies may classify them as high-risk drivers, resulting in higher premiums. It’s essential to shop around and compare quotes from different insurers to find the most competitive rates for your specific situation.

How can I reduce my automobile insurance premiums?

+There are several ways to reduce your automobile insurance premiums. First, maintain a clean driving record by avoiding accidents and traffic violations. Additionally, consider increasing your deductibles, as higher deductibles can lead to lower premiums. You can also explore discounts offered by insurance providers, such as safe driver discounts, good student discounts, or loyalty rewards.