Insurance Business Example

In today's dynamic business landscape, risk management and financial protection are paramount. This article delves into the intricate world of insurance, using a compelling business case to illustrate the significance of tailored insurance policies. We will explore the journey of a fictional company, EcoSolutions Inc., and how strategic insurance choices impacted its success.

The Rise of EcoSolutions Inc.: A Story of Innovation and Risk

EcoSolutions Inc. is a trailblazing environmental consulting firm founded by visionary entrepreneurs, Dr. Emily Thompson and Mr. Oliver Wright. With a passion for sustainability and a knack for technological innovation, they set out to revolutionize the industry.

The company’s flagship product, EcoTracker, is a cutting-edge software platform that helps businesses monitor and reduce their environmental impact. Within a year of its launch, EcoTracker gained widespread recognition and adoption, establishing EcoSolutions as a leader in the green technology space.

Understanding the Risks: A Comprehensive Assessment

Despite their success, Dr. Thompson and Mr. Wright recognized the inherent risks associated with their industry and the need for robust insurance coverage. They engaged a team of insurance experts to conduct a thorough risk assessment, identifying potential pitfalls and vulnerabilities.

The assessment revealed several key areas of concern:

- Liability Risks: With their software being used by a diverse range of businesses, EcoSolutions faced potential liability claims for data breaches, system failures, or even environmental accidents caused by client companies using EcoTracker.

- Property Risks: As a tech company, EcoSolutions had significant investments in office equipment, servers, and intellectual property. A fire, flood, or cyberattack could result in substantial losses.

- Business Interruption: The experts highlighted the potential impact of a prolonged disruption to their operations, whether due to natural disasters, cyberattacks, or employee illness. Such an event could cripple the company’s ability to deliver services and honor client contracts.

- Employee Wellbeing: With a talented team of engineers and consultants, EcoSolutions needed to protect its human capital. The assessment considered the risks associated with employee health, disability, and potential workplace accidents.

Crafting a Tailored Insurance Strategy

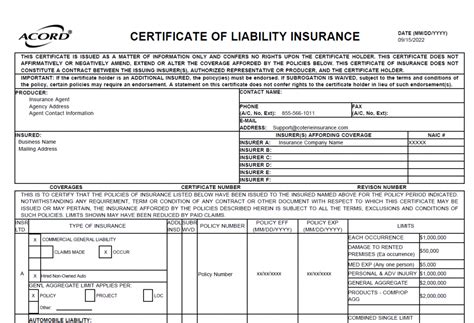

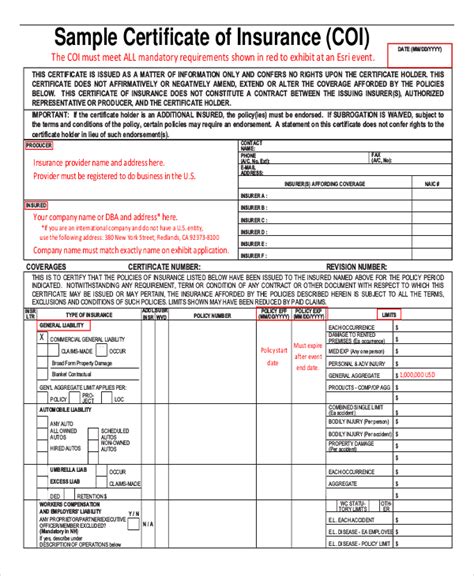

Armed with this comprehensive risk assessment, EcoSolutions set out to design an insurance portfolio that addressed their unique needs. Here’s how they approached it:

- Cyber Liability Insurance: Given the prevalence of cyber threats and their potential impact on EcoSolutions’ operations and client data, this was a top priority. The policy covered data breaches, ransomware attacks, and system failures, providing both liability protection and resources for crisis management and recovery.

- Professional Indemnity: This policy protected EcoSolutions against claims of negligence, errors, or omissions in their professional services. It was crucial given the complex nature of their environmental consulting work.

- Property Insurance: A tailored property insurance policy covered their office space, equipment, and intellectual property. It included provisions for business interruption, ensuring they could continue operations even in the face of a covered loss.

- Workers’ Compensation: To protect their employees and ensure business continuity, EcoSolutions obtained workers’ compensation insurance. This policy covered medical expenses, lost wages, and rehabilitation costs for employees injured on the job.

- Key Person Insurance: Recognizing the critical role of Dr. Thompson and Mr. Wright in the company’s success, they secured key person insurance. This policy provided financial protection in the event of their unexpected absence due to illness or death, ensuring the company’s survival.

The Impact of Insurance: A Success Story

As EcoSolutions continued its rapid growth, the foresight and strategic planning of Dr. Thompson and Mr. Wright paid dividends. Here are some key outcomes of their insurance strategy:

- Incident Response and Recovery: In the face of a ransomware attack, EcoSolutions’ cyber liability insurance proved invaluable. The policy covered the cost of incident response, legal fees, and system restoration, allowing them to minimize downtime and maintain client trust.

- Business Continuity: When a severe storm caused significant damage to their office building, EcoSolutions’ property insurance and business interruption coverage kicked in. This enabled them to quickly relocate operations, cover the cost of temporary offices, and ensure uninterrupted service to their clients.

- Employee Wellbeing and Productivity: By investing in workers’ compensation and health insurance, EcoSolutions created a supportive work environment. This led to increased employee satisfaction, reduced absenteeism, and a more engaged workforce.

- Risk Mitigation and Peace of Mind: With a comprehensive insurance portfolio, EcoSolutions could focus on their core business without worrying about potential liabilities or unexpected losses. This peace of mind allowed them to innovate and expand their market share confidently.

Looking Ahead: The Future of EcoSolutions

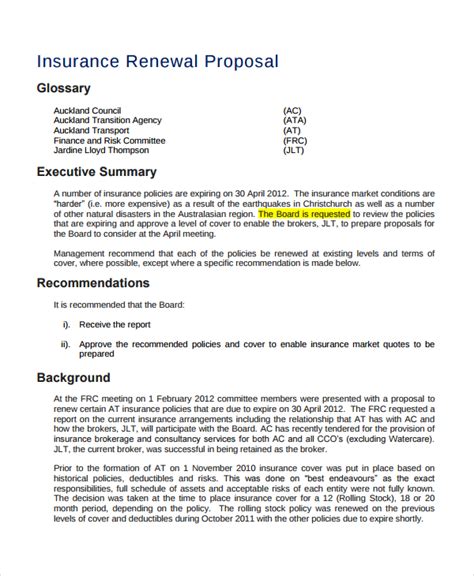

As EcoSolutions Inc. continues to thrive, their insurance strategy remains a cornerstone of their success. By staying abreast of industry trends and regularly reviewing their coverage, they ensure their policies remain aligned with their evolving needs.

The company’s founders, Dr. Thompson and Mr. Wright, attribute much of their success to their proactive approach to risk management. They understand that in the dynamic business world, insurance is not just a financial safeguard but a strategic tool that enables growth and long-term sustainability.

Conclusion

EcoSolutions Inc.’s journey highlights the critical role of insurance in modern businesses. By conducting a thorough risk assessment and crafting a tailored insurance portfolio, companies can protect their assets, mitigate liabilities, and ensure their long-term viability. As the business landscape continues to evolve, a proactive and strategic approach to insurance will remain a key differentiator for forward-thinking enterprises.

What are the key benefits of a tailored insurance strategy for businesses like EcoSolutions Inc.?

+A tailored insurance strategy offers several advantages. It ensures businesses have adequate coverage for their specific risks, provides peace of mind, and can help mitigate financial losses in the event of an incident. Additionally, it allows for more efficient allocation of resources, as businesses can focus on their core operations without worrying about unforeseen liabilities.

How often should businesses review and update their insurance policies?

+Businesses should regularly review their insurance policies, ideally annually or whenever there are significant changes to their operations, assets, or liabilities. This ensures that their coverage remains aligned with their current needs and any new risks that may have emerged.

What are some common pitfalls to avoid when selecting insurance policies for a business?

+Common pitfalls include underestimating the scope of coverage needed, failing to understand policy exclusions, and selecting policies solely based on price without considering the specific needs of the business. It’s crucial to work with experienced insurance brokers or advisors who can guide businesses through the process and ensure an appropriate level of coverage.