New York State Auto Insurance

Auto insurance is a crucial aspect of vehicle ownership, providing financial protection and peace of mind to drivers across the United States. In the bustling state of New York, with its diverse landscapes and bustling cities, understanding the nuances of auto insurance is essential for residents. This comprehensive guide will delve into the world of New York State auto insurance, exploring its unique features, requirements, and best practices.

Understanding New York State Auto Insurance Requirements

New York State mandates that all drivers carry liability insurance to legally operate a motor vehicle. This liability coverage protects you from financial losses in the event of an accident, covering the costs of bodily injury and property damage to others. Here’s a breakdown of the minimum liability requirements:

| Coverage Type | Minimum Requirement |

|---|---|

| Bodily Injury per Person | $25,000 |

| Bodily Injury per Accident | $50,000 |

| Property Damage | $10,000 |

While these minimums are legally required, many experts recommend carrying higher limits to provide more robust protection. The specific coverage and limits you choose will depend on your personal circumstances and the value of your assets.

Additional Coverage Options

Beyond the mandatory liability coverage, New York State drivers have the option to purchase various additional coverages to enhance their protection. These include:

- Collision Coverage: Pays for damages to your vehicle if you collide with another vehicle or object, regardless of fault.

- Comprehensive Coverage: Covers losses caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you're involved in an accident with a driver who has little or no insurance.

- Medical Payments Coverage: Covers medical expenses for you and your passengers, regardless of fault.

- Personal Injury Protection (PIP): A no-fault coverage that pays for medical expenses, lost wages, and other related costs, ensuring quick access to benefits after an accident.

These additional coverages can be tailored to your specific needs and budget, offering peace of mind and comprehensive protection.

The Impact of New York’s No-Fault Insurance System

New York State operates under a no-fault insurance system, which means that your own auto insurance policy is primarily responsible for covering your losses, regardless of who caused the accident. This system aims to streamline the claims process and reduce the number of lawsuits related to minor accidents.

Under New York's no-fault system, Personal Injury Protection (PIP) coverage is mandatory, ensuring that you and your passengers have access to medical benefits and income replacement without the need for a lengthy legal battle. However, it's important to note that there are certain situations where you may be able to pursue a personal injury lawsuit, such as in cases of severe injury or excessive economic loss.

Understanding the No-Fault Claims Process

When involved in an accident, New York’s no-fault system simplifies the claims process. Here’s a step-by-step guide:

- Seek Medical Attention: Your health and safety are paramount. Even if you feel uninjured, it's crucial to seek medical attention promptly after an accident.

- Notify Your Insurer: Contact your insurance provider as soon as possible to report the accident and initiate the claims process. Provide all relevant details, including the date, time, location, and any available police report information.

- Submit Your Claim: Complete and submit the necessary claim forms, providing documentation of your injuries and any related expenses. This may include medical bills, prescription receipts, and wage loss statements.

- Receive Benefits: Your insurer will review your claim and provide benefits for covered expenses, including medical costs, lost wages, and other approved expenses.

Remember, the no-fault system aims to expedite the claims process, but it's essential to keep detailed records and communicate regularly with your insurer to ensure a smooth experience.

Factors Influencing Auto Insurance Rates in New York

Auto insurance rates in New York can vary significantly depending on various factors. Insurance companies consider a range of criteria when determining premiums, including:

- Driver's Profile: Your age, gender, driving record, and credit history can all impact your insurance rates. Younger drivers and those with a history of accidents or traffic violations may face higher premiums.

- Vehicle Type: The make, model, and year of your vehicle can affect your insurance costs. Sports cars and luxury vehicles often carry higher premiums due to their increased risk of theft and higher repair costs.

- Coverage and Limits: The level of coverage and policy limits you choose will directly impact your premium. Higher coverage limits and comprehensive protection typically result in higher rates.

- Location: Where you live and garage your vehicle can influence rates. Urban areas with higher populations and congestion often have higher insurance costs due to increased accident risks.

- Usage: How you use your vehicle can impact your rates. Commuters who drive long distances daily may face higher premiums compared to those who primarily use their vehicles for short trips.

It's essential to shop around and compare quotes from multiple insurance providers to find the best rates that align with your specific circumstances.

Tips for Lowering Your Auto Insurance Premiums

While auto insurance is a necessary expense, there are strategies you can employ to potentially lower your premiums:

- Maintain a Clean Driving Record: Avoid accidents and traffic violations. A clean driving record can lead to significant savings on your insurance.

- Bundle Policies: Consider bundling your auto insurance with other policies, such as homeowners or renters insurance. Many providers offer discounts for bundling multiple policies.

- Increase Your Deductible: Opting for a higher deductible can lower your premium. However, ensure you choose a deductible amount that you're comfortable paying out of pocket in the event of a claim.

- Take Advantage of Discounts: Many insurance companies offer discounts for various reasons, such as good student discounts, safe driver discounts, and loyalty discounts. Ask your insurer about available discounts and ensure you're taking advantage of them.

- Shop Around: Regularly compare quotes from different insurance providers. The insurance market is competitive, and you may find better rates by switching providers.

The Role of Technology in New York State Auto Insurance

Advancements in technology have significantly impacted the auto insurance industry, and New York is no exception. Here’s how technology is shaping the landscape:

Telematics and Usage-Based Insurance

Telematics devices and usage-based insurance programs are gaining popularity in New York. These programs use technology to track your driving behavior, such as mileage, speed, and braking patterns. By providing data-driven insights into your driving habits, these programs can offer personalized insurance rates. Drivers with safe and cautious driving behaviors may qualify for lower premiums.

Digital Claims Processing

Insurance companies in New York are increasingly embracing digital claims processing. This streamlined approach allows for faster and more efficient claims handling. With digital submissions and real-time tracking, policyholders can expect a smoother and more transparent claims experience.

Online Policy Management

Many New York insurance providers offer online platforms and mobile apps for policy management. These tools enable policyholders to view and manage their policies, make payments, and even submit claims digitally. This level of convenience and accessibility is transforming the way policyholders interact with their insurance providers.

Choosing the Right Auto Insurance Provider in New York

With a plethora of insurance providers operating in New York, choosing the right one can be a daunting task. Here are some key considerations to help you make an informed decision:

- Financial Stability: Ensure the provider you choose is financially stable and has a solid reputation. Check their financial ratings and customer reviews to gauge their reliability.

- Coverage Options: Evaluate the range of coverage options offered by different providers. Look for a company that offers the specific coverages and limits you require, ensuring you have the protection you need.

- Customer Service: Excellent customer service is crucial. Assess the provider's reputation for responsiveness, accessibility, and claims handling. Consider reading online reviews and speaking with current or former customers to gauge their satisfaction.

- Discounts and Programs: Explore the discounts and programs offered by each provider. Some companies may offer unique perks or programs tailored to specific demographics or driving behaviors.

- Claims Process: Understand the claims process and how the provider handles claims. Look for transparency, efficiency, and a track record of fair and timely settlements.

Taking the time to research and compare providers can ensure you find a company that aligns with your needs and provides the best value for your insurance dollar.

Future Trends in New York State Auto Insurance

The auto insurance landscape in New York is evolving, and several trends are shaping the industry’s future. Here’s a glimpse into what we can expect:

Autonomous Vehicles and Insurance

As autonomous vehicles become more prevalent, insurance providers will need to adapt their policies to accommodate this new technology. Liability and coverage questions will arise, and insurers will need to develop innovative solutions to address the unique risks associated with self-driving cars.

Data-Driven Insurance

The continued advancement of data analytics and artificial intelligence will likely lead to more sophisticated usage-based insurance programs. Insurers will have access to vast amounts of data, allowing them to offer highly personalized rates based on individual driving behaviors and patterns.

Digital Transformation

The digital transformation of the insurance industry will continue to accelerate. Policyholders can expect even more streamlined processes, from quote comparisons to claims submissions, all accessible through digital platforms and mobile apps. This shift towards digital convenience will enhance the overall customer experience.

Collaborative Insurance Models

The traditional insurance model may evolve to include more collaborative approaches. Insurers may partner with mobility providers, ride-sharing services, and other stakeholders to offer innovative insurance solutions that cater to the changing transportation landscape.

As New York State continues to embrace technological advancements and adapt to the evolving transportation industry, auto insurance will play a crucial role in ensuring the safety and financial protection of its residents. By staying informed and proactive, drivers can navigate the complex world of auto insurance with confidence and peace of mind.

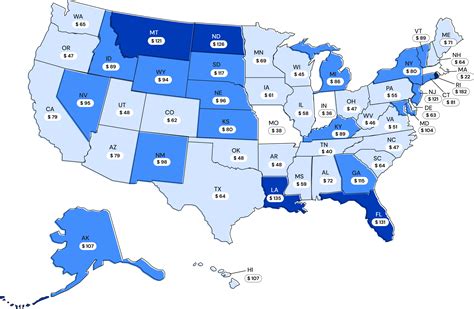

What is the average cost of auto insurance in New York State?

+The average cost of auto insurance in New York can vary significantly depending on various factors, including the driver’s profile, vehicle type, coverage limits, and location. According to recent data, the average annual premium in New York is approximately 1,500. However, it's important to note that rates can range from 1,000 to over $3,000, highlighting the impact of individual circumstances.

Can I customize my auto insurance policy to suit my specific needs?

+Absolutely! Auto insurance policies are highly customizable. You can choose the specific coverages and limits that align with your unique circumstances and budget. Whether you’re a cautious driver looking for comprehensive protection or a cost-conscious individual seeking the minimum required coverage, insurance providers offer flexibility to tailor your policy.

How often should I review and update my auto insurance policy?

+It’s recommended to review your auto insurance policy annually or whenever significant life changes occur. Life events such as getting married, buying a new car, or relocating to a different area can impact your insurance needs. Regular reviews ensure that your coverage remains up-to-date and provides the protection you require.

What happens if I’m involved in an accident with an uninsured driver in New York State?

+If you’re involved in an accident with an uninsured driver in New York, your own uninsured/underinsured motorist coverage (if you have it) will come into play. This coverage protects you in situations where the at-fault driver lacks sufficient insurance to cover your losses. It’s a valuable addition to your policy and can provide peace of mind in such circumstances.