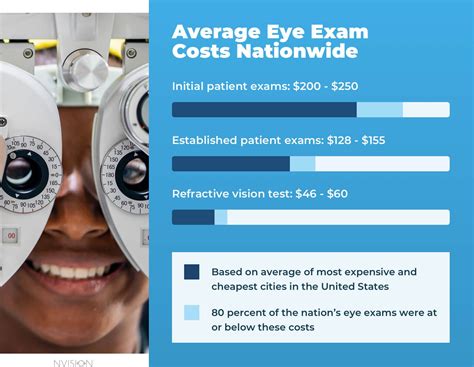

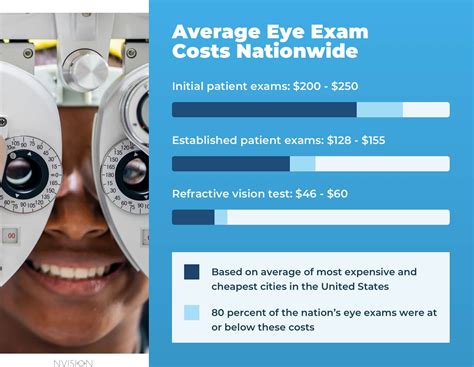

How Much Is Eye Insurance

Eye insurance is a vital component of comprehensive healthcare coverage, offering financial protection and access to essential eye care services. In today's world, where visual health is closely tied to overall well-being and productivity, having adequate eye insurance is more important than ever. This article aims to delve into the various aspects of eye insurance, providing an in-depth understanding of its costs, benefits, and implications for individuals and families.

Understanding Eye Insurance Coverage

Eye insurance, also known as vision insurance, is a specialized health insurance plan that covers a range of eye-related services and products. These plans typically include coverage for routine eye exams, corrective lenses (glasses or contacts), and, in some cases, more advanced procedures like LASIK surgery or cataract treatment. By providing financial support for these services, eye insurance ensures that individuals can maintain optimal visual health without incurring significant out-of-pocket expenses.

The cost of eye insurance can vary widely depending on several factors, including the scope of coverage, the provider, and the individual's or family's specific needs. It's essential to understand these variables to make an informed decision about eye insurance coverage.

Factors Influencing Eye Insurance Costs

When considering the cost of eye insurance, several key factors come into play:

- Coverage Level: The breadth of coverage offered by an eye insurance plan significantly impacts its cost. Basic plans may cover only routine eye exams and a limited allowance for corrective lenses, while more comprehensive plans could include coverage for a wider range of services, such as eye surgeries and specialty treatments.

- Provider Network: Eye insurance plans often have networks of preferred providers, including ophthalmologists, optometrists, and optical stores. Plans that offer a larger network of providers may cost more, as they provide greater flexibility and convenience for policyholders.

- Individual vs. Family Plans: Insurance costs can vary depending on whether the plan covers an individual or an entire family. Family plans typically offer a more cost-effective solution for families with multiple members requiring eye care.

- Deductibles and Co-Pays: Like traditional health insurance, eye insurance plans may have deductibles and co-pays. The amount of these out-of-pocket expenses can influence the overall cost of the plan.

- Additional Benefits: Some eye insurance plans offer extra benefits, such as discounts on laser eye surgery or coverage for specialty contact lenses. These additional perks can increase the plan's overall cost.

Analyzing Real-World Eye Insurance Plans

To gain a clearer understanding of eye insurance costs, let’s examine some real-world examples. These plans are offered by leading insurance providers and showcase the range of coverage and pricing available in the market.

| Plan Name | Coverage Highlights | Annual Premium |

|---|---|---|

| Basic Vision Plan | Annual eye exam, $100 allowance for glasses or contacts | $60 |

| Standard Vision Plan | Annual eye exam, $200 allowance for glasses or contacts, 20% discount on LASIK | $120 |

| Premium Vision Plan | Annual eye exam, unlimited allowance for glasses or contacts, coverage for laser eye surgery, vision therapy | $250 |

These plans illustrate the varying levels of coverage and associated costs. While the Basic Vision Plan offers a cost-effective solution for those primarily seeking routine eye exams and basic lens coverage, the Premium Vision Plan provides extensive coverage for a range of eye care needs, making it ideal for individuals with more complex visual health requirements.

Benefits and Considerations of Eye Insurance

Eye insurance offers several advantages that make it a worthwhile investment for individuals and families. Understanding these benefits can help underscore the importance of incorporating eye insurance into your overall healthcare strategy.

Financial Protection and Accessibility

One of the primary benefits of eye insurance is the financial protection it provides. Routine eye exams and corrective lenses can be costly, especially for families with multiple members. Eye insurance plans help spread these costs over time, making essential eye care services more affordable and accessible. By reducing the financial burden, eye insurance encourages individuals to prioritize their visual health and seek regular eye exams, which can lead to early detection and treatment of potential issues.

Preventative Care and Early Detection

Eye insurance plans often emphasize preventative care, encouraging policyholders to undergo regular eye exams. These exams are crucial for detecting not only refractive errors but also a range of eye conditions and diseases, including glaucoma, macular degeneration, and diabetic retinopathy. By identifying these issues early on, individuals can access timely treatment, potentially preventing more severe complications and preserving their vision.

Enhanced Visual Quality of Life

Corrective lenses and, in some cases, procedures like LASIK, can significantly improve an individual’s visual experience. Eye insurance plans that cover these services can enhance the overall quality of life for policyholders. Whether it’s achieving clearer vision through glasses or contacts or undergoing laser eye surgery to reduce dependence on corrective lenses, eye insurance supports individuals in achieving their best visual potential.

Considerations for Choosing an Eye Insurance Plan

When selecting an eye insurance plan, several key considerations should be taken into account:

- Coverage Needs: Assess your specific eye care needs. Consider factors like the frequency of eye exams, the type of lenses you prefer, and any potential procedures you may require in the future.

- Provider Network: Ensure that your preferred eye care providers are within the insurance plan's network. This can significantly impact your convenience and the overall cost of care.

- Cost vs. Benefits: Evaluate the balance between the plan's cost and the benefits it offers. While a more expensive plan may provide extensive coverage, it may not be necessary for individuals with basic eye care needs. Choose a plan that offers the right level of coverage at a reasonable cost.

- Additional Services: Some eye insurance plans offer extra services like vision therapy or discounts on specialty lenses. If these services align with your needs, they can provide added value to your insurance plan.

Future Trends and Implications

As the field of eye care continues to advance, the landscape of eye insurance is also evolving. Several key trends and developments are shaping the future of eye insurance and its impact on visual health.

Advancements in Eye Care Technology

The rapid pace of technological innovation in eye care is set to have a significant impact on eye insurance coverage. Advanced diagnostic tools, such as optical coherence tomography (OCT) and digital retinal imaging, are becoming more accessible and affordable. These technologies can provide more accurate and detailed assessments of eye health, potentially leading to earlier detection of eye conditions. Eye insurance plans may increasingly cover these advanced diagnostics, improving the overall effectiveness of eye care.

Integration of Telehealth Services

The rise of telehealth services has transformed the way healthcare is delivered, and eye care is no exception. Telemedicine platforms now offer remote eye exams and consultations, making eye care more accessible and convenient, especially for individuals in rural or underserved areas. Eye insurance plans that integrate telehealth services can improve policyholders’ access to eye care, reduce travel costs, and provide a more flexible care experience.

Expanding Coverage for Preventative Care

A growing emphasis on preventative care is likely to influence the scope of eye insurance coverage. As the importance of regular eye exams for early disease detection becomes more widely recognized, eye insurance plans may expand their coverage to include more frequent exams and a broader range of preventative services. This shift could lead to improved overall eye health and reduced long-term healthcare costs.

Addressing Vision Health Disparities

Eye insurance plans also have the potential to play a role in addressing vision health disparities. By offering affordable coverage and access to essential eye care services, insurance providers can help reduce barriers to eye health for underserved populations. This can lead to improved visual health outcomes and a more equitable healthcare landscape.

How often should I have an eye exam, and is it covered by insurance?

+The frequency of eye exams depends on your age and eye health history. Generally, adults should have an eye exam every 1-2 years, while children and individuals with certain eye conditions may require more frequent exams. Many eye insurance plans cover annual eye exams as a basic benefit.

What happens if I need eye surgery, and is it covered by my eye insurance plan?

+If you require eye surgery, your eye doctor will discuss the procedure and its potential benefits with you. The coverage for eye surgeries can vary depending on your insurance plan. Some plans may cover a wide range of procedures, while others may have specific limitations. It's essential to review your plan's coverage details and discuss any potential out-of-pocket costs with your eye care provider.

Are there any tax benefits associated with eye insurance plans?

+Eye insurance plans may offer tax benefits, depending on the country and the specific plan. In some cases, the premiums for eye insurance may be tax-deductible, similar to other healthcare expenses. It's advisable to consult a tax professional to understand the tax implications of your eye insurance plan.

In conclusion, eye insurance is a critical component of comprehensive healthcare coverage, offering financial protection and access to essential eye care services. By understanding the costs, benefits, and implications of eye insurance, individuals can make informed decisions about their visual health and well-being. As the field of eye care continues to advance, eye insurance plans will play an increasingly vital role in promoting eye health and ensuring accessibility to quality eye care services.