Full Coverage On Car Insurance

Full coverage on car insurance is a comprehensive protection plan that offers extensive coverage for vehicle owners. This type of insurance policy goes beyond the basic liability coverage, providing additional financial security and peace of mind for drivers. In this in-depth exploration, we will delve into the intricacies of full coverage car insurance, examining its benefits, components, and considerations to help you make informed decisions about your vehicle's protection.

Understanding Full Coverage Car Insurance

Full coverage car insurance is designed to offer a broad range of protection for your vehicle. It typically includes multiple types of coverage, each addressing different aspects of potential risks and damages. By opting for full coverage, you gain access to a comprehensive safety net that can safeguard you from various financial liabilities and unexpected expenses.

One of the key advantages of full coverage is its ability to protect your vehicle from a wide array of potential hazards. This includes not only accidents but also events like theft, vandalism, natural disasters, and even damage caused by animals. With full coverage, you can rest assured knowing that your vehicle is insured against a diverse set of risks.

Components of Full Coverage Car Insurance

Full coverage car insurance is composed of several essential components, each contributing to the overall protection it provides. These components often include:

- Comprehensive Coverage: This aspect of full coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, weather-related incidents, or collisions with animals.

- Collision Coverage: Collision coverage specifically covers damages to your vehicle resulting from collisions with other vehicles or objects, regardless of fault.

- Liability Coverage: Liability coverage is a fundamental component of any car insurance policy. It provides protection against claims arising from accidents you cause, including bodily injury and property damage claims.

- Uninsured/Underinsured Motorist Coverage: This coverage safeguards you in the event of an accident with a driver who either lacks insurance or has insufficient coverage to pay for the damages.

- Personal Injury Protection (PIP): PIP, often required in certain states, covers medical expenses and lost wages for you and your passengers, regardless of fault.

- Medical Payments Coverage: Similar to PIP, this coverage assists with medical expenses for you and your passengers, but it may have more flexible usage options.

- Roadside Assistance: Many full coverage policies include roadside assistance, offering benefits such as towing, flat tire changes, and fuel delivery in emergency situations.

The exact components and coverage limits of a full coverage policy can vary depending on your insurance provider and the state you reside in. It's crucial to carefully review the policy details to ensure you understand the scope of your coverage and any potential exclusions.

Benefits and Considerations of Full Coverage

Full coverage car insurance offers a multitude of benefits, providing a comprehensive risk management strategy for vehicle owners. By investing in full coverage, you gain the following advantages:

- Financial Protection: Full coverage offers a robust financial safety net, safeguarding you from potential catastrophic expenses resulting from accidents, theft, or natural disasters.

- Peace of Mind: With full coverage, you can drive with confidence, knowing that you are protected against a wide range of potential risks and liabilities.

- Comprehensive Risk Management: Full coverage allows you to tailor your policy to your specific needs, ensuring that you have the right level of protection for your vehicle and your circumstances.

- Enhanced Vehicle Protection: By opting for full coverage, you can take advantage of additional features like rental car reimbursement and gap insurance, which can provide even greater protection for your vehicle.

However, it's essential to consider the potential trade-offs and costs associated with full coverage. While full coverage offers extensive protection, it typically comes with higher premiums compared to basic liability coverage. As a result, it's crucial to weigh the benefits against the costs and assess whether full coverage aligns with your budget and insurance needs.

Factors Influencing Full Coverage Premiums

The cost of full coverage car insurance can vary significantly based on several factors. These factors include:

- Vehicle Type and Value: The make, model, and value of your vehicle play a significant role in determining your insurance premiums. Higher-value vehicles often require more extensive coverage, leading to increased premiums.

- Driver's Profile: Your driving history, age, and credit score are key factors that insurance companies consider when calculating premiums. A clean driving record and good credit score can result in lower premiums.

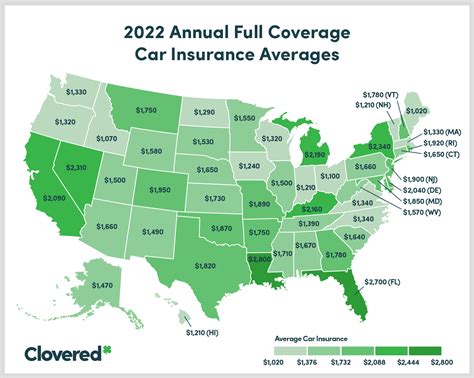

- Location and Usage: Where you live and how you use your vehicle can impact your premiums. Urban areas with higher accident rates and theft incidents may result in higher premiums.

- Coverage Limits and Deductibles: The coverage limits you choose and the deductibles you select can significantly affect your premium. Higher coverage limits and lower deductibles often lead to higher premiums.

- Discounts and Bundling: Many insurance companies offer discounts for various factors, such as safe driving records, loyalty, and bundling multiple insurance policies together. Taking advantage of these discounts can help reduce your premiums.

When shopping for full coverage car insurance, it's beneficial to obtain quotes from multiple providers. By comparing quotes, you can identify the best coverage options at the most competitive rates, ensuring you get the protection you need without overspending.

Real-World Examples and Case Studies

To illustrate the value of full coverage car insurance, let's explore some real-world scenarios and case studies:

Scenario 1: Collision with an Uninsured Driver

Imagine you're involved in an accident with a driver who lacks insurance coverage. Without full coverage, you would be responsible for paying for the repairs to your vehicle and any medical expenses for yourself and your passengers. However, with full coverage, your insurance provider would cover these costs, providing you with the financial support needed to recover from the accident.

Scenario 2: Natural Disaster Damage

In regions prone to natural disasters like hurricanes or floods, full coverage car insurance can be a lifesaver. If your vehicle is damaged by a storm or flood, comprehensive coverage under your full coverage policy would provide the necessary funds to repair or replace your vehicle, ensuring you're not left with a total loss.

Scenario 3: Theft and Vandalism

Unfortunately, vehicle theft and vandalism are common issues. With full coverage, you're protected against these risks. If your vehicle is stolen or vandalized, comprehensive coverage will help cover the cost of repairs or even provide a replacement vehicle, minimizing the financial impact of such incidents.

| Scenario | Coverage Type | Benefits |

|---|---|---|

| Collision with Uninsured Driver | Uninsured Motorist Coverage | Financial protection and peace of mind |

| Natural Disaster Damage | Comprehensive Coverage | Repairs or replacement of vehicle |

| Theft and Vandalism | Comprehensive Coverage | Repairs or replacement, minimizing financial loss |

These real-world examples highlight the importance of full coverage car insurance and its ability to provide financial protection and peace of mind in various situations.

Frequently Asked Questions

How much does full coverage car insurance typically cost?

+The cost of full coverage car insurance can vary widely based on factors like your vehicle, driving record, location, and coverage limits. On average, full coverage premiums can range from $100 to $250 per month, but it's essential to obtain quotes tailored to your specific circumstances.

Is full coverage car insurance mandatory in all states?

+No, full coverage car insurance is not mandatory in all states. However, it's important to note that while basic liability insurance is typically required, full coverage provides additional protection and is highly recommended to ensure comprehensive protection for your vehicle.

Can I customize my full coverage car insurance policy?

+Absolutely! Full coverage car insurance policies can be customized to meet your specific needs and budget. You can choose coverage limits, deductibles, and optional add-ons like rental car reimbursement or gap insurance to create a policy that suits your requirements.

What are some common exclusions in full coverage car insurance policies?

+Common exclusions in full coverage policies may include wear and tear, mechanical breakdowns, intentional damage, and certain types of damage caused by natural disasters. It's crucial to review your policy's exclusions to understand what is and isn't covered.

How can I save money on full coverage car insurance premiums?

+There are several strategies to save on full coverage premiums. These include maintaining a clean driving record, bundling multiple insurance policies, increasing your deductibles, taking advantage of discounts for safe driving or loyalty, and comparing quotes from multiple providers to find the best rates.

Full coverage car insurance is a valuable investment for vehicle owners, offering a comprehensive safety net against a wide range of risks. By understanding the components, benefits, and considerations of full coverage, you can make informed decisions to protect your vehicle and ensure financial security on the road.