Insurance Companies Home And Auto

The insurance industry plays a vital role in safeguarding individuals and their assets, with home and auto insurance being two of the most essential forms of coverage. These policies provide financial protection and peace of mind to millions of homeowners and vehicle owners worldwide. In this comprehensive guide, we will delve into the world of insurance companies specializing in home and auto policies, exploring their significance, key considerations, and the factors that influence policy decisions.

Understanding the Role of Insurance Companies

Insurance companies serve as financial intermediaries, offering protection against various risks and uncertainties. They assess potential risks, calculate premiums, and provide coverage for specific perils outlined in insurance policies. The home and auto insurance sectors are among the most prominent, offering tailored protection for two of life’s most significant investments.

The Importance of Home Insurance

Home insurance is a crucial safeguard for homeowners, providing financial security against unforeseen events such as natural disasters, theft, or accidents. It covers the structure of the home and often includes personal belongings and liability protection. With the rising costs of home construction and repairs, home insurance has become an essential tool to protect homeowners from devastating financial losses.

Key Components of Home Insurance Policies

- Dwelling Coverage: This covers the physical structure of the home, including walls, roofs, and foundations.

- Personal Property: Protection for belongings inside the home, such as furniture, electronics, and clothing.

- Liability Coverage: Safeguards homeowners against legal claims and medical expenses for injuries that occur on their property.

- Additional Living Expenses: Provides coverage for temporary living arrangements if the home becomes uninhabitable due to a covered event.

Home insurance policies vary depending on the insurer and the specific needs of the homeowner. Some policies offer comprehensive coverage, while others may be more tailored to specific risks, such as flood or earthquake insurance.

Auto Insurance: Protecting Your Vehicle and Beyond

Auto insurance is another critical aspect of financial protection. It provides coverage for vehicle owners against various risks, including accidents, theft, and liability claims. With the increasing cost of vehicle repairs and medical expenses, auto insurance plays a vital role in ensuring financial stability.

Key Considerations in Auto Insurance

- Liability Coverage: This covers bodily injury and property damage caused by the policyholder to others in an accident.

- Collision Coverage: Pays for repairs or replacement of the insured vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: Protects against non-collision incidents, such as theft, vandalism, or natural disasters.

- Medical Payments: Covers medical expenses for the policyholder and their passengers after an accident, regardless of fault.

Additionally, auto insurance policies may include optional add-ons, such as roadside assistance, rental car coverage, or gap insurance, which covers the difference between the vehicle's value and the amount owed on a lease or loan.

Factors Influencing Home and Auto Insurance Policies

Several factors influence the cost and coverage of home and auto insurance policies. Insurance companies assess these factors to determine the level of risk associated with each policyholder.

Risk Assessment in Home Insurance

- Location: The geographical location of a home plays a significant role in determining risk. Areas prone to natural disasters, such as hurricanes or earthquakes, often have higher insurance premiums.

- Home Value: The higher the value of the home, the more insurance it typically requires. This is especially true for high-value properties or those with expensive finishes and fixtures.

- Previous Claims: A history of insurance claims can impact future premiums. Frequent or costly claims may lead to higher rates or even policy cancellation.

Risk Assessment in Auto Insurance

- Vehicle Type: The make, model, and age of the vehicle influence the cost of insurance. Luxury vehicles or those with high repair costs may have higher premiums.

- Driving Record: A clean driving record with no accidents or violations is often rewarded with lower insurance rates. Conversely, a history of accidents or traffic violations can significantly increase premiums.

- Age and Gender: Statistical data suggests that younger drivers and males tend to have higher accident rates, leading to higher insurance premiums for these demographics.

The Benefits of Choosing Specialized Insurance Companies

While many insurance providers offer a wide range of policies, including home and auto insurance, there are advantages to choosing specialized insurance companies that focus specifically on these areas.

Expertise and Tailored Solutions

Specialized insurance companies have deep expertise in the home and auto insurance sectors. They understand the unique risks and challenges associated with these policies and can offer tailored solutions to meet the specific needs of their clients. This expertise often translates into more comprehensive coverage and better risk assessment.

Personalized Service and Support

Specialized insurance companies often provide a higher level of personalized service and support. They have dedicated teams of experts who can assist policyholders with claims, provide advice on coverage options, and offer guidance on risk mitigation strategies. This level of personalized attention can be invaluable when navigating complex insurance processes.

Innovative Products and Services

Specialized insurance companies are often at the forefront of innovation, developing new products and services to meet the evolving needs of their clients. This may include digital tools for policy management, mobile apps for filing claims, or innovative coverage options that address emerging risks, such as cyber threats or environmental concerns.

Navigating the Insurance Landscape

When it comes to choosing the right insurance company for your home and auto needs, there are several key considerations to keep in mind.

Reputation and Financial Stability

Research the insurance company’s reputation and financial stability. Look for companies with a strong track record of paying claims promptly and fairly. Check customer reviews and ratings to gauge their level of satisfaction and trust.

Coverage Options and Customization

Evaluate the range of coverage options offered by different insurance companies. Look for policies that provide comprehensive protection for your specific needs, whether it’s a high-value home, classic car, or unique circumstances. Ensure that the policy allows for customization to address any specific concerns you may have.

Claims Process and Customer Service

Understand the claims process and customer service offerings of each insurance company. Look for companies with a streamlined and efficient claims process, including 24⁄7 support and easy-to-use digital tools for filing claims. Positive customer service experiences can make a significant difference during times of need.

The Future of Home and Auto Insurance

The insurance industry is constantly evolving, and home and auto insurance are no exception. As technology advances and consumer expectations change, insurance companies are adapting to meet these new demands.

Technological Innovations

Insurance companies are leveraging technology to enhance the customer experience and improve risk assessment. This includes the use of telematics in auto insurance, where policyholders can voluntarily share their driving data to potentially lower premiums. Additionally, digital tools for policy management and claims filing are becoming more sophisticated and user-friendly.

Data-Driven Risk Assessment

Advanced analytics and machine learning are being utilized to assess risk more accurately. Insurance companies are analyzing vast amounts of data to identify patterns and predict potential risks, allowing for more precise pricing and coverage options. This data-driven approach benefits both policyholders and insurers by offering more tailored and efficient insurance solutions.

Environmental and Social Considerations

With growing concerns about climate change and environmental sustainability, insurance companies are exploring ways to address these issues. This includes developing coverage options for emerging risks, such as flood or wildfire, and encouraging policyholders to adopt sustainable practices through incentives and discounts.

Conclusion

Home and auto insurance are essential components of financial planning, providing protection and peace of mind for homeowners and vehicle owners. By understanding the key considerations and factors that influence these policies, individuals can make informed decisions when choosing insurance companies. Specialized insurance companies offer unique advantages, including expertise, personalized service, and innovative solutions, making them a compelling choice for those seeking comprehensive coverage.

What is the average cost of home insurance?

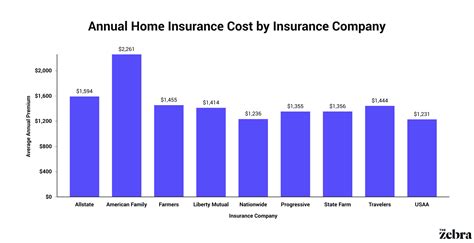

+The average cost of home insurance can vary significantly depending on factors such as location, home value, and coverage limits. According to industry data, the national average for home insurance premiums in the United States is approximately $1,300 per year. However, it’s important to note that rates can differ widely based on individual circumstances.

How can I lower my auto insurance premiums?

+There are several strategies to reduce auto insurance premiums. These include maintaining a clean driving record, shopping around for quotes from multiple insurers, increasing your deductible, and considering discounts for safe driving or bundling policies. Additionally, some insurers offer telematics programs that can reward safe driving habits with lower rates.

What should I do if my home is damaged in a natural disaster?

+If your home is damaged in a natural disaster, the first step is to ensure your safety and the safety of your loved ones. Contact your insurance company as soon as possible to report the claim. They will guide you through the claims process, which typically involves documenting the damage, providing proof of ownership, and working with adjusters to assess the extent of the loss. It’s crucial to take photos and videos of the damage for your records.