Apartment Insurance Rates

When it comes to apartment living, having adequate insurance coverage is essential to protect your belongings and yourself from unexpected events. The cost of apartment insurance, often referred to as renters insurance, can vary significantly based on numerous factors. Understanding these variables can help you navigate the insurance landscape and find the best coverage for your needs at a competitive rate.

Factors Influencing Apartment Insurance Rates

The price of apartment insurance is influenced by a multitude of factors, each playing a crucial role in determining the final premium. These factors include the specific location of your apartment, the level of coverage you require, and any additional options or riders you choose to add to your policy.

Location, Location, Location

One of the most significant determinants of apartment insurance rates is the geographical location of your residence. Insurance providers assess the risk associated with various areas, taking into account factors like crime rates, weather patterns, and the proximity to potential hazards. For instance, apartments located in regions prone to natural disasters like hurricanes or earthquakes will typically attract higher insurance premiums due to the increased likelihood of claims.

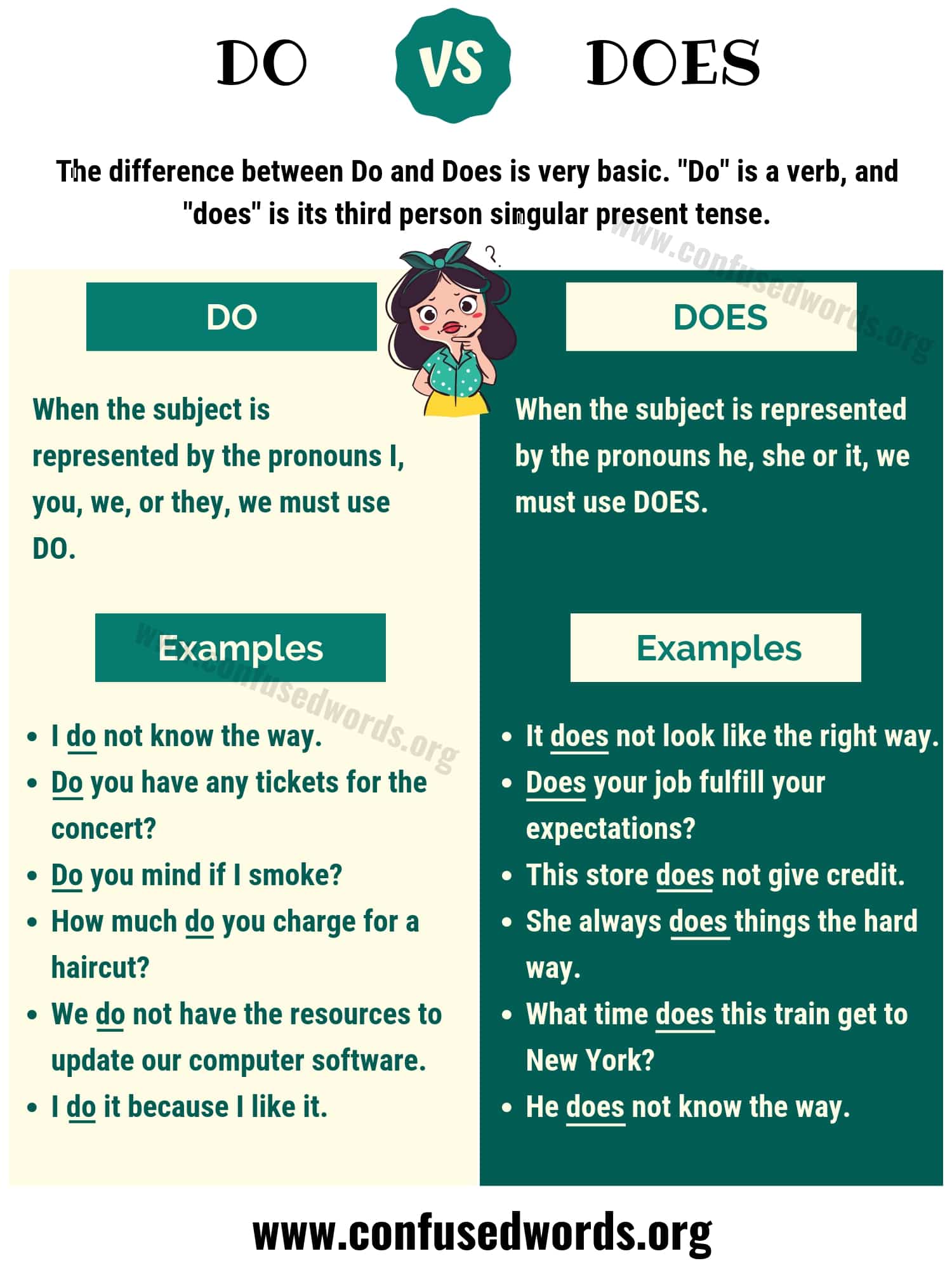

Consider the following table showcasing the average apartment insurance rates in different regions of the United States:

| Region | Average Annual Premium |

|---|---|

| Northeast | $350 |

| Southeast | $280 |

| Midwest | $220 |

| West | $320 |

Coverage Amounts and Limits

The level of coverage you choose for your apartment and personal belongings is another critical factor in determining insurance rates. Insurance providers offer a range of coverage limits, allowing you to select the amount that best suits your needs and the value of your possessions.

Consider the following scenario: you own a state-of-the-art home theater system worth $10,000. If you were to experience a covered loss, such as a fire or burglary, you would want sufficient coverage to replace this system. Therefore, your insurance policy should include a coverage limit that adequately covers the cost of your home theater system and other valuable items.

Optional Coverages and Riders

Apartment insurance policies often come with a range of optional coverages and riders that can be added to your policy for an additional premium. These options allow you to customize your coverage to meet your specific needs and provide protection for unique situations.

- Personal Liability Coverage: This coverage protects you if someone is injured in your apartment or if your actions cause property damage to others. It can help cover legal fees and any compensation you may be required to pay.

- Personal Property Replacement Cost: While standard apartment insurance policies often provide actual cash value coverage for your belongings, opting for replacement cost coverage ensures you receive the full cost to replace your items, even if they're no longer brand new.

- Identity Theft Coverage: In today's digital age, identity theft is a growing concern. This rider can provide additional coverage to help you recover and manage the financial and legal consequences of identity theft.

Tips for Finding Affordable Apartment Insurance

Navigating the apartment insurance market can be daunting, but with the right approach and a bit of research, you can find coverage that meets your needs without breaking the bank. Here are some strategies to consider when shopping for apartment insurance rates:

Compare Multiple Quotes

Obtaining quotes from multiple insurance providers is essential to ensure you’re getting the best rate for your specific circumstances. Online comparison tools can be a great starting point, allowing you to quickly and easily gather quotes from various insurers. However, it’s important to remember that these tools provide estimates, and you should always follow up with individual providers to verify the accuracy of the quotes and ensure you understand all the policy details.

Bundle Your Policies

If you already have other insurance policies, such as auto insurance or homeowner’s insurance, consider bundling your apartment insurance with the same provider. Many insurance companies offer discounts when you combine multiple policies, which can lead to significant savings on your overall insurance premiums.

Increase Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you can typically reduce your monthly insurance premiums. However, it’s important to choose a deductible amount that you’re comfortable paying in the event of a claim. Remember, a higher deductible means you’ll be responsible for a larger portion of the costs if you need to file a claim.

Take Advantage of Discounts

Insurance providers often offer various discounts to attract and retain customers. Some common discounts include:

- Multi-Policy Discounts: As mentioned earlier, bundling your insurance policies can lead to substantial savings.

- Safety Discounts: If your apartment has certain safety features like smoke detectors, fire sprinklers, or a monitored security system, you may be eligible for a discount on your insurance premium.

- Loyalty Discounts: Many insurance companies reward long-term customers with loyalty discounts, so it's worth checking if your provider offers such incentives.

- Student and Senior Discounts: Some insurers offer discounted rates for students or seniors, so be sure to inquire about any age-related discounts you may qualify for.

Consider Alternative Options

Apartment insurance isn’t a one-size-fits-all solution. Depending on your circumstances and preferences, you may want to explore alternative options. For example, if you’re a student living in a college-owned apartment, your university may offer group insurance policies at a discounted rate. Similarly, if you’re a member of certain organizations or associations, you might be eligible for group insurance discounts through your affiliation.

The Importance of Adequate Coverage

While finding affordable apartment insurance is essential, it’s equally crucial to ensure you have adequate coverage. Insufficient coverage can leave you vulnerable to financial losses in the event of a covered claim. Here are some key considerations when assessing your coverage needs:

Personal Property Valuation

Take the time to inventory your personal belongings and estimate their value. This step is crucial in determining the appropriate coverage limit for your apartment insurance policy. Consider the cost of replacing items like furniture, electronics, clothing, and other valuable possessions.

Liability Coverage

Apartment living often comes with unique liability risks. For instance, if a guest is injured in your apartment or if your actions cause damage to your landlord’s property, you could be held liable. Adequate liability coverage can protect you from these potential financial burdens.

Renters’ Loss of Use Coverage

In the event of a covered loss that renders your apartment uninhabitable, renters’ loss of use coverage can provide temporary living expenses while you find alternative accommodations. This coverage can help cover costs like hotel stays or temporary rental fees until your apartment is repaired or you find a new place to live.

Understanding Your Policy

Once you’ve secured an apartment insurance policy, it’s important to thoroughly understand the terms and conditions. Take the time to review your policy documents and familiarize yourself with the coverage limits, deductibles, and any exclusions or limitations. This knowledge will empower you to make informed decisions and ensure you’re adequately protected.

Common Policy Exclusions

While apartment insurance policies provide comprehensive coverage, there are typically certain exclusions. Common exclusions may include:

- Earthquakes and Floods: Standard apartment insurance policies often exclude coverage for damages caused by earthquakes and floods. If you live in an area prone to these natural disasters, you may need to purchase separate insurance policies to cover these risks.

- High-Value Items: Some personal belongings, such as jewelry, artwork, or collectibles, may have coverage limits or require additional riders to be fully protected. It's important to review your policy to understand the coverage for these high-value items.

- Negligence and Intentional Acts: Apartment insurance policies generally do not cover damages resulting from negligence or intentional acts. This means that if you intentionally damage your apartment or the belongings of others, your insurance policy likely won't provide coverage.

Future Outlook and Considerations

The landscape of apartment insurance is continually evolving, influenced by factors such as changing risk profiles, technological advancements, and shifts in consumer behavior. As we look to the future, several trends and considerations are worth noting:

Technological Innovations

The insurance industry is increasingly leveraging technology to enhance the customer experience and improve risk assessment. This includes the use of smart home devices and sensors to monitor and mitigate risks, as well as the adoption of artificial intelligence and machine learning to analyze data and identify patterns that can inform insurance rates and coverage.

Changing Risk Profiles

The risks associated with apartment living are not static. Factors such as climate change, increasing urban populations, and evolving security threats can all impact insurance rates. For example, as extreme weather events become more frequent, insurers may adjust rates to account for the heightened risk of claims related to natural disasters.

Consumer Behavior and Preferences

The preferences and expectations of apartment dwellers are also evolving. As consumers become more digitally savvy and environmentally conscious, insurance providers may need to adapt their offerings to meet these changing demands. This could include the development of more sustainable insurance products or the integration of digital tools and resources to enhance the customer experience.

Regulatory Changes

The insurance industry is subject to various regulations and oversight, and changes in regulatory frameworks can impact apartment insurance rates. For instance, if new regulations are introduced to address emerging risks or promote consumer protection, insurance providers may need to adjust their policies and pricing structures accordingly.

Conclusion

Apartment insurance is an essential component of financial protection for apartment dwellers. By understanding the factors that influence insurance rates and adopting a strategic approach to shopping for coverage, you can find an affordable policy that meets your unique needs. Remember to regularly review and update your insurance coverage to ensure it remains aligned with your changing circumstances and the evolving landscape of apartment living.

What is the average cost of apartment insurance in the United States?

+The average cost of apartment insurance in the US is approximately $180 per year, according to data from the Insurance Information Institute. However, rates can vary significantly based on factors such as location, coverage limits, and any additional options or riders.

Are there any ways to reduce my apartment insurance premium?

+Yes, there are several strategies you can employ to reduce your apartment insurance premium. These include comparing quotes from multiple providers, bundling your policies, increasing your deductible, taking advantage of available discounts, and exploring alternative insurance options.

What factors influence the cost of apartment insurance?

+The cost of apartment insurance is influenced by various factors, including your location, the coverage limits you choose, and any additional options or riders you add to your policy. Other factors, such as your credit score and claim history, may also impact your premium.

How often should I review my apartment insurance policy?

+It’s a good practice to review your apartment insurance policy annually or whenever your circumstances change significantly. This ensures that your coverage remains adequate and aligned with your needs, and it provides an opportunity to assess whether you’re getting the best rate.