How To Check If I Have Health Insurance

Understanding your health insurance coverage is an essential step towards ensuring you receive the necessary medical care and avoid unexpected financial burdens. This comprehensive guide will walk you through the process of verifying your health insurance status, explaining the various types of insurance, and providing practical steps to confirm your coverage.

Understanding Health Insurance

Health insurance is a vital financial tool that helps individuals manage the costs of medical care. It is a contractual agreement between an insurer and an individual, wherein the insurer agrees to cover a portion or all of the costs associated with various medical services and treatments in exchange for regular premium payments. This coverage can include a wide range of services, from routine check-ups and preventative care to more complex procedures and emergency treatments.

There are several types of health insurance plans available, each with its own set of benefits and coverage limits. The most common types include:

- Private Health Insurance: This type of insurance is typically offered through employers or purchased directly by individuals. It often provides a wide range of coverage options and may include additional benefits like dental and vision care.

- Government-Sponsored Insurance: Many countries offer government-funded or subsidized health insurance programs. Examples include Medicare in the United States, which provides coverage for individuals over 65 or with certain disabilities, and Medicaid, which assists low-income individuals and families.

- Group Insurance Plans: These plans are often offered through membership organizations, unions, or professional associations. They provide coverage to a specific group of people and can offer more affordable rates due to the larger pool of participants.

- Individual Insurance Policies: These are plans purchased directly by an individual from an insurance company. They can be tailored to an individual's specific needs and often provide a comprehensive range of coverage options.

Checking Your Health Insurance Coverage

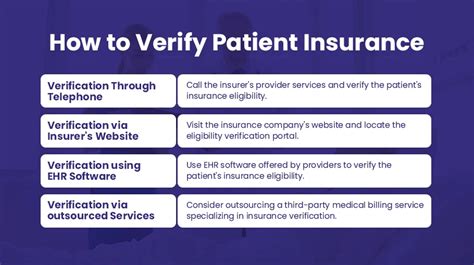

Verifying your health insurance coverage is a straightforward process that involves a few simple steps. Here’s a step-by-step guide to help you confirm your insurance status:

Step 1: Gather Your Insurance Documents

Start by collecting all relevant insurance documents. These may include your insurance card, policy documents, and any correspondence from your insurance provider. These documents will contain essential information such as your policy number, effective dates, and a summary of your coverage benefits.

Step 2: Contact Your Insurance Provider

If you’re unsure about your coverage or have specific questions, contacting your insurance provider is a great first step. They can provide detailed information about your policy, including what’s covered, any deductibles or copayments you may need to pay, and any exclusions or limitations.

Most insurance companies offer customer support via phone, email, or live chat. You can also often find answers to common questions on their website, in the form of frequently asked questions (FAQs) or detailed explanations of coverage.

Step 3: Review Your Policy Documents

Take the time to thoroughly read through your policy documents. These documents will outline the specifics of your coverage, including what types of medical services are covered, any pre-authorization requirements, and any limitations or exclusions. Understanding these details is crucial to ensuring you receive the full benefits of your insurance plan.

Step 4: Check with Your Healthcare Provider

Another way to confirm your insurance coverage is to contact your healthcare provider, such as your primary care physician or specialist. They often have access to insurance databases and can quickly verify your coverage and benefits. They can also guide you on any specific requirements or procedures related to your insurance plan.

Step 5: Use Online Tools and Resources

Many insurance providers now offer online tools and resources to help policyholders manage their coverage. These tools can provide real-time updates on your policy, including any changes to benefits or deductibles, and may even allow you to view and download your insurance card.

Additionally, there are third-party websites and applications that can help you compare and understand your insurance coverage. These resources often provide detailed explanations of different insurance plans and can assist you in making informed decisions about your healthcare.

Step 6: Regularly Review and Update Your Coverage

Health insurance plans can change over time, with updates to benefits, premiums, or coverage limits. It’s important to regularly review your policy and stay informed about any changes. This ensures you’re always aware of your coverage and can make any necessary adjustments to your healthcare decisions.

Additionally, life events such as getting married, having children, or changing jobs can impact your insurance needs. It's essential to review your coverage whenever these significant life changes occur to ensure you have the appropriate level of protection.

Conclusion

Verifying your health insurance coverage is a crucial step towards ensuring you receive the medical care you need without unexpected financial surprises. By following the steps outlined above, you can confidently understand your insurance status and make informed decisions about your healthcare.

Remember, health insurance is a complex topic, and it's always a good idea to seek advice from professionals or resources tailored to your specific needs and circumstances. With the right knowledge and tools, you can navigate the world of health insurance with ease and confidence.

What should I do if I find an error in my insurance coverage?

+

If you discover an error in your insurance coverage, it’s important to take immediate action. Contact your insurance provider and provide them with detailed information about the discrepancy. They will investigate the issue and work with you to resolve it. It’s also advisable to keep records of all communications and documentation related to the error.

Can I change my health insurance plan if I’m not satisfied with my current coverage?

+

Yes, you have the option to change your health insurance plan if you find that your current coverage doesn’t meet your needs. However, the availability of alternative plans and the timing of your enrollment may depend on your country’s insurance regulations and the type of plan you currently have. It’s advisable to research and compare different plans to find the one that best suits your healthcare requirements.

How often should I review my health insurance coverage?

+

It’s recommended to review your health insurance coverage at least once a year, or whenever there are significant changes in your life or healthcare needs. This ensures that your coverage remains up-to-date and aligned with your current requirements. Regular reviews also help you stay informed about any changes to your plan’s benefits, premiums, or coverage limits.