Life Insurance Policies For Over 60

As we navigate the journey of life, one crucial aspect often overlooked is the importance of financial protection, especially as we age. For individuals over the age of 60, securing a life insurance policy can be a wise decision, offering peace of mind and a safety net for loved ones. In this comprehensive guide, we will delve into the world of life insurance policies tailored for the over-60s, exploring the benefits, considerations, and steps to finding the right coverage.

The Significance of Life Insurance for Older Adults

Life insurance serves as a financial safety net, ensuring that your loved ones are provided for even in your absence. For older adults, the need for this protection may arise from various life events and responsibilities. Whether it’s covering funeral expenses, ensuring financial stability for dependents, or leaving a legacy for future generations, life insurance policies can be customized to meet these unique needs.

Moreover, life insurance can be a strategic tool for estate planning. It can help offset inheritance taxes, provide liquidity for beneficiaries, and even fund charitable donations. For individuals over 60, who may have accumulated assets and financial obligations, life insurance becomes an essential component of their overall financial strategy.

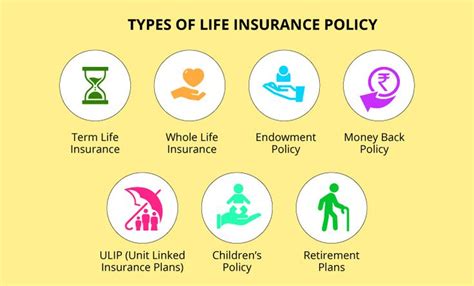

Understanding the Options: Types of Life Insurance Policies

The life insurance market offers a diverse range of policies, each designed to cater to specific needs and circumstances. For individuals over 60, the most common types of life insurance policies include:

Term Life Insurance

Term life insurance provides coverage for a set period, typically ranging from 10 to 30 years. It is an affordable option for those seeking temporary protection, such as covering mortgage payments or supporting dependents during their education. The policy pays out a lump sum to beneficiaries if the insured passes away during the term. However, it’s important to note that the premiums may increase as the policy renews, and coverage ends at the policy’s expiration.

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, offers coverage for the insured’s entire life. It provides a guaranteed death benefit, ensuring financial protection for beneficiaries regardless of when the insured passes away. Whole life insurance also accumulates cash value over time, which can be borrowed against or withdrawn if needed. This type of policy is ideal for individuals seeking long-term financial security and stability.

Universal Life Insurance

Universal life insurance is a flexible alternative to whole life insurance. It offers permanent coverage with the added benefit of adjustable premiums and death benefits. Policyholders can increase or decrease their premiums and coverage amounts to suit their changing financial circumstances. Universal life insurance also accumulates cash value, which can be used for various financial goals, such as retirement planning or emergency funds.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance is a specialized policy designed for individuals who may have pre-existing health conditions or difficulty obtaining traditional coverage. This type of policy does not require a medical exam and provides a death benefit to beneficiaries upon the insured’s passing. However, it typically has limited coverage amounts and higher premiums compared to standard life insurance policies.

Factors to Consider When Choosing a Policy

Selecting the right life insurance policy involves careful consideration of several factors. Here are some key aspects to keep in mind:

Coverage Amount

Determining the appropriate coverage amount is crucial. Consider your financial obligations, such as outstanding debts, mortgage payments, and dependent care costs. Ensure that the policy provides sufficient coverage to meet these needs and leaves a legacy for your loved ones.

Policy Term

The policy term should align with your financial goals and the period you anticipate needing coverage. For short-term needs, such as covering a mortgage, a term life insurance policy may suffice. However, if you seek lifelong protection, whole life or universal life insurance could be more suitable.

Premium Affordability

Life insurance premiums can vary significantly based on factors like age, health, and policy type. It’s essential to find a policy that fits within your budget while providing adequate coverage. Shopping around and comparing quotes from multiple insurers can help you find the most cost-effective option.

Cash Value Accumulation

For individuals over 60, the cash value accumulation feature of permanent life insurance policies can be advantageous. It provides a financial buffer and can be used for various purposes, such as retirement income, emergency funds, or even estate planning strategies.

Policy Flexibility

Consider the flexibility of the policy. Universal life insurance, for instance, offers adjustable premiums and coverage amounts, making it ideal for those with changing financial circumstances. Whole life insurance, while less flexible, provides a guaranteed death benefit and stable premiums.

The Application Process: Tips for a Smooth Experience

Applying for a life insurance policy as an older adult can be a straightforward process with the right guidance. Here are some tips to ensure a smooth application journey:

Choose a Reputable Insurer

Research and select a reputable insurance company with a solid financial standing and a history of fair claims processing. Check reviews and ratings to ensure you’re working with a trustworthy provider.

Be Honest and Transparent

Provide accurate and complete information during the application process. Misrepresenting your health or financial status can lead to policy cancellations or reduced benefits. Transparency is key to a successful application.

Understand the Medical Exam Process

Depending on the policy and your health status, you may be required to undergo a medical exam. Understand the process, prepare for it, and ensure you have all the necessary documents ready. Some insurers offer no-exam policies, which can be a convenient alternative.

Review and Compare Quotes

Obtain multiple quotes from different insurers to compare coverage, premiums, and policy terms. This step ensures you find the best value and the policy that aligns with your specific needs.

Seek Professional Advice

Consider consulting a financial advisor or insurance broker who specializes in life insurance. They can provide expert guidance, help you navigate the application process, and ensure you make an informed decision.

Maximizing the Benefits: Using Life Insurance Strategically

Life insurance policies for individuals over 60 can offer more than just financial protection. With the right strategy, these policies can become powerful tools for wealth accumulation and estate planning. Here’s how you can maximize the benefits:

Estate Planning

Life insurance can be a vital component of your estate plan. It can help fund inheritance taxes, provide liquidity for beneficiaries, and ensure the smooth transfer of assets. Work with an estate planning attorney to integrate your life insurance policy into your overall estate strategy.

Retirement Planning

The cash value accumulation feature of permanent life insurance policies can be a valuable retirement planning tool. You can borrow against or withdraw from the cash value to supplement your retirement income, providing financial flexibility during your golden years.

Charitable Giving

Life insurance policies can also be used to make charitable donations. By naming a charity as a beneficiary, you can leave a lasting legacy and support a cause close to your heart. This strategy can also provide tax benefits, enhancing the overall value of your donation.

Business Succession Planning

For business owners over 60, life insurance can be a critical component of business succession planning. It can provide funds to buy out a deceased owner’s share, ensuring business continuity and protecting the interests of remaining partners or shareholders.

Addressing Concerns: Common Questions and Misconceptions

When considering life insurance policies for individuals over 60, several common concerns and misconceptions arise. Let’s address some of these questions to provide clarity:

Is it too late to get life insurance at age 60?

+Absolutely not! While it's true that life insurance premiums may increase with age, many insurers offer specialized policies for older adults. The benefits of having life insurance, such as financial protection and estate planning, become even more crucial as you age.

How much does life insurance cost for someone over 60?

+The cost of life insurance for individuals over 60 can vary widely depending on factors like health, lifestyle, and the type of policy chosen. Term life insurance tends to be more affordable, while permanent life insurance policies may have higher premiums but offer long-term benefits. It's best to obtain multiple quotes to find the most suitable and cost-effective option.

Can I get life insurance with pre-existing health conditions?

+Yes, it is possible to obtain life insurance with pre-existing health conditions. While traditional life insurance policies may require a medical exam and consider your health history, there are specialized policies, such as guaranteed issue life insurance, that do not require a medical exam and provide coverage regardless of health status. However, these policies may have limited coverage amounts and higher premiums.

How long does the application process take for life insurance over 60?

+The application process for life insurance can vary depending on the insurer and the complexity of your application. In general, it can take several weeks to a few months. The time frame may be influenced by factors such as the need for a medical exam, the processing of your application, and the insurer's review process. It's essential to start the process early to ensure timely coverage.

Can I change my life insurance policy after it's been issued?

+Yes, it is possible to make changes to your life insurance policy after it has been issued. Depending on the type of policy and your insurer's terms, you may be able to adjust the coverage amount, add or remove beneficiaries, or even switch policy types. It's important to review your policy regularly and make any necessary updates to ensure it continues to meet your needs.

As individuals over the age of 60, having a life insurance policy can provide a sense of security and peace of mind. It ensures that your loved ones are financially protected and allows you to leave a lasting legacy. By understanding the options, considering your unique circumstances, and seeking professional guidance, you can find the right life insurance policy to meet your needs.

Remember, life insurance is not just about financial protection; it’s about caring for your family and loved ones even in your absence. With the right strategy and planning, you can make the most of your life insurance policy and ensure a brighter future for those you hold dear.