Insurance Hmo

The world of health insurance is vast and complex, with numerous options available to individuals and families seeking comprehensive healthcare coverage. Among the various plans, the Health Maintenance Organization (HMO) stands out as a popular choice, offering a unique approach to healthcare management. This article delves into the intricacies of Insurance HMOs, exploring their definition, benefits, coverage details, and real-world implications, providing an in-depth understanding of this vital healthcare option.

Understanding Insurance HMOs: An Overview

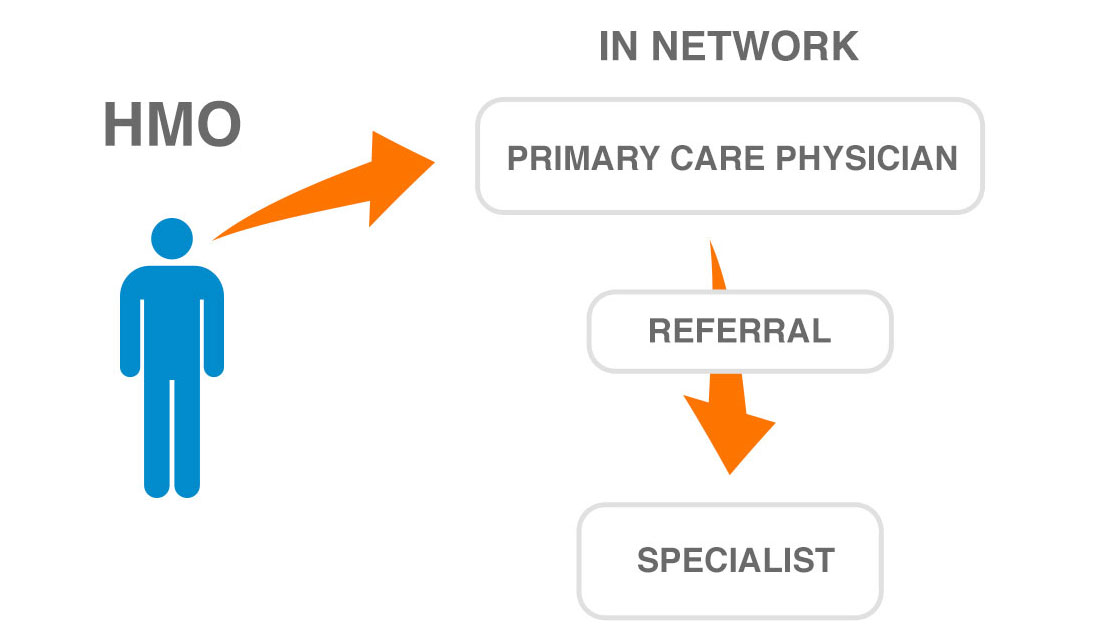

An Insurance HMO, or Health Maintenance Organization, is a type of managed healthcare plan that emphasizes preventative care and cost-effectiveness. Unlike traditional fee-for-service insurance plans, HMOs aim to provide comprehensive healthcare services by coordinating care through a network of primary care physicians (PCPs) and contracted healthcare providers.

At the core of the HMO model is the concept of a primary care physician. This physician acts as the central point of contact for all healthcare needs, coordinating and overseeing an individual's care. This integrated approach ensures that patients receive efficient and coordinated medical attention, reducing the risk of unnecessary treatments or duplication of services.

Insurance HMOs typically require members to select a primary care physician from within the HMO's network. This PCP becomes the patient's primary point of contact for all non-emergency healthcare needs. They are responsible for managing the patient's healthcare, including referring them to specialists within the HMO network when necessary. This gatekeeping role helps control costs and ensures that members receive appropriate and necessary care.

One of the key advantages of HMOs is their focus on preventative care. By encouraging regular check-ups, screenings, and immunizations, HMOs aim to identify and address health issues early on, potentially preventing more serious and costly health problems in the future. This proactive approach to healthcare not only benefits individual health but also contributes to a more sustainable and cost-effective healthcare system.

Benefits of Insurance HMOs

Insurance HMOs offer a range of benefits that make them an attractive choice for many individuals and families. Firstly, the cost-effectiveness of HMOs is a significant advantage. By coordinating care through a network of providers, HMOs can negotiate lower rates for healthcare services, resulting in reduced out-of-pocket expenses for members. This is particularly beneficial for those with chronic conditions or those who require regular medical attention.

Additionally, the integrated nature of HMOs ensures that members receive a seamless healthcare experience. With a designated PCP overseeing their care, members can expect efficient coordination of their healthcare needs. This coordination extends beyond primary care, as the PCP can facilitate referrals to specialists and other healthcare professionals within the HMO network, ensuring a smooth transition between different levels of care.

Another advantage of Insurance HMOs is their emphasis on preventative care. By promoting regular check-ups and screenings, HMOs help members stay on top of their health and catch potential issues early on. This proactive approach can lead to better health outcomes and potentially reduce the need for more extensive and costly treatments in the future.

Coverage and Services

Insurance HMOs provide a comprehensive range of healthcare services, covering a wide spectrum of medical needs. Routine check-ups and preventive care are typically included in the coverage, with members encouraged to schedule regular appointments with their PCP. These check-ups play a crucial role in maintaining overall health and detecting any potential health issues at an early stage.

In addition to preventive care, Insurance HMOs cover a variety of medical services, including specialist consultations, laboratory tests, imaging services, and prescription medications. Members can access these services through the HMO's network of contracted providers, ensuring that they receive quality care at agreed-upon rates. This network includes a diverse range of healthcare professionals, from family physicians and pediatricians to specialists in various fields, ensuring that members have access to the expertise they need.

For individuals with chronic conditions, Insurance HMOs often provide specialized programs and resources to help manage these conditions effectively. These programs may include educational resources, support groups, and tailored treatment plans designed to improve health outcomes and quality of life. By offering comprehensive support for chronic conditions, Insurance HMOs demonstrate their commitment to long-term health management.

| Service Category | Coverage Details |

|---|---|

| Preventive Care | Regular check-ups, screenings, and immunizations are typically covered, with an emphasis on early detection and health maintenance. |

| Specialist Consultations | Members can access a network of specialists for specific health concerns, with referrals managed by their PCP. |

| Laboratory and Imaging Services | Essential diagnostic tests and imaging procedures are covered, ensuring timely and accurate diagnoses. |

| Prescription Medications | Insurance HMOs often provide coverage for a wide range of prescription medications, with some plans offering mail-order options for added convenience. |

| Chronic Condition Management | Specialized programs and resources are available to support individuals with chronic illnesses, promoting better health outcomes. |

Choosing the Right Insurance HMO

When selecting an Insurance HMO, it’s crucial to consider various factors to ensure the plan aligns with your healthcare needs and preferences. Start by evaluating the HMO’s network of providers, ensuring that your preferred healthcare professionals are included. Consider the location and accessibility of these providers, as well as their reputation and expertise in your specific health concerns.

Next, review the HMO's coverage details, including the range of services offered and any potential limitations or exclusions. Pay close attention to the plan's benefits, such as prescription drug coverage, mental health services, and chronic condition management programs. These benefits can significantly impact your overall healthcare experience and long-term health management.

It's also essential to understand the cost structure of the Insurance HMO. This includes evaluating the monthly premiums, copayments, and deductibles. Consider your healthcare needs and budget to determine whether the plan's cost structure is affordable and aligns with your financial situation. Additionally, review any out-of-pocket maximums to understand the potential financial exposure in case of significant medical events.

Furthermore, explore the HMO's network of hospitals and facilities. Ensure that the hospitals you prefer or those conveniently located near you are included in the network. This is particularly important in case of emergencies or if you require specialized care that may not be available through your primary care physician.

Lastly, don't underestimate the value of personal recommendations and online reviews. Seek insights from friends, family, or colleagues who have experience with the Insurance HMO you're considering. Their firsthand experiences can provide valuable perspectives on the plan's performance, customer service, and overall satisfaction.

Real-World Examples: Insurance HMO Success Stories

Insurance HMOs have proven their effectiveness in various real-world scenarios, demonstrating their ability to provide quality healthcare while managing costs. For instance, consider the case of Mr. Johnson, a 55-year-old with a history of heart disease. By enrolling in an Insurance HMO, he gained access to a dedicated PCP who coordinated his care, ensuring regular check-ups and prompt referrals to specialists when needed. This proactive approach helped manage his condition effectively, reducing the risk of complications and unnecessary hospitalizations.

In another example, Mrs. Smith, a 35-year-old mother of two, found that her Insurance HMO offered a comprehensive approach to family healthcare. With a single plan, she was able to manage her own healthcare needs, including regular gynecological check-ups, as well as the healthcare of her young children. The HMO's network of pediatricians and family physicians provided convenient access to quality care, ensuring that her family's health was always a top priority.

These success stories highlight the benefits of Insurance HMOs, demonstrating how they can effectively coordinate care, manage chronic conditions, and provide a seamless healthcare experience. By combining cost-effectiveness with comprehensive coverage, Insurance HMOs offer a compelling solution for individuals and families seeking quality healthcare.

Future Implications and Innovations

As the healthcare landscape continues to evolve, Insurance HMOs are also adapting and innovating to meet the changing needs of their members. One notable trend is the increasing focus on digital health technologies. Insurance HMOs are leveraging telemedicine and digital platforms to enhance accessibility and convenience for their members. From virtual consultations to online patient portals, these technologies are revolutionizing the way healthcare services are delivered, making it easier for members to access care from the comfort of their homes.

Furthermore, Insurance HMOs are exploring innovative payment models to further enhance cost-effectiveness and improve patient outcomes. Value-based care models, for instance, are gaining traction, where providers are incentivized to deliver high-quality, cost-efficient care. This shift towards value-based care is not only beneficial for insurers but also for patients, as it encourages providers to prioritize preventive measures and coordinate care more effectively.

In addition, Insurance HMOs are recognizing the importance of addressing social determinants of health. By incorporating initiatives that address housing instability, food insecurity, and other social factors, HMOs are taking a holistic approach to healthcare. This comprehensive strategy not only improves overall health outcomes but also reduces healthcare disparities, creating a more equitable healthcare system.

Looking ahead, Insurance HMOs are expected to continue their journey of innovation, leveraging technology and adopting new care models to enhance patient experiences and improve health outcomes. With a focus on preventative care, cost-effectiveness, and member satisfaction, Insurance HMOs are poised to play a pivotal role in shaping the future of healthcare.

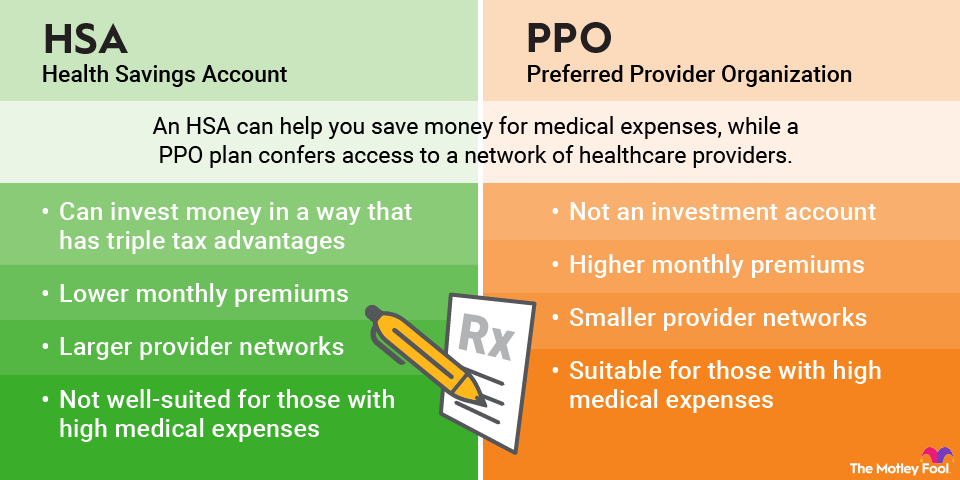

What is the difference between an HMO and a PPO insurance plan?

+An HMO and a PPO (Preferred Provider Organization) are two different types of managed healthcare plans. HMOs typically require members to select a primary care physician and coordinate their care through a network of providers, while PPOs offer more flexibility in choosing healthcare providers, both in and out of the network. PPOs often have higher premiums and copayments but provide more freedom in choosing healthcare professionals.

How do I choose the right Insurance HMO for my needs?

+When selecting an Insurance HMO, consider factors such as the network of providers, coverage details, cost structure, and personal recommendations. Evaluate your healthcare needs and preferences, ensuring that the HMO aligns with your requirements. It’s also beneficial to seek advice from healthcare professionals or financial advisors to make an informed decision.

Are there any disadvantages to enrolling in an Insurance HMO?

+While Insurance HMOs offer numerous benefits, there are some potential drawbacks. One consideration is the limited choice of providers, as members must typically choose from the HMO’s network. Additionally, HMOs may have stricter rules regarding referrals to specialists, and out-of-network care can be more costly. However, these disadvantages can be mitigated by carefully reviewing the plan’s details and ensuring it meets your specific healthcare needs.