Auto Insurance Companies In New Jersey

In the state of New Jersey, auto insurance is a crucial aspect of vehicle ownership, providing financial protection and peace of mind to drivers. With a diverse range of insurance companies operating in the region, understanding the landscape of auto insurance options is essential for residents to make informed choices about their coverage. This comprehensive guide delves into the world of auto insurance companies in New Jersey, exploring the key players, coverage options, and unique aspects of the market.

A Diverse Market: Exploring Auto Insurance Companies in New Jersey

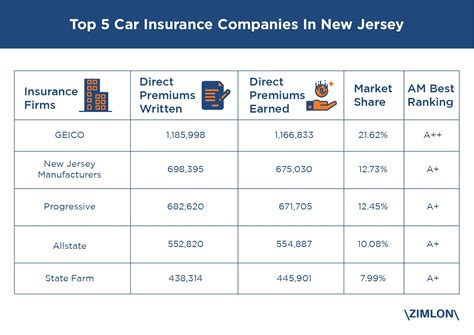

New Jersey boasts a vibrant and competitive auto insurance market, offering residents a wide array of choices when it comes to selecting an insurance provider. From national giants to local insurers, each company brings its own set of strengths, coverage options, and pricing strategies to the table. Let’s delve into some of the prominent auto insurance companies operating in the Garden State.

National Insurers: A Familiar Presence

Several well-known national insurance companies have a strong presence in New Jersey, offering their services to residents across the state. These companies, with their extensive resources and nationwide networks, often provide a comprehensive range of coverage options and additional services. Some of the notable national insurers operating in New Jersey include:

- State Farm: With a long-standing reputation for customer service, State Farm offers personalized auto insurance plans, emphasizing local agents who understand the unique needs of New Jersey drivers.

- GEICO: Known for their catchy advertising campaigns, GEICO provides competitive rates and a user-friendly online experience, making it a popular choice for many drivers seeking affordable coverage.

- Allstate: Allstate’s comprehensive range of insurance products and services, coupled with their “You’re In Good Hands” promise, has made them a trusted name in the industry, offering peace of mind to their customers.

These national insurers often leverage their scale to offer additional benefits, such as discounts for bundling multiple policies or loyalty programs, making them attractive options for many New Jersey residents.

Regional Insurers: Tailored Solutions for New Jersey

Alongside the national giants, a number of regional insurance companies have deep roots in New Jersey, offering tailored coverage options specifically designed for the state’s unique driving conditions and regulations. These regional insurers understand the local market and often provide specialized services and discounts that cater to the needs of New Jersey drivers.

- New Jersey Manufacturers (NJM): As a mutual company owned by its policyholders, NJM has a strong focus on customer satisfaction and offers competitive rates. They provide auto, homeowners, and business insurance, ensuring a comprehensive approach to protection.

- Progressive: With a commitment to innovation, Progressive offers a range of digital tools and services, making it easy for New Jersey drivers to manage their policies and receive personalized quotes. They also provide additional coverage options, such as pet injury protection and gap coverage.

- MetLife Auto & Home: A subsidiary of the well-known MetLife, Inc., this insurer offers a range of auto insurance products, including standard coverage, classic car insurance, and rideshare coverage, catering to the diverse needs of New Jersey drivers.

Regional insurers often have a more personalized approach, with local agents who can provide tailored advice and assistance, making them a preferred choice for many residents seeking a more intimate insurance experience.

Coverage Options: Understanding the Basics

Regardless of the insurance company you choose, understanding the coverage options available is crucial to ensure you receive the protection you need. In New Jersey, auto insurance policies typically include the following basic coverages:

- Liability Coverage: This coverage is mandatory in New Jersey and protects you against claims arising from bodily injury or property damage caused by you to others in an accident.

- Personal Injury Protection (PIP): Also known as “no-fault” coverage, PIP provides medical and income loss benefits to the insured and their passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

- Collision Coverage: This optional coverage pays for damages to your vehicle resulting from a collision with another vehicle or object, regardless of fault.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

Additionally, New Jersey residents can opt for various add-on coverages, such as rental car reimbursement, roadside assistance, and gap insurance, to further enhance their protection.

Unique Aspects of Auto Insurance in New Jersey

The auto insurance market in New Jersey has some unique characteristics that set it apart from other states. One notable aspect is the state’s use of an “assigned risk” plan, also known as the New Jersey Automobile Full Insurance Underwriting Association (JUA). This plan ensures that high-risk drivers, who may have difficulty obtaining insurance elsewhere, can still secure coverage.

Another distinctive feature is the state's use of a no-fault system, where drivers must rely on their own insurance coverage for compensation, regardless of who is at fault in an accident. This system, coupled with the mandatory Personal Injury Protection (PIP) coverage, ensures that injured parties receive prompt medical attention and income replacement benefits.

| Key Coverage | Description |

|---|---|

| Liability Coverage | Protects against claims arising from bodily injury or property damage caused by the insured. |

| Personal Injury Protection (PIP) | Provides medical and income loss benefits to the insured and their passengers, regardless of fault. |

| Uninsured/Underinsured Motorist Coverage | Protects against losses caused by uninsured or underinsured drivers. |

| Collision Coverage | Covers damages to the insured's vehicle resulting from collisions. |

| Comprehensive Coverage | Protects against damages caused by non-collision events, such as theft or natural disasters. |

The Future of Auto Insurance in New Jersey

The auto insurance landscape in New Jersey is continually evolving, influenced by technological advancements, regulatory changes, and shifting consumer preferences. Insurers are increasingly adopting digital tools and platforms to enhance the customer experience, providing convenient online quote comparisons and policy management.

Additionally, the rise of telematics and usage-based insurance programs offers New Jersey drivers the opportunity to customize their coverage and potentially reduce their premiums based on their driving habits. These innovative programs use data collected from onboard devices or smartphone apps to analyze driving behavior, providing a more accurate assessment of risk and, consequently, more tailored insurance rates.

As the auto insurance market in New Jersey continues to evolve, it's essential for residents to stay informed about the latest coverage options, discounts, and technological advancements. By understanding the unique aspects of the market and keeping up with industry trends, New Jersey drivers can make well-informed decisions to secure the best possible protection for their vehicles and themselves.

FAQ

What are the minimum auto insurance requirements in New Jersey?

+New Jersey requires all drivers to carry minimum liability coverage of 15,000 per person and 30,000 per accident for bodily injury, as well as 5,000 for property damage. Additionally, Personal Injury Protection (PIP) coverage is mandatory, providing up to 250,000 in medical and income loss benefits.

How can I find the best auto insurance rates in New Jersey?

+To find the best rates, compare quotes from multiple insurers, including both national and regional companies. Consider factors such as coverage options, discounts, and customer service when making your decision. Additionally, review your policy regularly to ensure you’re getting the best value for your needs.

Are there any discounts available for auto insurance in New Jersey?

+Yes, many insurers offer a variety of discounts, including multi-policy discounts for bundling auto and home insurance, safe driver discounts for maintaining a clean driving record, and loyalty discounts for long-term customers. Some insurers also provide discounts for specific occupations or membership in certain organizations.

What should I do if I’m involved in an accident in New Jersey?

+If you’re involved in an accident, prioritize the safety of yourself and others involved. Exchange information with the other driver(s), including names, contact details, and insurance information. Take photos of the accident scene and any damage to your vehicle. Report the accident to your insurance company as soon as possible, and provide them with all relevant details.

Can I switch auto insurance companies in New Jersey?

+Absolutely! New Jersey residents have the freedom to switch auto insurance companies at any time. To make the process smoother, compare quotes from different insurers to find a better deal, and ensure your new policy is in place before canceling your existing coverage. This way, you can avoid any gaps in coverage.