Liability Insurance For Auto

Introduction

Liability insurance is a fundamental aspect of vehicle ownership, providing essential coverage for drivers across the globe. In an era where road incidents are an unfortunate reality, understanding the intricacies of liability insurance is crucial for every vehicle owner. This comprehensive guide aims to shed light on the importance, coverage, and benefits of liability insurance, ensuring you make informed decisions regarding your automotive insurance needs.

Understanding Liability Insurance

Liability insurance, often referred to as ‘third-party insurance’, is a critical component of automotive insurance policies. It serves as a financial safeguard, protecting policyholders from potential liabilities arising from accidents involving their vehicles. This type of insurance covers bodily injury and property damage claims made against the insured driver by third parties, such as other drivers, passengers, or pedestrians involved in an accident.

The primary purpose of liability insurance is to provide financial protection in situations where the insured driver is found legally responsible for an accident. It ensures that the insured party can meet their legal obligations and cover the costs associated with injuries, property damage, and other related expenses incurred by the third party. By having liability insurance, drivers can drive with peace of mind, knowing they are protected against the financial risks that come with unexpected road incidents.

Coverage and Benefits

Bodily Injury Liability

Bodily injury liability coverage is a cornerstone of liability insurance policies. It provides financial protection in the event that an insured driver’s actions result in physical injuries to others. This coverage pays for medical expenses, rehabilitation costs, and lost wages incurred by the injured party. For instance, if an insured driver causes an accident resulting in serious injuries to another driver, liability insurance would cover the medical bills and related expenses, ensuring the injured party receives the necessary treatment and financial support.

Property Damage Liability

Property damage liability coverage is another critical aspect of liability insurance. It covers the cost of repairing or replacing property damaged by the insured driver in an accident. This includes damage to other vehicles, public or private property, and even personal belongings within the vehicle. For example, if an insured driver accidentally collides with a parked car, their liability insurance would cover the cost of repairing or replacing the damaged vehicle, ensuring the owner is not left with financial burden.

Legal Defense and Settlement Costs

Liability insurance not only covers the costs of bodily injury and property damage but also provides legal defense and settlement assistance. In cases where an accident results in legal action, liability insurance can provide coverage for attorney fees, court costs, and other legal expenses. Additionally, it can assist in negotiating and settling claims, ensuring the insured driver’s interests are protected and any potential financial liabilities are managed effectively.

Additional Benefits

Some liability insurance policies offer additional benefits and coverages. These may include rental car reimbursement, which provides compensation for the cost of renting a vehicle while the insured car is being repaired after an accident. Another common benefit is roadside assistance coverage, offering emergency services such as towing, flat tire changes, and fuel delivery, ensuring the insured driver receives prompt assistance in case of vehicle breakdowns.

Customization and Limits

Liability insurance policies can be customized to meet the specific needs and budget of the policyholder. Insured individuals can choose the coverage limits for bodily injury and property damage liability, allowing them to balance the level of protection they require with their financial capabilities. Higher limits provide more extensive coverage but may result in higher premiums, while lower limits may be more affordable but offer less financial protection in case of severe accidents.

Choosing the Right Liability Insurance

When selecting liability insurance, it is crucial to consider several factors to ensure you have the appropriate coverage. Here are some key considerations:

Legal Requirements: Different jurisdictions have varying legal requirements for minimum liability insurance coverage. It is essential to understand the specific regulations in your area to ensure compliance with the law.

Financial Responsibility: Evaluate your financial situation and determine the level of coverage you can comfortably afford. Consider your assets and potential liabilities to choose coverage limits that provide adequate protection.

Policy Terms and Conditions: Carefully review the terms and conditions of the liability insurance policy. Understand the exclusions, deductibles, and any specific limitations or restrictions that may apply.

Reputation and Reliability: Research and choose a reputable insurance provider known for their financial stability and reliable claims handling. This ensures you receive prompt and fair settlement in case of an accident.

Additional Coverages: Assess your specific needs and consider adding optional coverages to your liability insurance policy. This may include rental car reimbursement, roadside assistance, or other benefits that provide added peace of mind.

Price Comparison: Obtain quotes from multiple insurance providers to compare prices and coverage options. This allows you to find the best value for your insurance needs, ensuring you get adequate protection at a competitive rate.

Real-World Examples and Case Studies

To illustrate the importance and impact of liability insurance, let’s examine a few real-world scenarios:

Case Study 1: Bodily Injury Liability

Imagine a driver, John, who is involved in a serious accident, resulting in multiple injuries to the other driver and their passengers. John’s liability insurance policy, with adequate bodily injury liability coverage, steps in to cover the medical expenses, rehabilitation costs, and lost wages of the injured parties. This not only ensures the injured individuals receive the necessary treatment and support but also protects John from potential financial ruin.

Case Study 2: Property Damage Liability

In a different scenario, Sarah, an experienced driver, accidentally collides with a luxury car while merging onto a highway. Her liability insurance policy covers the cost of repairing the other vehicle, which exceeds $50,000. Without liability insurance, Sarah would have faced significant financial strain to cover the repair costs, potentially impacting her financial stability.

Case Study 3: Legal Defense and Settlement

Michael, a cautious driver, is involved in an accident where the other party alleges severe injuries and files a lawsuit. Michael’s liability insurance policy provides legal defense, covering attorney fees and court costs. Additionally, the insurance company assists in negotiating a fair settlement, protecting Michael from potential excessive financial liabilities.

Future Implications and Industry Trends

The landscape of liability insurance is evolving, driven by technological advancements and changing consumer needs. Here are some key trends and future implications:

Telematics and Usage-Based Insurance: Telematics technology allows insurance providers to track driving behavior and offer usage-based insurance policies. These policies may provide discounts or customized rates based on factors such as driving distance, time of day, and driving habits.

Connected Car Technology: The integration of connected car technology, such as advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication, is expected to enhance road safety and reduce accident rates. This may impact liability insurance premiums, as safer driving behaviors and reduced accident risks could lead to more affordable coverage.

Autonomous Vehicles: The rise of autonomous vehicles presents unique challenges and opportunities for liability insurance. As self-driving cars become more prevalent, insurance policies will need to adapt to address potential liabilities associated with this new technology.

Data-Driven Underwriting: Insurance providers are increasingly leveraging advanced analytics and big data to assess risk and set premiums. This data-driven approach allows for more accurate pricing and coverage options, ensuring policyholders receive tailored protection.

Digital Transformation: The insurance industry is undergoing digital transformation, with a focus on streamlining processes and enhancing customer experience. Online platforms and mobile apps are making it easier for policyholders to manage their insurance policies, file claims, and access real-time information.

Conclusion

Liability insurance is a critical component of responsible vehicle ownership, providing essential financial protection in the event of accidents. By understanding the coverage, benefits, and real-world implications of liability insurance, drivers can make informed decisions to ensure they are adequately protected. With the evolving landscape of automotive insurance, staying informed about industry trends and advancements is crucial to navigate the changing landscape of liability insurance effectively.

What is the minimum liability insurance coverage required by law in my state/country?

+

The minimum liability insurance coverage required varies by state/country. It is essential to research and understand the specific regulations in your area to ensure compliance with legal requirements. You can find this information through your local government websites or by consulting with insurance providers.

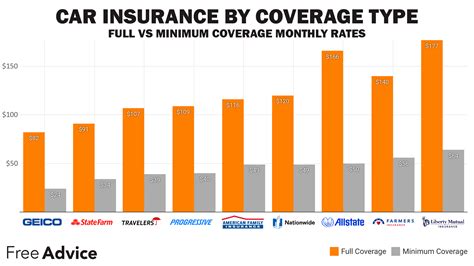

How much does liability insurance cost, and what factors influence the premium?

+

The cost of liability insurance can vary based on several factors, including your location, driving history, the make and model of your vehicle, and the coverage limits you choose. Generally, liability insurance is more affordable than comprehensive insurance, but the premium can still fluctuate based on these variables. It is advisable to obtain quotes from multiple insurance providers to find the best rate for your specific circumstances.

Can I add additional coverages to my liability insurance policy?

+

Yes, many liability insurance policies offer optional coverages that can be added to your policy. These may include rental car reimbursement, roadside assistance, personal injury protection, and more. It is important to review your specific needs and assess the benefits of these additional coverages to determine if they are worth the added cost.