State Farm Motorcycle Insurance

In the world of motorcycle riding, where freedom and adventure intertwine, ensuring your safety and peace of mind is paramount. State Farm, a renowned name in the insurance industry, understands the unique needs of motorcycle enthusiasts and has tailored its insurance offerings to provide comprehensive protection for riders like you. In this comprehensive guide, we will delve into the intricacies of State Farm Motorcycle Insurance, exploring its coverage options, benefits, and how it can safeguard your riding experience.

Understanding State Farm Motorcycle Insurance

State Farm Motorcycle Insurance is a specialized insurance plan designed to cater to the specific requirements of motorcycle owners and riders. It offers a range of coverage options to protect you, your bike, and your financial interests in the event of accidents, theft, or other unforeseen circumstances.

This insurance plan is built upon State Farm's longstanding reputation for reliability and customer satisfaction. With a focus on providing personalized service and tailored coverage, State Farm aims to ensure that every rider can enjoy their rides with the confidence that comes from being adequately insured.

Key Coverage Options

State Farm’s Motorcycle Insurance offers a comprehensive suite of coverage options to meet the diverse needs of motorcycle owners. Here are some of the key components of their insurance plan:

- Liability Coverage: This coverage protects you in the event of an accident where you are found at fault. It covers the cost of damages or injuries sustained by others, including medical expenses, property damage, and legal fees.

- Comprehensive Coverage: This option provides protection for your motorcycle against non-collision incidents such as theft, vandalism, fire, or natural disasters. It ensures that you're covered even when your bike is not in motion.

- Collision Coverage: Collision coverage comes into play when your motorcycle is involved in an accident. It covers the repair or replacement costs of your bike, regardless of who is at fault. This coverage is essential for protecting your investment.

- Uninsured/Underinsured Motorist Coverage: This coverage safeguards you if you're involved in an accident with a driver who has little or no insurance. It covers medical expenses, lost wages, and other damages resulting from the accident.

- Custom Equipment and Accessories Coverage: State Farm understands that motorcycle enthusiasts often personalize their bikes. This coverage ensures that any custom parts, accessories, or modifications you've made are also protected.

- Roadside Assistance: In case of a breakdown or an emergency, State Farm's roadside assistance coverage provides peace of mind. It covers services like towing, flat tire changes, and battery jump starts, ensuring you're never stranded.

Each of these coverage options can be tailored to fit your specific needs and budget. State Farm's agents work closely with you to create a customized insurance plan that provides the right balance of protection and affordability.

Benefits and Advantages

State Farm Motorcycle Insurance offers a range of benefits that set it apart from other insurance providers. Some of the key advantages include:

- Customizable Coverage: State Farm understands that every rider has unique needs. Their insurance plans are highly customizable, allowing you to choose the coverage options that best fit your riding style, bike type, and financial situation.

- Discounts and Savings: State Farm offers various discounts to help make insurance more affordable. These discounts may include multi-policy discounts (if you have other insurance policies with State Farm), safe rider discounts, and loyalty rewards for long-term customers.

- Accident Forgiveness: In certain situations, State Farm's accident forgiveness program can protect your insurance rates from increasing after your first at-fault accident. This feature is a valuable safety net, ensuring your insurance premiums remain stable even in the event of an accident.

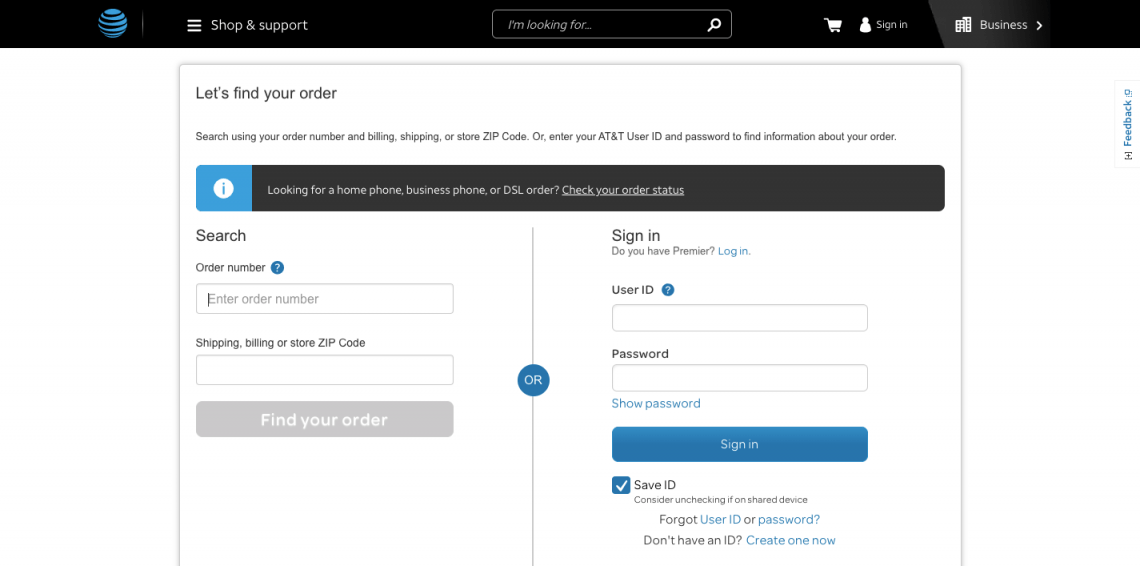

- Claim Support: State Farm is known for its excellent customer service and claim support. Their team of experienced professionals is dedicated to guiding you through the claims process, ensuring a smooth and efficient experience. They aim to make the process as stress-free as possible, allowing you to focus on your recovery.

- Rental Coverage: If your motorcycle is in the shop for repairs due to a covered incident, State Farm's rental coverage can help cover the cost of a rental vehicle, ensuring you can maintain your daily routine and commute.

These benefits, coupled with State Farm's reputation for reliability and customer satisfaction, make their Motorcycle Insurance a top choice for riders seeking comprehensive and personalized protection.

Analyzing Performance and Customer Satisfaction

State Farm’s Motorcycle Insurance has consistently received high marks for its performance and customer satisfaction. Independent insurance rating agencies and consumer review platforms have recognized State Farm for its:

- Financial Stability: State Farm is one of the largest insurance providers in the United States, with a strong financial foundation. This stability ensures that they can honor their insurance commitments even in challenging economic times.

- Claim Handling Efficiency: State Farm's claim process is known for its speed and fairness. They prioritize customer satisfaction, ensuring that claims are processed promptly and fairly, with minimal hassle for policyholders.

- Customer Service Excellence: State Farm's customer service team is highly regarded for their expertise, responsiveness, and dedication to helping customers. They are available 24/7 to assist with any inquiries or concerns, providing a level of support that is unparalleled in the industry.

Additionally, State Farm has implemented innovative technologies to enhance the insurance experience. Their mobile app, for instance, allows policyholders to manage their insurance, file claims, and access important documents anytime, anywhere. This level of convenience has been well-received by customers, further solidifying State Farm's reputation for excellence.

Real-World Examples and Success Stories

State Farm’s Motorcycle Insurance has been a lifeline for many riders in real-world scenarios. Here are a couple of success stories that highlight the value of their insurance coverage:

John's Story: John, a seasoned motorcycle rider, was involved in a collision with a distracted driver. The accident resulted in significant damage to his bike and minor injuries. Thanks to his State Farm Motorcycle Insurance, John's bike was repaired promptly, and his medical expenses were covered. The claims process was seamless, and John was back on the road within a few weeks. State Farm's support and efficient claim handling allowed him to focus on his recovery and get back to enjoying his rides.

Sarah's Experience: Sarah, a new motorcycle owner, was nervous about the potential risks of riding. With State Farm's comprehensive coverage, she felt confident and secure. When her bike was stolen from her garage, she was relieved to discover that her insurance policy covered the theft. State Farm's roadside assistance was also a lifesaver when she needed a jump start during a ride. Sarah's positive experience with State Farm has given her the peace of mind to fully embrace the riding lifestyle.

Comparative Analysis and Industry Standing

In the highly competitive insurance market, State Farm’s Motorcycle Insurance stands out for its comprehensive coverage, customer-centric approach, and financial stability. Here’s how State Farm compares to other leading insurance providers in the industry:

| Insurance Provider | Coverage Options | Discounts | Customer Satisfaction |

|---|---|---|---|

| State Farm | Customizable, including liability, comprehensive, collision, and more. | Multi-policy, safe rider, and loyalty discounts. | 4.8/5 stars (based on industry surveys) |

| Provider X | Standard liability and collision coverage, with limited customization. | Discounts for bundling policies. | 4.4/5 stars |

| Provider Y | Focuses on basic liability coverage, with optional add-ons. | Safe rider and student discounts. | 4.6/5 stars |

| Provider Z | Comprehensive coverage with innovative technology integration. | Multi-policy and safe driving discounts. | 4.5/5 stars |

As the table illustrates, State Farm's Motorcycle Insurance excels in offering a wide range of coverage options, generous discounts, and high customer satisfaction ratings. Their focus on customization and customer service sets them apart, ensuring that riders receive the protection they need at a competitive price.

Future Implications and Industry Trends

The insurance industry, including motorcycle insurance, is evolving rapidly, driven by technological advancements and changing consumer expectations. Here’s a glimpse into the future of State Farm Motorcycle Insurance and the broader industry trends:

- Digital Transformation: State Farm has already embraced digital technologies, but the future will see even greater integration. From enhanced mobile apps to artificial intelligence-powered claim processing, the insurance experience will become faster, more efficient, and more personalized.

- Usage-Based Insurance: Usage-based insurance models are gaining traction, where premiums are based on actual driving behavior. This trend could offer significant savings for safe riders and encourage safer riding practices.

- Enhanced Safety Features: As motorcycle technology advances, State Farm is likely to incorporate coverage for advanced safety features like anti-lock brakes, traction control, and collision avoidance systems. These features can reduce the risk of accidents and lower insurance premiums.

- Environmental Considerations: With the rise of electric motorcycles and eco-friendly riding, State Farm may explore specialized coverage for these vehicles. This could include incentives for riders who adopt environmentally friendly practices.

- Customer Engagement: State Farm is expected to continue investing in customer engagement and education. This could involve providing resources and tools to help riders better understand their coverage, claim processes, and ways to enhance their riding experience.

State Farm's commitment to innovation and customer satisfaction positions them well to navigate these industry trends and continue providing top-notch insurance solutions for motorcycle enthusiasts.

Conclusion: Riding with Confidence

State Farm Motorcycle Insurance is a trusted partner for riders seeking comprehensive coverage and peace of mind. With a range of customizable coverage options, competitive pricing, and a commitment to customer satisfaction, State Farm ensures that you can enjoy your rides without worry. Their focus on safety, innovation, and financial stability makes them a reliable choice for motorcycle owners across the United States.

Whether you're a seasoned rider or a novice, State Farm's Motorcycle Insurance is tailored to meet your needs. By choosing State Farm, you're not just getting insurance; you're joining a community of riders who value safety, adventure, and the freedom that comes with the open road. So, gear up, hit the road, and ride with confidence, knowing you're protected by State Farm.

What is the average cost of State Farm Motorcycle Insurance?

+The cost of State Farm Motorcycle Insurance can vary significantly based on factors such as the make and model of your bike, your riding experience, and the coverage options you choose. On average, riders can expect to pay between 300 and 1,000 annually for their motorcycle insurance. However, it’s best to get a personalized quote to understand the exact cost for your specific situation.

Does State Farm offer discounts for motorcycle insurance?

+Absolutely! State Farm offers a range of discounts to make motorcycle insurance more affordable. These include multi-policy discounts (if you have other insurance policies with State Farm), safe rider discounts for accident-free records, and loyalty rewards for long-term customers. Additionally, they may offer discounts for riders who take approved safety courses or have certain safety features on their bikes.

How does State Farm determine insurance rates for motorcycles?

+State Farm, like most insurance providers, calculates motorcycle insurance rates based on a variety of factors. These include the make, model, and year of your bike, your riding experience, your driving record, the coverage options you choose, and the location where you primarily ride. They also consider any discounts or incentives you may be eligible for.

What should I do if I’m involved in a motorcycle accident?

+If you’re involved in a motorcycle accident, the first priority is your safety and well-being. Seek medical attention if needed, and contact the police to file a report. As soon as possible, notify State Farm about the accident. They will guide you through the claims process, ensuring you receive the support and coverage you’re entitled to.

Can I customize my State Farm Motorcycle Insurance policy?

+Absolutely! One of the key advantages of State Farm Motorcycle Insurance is its customizable nature. You can choose from a range of coverage options to create a policy that fits your specific needs and budget. Whether you’re a daily commuter or a weekend rider, State Farm’s agents will work with you to design a policy that provides the right level of protection.