How Much Is The Insurance For A Car

Car insurance is a crucial aspect of vehicle ownership, providing financial protection in the event of accidents, theft, or other mishaps. The cost of insurance can vary significantly based on numerous factors, making it essential for vehicle owners to understand the key considerations and potential expenses involved.

Factors Influencing Car Insurance Premiums

The price of car insurance is determined by a combination of individual, vehicle, and environmental factors. These include:

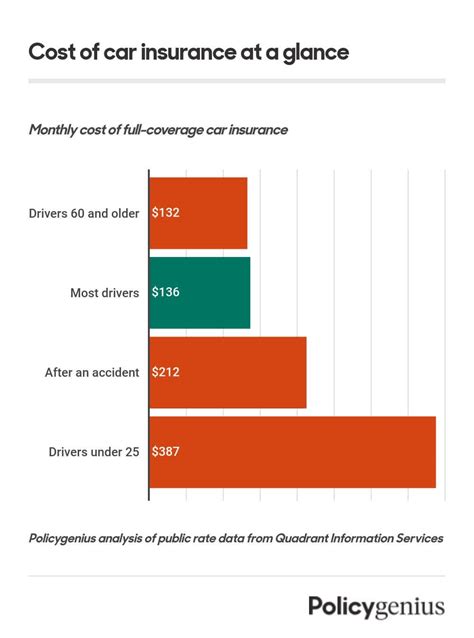

- Driver’s Profile: Age, gender, driving history, and credit score play a significant role. Young drivers and those with a history of accidents or traffic violations often face higher premiums.

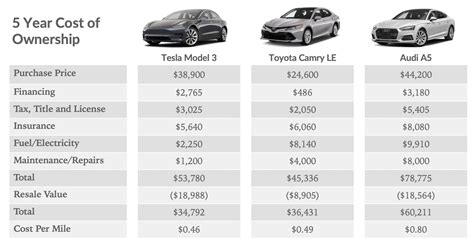

- Vehicle Type: The make, model, and year of the car can impact insurance costs. Luxury vehicles, sports cars, and SUVs may require more expensive coverage.

- Coverage Type: Different coverage options, such as liability-only, comprehensive, and collision, offer varying levels of protection and pricing.

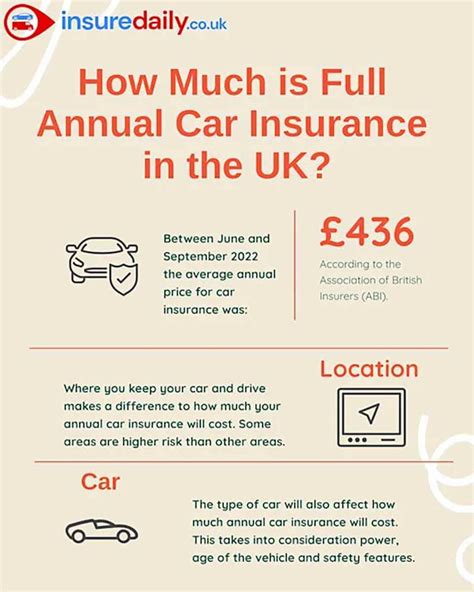

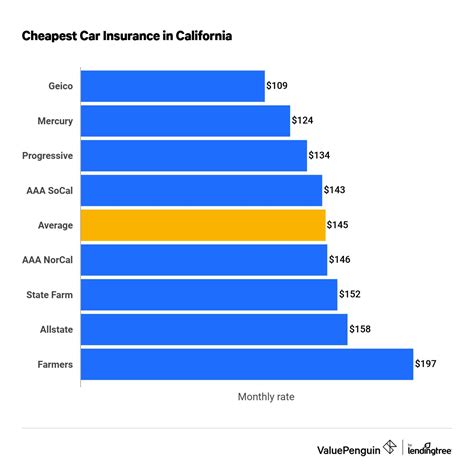

- Location: The area where the vehicle is garaged and driven can influence rates due to varying traffic conditions, crime rates, and weather patterns.

- Usage: The purpose of the vehicle, whether for personal, business, or pleasure, can affect insurance costs.

Estimating Insurance Costs

While exact insurance premiums can only be determined by specific insurers, general estimates can provide a starting point for understanding potential expenses.

| Coverage Type | Average Annual Cost |

|---|---|

| Liability-Only | 500 - 1,500 |

| Comprehensive | 1,000 - 3,000 |

| Collision | 700 - 2,500 |

These estimates are based on average rates across various states and should be considered as a rough guide. Actual costs can deviate significantly based on the factors mentioned earlier.

Strategies for Affordable Insurance

To secure the best car insurance deal, vehicle owners can employ various strategies:

- Compare Quotes: Obtain multiple quotes from different insurers to find the most competitive rates.

- Bundle Policies: Combining car insurance with other policies, such as home or life insurance, can often result in discounts.

- Increase Deductibles: Opting for higher deductibles can lower monthly premiums, but it’s important to ensure the chosen deductible is affordable in the event of a claim.

- Review Coverage Regularly: Insurance needs can change over time, so it’s beneficial to periodically review policies to ensure they remain adequate and cost-effective.

Real-World Examples of Insurance Costs

Let’s examine some real-world scenarios to illustrate the potential range of insurance costs.

Example 1: Young Driver

Sarah, a 22-year-old with a clean driving record, purchases a used Toyota Corolla. She opts for a comprehensive insurance policy with a 500 deductible. Based on her location and vehicle type, she receives quotes ranging from 1,200 to $1,800 annually.

Example 2: Experienced Driver

John, a 45-year-old with an excellent driving record, buys a new Tesla Model 3. He chooses a collision insurance policy with a 1,000 deductible. Due to his age and driving history, he receives quotes starting at 900 annually.

Example 3: Business Use

Emma, a 30-year-old business owner, uses her Ford Transit van for deliveries. She needs specialized commercial insurance. Quotes for this type of coverage range from 2,500 to 3,500 annually, reflecting the increased risk associated with business use.

The Future of Car Insurance

The insurance industry is evolving, and several trends are shaping the future of car insurance premiums.

- Telematics: Some insurers now offer usage-based insurance, where driving behavior is monitored through telematics devices. This can reward safe drivers with lower premiums.

- Technology Integration: Advances in vehicle technology, such as autonomous driving features, may lead to reduced accident rates and, subsequently, lower insurance costs.

- Digitalization: The increasing digitalization of the insurance industry, including online quote comparisons and paperless transactions, can drive down operational costs and benefit consumers.

Conclusion

Understanding the factors that influence car insurance costs is crucial for vehicle owners. By considering individual circumstances, comparing quotes, and staying informed about industry trends, drivers can make informed decisions to secure the best insurance coverage at an affordable price.

How can I get the most accurate insurance quotes?

+To get the most accurate insurance quotes, provide detailed and accurate information about yourself, your driving history, and your vehicle. Be transparent about any past accidents or violations, as insurers may discover this information during the underwriting process. Additionally, consider using insurance comparison websites or working with an independent insurance broker who can shop around for the best rates on your behalf.

What are some common discounts available for car insurance?

+Common discounts for car insurance include safe driver discounts, multi-policy discounts (bundling car insurance with other types of insurance), good student discounts, loyalty discounts, and discounts for certain occupations or affiliations. It’s worth inquiring about these discounts when obtaining quotes to ensure you’re taking advantage of all available savings.

How do my credit score and driving history impact insurance rates?

+Your credit score and driving history are significant factors in determining insurance rates. Insurers use credit-based insurance scores to assess your financial responsibility, and a good credit score can lead to lower premiums. Similarly, a clean driving record with no accidents or violations is generally rewarded with lower rates. However, the impact of these factors can vary by state and insurer.