How Much In Car Insurance

When it comes to car insurance, the cost can vary significantly depending on numerous factors. Understanding the components that influence insurance rates is crucial for individuals seeking affordable coverage for their vehicles. In this comprehensive guide, we will delve into the various factors that impact car insurance premiums, explore ways to find the best deals, and provide expert tips to help you make informed decisions about your automotive insurance coverage.

Factors Influencing Car Insurance Costs

Several key elements contribute to the overall cost of car insurance. These factors are considered by insurance providers to assess the level of risk associated with insuring a particular vehicle and driver. Here are some of the primary factors that influence car insurance rates:

Vehicle Type and Age

The type and age of your vehicle play a significant role in determining insurance costs. Generally, newer and more expensive cars tend to have higher insurance premiums. This is because they may require more expensive repairs or have advanced safety features that can impact insurance rates. Additionally, certain makes and models may have a higher risk of theft or be more prone to accidents, which can also affect insurance costs.

Driver’s Profile and History

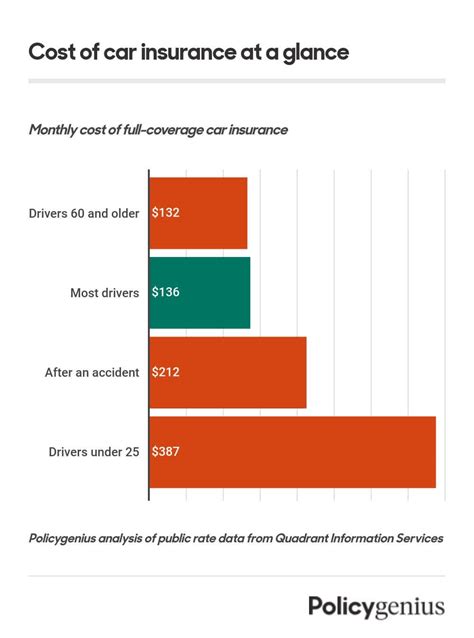

Your driving record and personal details are crucial in calculating insurance premiums. Insurance companies consider factors such as your age, gender, driving experience, and claims history. Young drivers, for instance, are often considered high-risk and may face higher insurance rates. Similarly, drivers with a history of accidents or traffic violations may also be charged higher premiums.

| Risk Factor | Impact on Premium |

|---|---|

| Age | Younger drivers (under 25) and older drivers (over 65) often pay higher premiums due to higher accident rates. |

| Gender | Insurance rates can vary based on gender, with some companies offering lower rates for female drivers. |

| Driving Experience | Inexperienced drivers, such as teens, typically have higher premiums until they gain more driving experience. |

| Claims History | A history of accidents or insurance claims can significantly increase insurance costs. |

Location and Usage

The area where you live and use your vehicle can impact insurance rates. Urban areas with higher population density and traffic congestion often have higher insurance costs due to the increased risk of accidents and theft. Additionally, the purpose for which you use your vehicle (e.g., commuting, business, pleasure) can also affect insurance premiums.

Coverage and Deductibles

The level of coverage you choose and the deductibles you select have a direct impact on your insurance premiums. Comprehensive coverage and collision coverage provide broader protection but typically result in higher premiums. On the other hand, opting for higher deductibles can lower your monthly insurance payments, but you’ll need to pay more out of pocket if you file a claim.

Additional Factors

There are several other factors that can influence insurance rates, including your credit score, marital status, and even the number of miles you drive annually. Some insurance companies may also consider your occupation and education level when assessing risk.

Finding Affordable Car Insurance

With a better understanding of the factors that impact car insurance costs, you can take steps to find more affordable coverage. Here are some strategies to consider:

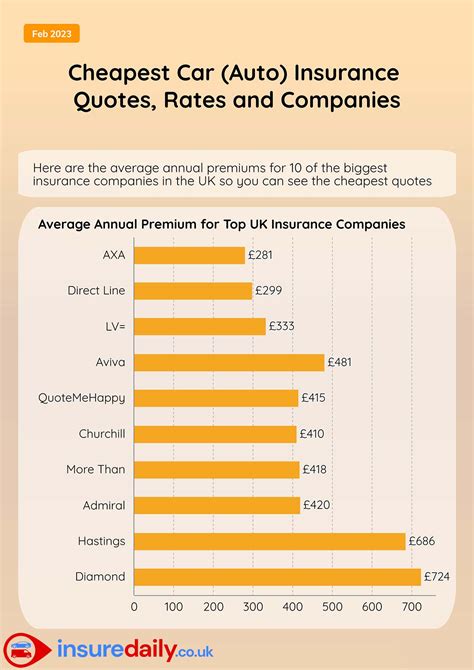

Compare Multiple Quotes

Obtaining quotes from multiple insurance providers is essential to finding the best deal. Comparison shopping allows you to assess different coverage options and premiums offered by various companies. Online insurance comparison tools can streamline this process, making it easier to find competitive rates.

Bundle Your Policies

If you have multiple insurance needs, such as home, life, or health insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts when you combine multiple policies, potentially saving you a significant amount on your car insurance premiums.

Explore Discounts

Insurance companies often provide various discounts to policyholders. Common discounts include safe driver discounts, good student discounts, loyalty discounts, and discounts for completing defensive driving courses. Ask your insurance provider about the discounts they offer and see if you qualify for any of them.

Improve Your Driving Record

Maintaining a clean driving record is crucial for keeping insurance costs down. Avoid traffic violations and accidents, as they can significantly increase your insurance premiums. If you have a history of accidents or violations, consider taking a defensive driving course to improve your driving skills and potentially lower your insurance rates.

Choose the Right Coverage

While it’s important to have adequate coverage, you should also avoid overinsuring your vehicle. Assess your needs and choose the coverage options that make sense for your situation. For older vehicles, you may not need comprehensive or collision coverage, as the cost of repairs may not justify the insurance premiums.

Shop Around Regularly

Insurance rates can change over time, and it’s a good practice to review your policy and shop around for better deals annually. Insurance providers may offer new discounts or promotions, and you can take advantage of these to lower your insurance costs.

Expert Tips for Managing Car Insurance Costs

Here are some additional tips from industry experts to help you manage your car insurance costs effectively:

- Increase Your Deductible: Choosing a higher deductible can significantly reduce your monthly insurance premiums. However, ensure that you can afford the higher out-of-pocket expense if you need to file a claim.

- Maintain a Good Credit Score: Your credit score can impact your insurance rates. Work on improving your credit score to potentially qualify for lower insurance premiums.

- Consider Usage-Based Insurance: Some insurance providers offer usage-based insurance programs that track your driving habits and reward safe driving with lower premiums. These programs can be beneficial for low-mileage drivers or those with a history of safe driving.

- Review Coverage Regularly: As your circumstances change, your insurance needs may also evolve. Regularly review your coverage to ensure you have the right amount of protection without paying for unnecessary coverage.

- Ask for Discounts: Don't hesitate to inquire about available discounts. Insurance providers may offer discounts for various reasons, such as membership in certain organizations, loyalty, or even for having safety features in your vehicle.

Frequently Asked Questions

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the US varies depending on factors like location and coverage. As of 2022, the average annual premium is approximately 1,674, but this can range from 500 to over $3,000 depending on individual circumstances.

Can I lower my insurance premiums by switching providers annually?

+Yes, shopping around for car insurance annually can help you find better deals and potentially lower your premiums. Insurance companies often offer competitive rates to attract new customers, so it’s worth exploring different providers each year.

Are there any factors that can cause my insurance rates to decrease over time?

+Yes, several factors can lead to lower insurance rates over time. These include maintaining a clean driving record, advancing in age (as older drivers often have lower rates), and improving your credit score. Additionally, certain safety features in your vehicle can also contribute to lower premiums.

Can I negotiate my car insurance premiums with the provider?

+While negotiating car insurance premiums directly with the provider is not common, you can still advocate for yourself. If you have a strong relationship with your insurance agent or broker, you may be able to discuss your situation and potential discounts. Additionally, regularly reviewing and comparing insurance quotes can help you identify more affordable options.