Supplemental Health Insurance Plans

Supplemental health insurance plans are an essential aspect of modern healthcare coverage, offering individuals and families additional financial protection and access to a wider range of medical services. These plans, designed to complement primary health insurance, have become increasingly popular as healthcare costs continue to rise. In this comprehensive guide, we will delve into the world of supplemental health insurance, exploring its benefits, types, and how it can provide peace of mind in an ever-evolving healthcare landscape.

Understanding Supplemental Health Insurance

Supplemental health insurance, often referred to as ancillary or gap coverage, is a type of insurance policy that extends the benefits of a primary health insurance plan. It is designed to fill the gaps left by traditional insurance, covering expenses that may not be fully covered or excluded from the primary plan.

The primary goal of supplemental health insurance is to enhance the financial security of policyholders by providing coverage for specific medical events, treatments, or services that are either costly or not typically covered by standard health insurance plans. These plans can be especially beneficial for individuals with pre-existing conditions, chronic illnesses, or those seeking access to advanced medical technologies and treatments.

The Importance of Supplemental Coverage

Healthcare costs have been on a steady rise, and traditional health insurance plans often come with high deductibles, copayments, and limited coverage for certain procedures. Supplemental insurance steps in to address these gaps, ensuring that policyholders have access to the care they need without incurring significant out-of-pocket expenses.

For example, a standard health insurance plan may cover a portion of a hospital stay, but supplemental insurance can cover the remaining costs, providing a more comprehensive financial safety net. This is particularly crucial for unexpected medical emergencies, where the costs can quickly escalate.

Who Benefits from Supplemental Insurance?

Supplemental health insurance plans are beneficial for a wide range of individuals, including:

- Individuals with Chronic Conditions: Those living with chronic illnesses often require ongoing medical care and specialized treatments. Supplemental insurance can cover the costs associated with managing these conditions, including medications, therapies, and regular check-ups.

- Families with Growing Needs: As families expand, their healthcare needs also evolve. Supplemental insurance can provide coverage for children's medical expenses, maternity care, and pediatric specialist visits, ensuring comprehensive family healthcare.

- Seniors and Retirement Planning: Seniors often face unique healthcare challenges, including age-related conditions and the need for long-term care. Supplemental insurance can help cover the costs of senior-specific medical services and assist in planning for future healthcare expenses.

- Young Adults and Recent Graduates: For young adults entering the workforce, supplemental insurance can bridge the gap between their employer-provided health insurance and the specific healthcare needs they may encounter, such as dental or vision care.

Types of Supplemental Health Insurance Plans

Supplemental health insurance comes in various forms, each designed to address specific healthcare needs. Here are some common types of supplemental plans:

Hospital Indemnity Plans

Hospital indemnity plans provide a fixed daily or weekly benefit amount for each day of hospitalization. These plans are designed to cover the costs associated with hospital stays, including room and board, nursing care, and other expenses. They offer a level of financial security during extended hospital stays, ensuring policyholders have the resources to cover their basic needs while in recovery.

Critical Illness Insurance

Critical illness insurance provides a lump-sum benefit payment upon the diagnosis of a specified critical illness, such as cancer, heart attack, stroke, or organ failure. This type of insurance offers financial protection during a time when medical expenses are often at their highest. Policyholders can use the benefit to cover treatment costs, travel expenses, or even make lifestyle adjustments to aid in their recovery.

Accident Insurance

Accident insurance plans provide coverage for injuries sustained in accidents, both on and off the job. These plans typically offer a benefit amount for specific injuries, such as broken bones, burns, or head injuries. They can help cover medical expenses, lost wages, and even rehabilitation costs associated with accident-related injuries.

Dental and Vision Insurance

Dental and vision insurance plans are designed to cover the costs of routine dental and eye care, as well as more extensive procedures. These plans can include coverage for regular check-ups, cleanings, fillings, orthodontics, and vision exams. By having a separate insurance plan for dental and vision care, individuals can ensure they receive the necessary preventative and corrective treatments without straining their primary health insurance coverage.

Long-Term Care Insurance

Long-term care insurance provides coverage for extended care needs, such as assistance with daily activities and skilled nursing care. This type of insurance is particularly beneficial for seniors who may require ongoing support due to age-related ailments or disabilities. Long-term care insurance can cover the costs of in-home care, assisted living facilities, and nursing homes, ensuring individuals receive the care they need without burdening their families financially.

Key Considerations for Choosing Supplemental Insurance

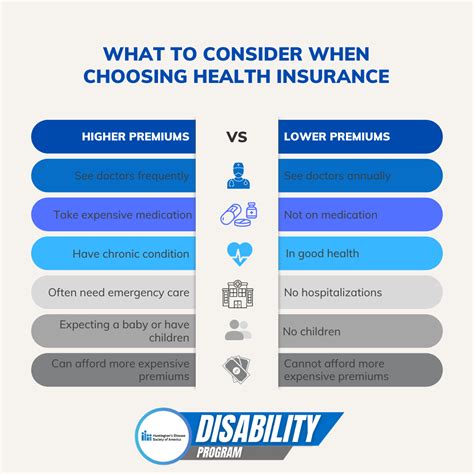

When selecting a supplemental health insurance plan, several factors should be taken into consideration to ensure the plan aligns with your specific needs:

Assess Your Healthcare Needs

Begin by evaluating your current and potential future healthcare needs. Consider any pre-existing conditions, chronic illnesses, or unique medical requirements you or your family may have. Understanding your specific needs will help you choose a supplemental plan that provides adequate coverage.

Review Your Primary Insurance Plan

Examine your primary health insurance policy to identify any gaps or limitations in coverage. Look for areas where supplemental insurance can enhance your financial protection, such as high deductibles, limited coverage for specific procedures, or exclusions for certain conditions.

Compare Multiple Plans

Research and compare different supplemental insurance plans offered by various providers. Consider factors such as the scope of coverage, benefit amounts, waiting periods, and any exclusions or limitations. Don’t hesitate to seek advice from insurance professionals to ensure you choose a plan that best suits your requirements.

Consider Cost and Budget

While supplemental insurance provides valuable coverage, it’s essential to consider the cost of the plan within your budget. Evaluate the premium amounts, deductibles, and any additional out-of-pocket expenses associated with the plan. Ensure that the benefits offered align with your financial capabilities and provide the necessary protection without straining your finances.

The Benefits of Supplemental Health Insurance

Supplemental health insurance offers a multitude of advantages, providing policyholders with enhanced peace of mind and financial security. Here are some key benefits:

Financial Protection

The primary benefit of supplemental insurance is financial protection. These plans cover expenses that traditional health insurance may not, reducing the financial burden of unexpected medical events. By having supplemental coverage, individuals can avoid draining their savings or incurring significant debt due to medical emergencies.

Access to Specialized Care

Supplemental insurance plans often provide access to a broader range of medical services and treatments. This includes advanced technologies, specialized procedures, and alternative therapies that may not be covered by primary insurance. With supplemental coverage, policyholders can explore a wider array of treatment options, ensuring they receive the best possible care.

Peace of Mind

Knowing that you have supplemental insurance can provide significant peace of mind. It alleviates the stress and anxiety associated with potential medical emergencies or chronic conditions. Policyholders can focus on their health and well-being, confident that their financial needs are adequately addressed.

Family Protection

Supplemental insurance plans can extend protection to the entire family. By covering a range of healthcare needs, from children’s medical expenses to senior-specific care, families can ensure that all members have access to the necessary medical services without compromising their financial stability.

Performance Analysis and Real-World Examples

Supplemental health insurance plans have proven their value in numerous real-world scenarios. Here are a few examples showcasing the impact of these plans:

Case Study: Hospital Indemnity Plan

Mr. Johnson, a 55-year-old man, was hospitalized for a week due to a severe heart condition. His primary health insurance covered a portion of the hospital stay, but he still faced significant out-of-pocket expenses. However, with a hospital indemnity plan, Mr. Johnson received a daily benefit amount for each day of his hospitalization, covering his room and board expenses and providing him with the financial resources he needed to focus on his recovery.

Case Study: Critical Illness Insurance

Ms. Smith, a 42-year-old woman, was diagnosed with breast cancer. Her critical illness insurance policy provided her with a lump-sum benefit payment upon diagnosis. This financial support allowed her to cover the costs of her treatment, including chemotherapy, radiation therapy, and surgery. The insurance benefit also helped her take time off work for her treatments and recovery, ensuring she had the necessary financial resources to combat the illness.

Case Study: Accident Insurance

Mr. Davis, a 35-year-old man, sustained a serious injury in a car accident, resulting in a broken leg and several other injuries. His accident insurance plan covered the costs of his emergency room visit, surgery, and rehabilitation. The insurance benefit helped him manage his medical expenses, lost wages, and even covered the cost of modifying his home to accommodate his temporary disability.

Future Implications and Industry Insights

The demand for supplemental health insurance is expected to continue rising as healthcare costs increase and individuals seek greater financial protection. Here are some key insights and future trends in the industry:

Customization and Flexibility

Supplemental insurance providers are increasingly offering customizable plans to cater to the diverse needs of policyholders. This trend allows individuals to select specific coverages based on their unique healthcare requirements, ensuring they receive tailored protection.

Integration with Primary Insurance

Many insurance companies are working towards integrating supplemental plans with primary health insurance policies. This integration simplifies the insurance process, providing a more seamless experience for policyholders. It also ensures that individuals have a comprehensive understanding of their overall coverage and can make informed decisions about their healthcare needs.

Technological Advancements

The insurance industry is embracing technology to enhance the efficiency and accessibility of supplemental insurance plans. Online platforms and mobile applications are being developed to streamline the enrollment process, provide real-time updates on coverage, and offer convenient access to policy information. These technological advancements aim to make supplemental insurance more accessible and user-friendly for all individuals.

Frequently Asked Questions

How does supplemental health insurance differ from primary health insurance?

+

Supplemental health insurance is designed to complement primary health insurance by filling gaps in coverage. It provides additional financial protection for specific medical events, treatments, or services that may not be fully covered by the primary plan.

Can I purchase supplemental insurance if I already have primary health insurance?

+

Yes, supplemental insurance is typically available to individuals who already have primary health insurance. It is intended to enhance your existing coverage and provide peace of mind by covering expenses not addressed by your primary plan.

Are there any age restrictions for purchasing supplemental health insurance?

+

Age restrictions can vary depending on the type of supplemental insurance and the provider. Some plans may have age limits, while others may be available to individuals of all ages. It’s important to review the specific terms and conditions of the plan you’re considering.

Can I customize my supplemental health insurance plan to meet my specific needs?

+

Absolutely! Many supplemental insurance providers offer customizable plans, allowing you to choose specific coverages based on your unique healthcare requirements. This ensures that your plan is tailored to your needs and provides the protection you desire.

What should I consider when comparing supplemental health insurance plans?

+

When comparing plans, consider factors such as the scope of coverage, benefit amounts, waiting periods, exclusions, and cost. Evaluate your specific healthcare needs and assess how well each plan aligns with those needs. Don’t hesitate to seek professional advice to make an informed decision.