Health Insurance Compare

Comparing Health Insurance Plans: A Comprehensive Guide to Making Informed Choices

Choosing the right health insurance plan is a critical decision that can impact your well-being and financial security. With a vast array of options available, navigating the health insurance landscape can be daunting. This comprehensive guide aims to demystify the process, offering expert insights and practical tips to help you compare plans effectively and make informed choices tailored to your unique needs.

Understanding Your Health Insurance Needs

Before embarking on your comparison journey, it's essential to understand your specific health insurance requirements. Consider the following factors to establish a clear direction for your search:

- Healthcare Coverage Needs: Assess your current and potential future healthcare needs. Do you have any pre-existing conditions or chronic illnesses that require regular treatment? Are you planning for potential maternity care or seeking coverage for a family member with specialized needs? Understanding your unique healthcare requirements is crucial for selecting an appropriate plan.

- Prescription Drug Coverage: Prescription medications can be a significant expense. Evaluate your current and anticipated prescription needs. Consider the cost of medications you regularly take, and look for plans that offer comprehensive prescription drug coverage, including any necessary specialty drugs.

- Doctor and Hospital Preferences: Take stock of the doctors and healthcare providers you currently see or plan to see. Ensure the plan you choose offers access to your preferred healthcare professionals and facilities. Some plans may have more limited networks, while others offer broader coverage.

- Preventive Care Benefits: Preventive care services, such as annual check-ups, screenings, and immunizations, are vital for maintaining good health and catching potential issues early. Look for plans that cover these services without requiring copays or deductibles.

- Dental and Vision Care: Depending on your needs, you may require additional coverage for dental and vision care. Standalone dental and vision plans are available, but some health insurance plans offer bundled coverage. Assess your requirements and compare the costs and benefits of various options.

Analyzing Plan Costs and Coverage

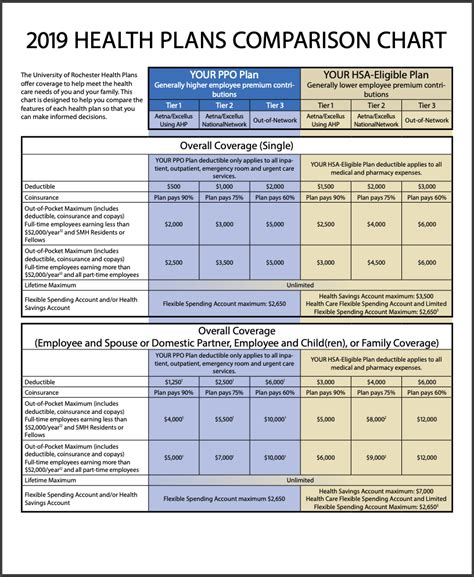

Once you've identified your specific needs, it's time to delve into the world of plan costs and coverage. This involves a detailed examination of premiums, deductibles, copays, and out-of-pocket maximums.

Premium Costs

Premiums are the regular payments you make to maintain your health insurance coverage. While it's tempting to opt for the lowest premium, remember that this isn't always the most cost-effective choice. Consider your anticipated healthcare needs and choose a plan that balances your budget with adequate coverage.

| Plan Name | Premium Cost (Monthly) |

|---|---|

| Essential Health Plan | $250 |

| Standard Health Plan | $320 |

| Premium Health Plan | $400 |

💡 Pro Tip: If you're employed, check if your employer offers any contribution towards your health insurance premiums. This can significantly reduce your out-of-pocket costs.

Deductibles and Copays

Deductibles are the amount you must pay out of pocket before your insurance coverage kicks in. Copays, on the other hand, are fixed amounts you pay for specific services, such as doctor visits or prescription medications. Understand the deductibles and copays for different services under each plan you're considering.

| Plan Name | Deductible (Annual) | Doctor Visit Copay | Specialist Visit Copay |

|---|---|---|---|

| Essential Health Plan | $2,000 | $30 | $50 |

| Standard Health Plan | $1,500 | $25 | $40 |

| Premium Health Plan | $1,000 | $20 | $35 |

Out-of-Pocket Maximums

Out-of-pocket maximums represent the limit on the amount you'll pay for covered services in a year. Once you reach this maximum, your insurance plan covers 100% of eligible expenses for the remainder of the year. This can provide significant financial protection in the event of a serious illness or injury.

| Plan Name | Out-of-Pocket Maximum (Annual) |

|---|---|

| Essential Health Plan | $5,000 |

| Standard Health Plan | $4,000 |

| Premium Health Plan | $3,000 |

Evaluating Plan Networks and Coverage Areas

The healthcare providers and facilities included in a plan's network can significantly impact your experience and out-of-pocket costs. Ensure the plan you choose offers access to the doctors and hospitals you prefer or need.

In-Network vs. Out-of-Network

In-network providers have negotiated rates with the insurance company, often resulting in lower costs for you. Out-of-network providers, on the other hand, may charge higher rates, and you may be responsible for a larger portion of the cost. Check if your preferred healthcare providers are in-network under the plans you're considering.

Coverage Areas

If you frequently travel or anticipate moving in the future, it's crucial to understand a plan's coverage areas. Some plans may have limited coverage outside of certain regions or states, while others offer nationwide coverage. Ensure the plan you choose provides the necessary coverage for your lifestyle and potential future plans.

Understanding Plan Benefits and Exclusions

Health insurance plans can vary significantly in the benefits they offer and the services they exclude. It's crucial to thoroughly review the fine print to ensure the plan aligns with your healthcare needs.

Benefits and Coverage Details

Each plan will outline the specific services and treatments it covers. These can include hospitalization, emergency care, mental health services, maternity care, and more. Understand the scope of coverage for each plan you're considering.

| Plan Name | Benefits Covered |

|---|---|

| Essential Health Plan | Hospitalization, Emergency Care, Lab Tests, X-rays, Mental Health Services |

| Standard Health Plan | All Essential Benefits, plus Maternity Care, Vision Exams, Chiropractic Care |

| Premium Health Plan | All Standard Benefits, plus Dental Care, Alternative Therapies, Travel Health Services |

Exclusions and Limitations

While plans may advertise comprehensive coverage, they often come with exclusions and limitations. These can include specific treatments, procedures, or conditions that are not covered. Carefully review the plan's exclusions to ensure they don't impact your healthcare needs.

| Plan Name | Exclusions |

|---|---|

| Essential Health Plan | Cosmetic Surgery, Fertility Treatments, Weight Loss Surgery |

| Standard Health Plan | All Essential Exclusions, plus Elective Cosmetic Procedures |

| Premium Health Plan | All Standard Exclusions, plus Experimental Treatments, Stem Cell Therapy |

Assessing Plan Ratings and Customer Satisfaction

In addition to the practical aspects of plan comparison, it's essential to consider the overall reputation and customer satisfaction ratings of the insurance provider. This can give you insights into the company's reliability, customer service, and claim handling processes.

Plan Ratings and Reviews

Look for independent reviews and ratings of the insurance providers offering the plans you're considering. Websites like J.D. Power, A.M. Best, and the National Committee for Quality Assurance (NCQA) provide valuable insights into plan quality and customer satisfaction.

| Insurance Provider | Plan Rating (Out of 5) |

|---|---|

| Health Provider Alliance | 4.8 |

| Wellness Health Network | 4.6 |

| CaringCare Insurance | 4.4 |

Customer Service and Claim Handling

Consider the reputation of the insurance provider's customer service and claim handling processes. Efficient and responsive customer service can make a significant difference, especially when you need assistance or have questions about your coverage.

💡 Pro Tip: Check online forums and review sites for customer experiences and feedback. Real-world anecdotes can provide valuable insights into the insurance provider's performance and reliability.

Future Implications and Plan Flexibility

When choosing a health insurance plan, it's essential to consider not just your current needs but also potential future changes. Life is full of surprises, and your healthcare needs may evolve over time. Here's how to ensure your plan can adapt to future circumstances.

Plan Flexibility and Special Circumstances

Look for plans that offer flexibility to accommodate changes in your life. This includes options for adding dependents, changing coverage levels, or adjusting your plan to meet new healthcare needs. Some plans may also offer special provisions for specific life events, such as marriage, divorce, or the birth of a child.

Future Health Needs and Cost Considerations

Consider your potential future health needs. If you anticipate significant medical expenses or have a known condition that may require ongoing treatment, ensure the plan you choose provides adequate coverage and doesn't impose excessive out-of-pocket costs. Balancing cost and coverage is crucial to ensure financial security and peace of mind.

Long-Term Plan Stability

Choose an insurance provider with a track record of stability and financial strength. This ensures that your plan is likely to remain viable and reliable over the long term. Consider the provider's financial ratings and any recent changes or developments that may impact their stability.

💡 Pro Tip: Regularly review your health insurance plan to ensure it continues to meet your needs. Life circumstances and healthcare requirements can change, so it's essential to stay informed and adapt your coverage accordingly.

What is the difference between an HMO and a PPO plan?

+

HMO (Health Maintenance Organization) plans typically have a more restricted network of healthcare providers and require you to choose a primary care physician (PCP) who coordinates your care. PPO (Preferred Provider Organization) plans offer more flexibility, allowing you to visit healthcare providers within or outside the network, though costs may be lower when using in-network providers.

How do I know if a plan covers my specific medical condition?

+

Review the plan’s coverage details and exclusions carefully. If you have a specific medical condition, contact the insurance provider directly to discuss your needs and ensure the plan covers the necessary treatments and services. Some plans may have additional provisions or requirements for pre-existing conditions.

What happens if I need emergency medical care while traveling internationally?

+

Most health insurance plans offer some level of emergency medical coverage outside the United States, but the specifics can vary. Check your plan’s coverage details and consider purchasing additional travel insurance if you anticipate traveling internationally. Some plans may have limitations on the duration of coverage or require prior approval for certain services.