Find Auto Insurance

Welcome to our comprehensive guide on understanding and navigating the process of finding the best auto insurance for your vehicle. The world of insurance can be complex, but we're here to break it down and make it as simple and straightforward as possible. Whether you're a seasoned driver or a novice behind the wheel, having the right auto insurance is crucial to protect yourself and your vehicle. In this article, we will explore the key factors to consider, provide valuable insights, and offer practical tips to help you find the perfect auto insurance policy that suits your needs and budget.

Understanding Auto Insurance

Auto insurance, often referred to as car insurance, is a contractual agreement between you and an insurance company. It provides financial protection in the event of an accident, theft, or other vehicle-related incidents. It’s a safety net that ensures you and your vehicle are covered, offering peace of mind and protection against unexpected expenses.

Why Auto Insurance is Important

The primary purpose of auto insurance is to safeguard your financial well-being. Imagine being involved in an accident that results in significant damage to your vehicle or another person’s property. Without insurance, you would be responsible for covering all the costs, which can be substantial. Auto insurance steps in to cover these expenses, ensuring you’re not left with a hefty financial burden.

Additionally, many states and jurisdictions require drivers to carry a minimum level of auto insurance. Failing to comply with these regulations can result in legal penalties, including fines and even suspension of your driver's license. Having adequate insurance coverage not only protects you but also fulfills your legal obligations as a responsible driver.

Types of Auto Insurance Coverage

Auto insurance policies typically offer a range of coverage options to tailor the protection to your specific needs. Here are some common types of coverage you’ll encounter:

- Liability Coverage: This is the most basic form of auto insurance, covering the costs of damage or injuries you cause to others. It includes bodily injury liability and property damage liability.

- Collision Coverage: Collision coverage pays for repairs to your vehicle if you're involved in an accident, regardless of who is at fault. It provides protection against costly repairs or replacement of your vehicle.

- Comprehensive Coverage: Comprehensive coverage protects against damages caused by non-collision incidents, such as theft, vandalism, natural disasters, or damage caused by animals. It provides a broader level of protection for your vehicle.

- Personal Injury Protection (PIP): PIP coverage, also known as no-fault insurance, covers medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident. It ensures you receive prompt medical attention and financial support during recovery.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who has insufficient or no insurance. It ensures you're not left financially vulnerable in such situations.

Each type of coverage has its own set of benefits and limitations. Understanding these options will help you choose the right combination of coverage to suit your driving habits and preferences.

Factors to Consider When Choosing Auto Insurance

When it comes to selecting the best auto insurance, several factors come into play. By considering these aspects, you can make an informed decision and find a policy that aligns with your needs and budget.

Assessing Your Needs

Before diving into the world of auto insurance, take a moment to assess your specific needs. Consider the following questions to help guide your decision-making process:

- What type of vehicle do you drive? Different vehicles have varying insurance needs and costs. Luxury cars or sports cars, for instance, may require specialized coverage and higher premiums.

- How often do you drive? Frequent drivers may require more comprehensive coverage compared to occasional drivers.

- Do you have any specific requirements or concerns? For example, if you frequently drive in areas prone to natural disasters, you might want to prioritize comprehensive coverage.

- Are there any additional drivers or vehicles to consider? If you have a family, ensuring adequate coverage for multiple drivers and vehicles is crucial.

By understanding your unique circumstances, you can tailor your insurance search to find the most suitable policy.

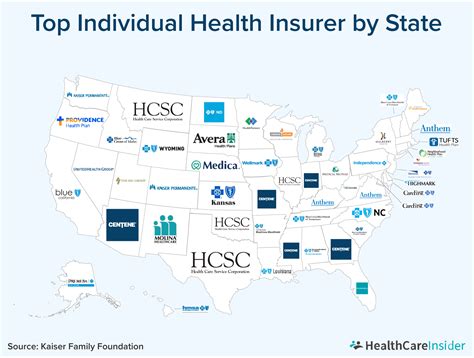

Comparing Insurance Providers

The auto insurance market is competitive, with numerous providers offering a wide range of policies. It’s essential to compare different insurance companies to find the best deal and coverage. Here are some key considerations when comparing providers:

- Reputation and Financial Stability: Look for insurance companies with a solid reputation and financial stability. Check customer reviews and ratings to ensure the provider has a positive track record.

- Coverage Options: Evaluate the range of coverage options offered by each provider. Ensure they offer the specific types of coverage you require, such as liability, collision, and comprehensive coverage.

- Premiums and Discounts: Compare the premiums (monthly or annual costs) offered by different providers. Also, inquire about potential discounts for good driving records, safe vehicles, or multi-policy discounts.

- Claims Process and Customer Service: The claims process is a critical aspect of auto insurance. Research the provider's claims handling process, response times, and customer satisfaction ratings. Ensure they offer prompt and efficient service during claims.

- Additional Benefits: Some insurance providers offer unique benefits or perks, such as roadside assistance, rental car coverage, or accident forgiveness. Consider these additional features when comparing policies.

Understanding Coverage Limits and Deductibles

When reviewing auto insurance policies, it’s crucial to understand coverage limits and deductibles. These factors can significantly impact the cost and extent of your coverage.

Coverage Limits: Coverage limits refer to the maximum amount an insurance company will pay for a specific type of claim. For example, the liability coverage limit determines the maximum payout for injuries or property damage you cause to others. Higher coverage limits provide greater protection but may result in higher premiums.

Deductibles: Deductibles are the amount you agree to pay out of pocket before your insurance coverage kicks in. For instance, if you have a $500 deductible and make a claim, you'll pay the first $500, and the insurance company will cover the remaining costs. Choosing a higher deductible can lower your premiums, but it also means you'll pay more out of pocket in the event of a claim.

Finding the right balance between coverage limits and deductibles is essential. Consider your financial situation and risk tolerance when making these decisions.

Reviewing Policy Exclusions and Restrictions

While reviewing auto insurance policies, it’s important to pay close attention to the fine print. Every policy has its own set of exclusions and restrictions that outline what is not covered. Understanding these limitations is crucial to ensure you’re not caught off guard in the event of a claim.

Common exclusions may include damage caused by normal wear and tear, intentional acts, or participation in illegal activities. Some policies may also exclude coverage for specific types of vehicles, such as classic cars or off-road vehicles. Make sure to thoroughly read and understand the exclusions and restrictions before finalizing your policy choice.

Tips for Finding the Best Auto Insurance

Now that we’ve covered the key factors to consider, here are some practical tips to help you find the best auto insurance policy for your needs:

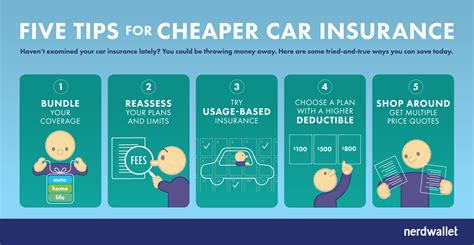

Shop Around and Get Quotes

Don’t settle for the first insurance quote you receive. Take the time to shop around and compare quotes from multiple providers. Online insurance marketplaces and comparison websites can be valuable tools to quickly gather quotes and compare policies. Remember, quotes can vary significantly, so it’s worth investing the time to find the most competitive rates.

Bundle Policies for Discounts

If you have multiple insurance needs, such as home, auto, and life insurance, consider bundling your policies with the same provider. Many insurance companies offer multi-policy discounts, which can result in significant savings. Bundling your insurance policies not only saves you money but also simplifies your insurance management.

Utilize Online Tools and Resources

The internet is a powerful resource when it comes to finding auto insurance. Utilize online tools, such as insurance calculators and comparison websites, to quickly assess your options and understand the market. These tools can provide valuable insights into coverage options, premiums, and customer reviews, helping you make informed decisions.

Seek Professional Advice

If you’re unsure about the best auto insurance options for your specific circumstances, consider seeking advice from a professional insurance broker or agent. They have extensive knowledge of the insurance market and can guide you through the process, ensuring you choose a policy that meets your needs and budget.

Read Reviews and Seek Recommendations

Before finalizing your insurance decision, take the time to read reviews and seek recommendations from trusted sources. Online review platforms and social media groups can provide valuable insights into the experiences of other policyholders. Additionally, ask friends, family, or colleagues for recommendations based on their positive experiences with specific insurance providers.

The Future of Auto Insurance

The auto insurance industry is constantly evolving, and technological advancements are shaping the future of coverage. Here’s a glimpse into some of the trends and innovations that are transforming the way we insure our vehicles:

Telematics and Usage-Based Insurance

Telematics refers to the use of technology to track and analyze driving behavior. Usage-based insurance, also known as pay-as-you-drive insurance, utilizes telematics to monitor factors such as mileage, driving speed, and braking patterns. This data is then used to calculate insurance premiums, offering discounts to safe drivers and providing a more personalized pricing model.

Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics are revolutionizing the insurance industry. AI-powered systems can analyze vast amounts of data, including driving patterns, accident records, and vehicle maintenance, to predict and mitigate risks. This technology enables insurance providers to offer more accurate and tailored coverage, benefiting both insurers and policyholders.

Connected Cars and Vehicle Safety Features

The rise of connected cars and advanced vehicle safety features is influencing the auto insurance landscape. Insurance providers are recognizing the safety benefits of technologies like automatic emergency braking, lane departure warning, and collision avoidance systems. As these features become more prevalent, insurance premiums may reflect the reduced risk associated with these advanced safety measures.

Blockchain Technology and Smart Contracts

Blockchain technology is making its mark on the insurance industry, offering enhanced security, transparency, and efficiency. Smart contracts, powered by blockchain, can automate certain insurance processes, such as claims processing and policy management. This technology has the potential to streamline insurance operations and provide a more secure and trustworthy environment for policyholders.

Conclusion

Finding the best auto insurance is a crucial step in ensuring your financial protection and peace of mind while on the road. By understanding the different types of coverage, comparing providers, and considering factors like coverage limits, deductibles, and exclusions, you can make an informed decision. With the right auto insurance policy, you can drive with confidence, knowing you’re protected against unexpected events and financial liabilities.

Remember, the auto insurance landscape is dynamic, and staying informed about the latest trends and innovations can help you stay ahead of the curve. Embrace the advancements in technology, seek professional advice when needed, and continue to evaluate your insurance needs as your circumstances change. Safe driving and happy motoring!

How much does auto insurance typically cost?

+The cost of auto insurance can vary widely depending on factors such as your driving record, the type of vehicle you drive, and your location. On average, you can expect to pay anywhere from 500 to 1,500 annually for basic liability coverage. However, the cost can be higher or lower based on your specific circumstances.

What factors can impact my auto insurance rates?

+Several factors can influence your auto insurance rates, including your age, gender, driving history, credit score, and the make and model of your vehicle. Insurance companies use these factors to assess the level of risk associated with insuring you. Additionally, the coverage options you choose and any discounts you qualify for can impact your rates.

Can I save money on my auto insurance?

+Yes, there are several ways to save money on your auto insurance. You can shop around and compare quotes from multiple providers to find the most competitive rates. Additionally, you can take advantage of discounts offered by insurance companies, such as safe driver discounts, multi-policy discounts, or discounts for having certain safety features in your vehicle.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, the first step is to ensure the safety of yourself and others involved. Exchange contact and insurance information with the other driver(s). Take photos of the accident scene and any visible damage. Report the accident to your insurance company as soon as possible and provide them with all the necessary details. They will guide you through the claims process and assist with any necessary repairs or settlements.