Healthcare Insurance Companies

The healthcare industry is a complex and ever-evolving sector, with healthcare insurance companies playing a pivotal role in shaping the accessibility and affordability of medical services. These entities, through their intricate networks and diverse coverage options, provide a safety net for individuals and families, offering financial protection during times of medical need. In this comprehensive exploration, we delve into the world of healthcare insurance companies, dissecting their operational intricacies, market impact, and the evolving landscape they navigate.

Understanding Healthcare Insurance Companies: A Comprehensive Overview

Healthcare insurance companies are organizations that specialize in providing insurance coverage for medical expenses. They act as intermediaries, offering a range of plans and policies that individuals, families, and businesses can purchase to protect themselves from the financial burden of healthcare costs. These companies operate within a highly regulated environment, ensuring that their policies meet certain standards and provide essential health benefits.

The primary objective of healthcare insurance companies is to mitigate the financial risks associated with medical care. By pooling resources from a large number of policyholders, these companies can effectively manage the costs of healthcare services, making them more accessible and affordable for the general population. This mechanism of risk pooling allows for a more equitable distribution of healthcare expenses, ensuring that individuals with higher medical needs do not bear the entire burden.

Key Functions and Operations of Healthcare Insurance Companies

Healthcare insurance companies perform a multitude of functions to ensure the smooth delivery of healthcare services and the financial security of their policyholders. These functions include:

- Risk Assessment and Underwriting: Insurance companies assess the medical risks of potential policyholders to determine the premiums they will charge. This process involves evaluating an individual's medical history, lifestyle factors, and other relevant information to accurately estimate the likelihood of future medical expenses.

- Premium Collection and Policy Management: Once policies are issued, insurance companies collect premiums from policyholders on a regular basis. They manage these policies, ensuring that coverage remains up-to-date and compliant with regulatory requirements. Policy management also includes handling renewals, changes, and cancellations.

- Claims Processing: When policyholders require medical services, they file claims with their insurance company. The company then evaluates these claims, verifying the validity of the expenses and ensuring they are covered under the policy. This process involves meticulous review and adjudication to ensure fair and accurate reimbursement.

- Network Management: Many healthcare insurance companies maintain networks of healthcare providers, such as hospitals, clinics, and physicians, with whom they have negotiated rates. Policyholders typically receive discounted rates when they utilize these in-network providers. Managing these networks is a critical aspect of controlling costs and ensuring quality healthcare access.

- Customer Service and Education: Insurance companies provide customer support to policyholders, offering assistance with policy understanding, claims filing, and general healthcare navigation. They also play a role in educating the public about healthcare options, insurance coverage, and preventive care.

The Impact of Healthcare Insurance Companies on the Industry and Consumers

Healthcare insurance companies exert a significant influence on the healthcare industry and the lives of consumers. Their role extends beyond financial protection, impacting various aspects of healthcare delivery and patient experience.

Influencing Healthcare Access and Affordability

One of the most critical roles of healthcare insurance companies is to improve access to healthcare services. By offering insurance coverage, they provide individuals and families with the financial means to seek necessary medical care without the fear of overwhelming expenses. This accessibility is particularly crucial for preventive care, ensuring that individuals can address health issues early on, which can lead to better health outcomes and reduced long-term costs.

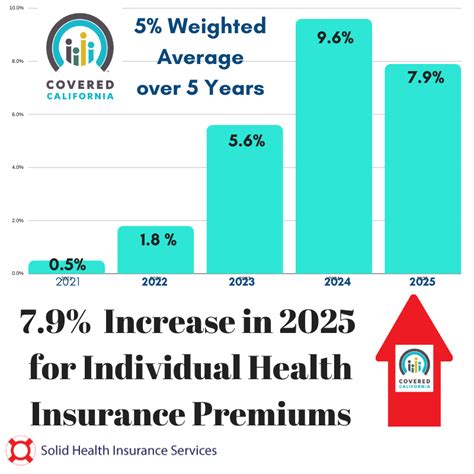

Moreover, insurance companies negotiate rates with healthcare providers, often resulting in lower costs for policyholders. This cost containment strategy can make healthcare more affordable for a broader population, especially when combined with government initiatives and subsidies.

| Healthcare Insurance Impact | Key Metrics |

|---|---|

| Increased Access to Healthcare | Percentage of insured individuals accessing preventive care services. |

| Affordability of Healthcare | Average out-of-pocket expenses for insured vs. uninsured individuals. |

Driving Quality and Efficiency in Healthcare Delivery

Healthcare insurance companies play a pivotal role in shaping the quality and efficiency of healthcare delivery. Through their network management and provider contracting, they can influence the practices and standards of healthcare providers. By negotiating better rates and quality standards, insurance companies can drive improvements in the overall healthcare system, leading to better patient outcomes and more efficient resource utilization.

Providing Financial Protection and Security

The primary function of healthcare insurance companies is to provide financial protection to policyholders. In the event of a medical emergency or chronic illness, the costs of treatment can be astronomical. Healthcare insurance acts as a safety net, ensuring that individuals and families do not face financial ruin due to medical expenses. This protection is particularly crucial for those with pre-existing conditions or those who require long-term care.

Navigating the Complex Landscape: Challenges and Opportunities for Healthcare Insurance Companies

The healthcare insurance industry operates within a dynamic and highly regulated environment, facing a myriad of challenges and opportunities. These entities must navigate complex legal and ethical considerations while adapting to evolving market demands and technological advancements.

Regulatory and Compliance Landscape

Healthcare insurance companies are subject to extensive regulatory oversight to ensure fair practices and protect consumer rights. These regulations cover a broad spectrum, from the Affordable Care Act (ACA) in the United States, which mandates essential health benefits and prohibits discrimination based on pre-existing conditions, to various state-level regulations that govern premium rates and network adequacy.

Compliance with these regulations is crucial for insurance companies to maintain their license to operate and to avoid legal repercussions. They must continually adapt their policies and practices to remain compliant, which can be a significant operational challenge.

Technological Innovations and Digital Transformation

The digital age has brought about significant opportunities for healthcare insurance companies to enhance their operations and customer engagement. Advanced technologies like artificial intelligence, machine learning, and data analytics are being leveraged to improve risk assessment, streamline claims processing, and personalize insurance offerings. For instance, predictive analytics can identify high-risk individuals or predict disease outbreaks, enabling more proactive healthcare management.

Digital platforms and mobile apps are also transforming the way insurance companies interact with their customers, offering convenient online enrollment, claims filing, and policy management. These innovations not only enhance customer experience but also reduce operational costs and improve efficiency.

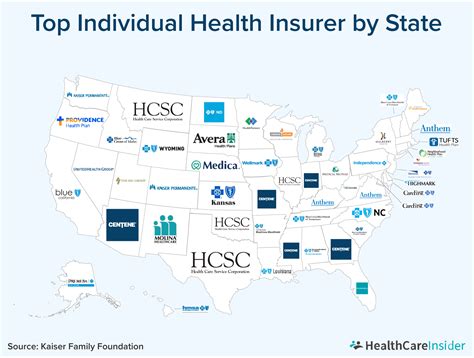

Market Competition and Consumer Expectations

The healthcare insurance market is highly competitive, with a large number of players vying for customers. This competition has led to a focus on customer satisfaction and innovative product offerings. Insurance companies are increasingly tailoring their policies to meet the unique needs of different demographic groups, offering flexible plans that cater to specific health conditions or lifestyle choices.

Additionally, consumer expectations have evolved, with individuals demanding more transparency, personalization, and convenience from their insurance providers. This shift has compelled insurance companies to enhance their customer service, improve communication, and provide easy-to-understand policy information.

Future Outlook: Evolving Trends and Innovations in Healthcare Insurance

The future of healthcare insurance is poised for significant transformation, driven by technological advancements, changing consumer preferences, and ongoing regulatory reforms. Here are some key trends and innovations that are shaping the industry’s trajectory:

Personalized Healthcare and Precision Insurance

The rise of personalized medicine and precision healthcare is prompting insurance companies to develop tailored insurance products. These products take into account an individual’s unique genetic makeup, lifestyle factors, and health history to offer more precise coverage and pricing. By leveraging big data analytics and advanced risk assessment models, insurance companies can offer policies that better meet the specific needs of each policyholder.

Digital Health and Telemedicine Integration

The integration of digital health technologies and telemedicine services is revolutionizing the way healthcare is delivered and accessed. Insurance companies are increasingly covering telemedicine visits and digital health solutions, recognizing their potential to improve access to care, especially in rural or underserved areas. This integration not only enhances convenience for policyholders but also contributes to cost savings by reducing the need for in-person visits.

Value-Based Insurance and Wellness Incentives

There is a growing shift towards value-based insurance, where payment is linked to the quality and outcomes of healthcare services, rather than the volume of services provided. This model incentivizes insurance companies to focus on preventive care and wellness programs, which can lead to better health outcomes and reduced long-term costs. Insurance companies are offering incentives and rewards for policyholders who adopt healthy lifestyles or participate in wellness initiatives.

Data-Driven Decision Making and AI Integration

Advanced data analytics and artificial intelligence are transforming the way insurance companies operate. These technologies enable more accurate risk assessment, improved fraud detection, and personalized policy recommendations. AI-powered chatbots and virtual assistants are enhancing customer service, providing instant support and policy information. Additionally, predictive analytics can anticipate healthcare needs and identify high-risk populations, allowing for more proactive intervention.

Conclusion: Healthcare Insurance Companies as Cornerstone of Healthcare Accessibility

Healthcare insurance companies are integral to the modern healthcare system, serving as a critical link between patients and healthcare providers. Their role in managing risk, providing financial protection, and improving access to quality healthcare cannot be overstated. As the industry continues to evolve, insurance companies must remain agile, adapting to regulatory changes, technological advancements, and shifting consumer preferences to ensure they continue to meet the diverse needs of their policyholders.

In navigating the complex landscape of healthcare insurance, these companies play a pivotal role in shaping the future of healthcare, driving innovation, and enhancing the overall patient experience. Their commitment to providing accessible and affordable healthcare solutions is a testament to their vital contribution to public health and well-being.

How do healthcare insurance companies determine premiums?

+Premiums are determined through a process called underwriting, where insurance companies assess an individual’s medical risks based on factors like medical history, age, gender, lifestyle, and geographic location. They use actuarial science to estimate the likelihood of future healthcare costs and set premiums accordingly.

What are some challenges faced by healthcare insurance companies in managing costs?

+Insurance companies face challenges in controlling costs, including rising healthcare prices, unexpected high-cost treatments, and the need to balance providing comprehensive coverage with maintaining affordable premiums. They employ various strategies, such as negotiating rates with healthcare providers and promoting preventive care, to manage these costs effectively.

How do healthcare insurance companies contribute to public health initiatives?

+Insurance companies play a significant role in public health by promoting preventive care, covering vaccinations and screenings, and supporting wellness programs. They also contribute to health research and education, helping to improve overall population health and reduce the burden of chronic diseases.