Insured Cars

In the realm of automotive safety and insurance, the topic of insured cars is a critical aspect that merits a comprehensive exploration. The landscape of vehicle insurance is complex and dynamic, shaped by various factors such as regional regulations, economic conditions, and technological advancements. This article aims to delve into the world of insured cars, shedding light on the intricacies of insurance coverage, the factors influencing policy decisions, and the broader implications for road safety and the automotive industry.

Understanding Insured Cars: An Overview

Insured cars represent a significant portion of the global automotive fleet, with millions of vehicles protected by various insurance policies. These policies are designed to provide financial protection to vehicle owners and drivers in the event of accidents, theft, or other unforeseen circumstances. The concept of car insurance is deeply rooted in the principles of risk management, aiming to mitigate the potential financial burden that can arise from vehicle-related incidents.

The insurance landscape for cars is vast and diverse, encompassing numerous types of coverage and varying levels of protection. From comprehensive policies that offer wide-ranging coverage to more specialized options like gap insurance and rental car coverage, the choices available to vehicle owners are extensive. The selection of an appropriate insurance policy is a crucial decision that can significantly impact an individual's financial security and peace of mind.

Factors Influencing Insurance Coverage for Cars

Several key factors come into play when determining the scope and cost of insurance coverage for cars. These factors include the type of vehicle, the driver’s age and driving record, geographical location, and the desired level of coverage. Each of these elements plays a unique role in shaping the insurance landscape, and understanding their interplay is essential for making informed decisions.

Vehicle Type and Value

The type and value of a vehicle are fundamental considerations in insurance coverage. High-end luxury cars or specialized vehicles often come with higher insurance premiums due to their elevated replacement and repair costs. Conversely, more affordable, mass-produced vehicles may attract lower insurance rates. The age and condition of the vehicle also factor into the equation, with newer models generally commanding higher insurance costs.

| Vehicle Category | Average Insurance Premium |

|---|---|

| Luxury Cars | $2,500 - $3,000 annually |

| Standard Sedans | $1,200 - $1,800 annually |

| Economy Cars | $800 - $1,200 annually |

Driver Profile and Risk Assessment

The driver’s profile, including age, gender, and driving history, is a critical determinant of insurance rates. Younger drivers, particularly those under the age of 25, are often considered high-risk due to their relative inexperience, leading to higher insurance premiums. Conversely, mature drivers with clean driving records may enjoy more competitive rates. Gender-based pricing is also a consideration, with statistical differences in driving behavior sometimes influencing insurance costs.

Geographical Location and Regional Factors

The geographical location of the vehicle’s primary use significantly impacts insurance rates. Regions with higher rates of accidents, theft, or natural disasters often carry higher insurance premiums. Additionally, local laws and regulations can influence insurance costs, with some areas mandating specific coverage levels or add-ons.

Desired Coverage and Policy Add-ons

The level of coverage desired by the policyholder is a critical factor in insurance costs. Comprehensive policies that offer protection against a wide range of incidents, including accidents, theft, and natural disasters, typically command higher premiums. In contrast, more basic liability-only policies may be more affordable but provide limited coverage.

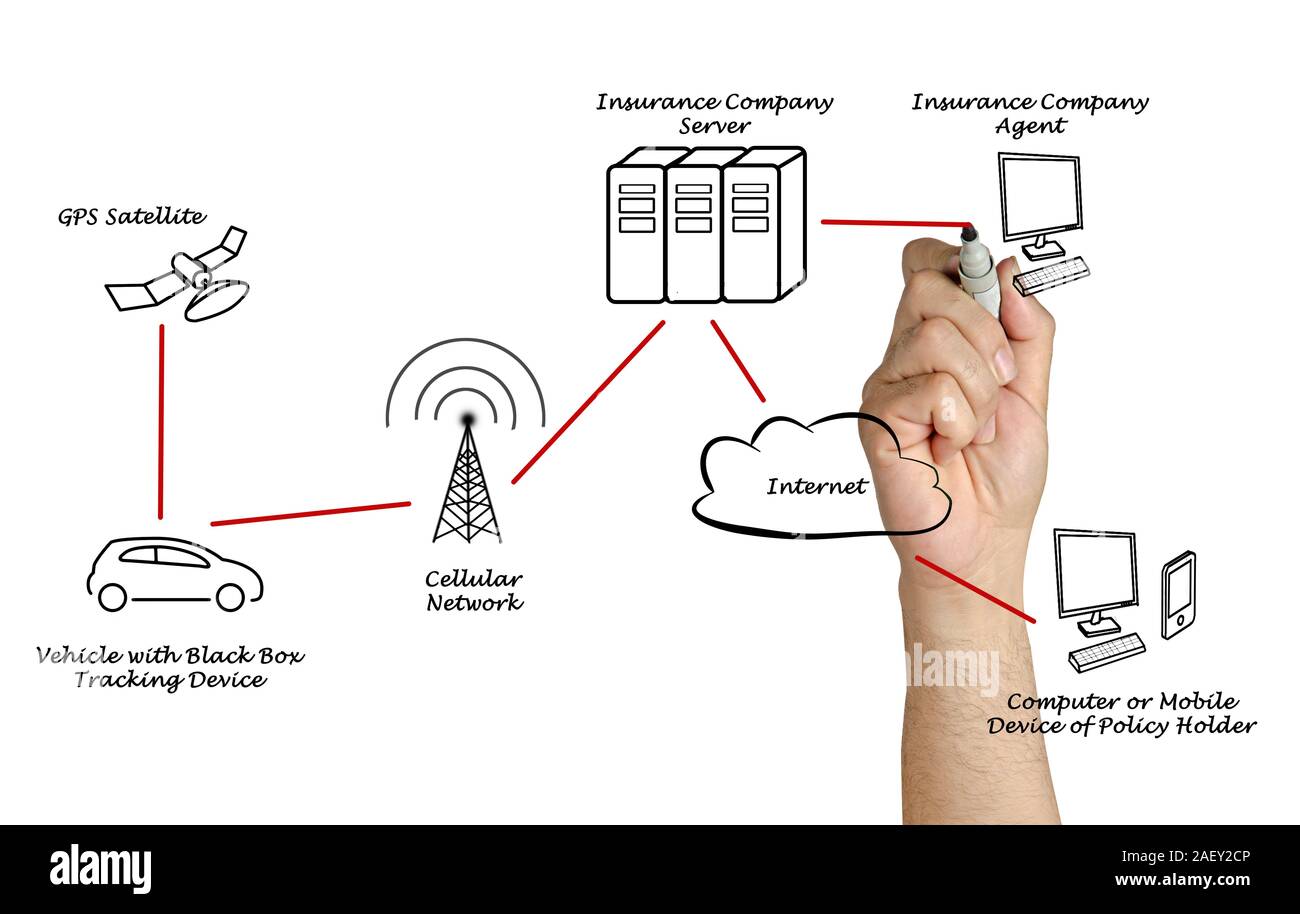

The Impact of Technology on Car Insurance

The rapid advancement of technology is revolutionizing the car insurance industry, introducing new opportunities and challenges. Telematics, a technology that tracks and analyzes driving behavior, is increasingly being used to offer personalized insurance rates based on real-time data. This shift towards usage-based insurance (UBI) has the potential to reward safe drivers with lower premiums, fostering a culture of safer driving practices.

Furthermore, the integration of advanced driver-assistance systems (ADAS) and autonomous driving technologies is poised to transform the insurance landscape. As vehicles become increasingly equipped with sophisticated safety features, the risk of accidents and the associated insurance claims may decrease. This evolution could lead to a reevaluation of insurance policies, potentially reducing premiums for drivers benefiting from these advanced safety systems.

Insurance Coverage and Road Safety

Car insurance plays a pivotal role in promoting road safety and mitigating the financial impact of accidents. By providing financial protection, insurance coverage encourages drivers to prioritize safety and maintain their vehicles in optimal condition. The presence of insurance coverage also incentivizes drivers to adhere to traffic rules and regulations, knowing that their actions could have financial consequences.

Moreover, the data collected by insurance companies through accident claims provides valuable insights into road safety trends. This information can be leveraged to identify high-risk areas, develop targeted safety campaigns, and inform policy decisions aimed at enhancing road safety. The collaboration between insurance providers and road safety authorities is essential in fostering a culture of responsible driving and reducing accident rates.

The Future of Insured Cars: Trends and Predictions

The future of insured cars is poised for significant evolution, driven by technological advancements and changing consumer expectations. As autonomous vehicles become a reality, the traditional insurance model may undergo a transformative shift. The focus could shift from individual driver behavior to the performance and reliability of autonomous systems, with insurance policies adapting to cover potential liabilities arising from these new technologies.

Additionally, the rise of shared mobility and ride-sharing services is expected to influence the insurance landscape. As more individuals opt for car-sharing or ride-hailing services, the demand for flexible and comprehensive insurance coverage for these platforms will grow. Insurance providers will need to adapt their policies to accommodate the unique needs of these emerging mobility models.

Conclusion: A Complex and Dynamic Landscape

The world of insured cars is a complex and ever-evolving landscape, shaped by a myriad of factors and influenced by technological advancements. From the fundamental considerations of vehicle type and driver profile to the transformative impact of emerging technologies, the insurance industry is continually adapting to meet the changing needs of vehicle owners and drivers. As we look to the future, the role of car insurance in promoting road safety and providing financial protection remains paramount, ensuring a safer and more sustainable automotive ecosystem.

How do insurance companies determine rates for different vehicle types and drivers?

+Insurance companies employ sophisticated risk assessment models that consider various factors such as vehicle type, value, driver age and record, geographical location, and desired coverage. These models help insurance providers calculate appropriate premiums based on the level of risk associated with each policyholder.

What is the impact of telematics and usage-based insurance (UBI) on insurance rates and road safety?

+Telematics and UBI have the potential to revolutionize the insurance industry by offering personalized rates based on real-time driving data. This technology rewards safe drivers with lower premiums, encouraging safer driving practices and ultimately reducing accident rates. UBI also provides valuable data for insurance companies to identify high-risk behaviors and areas, allowing for more targeted road safety initiatives.

How might the rise of autonomous vehicles impact car insurance policies and premiums?

+As autonomous vehicles become more prevalent, the focus of insurance policies may shift from individual driver behavior to the performance and reliability of autonomous systems. Insurance premiums could potentially decrease as these vehicles are designed with advanced safety features, reducing the risk of accidents. However, the liability landscape may become more complex, requiring insurance providers to adapt their policies accordingly.