Can You Negotiate Car Insurance

When it comes to car insurance, many people wonder if there's room for negotiation to secure a better deal. The good news is that, unlike many other industries, the insurance sector often allows for some flexibility, providing an opportunity to negotiate and potentially save on your premiums. This guide will delve into the world of car insurance negotiations, offering expert insights and practical strategies to help you navigate this process successfully.

Understanding the Car Insurance Negotiation Landscape

Car insurance negotiations can vary based on several factors, including your location, the insurance provider, and the specific coverage you’re seeking. While not all insurers offer negotiable rates, many do provide some leeway, especially for loyal customers or those who bundle multiple policies.

One of the key advantages of negotiating car insurance is the potential for significant savings. According to a recent study by Insurance Journal, nearly 20% of consumers who negotiated their car insurance rates saved an average of 15% on their premiums. These savings can add up over time, making the negotiation process well worth the effort.

However, it's essential to approach car insurance negotiations with a strategic mindset. Here are some key considerations to keep in mind:

- Research Multiple Providers: Before initiating negotiations, it's crucial to understand the market. Compare quotes from various insurers to get a sense of the average rates and the range of coverage options available. This research will not only inform your negotiation strategy but also ensure you're not overspending on your car insurance.

- Understand Your Risk Profile: Insurance providers assess risk based on factors such as your driving history, age, and the type of vehicle you drive. Understanding your risk profile can help you anticipate the insurer's perspective and strategize your negotiation accordingly.

- Know Your Coverage Needs: It's important to strike a balance between adequate coverage and cost. While negotiating for lower premiums, ensure you're not sacrificing essential coverage that could leave you vulnerable in the event of an accident or other unforeseen circumstances.

Negotiation Strategies for Car Insurance

When it comes to negotiating car insurance, a thoughtful approach can lead to substantial savings. Here are some effective strategies to consider:

Compare Quotes and Seek Bundling Opportunities

One of the most powerful negotiation tools is knowledge. By comparing quotes from multiple insurers, you gain a comprehensive understanding of the market rates. This information allows you to make informed decisions and negotiate confidently. Additionally, inquire about bundling discounts. Many insurers offer reduced rates when you combine multiple policies, such as car insurance with home or renters' insurance.

Leverage Loyalty and Longevity

If you've been a loyal customer with a particular insurer for an extended period, don't hesitate to emphasize this during negotiations. Insurers often value long-term customers and may be willing to offer discounted rates to retain your business. Highlight your longevity and loyalty, and inquire about any loyalty programs or discounts available.

Negotiate Coverage Levels

While it's important to maintain adequate coverage, you might find some wiggle room when it comes to specific coverage types. For instance, you could negotiate a higher deductible for comprehensive or collision coverage, which could lower your premiums. Alternatively, if you have an older vehicle, you might consider dropping collision coverage altogether, especially if the cost of repairs exceeds the vehicle's value.

Discuss Discounts and Special Offers

Insurers often have a range of discounts and special offers that aren't always advertised. During negotiations, ask about these opportunities. Common discounts include safe driver discounts, multi-car discounts, and discounts for taking defensive driving courses. These discounts can significantly reduce your premiums, so it's worth exploring all available options.

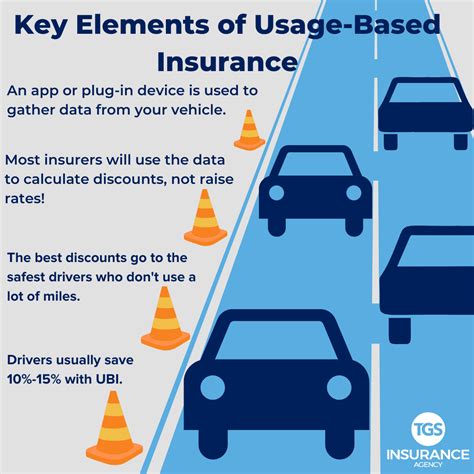

Consider Telematics Devices

Some insurers offer telematics devices that monitor your driving behavior, including speed, braking, and cornering. By installing these devices and demonstrating safe driving habits, you may qualify for discounted rates. While this approach requires a commitment to safe driving, it can lead to substantial savings over time.

| Discount Type | Potential Savings |

|---|---|

| Loyalty Discount | Up to 10% off |

| Safe Driver Discount | 5-15% off |

| Multi-Policy Discount | Up to 20% off |

The Impact of Negotiation on Your Car Insurance Experience

Negotiating your car insurance not only provides an opportunity for cost savings but also allows you to tailor your coverage to your specific needs. By actively engaging in the negotiation process, you can ensure that your insurance policy aligns with your expectations and budget. Additionally, successful negotiation can foster a stronger relationship with your insurer, leading to better service and support in the long run.

Real-Life Success Stories

To illustrate the impact of negotiation, consider the following real-life examples:

-

John's Story: John, a 30-year-old driver with a clean record, recently negotiated his car insurance policy. By comparing quotes and emphasizing his safe driving history, he secured a 12% discount on his premiums. This savings, when applied annually, amounts to a significant reduction in his overall insurance costs.

-

Sarah's Experience: Sarah, a busy professional, wanted to streamline her insurance needs. By negotiating with her insurer, she was able to bundle her car and home insurance policies, resulting in a 15% discount on her car insurance. This not only saved her money but also simplified her insurance management process.

Performance Analysis and Future Implications

The ability to negotiate car insurance rates has significant implications for both consumers and the insurance industry. For consumers, it provides an avenue to customize their insurance plans and save money. For insurers, it encourages competition and innovation, driving the development of new products and services to meet consumer demands.

As the insurance landscape continues to evolve, the negotiation process is likely to become even more prevalent. With the rise of telematics and data-driven insurance models, insurers will have an even deeper understanding of individual risk profiles, potentially leading to more personalized and flexible policies. This shift towards customization and negotiation is expected to benefit consumers, offering them greater control over their insurance costs and coverage.

Navigating the Complexities of Car Insurance Negotiation

While car insurance negotiation offers many benefits, it's not without its challenges. One of the primary complexities lies in understanding the intricate details of insurance policies. Different insurers may have varying coverage options, exclusions, and fine print, making it essential to carefully review and compare policies.

Additionally, the negotiation process itself can be time-consuming and requires a certain level of expertise. It's crucial to approach negotiations with a clear understanding of your needs and goals, as well as a willingness to explore various options. By arming yourself with knowledge and a strategic mindset, you can successfully navigate the complexities of car insurance negotiation and secure the best possible deal.

Frequently Asked Questions

Can I negotiate car insurance rates online?

+While some insurers may offer online quotes and basic discounts, effective negotiation often requires a direct conversation with an insurance representative. This allows for a more personalized assessment of your needs and the potential for greater flexibility in rates.

What if I'm a new driver? Can I still negotiate my insurance rates?

+As a new driver, you may have fewer options for negotiation due to your lack of established history with insurers. However, you can still compare quotes, explore discounts for good students or safe driving courses, and consider bundling policies to find the best possible rates.

How often should I review and negotiate my car insurance rates?

+It's a good practice to review your car insurance rates annually, especially if your circumstances have changed. This could include a new vehicle, a change in address, or an improved driving record. Regular reviews and potential negotiations can ensure you're always getting the best value for your insurance needs.

By understanding the negotiation landscape, adopting strategic approaches, and staying informed about your options, you can successfully navigate the world of car insurance negotiations. Remember, the key is to be proactive, knowledgeable, and confident in your interactions with insurers. With the right approach, you can secure the coverage you need at a price that fits your budget.