What Home Insurance Covers

Home insurance is a vital financial protection for homeowners, providing coverage for various risks and potential damages that could impact one's residence and belongings. It offers peace of mind by ensuring that homeowners are prepared for the unexpected and can recover from losses effectively. However, it's crucial to understand the specifics of what home insurance covers to make informed decisions about your policy and ensure you have the right level of protection.

Understanding the Basics of Home Insurance Coverage

Home insurance, also known as property insurance, is a contract between a homeowner and an insurance provider. This contract outlines the specific risks and perils that the insurance company agrees to protect the homeowner against. In exchange for these protections, the homeowner pays a premium, typically on a monthly or annual basis. The coverage provided by home insurance can vary significantly depending on the policy and the insurer, so it’s essential to review the details carefully.

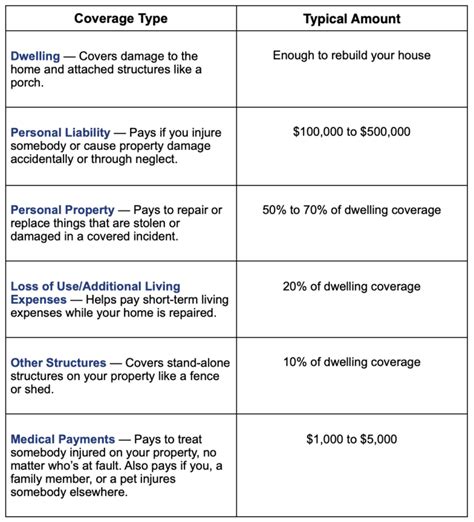

Home insurance policies typically cover two main categories: the structure of the home itself and the personal belongings within it. Additionally, many policies offer liability coverage, which protects the homeowner in case someone is injured on their property or their actions cause damage to others.

Structural Coverage

The structural coverage in a home insurance policy refers to the protection provided for the physical dwelling and its permanent fixtures. This coverage typically includes the main house, any attached structures like garages or carports, and sometimes even outbuildings like sheds or guest houses, depending on the policy.

Structural coverage protects against various perils, including:

- Fire damage

- Smoke damage

- Windstorm damage, including hurricanes and tornadoes

- Hail damage

- Lightning strikes

- Explosions

- Vandalism and malicious mischief

- Weight of ice or snow

- Accidental discharge or overflow of water or steam from heating, air conditioning, or automatic fire protective sprinkler systems

It's important to note that some natural disasters, such as earthquakes and floods, often require additional coverage or separate policies. These perils are typically excluded from standard home insurance policies due to their high risk and potential for extensive damage.

Personal Property Coverage

Personal property coverage in a home insurance policy protects the homeowner’s belongings, such as furniture, electronics, clothing, and other personal items. This coverage is essential as it ensures that, in the event of a covered loss, the homeowner can replace or repair their possessions.

Personal property coverage typically includes:

- Clothing, furniture, electronics, and other household items

- Jewelry, artwork, and other valuable items (often with coverage limits)

- Sports equipment and musical instruments

- Damage or theft of items stored in a separate location, such as a storage unit

However, it's crucial to understand that personal property coverage has limits and exclusions. For instance, high-value items like jewelry, artwork, or expensive electronics may have coverage limits, and the policy may not cover certain items at all. Additionally, damage or loss caused by certain perils, such as floods or earthquakes, may require separate coverage.

Liability Coverage

Liability coverage is an essential aspect of home insurance, as it protects the homeowner from financial losses resulting from accidents or injuries that occur on their property. This coverage is designed to provide legal defense and financial protection if the homeowner is sued for bodily injury or property damage caused to others.

Liability coverage typically includes:

- Bodily injury: If someone is injured on your property, liability coverage can help cover medical expenses and legal fees if you're found liable.

- Property damage: If your actions cause damage to someone else's property, liability coverage can help cover the cost of repairs or replacements.

- Legal defense: In the event of a lawsuit, liability coverage can provide legal representation and cover court costs.

Liability coverage is especially important for homeowners who frequently have visitors or host events on their property. It offers protection against unexpected accidents and provides a safety net against potential financial ruin.

Additional Coverages and Endorsements

Beyond the basic structural, personal property, and liability coverages, home insurance policies often offer additional coverages and endorsements to tailor the policy to the specific needs of the homeowner. These additional protections can provide comprehensive coverage for various situations and can be added to the policy for an additional premium.

Additional Living Expenses (ALE)

If a home is damaged to the extent that it becomes uninhabitable, Additional Living Expenses (ALE) coverage can help cover the costs of temporary housing, meals, and other necessary expenses while the home is being repaired or rebuilt. This coverage ensures that homeowners have a place to stay and can maintain their daily routines during the restoration process.

Personal Injury Coverage

Personal injury coverage provides protection against claims of slander, libel, false arrest, invasion of privacy, and other personal injuries. This coverage is an important addition for homeowners who want to protect themselves from a wide range of potential legal claims.

Replacement Cost Coverage

Replacement cost coverage ensures that, in the event of a covered loss, the homeowner will receive enough money to replace their damaged or destroyed property with new items of similar quality. This coverage is particularly beneficial for homeowners who want to ensure that they can fully restore their home and belongings without incurring significant out-of-pocket expenses.

| Type of Coverage | Description |

|---|---|

| Actual Cash Value (ACV) | Pays the cost to repair or replace the damaged property minus depreciation. |

| Guaranteed or Extended Replacement Cost | Provides additional coverage beyond the policy limits to ensure the home can be rebuilt completely, regardless of the original cost. |

Scheduled Personal Property Endorsements

For high-value items like jewelry, artwork, or collectibles, a scheduled personal property endorsement can provide more comprehensive coverage. This endorsement lists specific items and their values, ensuring that they are adequately insured and protected.

Water Backup Coverage

Water backup coverage provides protection against damage caused by the backup of water or sewage through drains or sewers. This coverage is essential for homeowners as it can protect against damage from clogged drains, broken pipes, or other water-related issues.

Exclusions and Limitations in Home Insurance Policies

While home insurance provides comprehensive coverage for many risks, it’s important to be aware of the exclusions and limitations within the policy. These exclusions are specific perils or situations that are not covered by the insurance provider, and understanding them is crucial to ensure you’re adequately prepared for potential losses.

Common Exclusions in Home Insurance Policies

Some common exclusions in home insurance policies include:

- Earthquakes and Floods: These natural disasters often require separate coverage or endorsements, as they are considered high-risk perils.

- War and Nuclear Hazards: Damage or loss caused by war, including civil war, and nuclear hazards, such as radioactive contamination, are typically excluded.

- Intentional Acts: Any damage or loss caused intentionally by the homeowner or a household member is not covered.

- Ordinary Wear and Tear: Degeneration or deterioration of property due to regular use and aging is not covered.

- Neglect: Damage resulting from the homeowner’s failure to maintain their property is often excluded.

- Insect or Vermin Damage: Damage caused by insects, vermin, or rodents is typically not covered.

- Mechanical or Electrical Breakdown: Malfunctions or breakdowns of appliances, machinery, or electrical systems are often excluded from standard home insurance policies.

- Water Damage: Damage caused by water that backs up through sewers or drains, or water below the surface of the ground, is often excluded unless specific water backup coverage is added.

It's important to note that exclusions can vary depending on the insurance provider and the policy, so it's crucial to review the details carefully to understand what is and isn't covered.

Policy Limits and Deductibles

Home insurance policies also have policy limits, which are the maximum amounts the insurance company will pay for covered losses. These limits can vary depending on the type of coverage and the specific policy. For instance, the policy may have a limit on the amount it will pay for personal property losses, and this limit may not cover the full replacement cost of all items in the home.

Additionally, home insurance policies typically have deductibles, which are the amounts the homeowner must pay out of pocket before the insurance coverage kicks in. Deductibles can vary based on the policy and the type of coverage. For example, a policy may have a separate deductible for windstorm damage or a higher deductible for certain types of losses, such as water damage.

Understanding Your Home Insurance Policy

Understanding the intricacies of your home insurance policy is crucial to ensure you have the right coverage for your needs. It’s important to carefully review the policy documents, including the declarations page, which outlines the specific coverages, limits, and deductibles, as well as the policy endorsements, which may add or modify coverage.

If you have any questions or concerns about your policy, it's best to consult with your insurance agent or broker. They can provide guidance on interpreting the policy and making any necessary adjustments to ensure you have the right level of protection. Additionally, it's recommended to periodically review your policy to ensure it aligns with your current needs and any changes in your home or personal circumstances.

Tips for Reviewing Your Home Insurance Policy

- Understand the coverages and limits: Review the policy documents to understand what perils are covered and the maximum amounts the insurance company will pay for each type of loss.

- Consider your specific needs: Evaluate your personal circumstances and the potential risks your home may face. For instance, if you live in an area prone to natural disasters, you may need additional coverage.

- Review policy endorsements: Endorsements can modify or add coverage to your policy. Ensure you understand the impact of any endorsements on your overall coverage.

- Keep an inventory of your belongings: Maintain a detailed list of your personal property, including receipts and appraisals for valuable items. This can help ensure you have adequate personal property coverage and make the claims process smoother.

- Regularly update your policy: Life changes, such as home renovations or the addition of valuable items, may require adjustments to your policy. Keep your insurance agent informed to ensure your coverage remains up to date.

What should I do if I’m unsure about my home insurance coverage?

+If you have any doubts or concerns about your home insurance coverage, it’s best to reach out to your insurance agent or broker. They can provide clarity on the specifics of your policy and help you understand what is and isn’t covered. Additionally, they can guide you on any necessary adjustments to ensure you have the right level of protection.

How often should I review my home insurance policy?

+It’s recommended to review your home insurance policy annually, or whenever you experience significant life changes. These changes could include home renovations, the addition of valuable items, or a change in your personal circumstances. Regular policy reviews ensure that your coverage remains aligned with your needs and that you’re not overpaying for unnecessary coverage.

What are some common mistakes people make when choosing home insurance coverage?

+One common mistake is selecting a policy based solely on price without considering the coverage details. Another mistake is assuming that all perils are covered, when in reality, many policies have exclusions. Additionally, failing to keep an updated inventory of personal belongings can lead to inadequate personal property coverage.