Best/Cheapest Car Insurance

Finding the best and cheapest car insurance can be a challenging task, as it involves evaluating various factors and understanding your specific needs. With numerous insurance providers offering a wide range of policies, it's essential to navigate through the options carefully to secure the most suitable coverage at an affordable price. This article aims to guide you through the process, providing expert insights and strategies to help you make an informed decision.

Understanding Car Insurance: The Basics

Car insurance is a contract between you, the policyholder, and the insurance company. It provides financial protection against potential losses and liabilities arising from vehicle-related incidents. Understanding the different components of car insurance is crucial to make an informed choice.

Liability Coverage

Liability coverage is a fundamental aspect of car insurance. It covers the costs associated with bodily injuries and property damage that you, as the policyholder, may cause to others in an accident. This includes medical expenses, repair costs, and legal fees. Most states have minimum liability coverage requirements, but it’s advisable to opt for higher limits to ensure adequate protection.

| Coverage Type | Minimum Requirement |

|---|---|

| Bodily Injury Liability (per person) | $25,000 - $50,000 |

| Bodily Injury Liability (per accident) | $50,000 - $100,000 |

| Property Damage Liability | $25,000 - $50,000 |

Comprehensive and Collision Coverage

Comprehensive and collision coverage provide protection for your own vehicle. Comprehensive coverage covers damages caused by events other than collisions, such as theft, vandalism, natural disasters, or animal strikes. Collision coverage, on the other hand, covers damages to your vehicle resulting from collisions with other vehicles or objects.

Medical Payments Coverage

Medical payments coverage, often referred to as MedPay, covers the medical expenses of you and your passengers in the event of an accident, regardless of fault. This coverage can be particularly beneficial as it offers quick access to medical care without the need for lengthy legal processes.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you in situations where the at-fault driver has little or no insurance coverage. It ensures that you are financially protected in case the other driver cannot cover the costs of the damages they caused.

Factors Influencing Car Insurance Rates

Several factors play a significant role in determining the cost of car insurance. Understanding these factors can help you tailor your policy and potentially reduce your premiums.

Vehicle Type and Usage

The type of vehicle you own and how you use it can impact your insurance rates. Sports cars and luxury vehicles often come with higher insurance premiums due to their performance capabilities and expensive repair costs. Additionally, vehicles used for business purposes or long-distance commuting may attract higher rates.

Driving Record

Your driving history is a crucial factor in determining insurance rates. Insurance companies consider factors such as traffic violations, accidents, and claims made. A clean driving record with no recent violations or accidents can lead to lower premiums, while multiple violations or accidents may result in higher rates or even policy cancellations.

Age and Gender

Insurance rates can vary based on age and gender. Young drivers, particularly those under 25, are often considered high-risk due to their lack of driving experience. As a result, they may face higher insurance premiums. Similarly, gender can play a role, with some insurers charging slightly different rates for male and female drivers.

Location and Mileage

Your geographic location and annual mileage are also considered in determining insurance rates. Areas with high population density, heavy traffic, and a history of frequent accidents or thefts may result in higher premiums. Additionally, the number of miles you drive annually can impact your rates, as more miles generally mean a higher risk of accidents.

Strategies to Find the Best and Cheapest Car Insurance

Now that we’ve covered the basics and the factors influencing car insurance rates, let’s explore some strategies to help you find the best and cheapest policy that suits your needs.

Shop Around and Compare

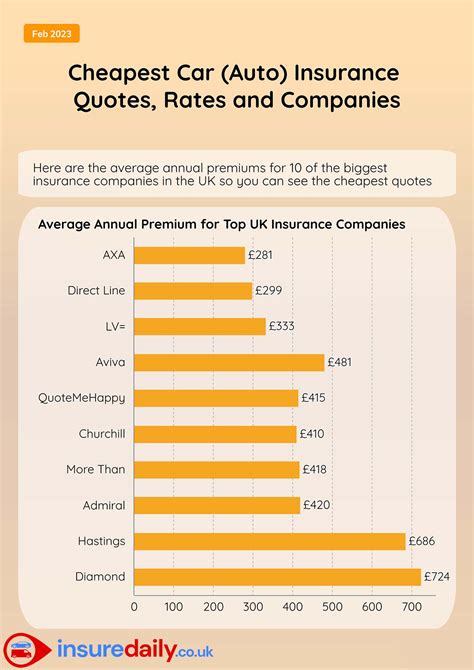

One of the most effective ways to find the best deal is to shop around and compare quotes from multiple insurance providers. Each insurer has its own rating system and pricing structure, so obtaining quotes from at least three to five companies can give you a good idea of the range of prices available.

Bundle Your Policies

Consider bundling your car insurance with other policies, such as home or renters’ insurance. Many insurers offer discounts when you bundle multiple policies, as it simplifies their administrative processes and reduces the likelihood of policy cancellations.

Utilize Online Tools and Discounts

Insurance companies often provide online tools and resources to help you find the right coverage. These tools allow you to compare policies, estimate premiums, and identify applicable discounts. Additionally, look for discounts based on your profession, educational achievements, or membership in certain organizations. Some insurers also offer discounts for safe driving, anti-theft devices, or completing defensive driving courses.

Understand Your Coverage Needs

Before purchasing a policy, ensure you understand your coverage needs. Consider your vehicle’s value, your financial situation, and the potential risks you face on the road. While it’s tempting to opt for the cheapest policy, it’s essential to strike a balance between cost and adequate coverage. Insufficient coverage can leave you vulnerable to financial losses in the event of an accident.

Review Your Policy Regularly

Car insurance rates and coverage needs can change over time. It’s a good practice to review your policy annually to ensure it still meets your requirements. Factors such as changes in your driving record, vehicle upgrades, or life events (like getting married or buying a home) can impact your insurance needs and potentially lead to cost savings.

Maintain a Good Driving Record

A clean driving record is one of the most effective ways to keep your insurance premiums low. Avoid traffic violations and practice safe driving habits. Many insurance companies offer accident forgiveness programs, which can prevent your rates from increasing after a single at-fault accident. However, these programs often come with a cost, so it’s important to weigh the benefits against the additional expense.

Conclusion: Making an Informed Decision

Finding the best and cheapest car insurance requires a combination of research, comparison, and understanding your specific needs. By familiarizing yourself with the basics of car insurance, the factors that influence rates, and the strategies to find the best deals, you can make an informed decision that provides the right coverage at an affordable price.

Frequently Asked Questions

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the U.S. varies based on factors such as location, driving record, and coverage limits. According to recent data, the national average for car insurance premiums is around 1,674 annually. However, rates can range from a few hundred dollars to over 3,000, depending on individual circumstances.

Can I get car insurance without a license?

+Obtaining car insurance without a valid driver’s license can be challenging. Most insurance providers require proof of a valid license to issue a policy. However, there may be exceptions for certain situations, such as purchasing insurance for a vehicle that is not primarily driven by you or for non-operational vehicles.

How often should I review my car insurance policy?

+It’s advisable to review your car insurance policy annually or whenever there are significant changes in your life or driving circumstances. Regular reviews ensure that your coverage remains up-to-date and aligned with your needs. Additionally, reviewing your policy allows you to take advantage of any discounts or policy enhancements offered by your insurer.