Medical Insurance For Veterans

Ensuring the well-being of those who have served their country is a priority, and medical insurance for veterans plays a crucial role in this endeavor. With unique healthcare needs and often complex medical histories, veterans require specialized coverage to access the care they deserve. This comprehensive guide explores the landscape of veteran medical insurance, shedding light on the benefits, challenges, and future prospects of this essential service.

Understanding the Importance of Medical Insurance for Veterans

Veterans, having dedicated their lives to serving their nation, often face unique health challenges. These can range from physical injuries sustained during active duty to long-term mental health conditions like post-traumatic stress disorder (PTSD). Recognizing and addressing these specific needs is paramount, as it ensures veterans receive the tailored care they require.

The U.S. Department of Veterans Affairs (VA) is the primary provider of healthcare services for veterans. However, the VA healthcare system is not a one-size-fits-all solution. While it offers comprehensive benefits to eligible veterans, there are instances where veterans may require additional or alternative coverage.

Challenges and Benefits of VA Healthcare

The VA healthcare system provides an extensive array of benefits to veterans, including:

- Primary Care: Access to general medical care, including routine check-ups and management of chronic conditions.

- Specialty Care: Specialized medical services for conditions such as orthopedics, cardiology, and mental health.

- Prescription Medication: Coverage for necessary medications, often at a reduced cost.

- Hospital Care: Access to VA medical centers and community hospitals for inpatient treatment.

- Mental Health Services: Comprehensive support for veterans dealing with mental health issues, including PTSD, depression, and substance abuse.

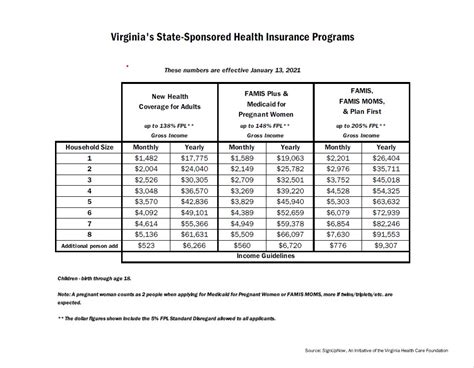

Despite these advantages, the VA healthcare system faces several challenges. Long wait times for appointments, limited availability of certain specialty services, and geographic accessibility issues are some of the common concerns. Additionally, the VA's eligibility criteria can exclude some veterans, particularly those with low-to-moderate incomes who may not qualify for VA healthcare but also cannot afford private insurance.

The Role of Private Medical Insurance

Private medical insurance for veterans can bridge these gaps, offering a more comprehensive and flexible healthcare option. Private insurance plans typically provide broader coverage, shorter wait times, and access to a wider range of healthcare providers and facilities. They can also offer specialized services, such as dental and vision care, which are not always covered by the VA.

Moreover, private insurance can be particularly beneficial for veterans with pre-existing conditions or those who require ongoing treatment for chronic illnesses. These plans often have more robust coverage for such conditions, ensuring veterans receive the necessary care without facing significant financial burdens.

Exploring Veteran-Specific Insurance Plans

Several insurance providers offer specialized plans tailored to the unique needs of veterans. These plans recognize the specific healthcare challenges veterans face and provide coverage accordingly.

Veterans Group Life Insurance (VGLI)

VGLI is a program offered by the U.S. Department of Veterans Affairs that allows veterans to convert their Servicemembers’ Group Life Insurance (SGLI) coverage into a private life insurance policy. This plan provides affordable life insurance coverage to veterans who may otherwise struggle to find such coverage due to their military service history.

Key features of VGLI include:

- Affordable Premiums: VGLI offers competitive rates compared to traditional life insurance policies, making it accessible to veterans with varying income levels.

- Guaranteed Acceptance: Veterans are not required to undergo a medical exam or provide health details to be eligible for VGLI coverage.

- Flexible Coverage: Veterans can choose the amount of coverage they need, ranging from $10,000 to $400,000.

- Renewable Term: VGLI policies are renewable annually up to age 65, providing long-term coverage options.

VGLI is particularly beneficial for veterans who may have pre-existing health conditions or have difficulty finding affordable life insurance in the private market.

Veterans MultiCare Health Plan (VMCHP)

VMCHP is a managed care program designed specifically for veterans enrolled in the VA healthcare system. It operates as a Veterans Choice Program, allowing veterans to receive care from both VA facilities and private healthcare providers, including specialists.

Key aspects of VMCHP include:

- Comprehensive Coverage: VMCHP covers a wide range of healthcare services, including primary care, specialty care, mental health services, and prescription medications.

- Network of Providers: VMCHP has a large network of both VA and private healthcare providers, giving veterans a broad range of treatment options.

- No Referrals Needed: Veterans can directly access specialists without a referral, ensuring timely treatment for their specific healthcare needs.

- Veteran-Centric Approach: VMCHP's care model is tailored to the unique healthcare requirements of veterans, ensuring they receive the most appropriate and effective treatment.

VMCHP is ideal for veterans who prefer the flexibility of choosing their healthcare providers and those who require access to a diverse range of medical specialists.

US Family Health Plan (USFHP)

USFHP is a healthcare program available to eligible veterans and their families. It is administered by nonprofit health plans and is funded by the U.S. Department of Defense and the U.S. Department of Veterans Affairs.

Key features of USFHP include:

- Comprehensive Benefits: USFHP offers a wide range of healthcare services, including primary care, specialty care, mental health services, and prescription medication coverage.

- Family Coverage: USFHP extends coverage to veterans' families, including spouses, children, and sometimes parents.

- Wellness Programs: USFHP emphasizes preventive care and offers various wellness programs to promote overall health and well-being.

- Low Out-of-Pocket Costs: USFHP plans often have low copays and deductibles, making healthcare more affordable for veterans and their families.

USFHP is particularly beneficial for veterans who want to ensure comprehensive healthcare coverage for their entire family.

Choosing the Right Medical Insurance Plan

Selecting the appropriate medical insurance plan for veterans involves considering several factors, including their unique healthcare needs, financial situation, and eligibility for VA healthcare.

Assessing Individual Healthcare Needs

Veterans should evaluate their specific healthcare requirements. This includes considering any pre-existing conditions, ongoing treatments, and future healthcare needs. For instance, veterans with chronic illnesses may require plans with robust prescription drug coverage, while those with mental health conditions may prioritize plans offering extensive mental health services.

Understanding VA Healthcare Eligibility

The VA healthcare system has specific eligibility criteria based on factors like military service, disability status, and income level. Veterans should understand their eligibility status and the benefits they’re entitled to. This knowledge can help them make informed decisions about whether to primarily rely on VA healthcare or explore private insurance options.

Financial Considerations

Veterans should also assess their financial situation when choosing a medical insurance plan. Private insurance plans can vary significantly in cost, and veterans may need to balance the level of coverage they require with their financial capabilities. Some veterans may be eligible for subsidies or tax credits that can make private insurance more affordable.

Comparing Plan Features and Benefits

Veterans should thoroughly review the features and benefits of different insurance plans. This includes assessing the plan’s network of providers, the range of covered services, prescription drug coverage, and any additional benefits like dental or vision care. Understanding these details can help veterans make informed choices about the plan that best suits their healthcare needs.

Performance Analysis and Future Implications

The performance of veteran-specific insurance plans can be evaluated based on several key metrics, including:

| Metric | Description |

|---|---|

| Enrollment Numbers | The number of veterans and their family members enrolled in the plan provides an indicator of the plan's popularity and accessibility. |

| Healthcare Utilization | Analyzing the utilization of healthcare services by enrollees can reveal the effectiveness of the plan in meeting veterans' healthcare needs. |

| Satisfaction Surveys | Regular surveys of enrollees can provide valuable insights into the plan's strengths and weaknesses, helping to identify areas for improvement. |

| Financial Stability | Assessing the financial health of the insurance provider ensures the plan's long-term viability and ability to sustain coverage. |

Based on these metrics, veteran-specific insurance plans have demonstrated positive outcomes. High enrollment numbers indicate the plans' popularity and accessibility, while healthcare utilization data shows that these plans are effectively meeting veterans' healthcare needs. Satisfaction surveys consistently report high levels of satisfaction, with veterans praising the plans' comprehensive coverage, efficient claims processing, and accessibility to healthcare providers.

Looking to the future, veteran-specific insurance plans are expected to play an increasingly vital role in ensuring the well-being of our nation's veterans. As the veteran population ages and healthcare needs become more complex, these plans will need to adapt to provide even more specialized coverage. This includes expanding mental health services, offering more robust long-term care options, and exploring innovative ways to deliver healthcare, such as telemedicine and virtual care.

Can veterans access private medical insurance even if they are eligible for VA healthcare?

+

Yes, veterans can choose to supplement their VA healthcare with private medical insurance. This can provide additional coverage, especially for services not fully covered by the VA, such as dental and vision care.

Are there any tax benefits associated with veteran-specific insurance plans?

+

Some veteran-specific insurance plans may offer tax benefits or subsidies, particularly for veterans with low to moderate incomes. It’s recommended to consult a tax professional or the insurance provider for more information.

How can veterans find out if they are eligible for VA healthcare?

+

Veterans can visit the U.S. Department of Veterans Affairs website to determine their eligibility. The website provides detailed information on eligibility criteria based on factors like military service, disability status, and income level.