Health Insurance Applications

Navigating the intricate world of health insurance is an essential aspect of life, especially when it comes to applying for coverage. The process can be complex and intimidating, but with the right knowledge and a strategic approach, you can successfully secure the health insurance plan that best suits your needs. In this comprehensive guide, we will delve into the key aspects of health insurance applications, providing you with expert insights and practical steps to ensure a smooth and successful journey.

Understanding Health Insurance Applications

A health insurance application is a formal process through which individuals or families apply for health coverage. It involves gathering and submitting relevant information to an insurance provider, demonstrating your eligibility and suitability for their plans. This process is crucial as it determines the type of coverage you receive, the cost of your premiums, and your overall healthcare experience.

The application process typically begins with researching and comparing different health insurance plans available in your area. This step is vital as it allows you to understand the various options, their coverage limits, and the associated costs. Online resources, insurance brokers, and even local health departments can provide valuable information to aid in your decision-making process.

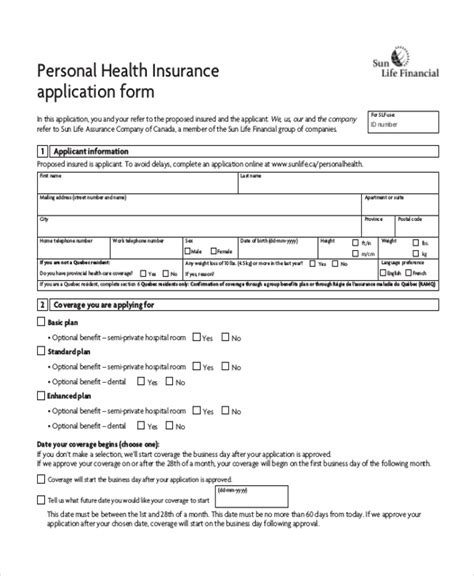

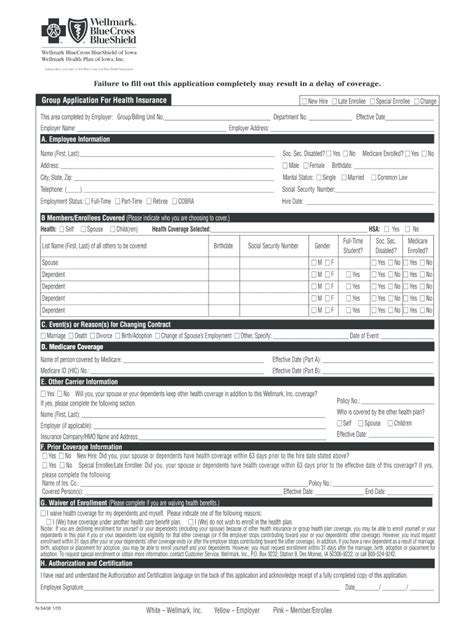

Once you've identified the plans that align with your needs, the next step is to gather the necessary documentation and complete the application. This process can vary depending on the insurance provider and the type of plan you're applying for. However, some common requirements include personal and demographic information, details about your current health status and medical history, and proof of income or employment.

Key Documents for Health Insurance Applications

- Personal Identification: A valid government-issued ID, such as a driver’s license or passport, is typically required to verify your identity.

- Social Security Number: This is essential for tax purposes and to ensure compliance with federal regulations.

- Income and Employment Details: Providing proof of income is crucial, as it determines your eligibility for certain plans and subsidies. This may include pay stubs, tax returns, or employment letters.

- Medical Records: Some insurance providers may request medical records to assess your health status and determine the appropriate level of coverage. This could include recent doctor’s visits, laboratory results, or prescription histories.

- Dependents’ Information: If you’re applying for a family plan, you’ll need to provide details about your dependents, such as their names, dates of birth, and relationship to you.

Online vs. Paper Applications

In today’s digital age, many insurance providers offer online applications, making the process more accessible and convenient. Online applications often provide real-time updates and allow for faster processing times. However, some individuals may prefer the traditional paper application, especially if they have complex circumstances or require additional assistance.

| Application Type | Pros | Cons |

|---|---|---|

| Online | Convenient, real-time updates, faster processing | May require digital literacy, potential for data breaches |

| Paper | Personalized assistance, suitable for complex cases | Slower processing, potential for errors or loss of documents |

Regardless of the application method you choose, it's crucial to ensure the accuracy and completeness of your information. Incomplete or incorrect applications can lead to delays, increased costs, or even rejection of your application.

The Application Review Process

Once you’ve submitted your health insurance application, it undergoes a thorough review process by the insurance provider. This step is critical as it determines whether you’re accepted into the plan, and if so, under what terms.

Verification of Information

The first step in the review process is the verification of the information you’ve provided. Insurance companies use various methods to ensure the accuracy of your application. This may include cross-referencing your details with government databases, verifying your income or employment status, and checking your medical history.

During this stage, it's essential to be transparent and provide accurate information. Deliberate misrepresentation or omission of facts can lead to severe consequences, including application denial or even legal action.

Underwriting and Risk Assessment

After verifying your information, the insurance company’s underwriting team assesses the risk associated with covering you. This process involves evaluating your age, health status, medical history, and other factors to determine the likelihood of you incurring significant healthcare costs. Based on this assessment, the underwriter determines the terms of your coverage, including your premium, deductibles, and any exclusions or limitations.

It's important to note that the underwriting process can vary depending on the type of insurance plan you're applying for. Some plans, such as employer-sponsored group health insurance, may have more relaxed underwriting criteria, while individual plans may be subject to stricter guidelines.

Communication and Decision

Following the underwriting process, the insurance provider will communicate their decision to you. This communication typically outlines the terms of your coverage, including the premium amount, deductibles, and any specific conditions or limitations. If you’re satisfied with the terms, you can proceed with accepting the plan and making the necessary payments to activate your coverage.

In some cases, the insurance company may request additional information or clarification before making a final decision. It's crucial to respond promptly to such requests to avoid delays in the application process.

Maximizing Your Chances of Success

Applying for health insurance can be a complex and competitive process. To increase your chances of a successful application, consider the following expert tips:

- Research and Compare: Take the time to thoroughly research and compare different health insurance plans. Understand their coverage limits, costs, and any unique benefits they offer. This step is crucial in finding a plan that aligns with your needs and budget.

- Seek Professional Guidance: If you're unsure about the application process or have complex circumstances, consider seeking guidance from an insurance broker or healthcare navigator. These professionals can provide personalized advice and assist you in completing your application accurately.

- Provide Accurate Information: Honesty and transparency are paramount in the health insurance application process. Providing accurate and complete information ensures a smoother review process and reduces the risk of delays or denials.

- Stay Informed: Keep yourself updated on the latest healthcare policies and regulations. Understanding the current landscape can help you navigate the application process more effectively and make informed decisions.

- Be Prepared for Underwriting: Understand the underwriting process and be prepared to provide any additional information or documentation requested by the insurance company. This demonstrates your cooperation and commitment to the application process.

Special Considerations for Specific Groups

The health insurance application process may vary for different groups of individuals. Here are some considerations for specific groups:

- Seniors: Medicare, the federal health insurance program for seniors, has its own application process. It's important to understand the enrollment periods and eligibility requirements to ensure a smooth transition into Medicare coverage.

- Low-Income Individuals: Certain health insurance plans, such as Medicaid or the Children's Health Insurance Program (CHIP), are designed to provide coverage for low-income individuals and families. These programs have specific eligibility criteria and application processes, so it's crucial to understand your options and how to apply.

- Small Businesses: If you're a small business owner looking to provide health insurance for your employees, you may have access to group health insurance plans. These plans often offer cost-saving benefits and simplified application processes. Understanding the options available to small businesses can help you make informed decisions about employee benefits.

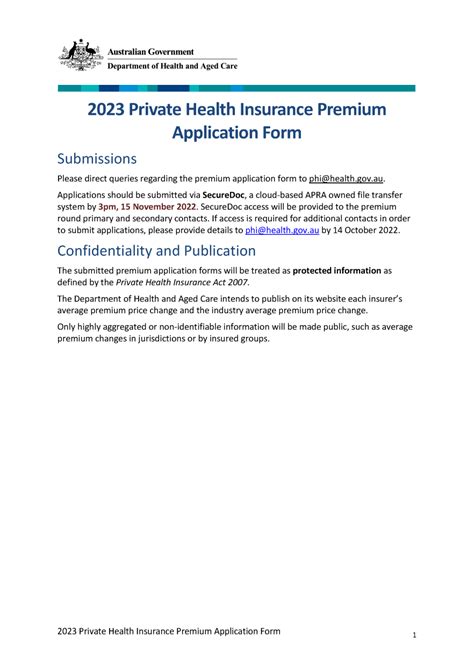

The Future of Health Insurance Applications

As technology continues to advance, the health insurance application process is evolving to become more streamlined and efficient. Here are some future implications and trends to consider:

Digital Innovation

The rise of digital health platforms and applications is transforming the way individuals interact with their healthcare providers and insurance companies. These platforms offer convenient, user-friendly interfaces for managing health insurance applications, providing real-time updates, and streamlining the entire process.

Data-Driven Decisions

With the increasing availability of health data, insurance companies are leveraging advanced analytics to make more informed decisions during the application review process. This shift towards data-driven underwriting is expected to enhance the accuracy and efficiency of the application process, leading to faster decisions and improved customer experiences.

Expanded Access and Coverage

Efforts to expand healthcare coverage and improve access are ongoing. This includes initiatives to simplify the application process, reduce barriers to enrollment, and increase outreach to underserved communities. These efforts aim to ensure that more individuals and families can access affordable and comprehensive health insurance plans.

Consumer-Centric Approach

The future of health insurance applications is expected to place a greater emphasis on consumer experience and satisfaction. Insurance providers are recognizing the importance of delivering personalized and convenient services to their customers. This shift towards a consumer-centric approach may involve more transparent communication, improved customer support, and innovative solutions to simplify the application and claims processes.

Conclusion

Applying for health insurance is a critical step towards securing your healthcare needs and financial well-being. By understanding the application process, gathering the necessary documentation, and following expert tips, you can navigate this complex journey with confidence. Remember, the key to a successful application is accuracy, preparation, and a willingness to seek guidance when needed. With the right approach, you can find the health insurance plan that best suits your unique circumstances and ensures peace of mind for you and your loved ones.

What documents are typically required for a health insurance application?

+Commonly required documents include a valid ID, social security number, proof of income or employment, and medical records. Dependents’ information may also be necessary if you’re applying for a family plan.

How long does the health insurance application process typically take?

+The duration can vary depending on the insurance provider and the complexity of your application. Generally, it can take anywhere from a few days to several weeks. Online applications often result in faster processing times.

Can I apply for health insurance online, or do I need to submit a paper application?

+Most insurance providers offer online applications, which are convenient and provide real-time updates. However, if you have complex circumstances or prefer personalized assistance, a paper application may be more suitable.

What happens if I provide inaccurate or incomplete information on my health insurance application?

+Providing inaccurate or incomplete information can lead to delays, increased costs, or even denial of your application. It’s crucial to be transparent and provide accurate details to ensure a smooth and successful application process.

Are there any special considerations for seniors or low-income individuals when applying for health insurance?

+Yes, seniors may be eligible for Medicare, while low-income individuals can explore options like Medicaid or CHIP. Understanding the specific application processes and eligibility criteria for these programs is essential for successful enrollment.