Am Best Ratings For Insurance Companies

In the complex world of insurance, understanding the financial strength and stability of insurance companies is crucial for both policyholders and investors. Enter AM Best, an independent rating agency that has been evaluating the insurance industry for over a century. Their ratings provide an essential guide to the reliability and performance of insurance carriers, helping stakeholders make informed decisions. In this comprehensive article, we delve into the intricacies of AM Best ratings, exploring their methodology, the factors they consider, and their impact on the insurance landscape.

Understanding AM Best Ratings

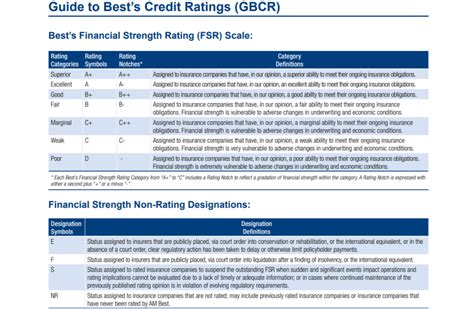

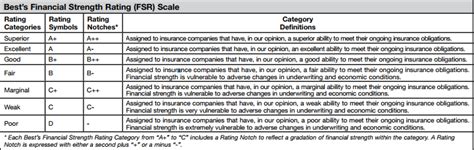

AM Best is a globally recognized rating agency that specializes in assessing the financial health of insurance companies. Their ratings are widely regarded as a critical tool for evaluating the stability and creditworthiness of insurers. The agency’s ratings provide a snapshot of an insurance company’s ability to meet its financial obligations, such as paying out claims, over both the short and long term.

The AM Best rating system uses a combination of letters and numbers to indicate an insurer's financial strength. The highest rating is A++ (Superior), which indicates an insurer with the strongest possible balance sheet and the highest level of financial security. As the ratings progress downward, they reflect a decreasing level of financial strength and stability. The lowest rating, S (In Liquidation), indicates that an insurer is in the process of being wound up and its assets liquidated.

| AM Best Rating | Description |

|---|---|

| A++ | Superior |

| A+ | Excellent |

| A | Excellent |

| A- | Excellent |

| B++ | Good |

| ... | ... |

| S | In Liquidation |

AM Best's ratings are not static; they are subject to continuous review and can change based on an insurer's performance and financial position. This dynamic nature ensures that the ratings remain a reliable indicator of an insurer's financial health.

Factors Influencing AM Best Ratings

The AM Best rating process is comprehensive and considers a wide range of factors to assess an insurer’s financial strength. Here are some key aspects that play a role in determining an insurer’s rating:

- Financial Strength: This is the core metric assessed by AM Best. It evaluates an insurer's ability to meet its obligations, including paying claims, over the long term. Factors such as capital adequacy, profitability, and risk management practices are scrutinized.

- Business Profile: AM Best considers an insurer's business strategy, market position, and the stability of its revenue streams. A diverse and stable business profile is generally favored.

- Operating Performance: The agency analyzes an insurer's operational efficiency, including its ability to manage expenses, underwrite policies effectively, and maintain a healthy claims-paying ratio.

- Risk Management: Insurers with robust risk management frameworks and effective controls to mitigate various risks are often viewed favorably by AM Best.

- Capital Adequacy: The insurer's capital position is assessed to ensure it has sufficient resources to weather adverse events and market fluctuations.

- Market Conduct: AM Best evaluates an insurer's compliance with regulatory standards and its track record in dealing with policyholders and claims.

- Management Competence: The experience and expertise of an insurer's management team are considered, as effective leadership can significantly impact an insurer's long-term success.

Impact of AM Best Ratings

AM Best ratings carry significant weight in the insurance industry and can influence various aspects of an insurer’s operations and market perception.

Consumer Confidence

Policyholders often rely on AM Best ratings to assess the financial stability of their insurance providers. A high rating can instill confidence, assuring customers that their insurer is financially secure and capable of honoring its commitments. This confidence is especially critical in times of crisis or natural disasters when policyholders need to rely on their insurance coverage.

Investor Decisions

Investors, including institutional investors and those considering insurance-linked securities, use AM Best ratings to assess the creditworthiness of insurance companies. A strong rating can attract investment, as it indicates a lower risk of default. Conversely, a decline in an insurer’s rating may prompt investors to reconsider their holdings.

Regulatory Oversight

Insurance regulators often refer to AM Best ratings when evaluating an insurer’s financial health. A high rating can simplify an insurer’s interactions with regulators, while a low rating may trigger increased scrutiny and potentially lead to regulatory interventions.

Competitive Advantage

AM Best ratings can be a differentiator in a competitive insurance market. Insurers with superior ratings may have an edge in attracting new business and retaining existing clients, as these ratings can be a testament to their financial strength and stability.

The Role of AM Best in the Insurance Landscape

AM Best plays a critical role in maintaining the stability and transparency of the insurance industry. Their ratings provide a standardized and objective measure of an insurer’s financial health, helping to ensure that policyholders’ interests are protected and that investors can make informed decisions. By continuously monitoring and evaluating insurers, AM Best contributes to a more resilient insurance market.

Furthermore, AM Best's ratings can drive insurers to strive for excellence. A strong rating is a badge of honor, encouraging insurers to maintain robust financial practices, effective risk management, and efficient operations. This, in turn, benefits the entire insurance ecosystem, from policyholders who enjoy peace of mind to investors who can confidently allocate their capital.

AM Best’s Methodology: A Deeper Dive

AM Best’s rating methodology is complex and rigorous, designed to provide a comprehensive assessment of an insurer’s financial health. The process involves a detailed analysis of an insurer’s financial statements, business strategies, and risk management practices. Here’s a glimpse into some of the key steps involved:

- Financial Statement Analysis: AM Best scrutinizes an insurer's financial statements, including balance sheets, income statements, and cash flow statements. They assess the insurer's capital position, profitability, and ability to generate sustainable cash flows.

- Underwriting Analysis: The agency evaluates an insurer's underwriting practices, including its ability to accurately price and manage risks. This analysis considers factors such as the insurer's loss ratio, expense ratio, and the quality of its underwriting decisions.

- Risk Assessment: AM Best assesses the various risks an insurer faces, including credit risk, market risk, operational risk, and legal/regulatory risk. They analyze the insurer's risk management framework and its effectiveness in mitigating these risks.

- Capital Adequacy: The insurer's capital position is closely examined to ensure it meets regulatory requirements and can absorb potential losses. AM Best considers both the quantity and quality of an insurer's capital, including its solvency ratios and the sources of capital.

- Market and Competitive Analysis: The agency evaluates an insurer's market position and competitive advantages. This includes assessing the insurer's market share, customer base, and the stability of its revenue streams.

- Management and Governance: AM Best examines the insurer's management team, its strategic vision, and its ability to execute its business plan. Effective governance and strong leadership are key factors in an insurer's long-term success.

Based on this comprehensive analysis, AM Best assigns a rating that reflects the insurer's overall financial strength and stability. The agency regularly monitors insurers and updates their ratings as necessary, ensuring that the ratings remain a reliable indicator of an insurer's financial health.

The Future of AM Best Ratings

As the insurance industry continues to evolve, AM Best remains committed to adapting its rating methodology to stay relevant and effective. The agency is continually refining its processes to incorporate emerging trends, such as the impact of technology and digital transformation on the insurance sector.

In recent years, AM Best has expanded its focus to include assessments of insurers' operational resilience and their ability to navigate emerging risks, such as cyber threats and climate-related risks. This evolution in the rating methodology reflects the agency's commitment to providing comprehensive and forward-looking assessments of insurers' financial health.

Furthermore, AM Best is increasingly integrating environmental, social, and governance (ESG) factors into its rating process. As sustainability and responsible investing gain prominence, AM Best recognizes the importance of assessing insurers' ESG practices. This integration allows investors and stakeholders to make more informed decisions, considering not only an insurer's financial strength but also its commitment to sustainable practices.

Looking ahead, AM Best is poised to play an even more pivotal role in the insurance landscape. With its rigorous rating methodology and commitment to adaptation, the agency will continue to provide valuable insights into insurers' financial health, helping to foster a stable and resilient insurance market.

Conclusion

AM Best ratings are an indispensable tool for navigating the complex world of insurance. They provide a transparent and objective assessment of an insurer’s financial strength and stability, benefiting policyholders, investors, and the industry as a whole. As the insurance landscape continues to evolve, AM Best remains a trusted guardian of financial integrity, ensuring that insurers maintain their commitments and policyholders can rely on their coverage.

How often does AM Best update its ratings for insurance companies?

+AM Best continuously monitors the insurance industry and updates its ratings as necessary. While there is no fixed schedule, ratings can be revised at any time based on new information or changes in an insurer’s financial health.

Are AM Best ratings the only factor to consider when choosing an insurance company?

+While AM Best ratings are a critical indicator of an insurer’s financial strength, they are not the sole factor to consider. Policyholders should also assess an insurer’s coverage options, customer service, and claims handling reputation to make an informed decision.

What happens if an insurance company’s AM Best rating declines significantly?

+A significant decline in an insurer’s AM Best rating may prompt regulatory intervention and could impact its ability to attract new business and retain customers. In extreme cases, a low rating could lead to financial distress or insolvency.

How can policyholders stay informed about their insurer’s AM Best rating?

+Policyholders can check their insurer’s AM Best rating on the AM Best website. The agency also provides rating updates and news alerts to keep stakeholders informed about changes in an insurer’s financial health.

Are there any alternatives to AM Best ratings for assessing insurance companies’ financial strength?

+Yes, there are other rating agencies, such as Standard & Poor’s and Moody’s, that also provide financial strength ratings for insurance companies. Policyholders and investors can consider multiple rating sources to gain a comprehensive understanding of an insurer’s financial health.