Purchase Homeowners Insurance Online

Homeowners insurance is a crucial aspect of protecting one's most valuable asset - their home. With the digital age upon us, the process of purchasing insurance has evolved, offering convenience and accessibility. In this comprehensive guide, we delve into the world of online homeowners insurance, exploring the benefits, considerations, and steps to ensure a seamless and informed buying experience.

Understanding the Importance of Homeowners Insurance

Homeownership comes with a multitude of responsibilities, and one of the most critical is safeguarding your property and belongings. Homeowners insurance acts as a financial safety net, providing coverage for various risks and perils that could potentially lead to significant losses. From natural disasters to theft and liability claims, this comprehensive policy offers peace of mind and financial protection.

Here's a breakdown of the key components of homeowners insurance:

- Dwelling Coverage: This covers the physical structure of your home, including repairs or reconstruction in the event of damage.

- Personal Property Coverage: Protects your belongings inside the home, such as furniture, electronics, and clothing, in case of theft, damage, or loss.

- Liability Protection: Provides coverage if someone is injured on your property or if you are found legally responsible for causing property damage or bodily harm to others.

- Additional Living Expenses: If your home becomes uninhabitable due to a covered event, this coverage helps with temporary housing and other necessary expenses.

- Optional Coverages: Depending on your needs, you can customize your policy with additional coverage for specific risks, such as flood, earthquake, or identity theft.

The importance of homeowners insurance cannot be overstated, especially considering the potential financial devastation that can result from unexpected events. By understanding the coverage options and selecting the right policy, homeowners can ensure they are adequately protected.

The Rise of Online Homeowners Insurance

In today’s fast-paced world, the convenience of online services is a game-changer. The insurance industry has embraced digital transformation, offering homeowners the ability to purchase coverage online, anytime, anywhere. This shift towards online insurance not only provides ease of access but also introduces a range of benefits that cater to the modern consumer.

Benefits of Buying Homeowners Insurance Online

The online insurance marketplace offers a host of advantages, making it an appealing choice for homeowners seeking efficient and transparent coverage:

- Convenience and Accessibility: Online platforms allow homeowners to shop for insurance policies at their own pace, from the comfort of their homes. With 24/7 access, there's no need to wait for office hours or schedule appointments.

- Comparative Shopping: Insurance comparison websites aggregate policies from multiple providers, enabling homeowners to compare coverage options, premiums, and features side by side. This empowers consumers to make informed decisions.

- Real-Time Quotes: Online insurance platforms utilize advanced algorithms to provide instant quotes based on the information provided by the homeowner. This eliminates the wait time associated with traditional insurance agents.

- Personalized Coverage: Online platforms often offer interactive tools and questionnaires that help homeowners assess their specific needs and tailor their coverage accordingly. This ensures a policy that is truly reflective of their unique circumstances.

- Paperless Transactions: Digital insurance platforms facilitate a completely paperless process, from quote generation to policy issuance. This not only saves time but also reduces the environmental impact associated with physical documentation.

- Discounts and Promotions: Online insurance providers often offer exclusive discounts and promotions to attract customers. These incentives can lead to significant savings on homeowners insurance policies.

Considerations Before Purchasing Online

While the online insurance landscape presents numerous benefits, it’s essential to approach the process with caution and awareness. Here are some key considerations to keep in mind:

- Research and Reputation: Before choosing an online insurance provider, conduct thorough research to ensure their legitimacy and reputation. Check for customer reviews, ratings, and financial stability ratings to make an informed decision.

- Policy Details and Fine Print: Carefully review the policy terms and conditions, including coverage limits, exclusions, and deductibles. Ensure that the policy aligns with your specific needs and provides adequate protection.

- Customer Service and Claims Process: Evaluate the online provider's customer service accessibility and response times. Additionally, understand their claims process, including the steps involved, timelines, and any potential limitations.

- Bundling Options: Consider the potential savings and convenience of bundling your homeowners insurance with other policies, such as auto insurance. Many online providers offer discounts for bundling, making it a cost-effective choice.

- Renewal and Updates: Understand the renewal process and any potential changes to your policy. Keep track of renewal dates and review your coverage regularly to ensure it remains up-to-date and aligns with your changing needs.

Step-by-Step Guide: Purchasing Homeowners Insurance Online

Now that we’ve explored the benefits and considerations, let’s dive into a step-by-step guide to help you navigate the process of purchasing homeowners insurance online smoothly and confidently.

Step 1: Assessing Your Insurance Needs

Before you begin your online insurance journey, it’s essential to understand your specific needs and requirements. Here’s a checklist to help you assess your insurance needs:

- Evaluate the value of your home and its contents. Consider the cost of rebuilding or replacing your home and belongings in the event of a covered loss.

- Identify any unique risks or exposures specific to your location, such as natural disasters or crime rates.

- Assess your personal liability risks, especially if you have frequent visitors or host events on your property.

- Consider any additional coverage needs, such as flood or earthquake insurance, depending on your location and personal circumstances.

- Review your current insurance policies (if any) to understand what coverage you already have and identify any gaps.

Step 2: Researching Online Insurance Providers

With a clear understanding of your insurance needs, it’s time to explore the online marketplace. Here’s how to research and compare insurance providers effectively:

- Start by identifying reputable online insurance comparison websites. These platforms aggregate policies from multiple providers, allowing you to compare options side by side.

- Check the provider's financial stability ratings and customer reviews to ensure they are a reliable and trusted source.

- Evaluate the range of coverage options and additional benefits offered by each provider. Look for policies that align with your specific needs and provide adequate protection.

- Compare premiums and discounts. While cost is an important factor, it should not be the sole deciding factor. Balance affordability with comprehensive coverage.

- Explore the online provider's reputation for customer service and claims handling. You want to ensure they provide prompt and efficient assistance when needed.

Step 3: Obtaining Quotes and Comparing Policies

Once you’ve identified a few reputable online insurance providers, it’s time to obtain quotes and compare policies. Here’s a guide to help you through this process:

- Visit the provider's website and utilize their online quote tool. Provide accurate and detailed information about your home, location, and personal circumstances to obtain an accurate quote.

- Compare the quotes based on coverage limits, deductibles, and premiums. Ensure you're comparing apples to apples by evaluating similar coverage options.

- Read through the policy documents carefully, paying attention to the fine print. Understand the exclusions and limitations to ensure you're not overlooking any crucial details.

- Consider any optional endorsements or riders that can enhance your coverage. These additional coverages can provide peace of mind for specific risks or valuable belongings.

- Evaluate the provider's claims process and customer service reputation. You want to choose a provider that offers efficient and responsive support when you need it most.

Step 4: Selecting and Purchasing Your Policy

After thorough research and comparison, it’s time to select the homeowners insurance policy that best meets your needs. Here’s a guide to help you finalize your decision and complete the purchase:

- Review the policy documents one last time, ensuring you understand the coverage, deductibles, and any exclusions or limitations.

- Confirm the policy's renewal process and any potential changes or adjustments that may occur over time.

- Consider any discounts or promotions offered by the provider. You may be eligible for savings based on factors like bundling policies or installing security systems.

- Choose a payment method that suits your preferences, whether it's a one-time payment or monthly installments.

- Complete the purchase process, providing any necessary payment and personal information. Ensure you receive a confirmation email or policy document as proof of purchase.

Step 5: Understanding Your Policy and Ongoing Maintenance

Once you’ve purchased your homeowners insurance policy, it’s important to familiarize yourself with its terms and conditions. Here’s what you need to know:

- Review the policy documents thoroughly, understanding the coverage limits, deductibles, and any additional endorsements or riders you've added.

- Keep track of important policy details, including the policy number, effective dates, and any contact information for the insurance provider.

- Understand the claims process and what steps you need to take in the event of a covered loss. Familiarize yourself with any required documentation or evidence.

- Review your policy annually to ensure it remains up-to-date and aligns with your changing needs. Adjustments may be necessary as your home or personal circumstances evolve.

- Stay informed about any changes or updates to your policy, such as premium increases or coverage adjustments. Contact your insurance provider if you have any questions or concerns.

Conclusion: Embracing the Digital Future of Homeowners Insurance

The digital transformation of the insurance industry has brought about a revolution in how homeowners access and purchase coverage. Online homeowners insurance offers unparalleled convenience, transparency, and customization. By following the step-by-step guide outlined above, you can navigate the online insurance landscape with confidence, ensuring you find the right policy to protect your most valuable asset.

Remember, homeowners insurance is not a one-size-fits-all solution. It's crucial to assess your specific needs, compare policies, and select a provider that offers comprehensive coverage and exceptional customer service. With the right policy in place, you can rest easy knowing your home and belongings are protected, allowing you to focus on the joys of homeownership.

FAQ

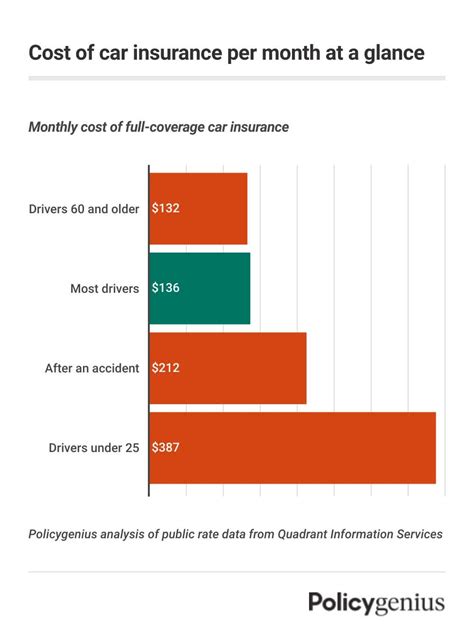

What is the average cost of homeowners insurance in the United States?

+

The average cost of homeowners insurance in the U.S. varies depending on factors such as location, property value, and coverage limits. According to recent data, the national average premium for homeowners insurance is around $1,200 per year. However, it’s important to note that rates can significantly differ based on individual circumstances.

Are there any discounts available for homeowners insurance policies?

+

Yes, many insurance providers offer discounts on homeowners insurance policies. Some common discounts include bundling your homeowners insurance with other policies (such as auto insurance), installing security systems or fire protection devices, maintaining a good credit score, and being claim-free for a certain period. It’s worth exploring these options to potentially save on your premiums.

How often should I review and update my homeowners insurance policy?

+

It’s recommended to review your homeowners insurance policy annually or whenever there are significant changes to your home or personal circumstances. This includes renovations, additions, or significant improvements to your property, as well as changes in your family size, personal belongings, or liability risks. Regularly updating your policy ensures that your coverage remains adequate and up-to-date.