Do I Have To Have Car Insurance

When it comes to owning and operating a vehicle, one of the most common questions that arise is whether or not car insurance is a legal requirement. The answer to this question is not a simple yes or no, as it largely depends on the jurisdiction in which you reside. While some countries and states have strict laws mandating car insurance, others may have more flexible regulations or even no compulsory insurance requirements. In this comprehensive guide, we will delve into the world of car insurance laws, exploring the varying legal landscapes, the benefits of insurance, and the potential consequences of driving without coverage.

The Legal Landscape of Car Insurance

The legal obligations regarding car insurance vary greatly from one place to another. In many developed countries, such as the United States, Canada, and most European nations, having car insurance is not just a wise choice but a legal necessity. These regions typically have comprehensive legislation in place that outlines the minimum levels of insurance coverage required for all registered vehicles. Failure to comply with these laws can result in severe penalties, including fines, license suspension, or even vehicle impoundment.

Let's take a closer look at some specific jurisdictions to understand the diversity of car insurance laws:

United States

In the United States, car insurance requirements are determined at the state level. While all states mandate some form of financial responsibility, the specific insurance requirements can vary significantly. For instance, in Massachusetts, drivers must carry personal injury protection (PIP) insurance, which covers medical expenses and lost wages for the policyholder and their passengers, regardless of fault. On the other hand, in New Hampshire, drivers can choose to opt out of insurance and instead pay an annual fee for a certificate of self-insurance, although this option is not recommended for most drivers.

United Kingdom

The United Kingdom has a robust system of compulsory insurance, with the Motor Insurance Database (MID) maintaining records of all insured vehicles. The Road Traffic Act of 1988 requires all vehicle owners to have at least third-party insurance, which covers damage or injury caused to third parties but not the policyholder. Uninsured driving is a serious offense in the UK, and offenders can face significant penalties, including heavy fines, license disqualification, and even imprisonment.

Australia

Australia’s car insurance laws are similar to those in the UK, with each state and territory having its own specific regulations. In general, Australian drivers are required to have at least third-party personal injury insurance, which covers the cost of injuries sustained by other people in an accident for which the policyholder is at fault. However, comprehensive insurance, which covers a wider range of risks including damage to the policyholder’s vehicle, is also widely recommended.

International Variations

Beyond these specific examples, car insurance laws vary across the globe. Some countries, like Germany and Japan, have a more comprehensive approach, requiring vehicle owners to have fully comprehensive insurance policies that cover a wide range of potential damages. In contrast, certain developing nations may have less stringent requirements or even lack mandatory insurance laws altogether, leaving it up to individual drivers to decide whether or not to purchase insurance.

The Benefits of Car Insurance

Regardless of whether car insurance is legally mandated, there are numerous compelling reasons to invest in a robust insurance policy. Here are some key benefits that car insurance provides:

- Financial Protection: Car insurance offers crucial financial coverage in the event of an accident. It can help cover the costs of repairs or replacements for your vehicle, as well as medical expenses and legal fees resulting from an incident.

- Peace of Mind: Having insurance provides peace of mind, knowing that you and your passengers are protected in the event of an accident. It alleviates the financial burden and stress associated with unexpected damages or injuries.

- Legal Compliance: In jurisdictions where car insurance is mandatory, having the required coverage ensures that you are in compliance with the law. This avoids potential legal consequences and helps maintain a clean driving record.

- Liability Coverage: Car insurance often includes liability coverage, which protects you from financial responsibility if you cause damage or injury to others. This coverage is particularly important for safeguarding your assets and future financial stability.

- Additional Benefits: Many insurance policies offer optional add-ons, such as roadside assistance, rental car coverage, or personalized protection plans. These additional benefits can enhance your overall driving experience and provide extra convenience and security.

Consequences of Driving Without Insurance

While the decision to drive without insurance may seem appealing to some, especially in regions without strict enforcement, the potential consequences can be severe and far-reaching. Here are some of the key repercussions of driving uninsured:

- Legal Penalties: In jurisdictions where car insurance is mandatory, driving without insurance is a serious offense. Penalties can include hefty fines, license suspension or revocation, and even imprisonment in some cases. These legal consequences can have long-lasting impacts on your driving privileges and record.

- Financial Liability: Without insurance, you are personally responsible for any damages or injuries caused in an accident. This can result in significant out-of-pocket expenses, potentially draining your savings or even leading to financial ruin. Legal fees and medical costs can quickly accumulate, making the financial burden of an accident without insurance overwhelming.

- Limited Legal Recourse: If you are involved in an accident caused by an uninsured driver, your options for legal recourse may be limited. It can be challenging to pursue compensation from an individual without insurance, as they may not have the financial means to cover the costs. This leaves you vulnerable and without adequate protection.

- Increased Risk: Driving without insurance increases the overall risk on the roads. Uninsured drivers may be more likely to engage in unsafe driving behaviors, knowing that they have no financial protection in the event of an accident. This can contribute to a culture of reckless driving and higher accident rates.

Making Informed Choices

Understanding the legal requirements and benefits of car insurance is crucial for making informed decisions about your driving and financial well-being. While the laws may vary, the potential consequences of driving without insurance are universally significant and can have long-lasting effects. By investing in the right insurance coverage, you not only protect yourself and your passengers but also contribute to a safer and more responsible driving environment.

As you navigate the world of car insurance, it's essential to research and compare different policies to find the best fit for your needs and budget. Whether you're a seasoned driver or a new car owner, staying informed and proactive about insurance is a wise choice that can provide invaluable peace of mind and protection on the roads.

What happens if I’m caught driving without insurance in a jurisdiction where it’s mandatory?

+Being caught driving without insurance in a jurisdiction where it’s mandatory can result in serious consequences. You may face fines, license suspension or revocation, and even imprisonment in some cases. It’s important to comply with the law to avoid these penalties and maintain a clean driving record.

Are there any situations where I can drive without insurance even if it’s legally required?

+In most cases, there are no exceptions to the mandatory insurance laws. However, some jurisdictions may allow temporary exemptions for specific situations, such as during vehicle registration or transfer of ownership. It’s crucial to understand the laws in your area and ensure compliance during these transitional periods.

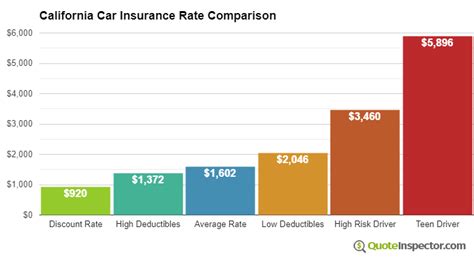

Can I save money on car insurance by choosing a lower level of coverage?

+While opting for a lower level of coverage may result in lower premiums, it’s important to carefully consider your needs and potential risks. Lower coverage may not provide adequate protection in the event of an accident, leaving you vulnerable to significant financial losses. It’s recommended to assess your individual circumstances and choose a policy that offers comprehensive coverage at an affordable price.