State Farm Insurance Application

The State Farm Insurance Application is a crucial component for anyone seeking insurance coverage from one of the leading providers in the United States. With a rich history spanning over a century, State Farm has established itself as a trusted name in the insurance industry, offering a comprehensive range of services and coverage options to its customers. In this article, we will delve into the details of the State Farm Insurance Application process, exploring the requirements, steps involved, and the benefits it offers to potential policyholders.

Understanding the State Farm Insurance Application

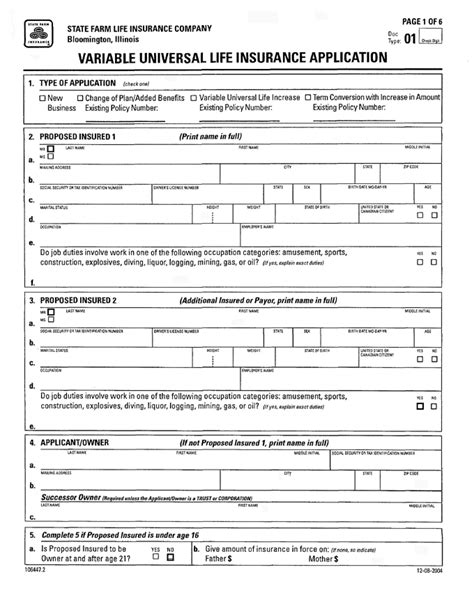

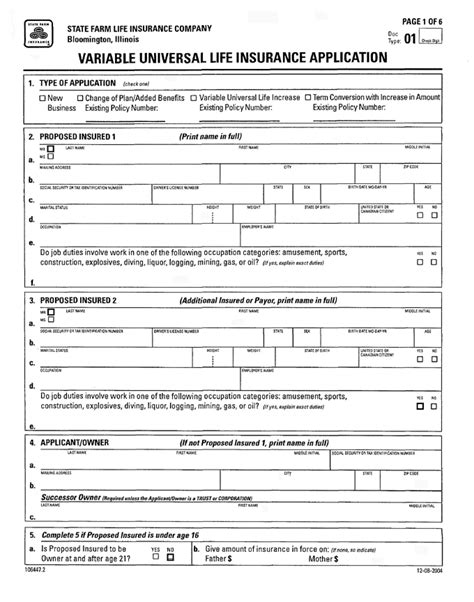

The State Farm Insurance Application serves as the initial step towards securing insurance coverage from State Farm. It is a comprehensive document that collects essential information about the applicant, their personal details, and their insurance needs. This application process is designed to be user-friendly and efficient, allowing individuals to navigate through the steps seamlessly and obtain the coverage they require.

State Farm offers a wide array of insurance products, including auto insurance, home insurance, life insurance, health insurance, and more. The application process varies slightly depending on the type of insurance being sought, but the core principles and requirements remain consistent across all policies.

Key Requirements for the Application Process

To initiate the State Farm Insurance Application process, applicants must meet certain basic requirements. These requirements may vary based on the type of insurance and the state in which the applicant resides. However, here are some common prerequisites that most applicants need to fulfill:

- Age Eligibility: Applicants must be of legal age, typically 18 years or older, to apply for insurance independently. For minors, parental consent and involvement may be required.

- Residency Status: State Farm primarily serves customers within the United States, so applicants must provide proof of residency in one of the states where State Farm operates.

- Valid Identification: A valid government-issued identification, such as a driver's license or passport, is necessary to verify the applicant's identity.

- Personal Information: The application requires detailed personal information, including full name, date of birth, contact details, and social security number (or equivalent for non-US citizens). This information is essential for policy issuance and claims processing.

- Vehicle or Property Details: For auto and home insurance applications, accurate and comprehensive details about the vehicle(s) or property being insured are necessary. This includes make, model, year, VIN numbers, and any existing damage or claims history.

- Health Information: Life and health insurance applications may require additional health-related information, such as medical history, current health status, and lifestyle factors.

- Financial Information: Applicants are often asked to provide financial details, including income, assets, and any existing debts or liabilities. This information is used to assess the applicant's ability to pay premiums and manage financial obligations.

Navigating the State Farm Insurance Application Process

The State Farm Insurance Application process is designed to be straightforward and accessible. Applicants can choose to complete the application online, over the phone, or in person at a local State Farm agency. Here's a step-by-step breakdown of the application process:

Step 1: Choose Your Insurance Type

The first step is to determine the type of insurance you require. State Farm offers a diverse range of insurance products, so it's essential to understand your specific needs. Whether it's auto insurance, home insurance, life insurance, or any other type of coverage, selecting the right insurance type is crucial.

Step 2: Gather Necessary Documents and Information

Before initiating the application, it's beneficial to gather all the required documents and information. This includes personal identification, vehicle or property details, financial records, and any other relevant documents specific to your insurance needs. Having these documents readily available streamlines the application process.

Step 3: Initiate the Application Online or In-Person

State Farm provides multiple channels for applicants to initiate the insurance application process. You can choose to apply online through the State Farm website, which offers a user-friendly interface and guides you through the application steps. Alternatively, you can visit a local State Farm agency or contact an agent over the phone to start the application process.

Step 4: Provide Personal and Insurance Details

During the application process, you will be prompted to provide detailed personal information, including your full name, date of birth, contact details, and social security number. Additionally, you will need to furnish information related to your insurance needs, such as the type of coverage required, the vehicle or property to be insured, and any existing insurance policies.

Step 5: Review and Verify Information

Once you have completed the application, it is crucial to review all the information provided for accuracy. State Farm may also require you to verify certain details, such as your identity, vehicle ownership, or property ownership. This verification process ensures the accuracy of the information and helps in the smooth processing of your application.

Step 6: Select Coverage and Payment Options

After reviewing and verifying your information, you will be presented with various coverage options and payment plans. State Farm offers customizable insurance packages to suit different needs and budgets. You can choose the coverage limits, deductibles, and additional endorsements that align with your requirements and financial capabilities.

Step 7: Receive Policy Documents and Begin Coverage

Upon successful completion of the application process and approval by State Farm, you will receive your insurance policy documents. These documents outline the terms and conditions of your insurance coverage, including the coverage limits, premiums, and any applicable exclusions. With the policy documents in hand, you can begin enjoying the benefits of your State Farm insurance coverage.

Benefits of Choosing State Farm Insurance

State Farm Insurance offers numerous advantages to its policyholders, making it a preferred choice for many individuals and businesses. Here are some key benefits of choosing State Farm for your insurance needs:

Comprehensive Coverage Options

State Farm provides a wide range of insurance products, ensuring that customers can find the coverage they need. From auto insurance and home insurance to life insurance and health insurance, State Farm offers comprehensive solutions to protect various aspects of your life.

Personalized Service and Local Presence

State Farm is known for its personalized service and local presence. With a network of local agents across the United States, policyholders can enjoy face-to-face interactions and receive personalized advice and support. This local presence ensures that customers receive prompt assistance and tailored solutions to their insurance needs.

Excellent Customer Service and Claims Handling

State Farm prides itself on its exceptional customer service and claims handling processes. The company has a dedicated team of professionals who are committed to providing prompt and efficient service. Policyholders can expect timely assistance, clear communication, and a seamless claims process, ensuring a stress-free experience during times of need.

Innovative Digital Tools and Resources

State Farm embraces technology to enhance the customer experience. The company offers a range of digital tools and resources, such as mobile apps, online portals, and interactive platforms, to streamline the insurance journey. These tools enable policyholders to manage their policies, file claims, and access important information conveniently from their devices.

Financial Strength and Stability

State Farm is renowned for its financial strength and stability. With a solid financial foundation, the company can provide long-term security and peace of mind to its policyholders. State Farm's financial stability ensures that it can honor its commitments and pay out claims promptly, even during challenging economic times.

Frequently Asked Questions (FAQ)

Can I apply for State Farm insurance if I have a poor credit history or past insurance claims?

+Yes, State Farm considers applicants with various credit histories and insurance backgrounds. While a poor credit history or past claims may impact your insurance rates, State Farm assesses each application individually and provides tailored solutions. It's recommended to be transparent about your circumstances during the application process.

What documentation is required for the State Farm insurance application?

+The documentation required for the State Farm insurance application varies based on the type of insurance and your specific circumstances. Generally, you will need to provide proof of identity, residency, vehicle or property ownership, and financial information. It's advisable to gather these documents beforehand to streamline the application process.

How long does it take to receive a decision on my State Farm insurance application?

+The time it takes to receive a decision on your State Farm insurance application can vary depending on various factors. Typically, State Farm aims to provide a decision within a few business days after receiving a complete application. However, complex cases or additional verifications may require more time. State Farm will keep you informed throughout the process.

Can I customize my State Farm insurance policy to meet my specific needs?

+Absolutely! State Farm understands that every individual's insurance needs are unique. The company offers customizable insurance policies, allowing you to choose the coverage limits, deductibles, and additional endorsements that align with your requirements and budget. This flexibility ensures you receive a tailored insurance solution.

What support does State Farm provide for policyholders in case of an emergency or claim?

+State Farm is dedicated to providing exceptional support to its policyholders during emergencies and claims. The company has a dedicated claims team available 24/7 to assist you. Whether it's a natural disaster, an accident, or a health emergency, State Farm offers prompt and compassionate support, guiding you through the claims process and ensuring a smooth resolution.

In conclusion, the State Farm Insurance Application process is designed to be accessible and tailored to the unique needs of each applicant. By following the outlined steps and utilizing the benefits offered by State Farm, individuals can secure comprehensive insurance coverage with a trusted provider. With its personalized service, financial strength, and innovative tools, State Farm continues to be a leading choice for insurance coverage in the United States.